In 2024, Tesla faces unprecedented challenges in maintaining its leadership in the electric vehicle (EV) market. With a notable first-quarter delivery shortfall leading to a 31% drop in stock price, the question arises: can Tesla adapt its strategy to remain at the forefront of the EV industry?

Tesla’s Q1 Delivery Miss and Market Reaction

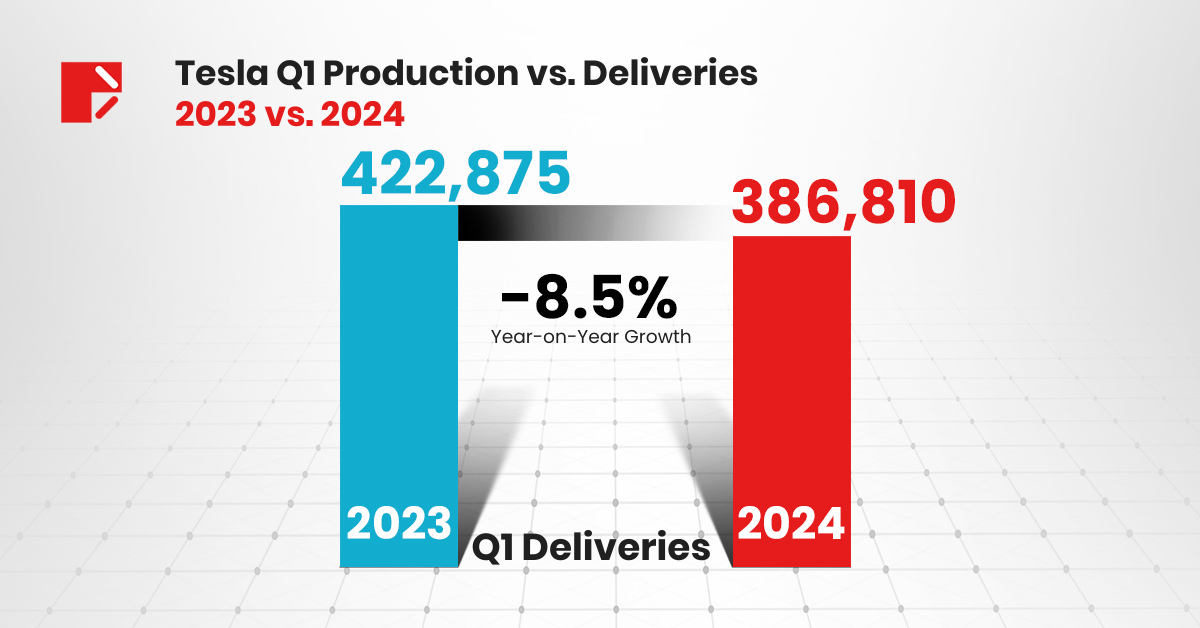

The year started unfavourably for Tesla, as the company reported first-quarter vehicle deliveries that fell significantly short of expectations.

Delivering only 386,810 units against an anticipated 449,080, the discrepancy has not only impacted Tesla’s stock but has also reinforced a troubling trend of underperformance.

This delivery shortfall was surprising and below the Wall Street consensus, which had adjusted its forecast down from 470,000 to around 431,000 due to perceived production issues.

The immediate aftermath saw Tesla’s stock plummet by nearly 5%, reflecting investor anxieties over operational hiccups and their potential long-term effects on Tesla’s growth trajectory.

Market Position Analysis and Data:

This decline starkly contrasts with the year-on-year growth of 20% in deliveries observed in previous quarters, signaling potential issues in supply chain or market demand.

Tesla’s Market Position and Future Outlook

Despite these setbacks, Tesla continues to invest heavily in its future, with planned capital expenditures exceeding $10 billion for 2024. A significant portion of this investment is directed towards the development of robotaxis, a move that has been met with considerable skepticism.

Analysts are increasingly doubtful of Tesla’s strategy, highlighting the stiff competition from more established companies like Waymo and significant regulatory and technological hurdles. This skepticism questions the feasibility of Musk’s vision and Tesla’s ability to fulfil its ambitious growth targets amidst these uncertainties.

Tesla’s Projected Capital Expenditures and Expected Outcomes

Key Areas of Investment: Expansion of manufacturing facilities, R&D for Autopilot and AI, and development of new models.

These investments are aimed at maintaining Tesla’s technological edge and expanding its global manufacturing footprint, particularly in markets like China and Europe.

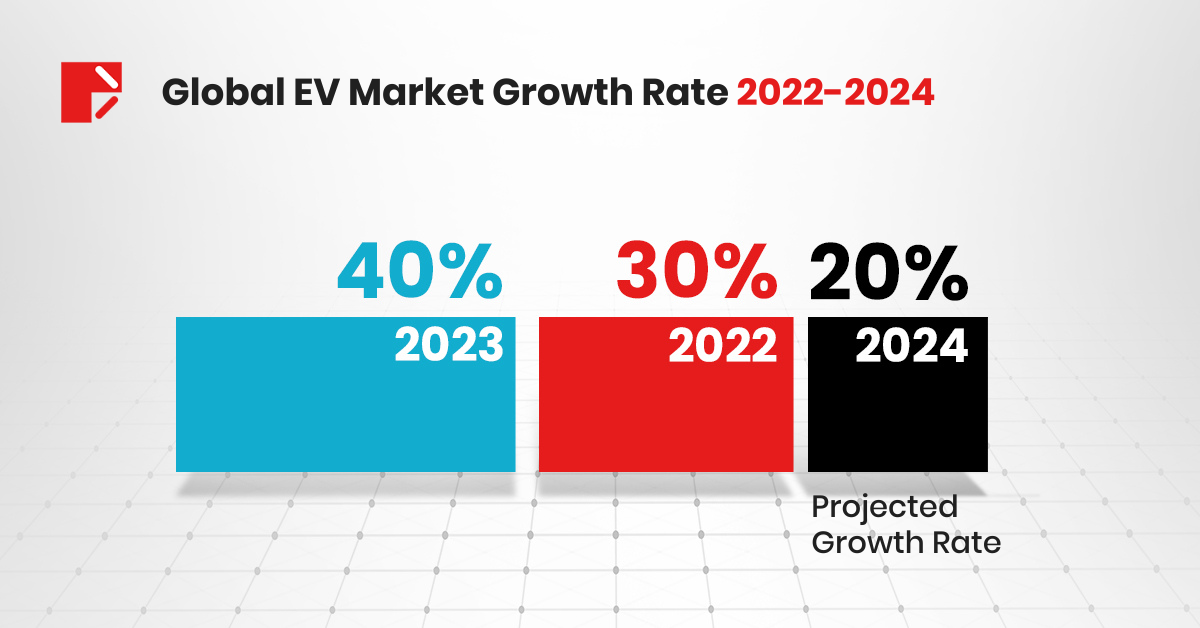

Slowdown in EV Demand and Its Implications

The global demand for electric vehicles is slowing down, influenced by economic tightening and shifting consumer preferences. Tesla, which has relied on robust market growth for its expansion plans, could face stiffer challenges if the trend continues. Tesla’s high pricing strategy may hinder its competitiveness, especially as Chinese EV manufacturers like BYD and Li Auto offer more affordable alternatives that appeal to price-sensitive consumers.

Demand Slowdown Analysis and Data:

This deceleration can impact Tesla’s sales volumes, especially in saturated markets like North America and Europe, where competition is also intensifying.

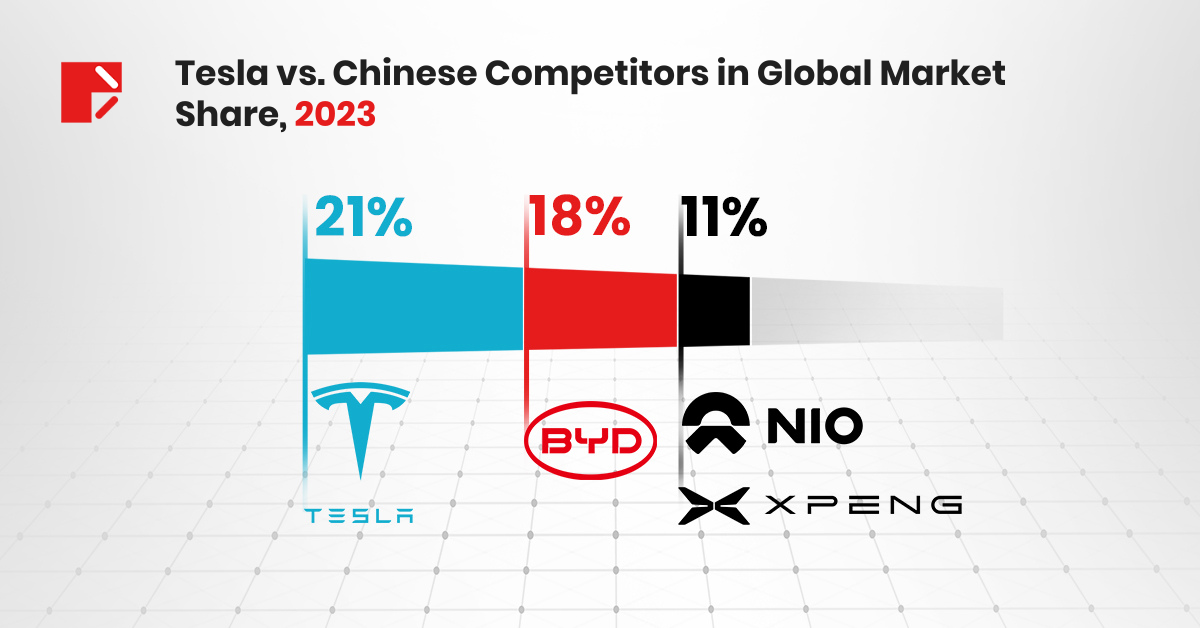

Comparison with Chinese EV Competitors

Tesla’s dominance is increasingly challenged by Chinese EV makers, who are not only capturing the domestic market but also expanding globally. The cancellation of Tesla’s more affordable Model 2 has potentially left the company at a competitive disadvantage.

Tesla’s reluctance to adjust its pricing strategy has positioned it unfavorably against Chinese EV manufacturers. Companies like BYD and Li Auto not only offer more affordable alternatives and advancements in battery technology but are also expanding their global footprint rapidly.

As a result, Tesla’s market share is under threat, with its high-priced models becoming less appealing in contrast to the value-driven offerings from these competitors. This competitive disadvantage is a pressing concern that Tesla needs to address to maintain its market leadership.

Competitor Comparison Analysis and Data:

These trends highlight the growing threat from Chinese competitors in key markets, potentially eroding Tesla’s market share.

Market Dynamics and the Future of the EV Industry

The EV industry is evolving rapidly with advances in technology and changes in consumer behavior. Tesla’s focus on innovations like robotaxis and self-driving technologies must navigate technological, regulatory, and market acceptance challenges to sustain its industry leadership.

Key Drivers of EV Market Growth, 2024-2030

Regulation: Increasingly stringent emissions regulations worldwide

Technology: Advancements in battery technology and charging infrastructure

Consumer Preferences: Growing environmental awareness and cost-effectiveness

The Road Ahead for Tesla

As Tesla navigates through a turbulent 2024, its ability to adapt to market demands, refine its strategies, and overcome operational challenges will be crucial.

With analysts expressing skepticism over its current approaches, particularly in robotaxi development and pricing strategies, Tesla’s upcoming decisions will be pivotal in either reinforcing its market dominance or revealing potential vulnerabilities that could impact its industry standing.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and the client should therefore be prepared to suffer significant losses when using such trading facilities.

Please ensure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to learn more.