On its inaugural day of trading under the new ticker symbol DJT, shares of Trump Media & Technology Group, the parent company of Truth Social, displayed a remarkable performance, ascending by 16%. This surge, coupled with an earlier peak of 50% during Tuesday’s session, underscores the heightened anticipation surrounding the platform’s market debut.

The ascent of DJT follows its merger with Digital World Acquisition Corp. (DWAC), a special purpose vehicle with a presence in the public market since 2021. The approval of this merger by shareholders last week paved the way for Truth Social’s entry into the realm of publicly traded companies.

Closing at USD 57.99 on Tuesday, the Wall Street Journal reported that the valuation of Donald Trump’s Truth Social was almost as big as U.S. Steel’s. DJT’s market capitalization soared to approximately USD 8 billion, reflecting the enthusiasm of investors. However, amidst this buzz, questions arise regarding the sustainability of such valuation levels when compared with underlying market fundamentals.

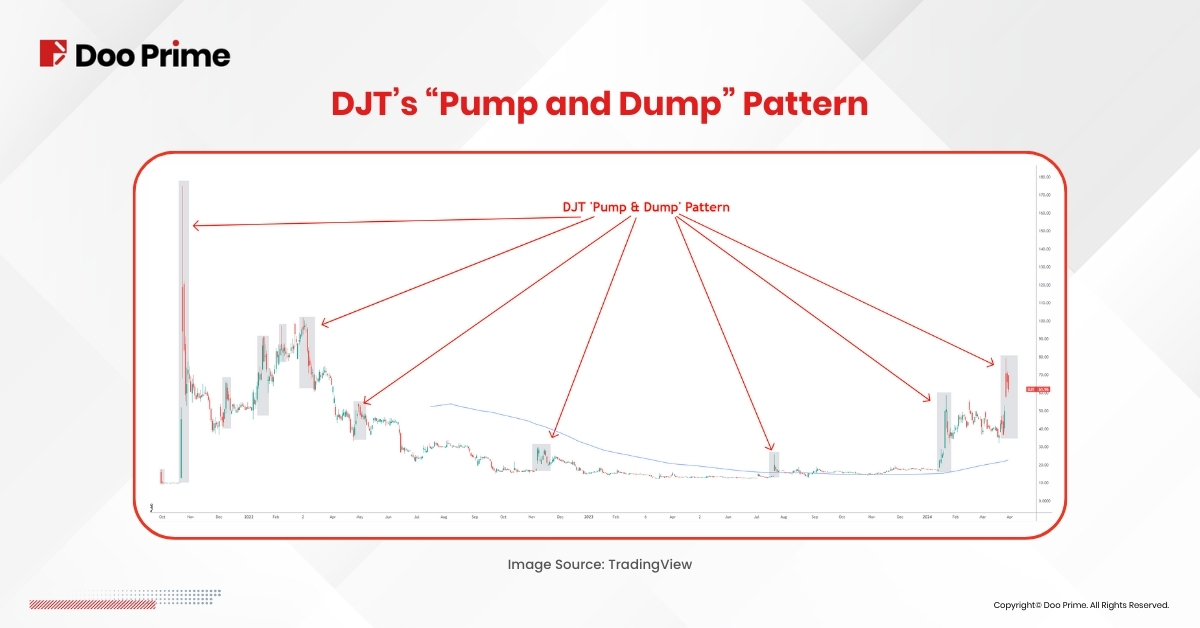

The “Trump and Dump” Pattern

A close examination of DJT’s market performance reveals a recurring trend commonly associated with high-profile Special Purpose Acquisition Company (SPAC) acquisitions. The initial surge in DJT’s stock price mirrors past instances where the anticipation surrounding such mergers propelled prices to extraordinary highs, only to be swiftly followed by notable downturns shortly thereafter.

This phenomenon mirrors a commonly known “Pump and Dump” scheme, wherein investors artificially inflate a stock’s price through misleading tactics, only to sell off their shares once the price reach its peak. This practice can lead to significant losses for unsuspecting investors caught in the downturn.

Notably, this pattern has been observable throughout DJT’s history from October 2022 to the present, indicating a susceptibility to market speculation and manipulation. Thus, investors are advised to approach DJT’s stock with caution, considering the risks posed by such volatile market conditions.

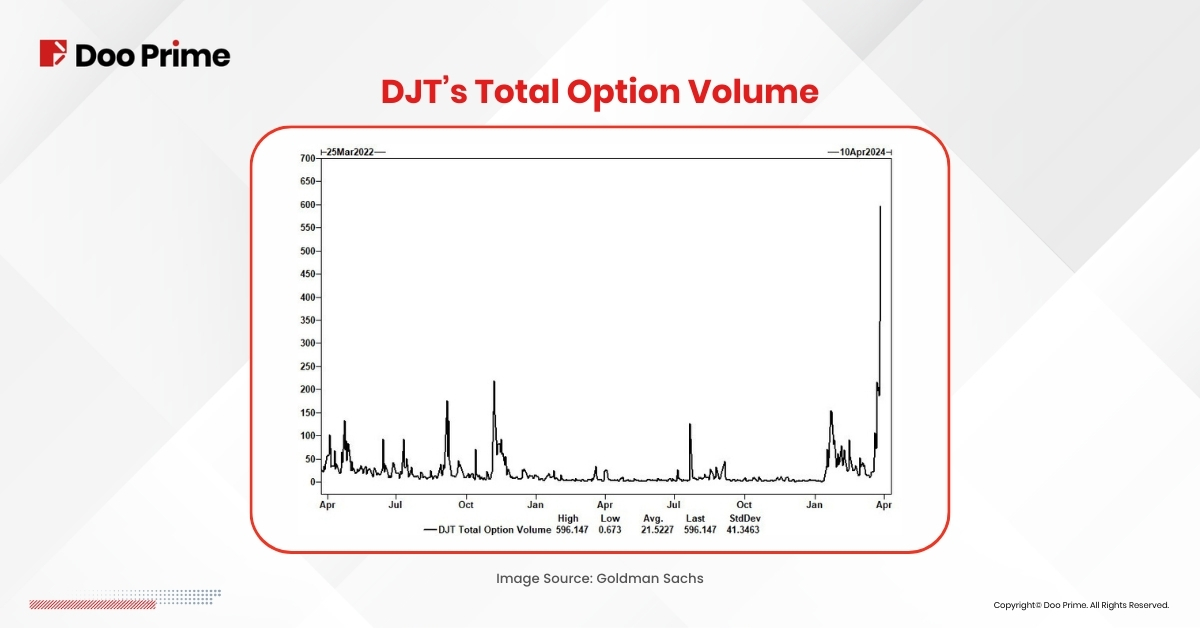

Heightened Speculation: Call Options and Market Dynamics

The significant volume of call options being traded on DJT has intensified speculation surrounding the platform’s market performance. While call options conventionally indicate bullish sentiment, their unusually high volume in this context raises questions on the underlying market dynamics.

In certain scenarios, a surge in call options can function as a contrarian indicator, suggesting anticipation of a potential price correction. This observation gains significance when considered alongside the current lock-up period, which imposes restrictions on major shareholders from selling their shares for the next six months. Consequently, there is a possibility of artificial inflation of demand during this period, further complicating the assessment of DJT’s market trajectory.

Assessing Valuation Metrics

It’s crucial to examine DJT’s financial fundamentals amidst the frenzy of market speculation. Recent disclosures reveal a stark contrast between DJT’s revenue, reported at USD 2.3 million, and its current market capitalization standing at USD 8.39 billion as of the 29th of March .

Jay Ritter, a finance professor at the University of Florida, underscored the disparity between DJT’s stock price and its actual value in a statement to CNN. He emphasized that if the company’s stock accurately reflected its value, “it would be priced not at USD 70 but at USD 2”. This substantial disparity between the stock price and its actual value raises significant concerns. Moreover, it underscores the potential temptation for cash-poor stakeholders, such as Trump, to sell off a substantial portion of their shares.

The evident overvaluation of DJT’s stock price casts doubt on the sustainability of current price levels. In other words, heightened volatility in the short term seems likely. However, there is a chance that the market will eventually adjust the stock price to better reflect its true value. This adjustment process could lead to a correction, where the stock price aligns more closely with the company’s fundamental value.

Investing With Prudence

Despite the initial excitement surrounding Truth Social’s entry into the stock market, it’s essential for investors to exercise a cautious approach. Investors should view DJT as a speculative investment rather than a long-term opportunity. With limited financial transparency and uncertain growth metrics, investing in DJT entails significant risk. Critical factors such as user base expansion and engagement levels remain pivotal, yet undisclosed aspects of the platform’s performance.

While Truth Social’s emergence onto the stock market marks a significant milestone, prudent investors should exercise caution. With its long-term prospects hinging on numerous uncertainties, thorough due diligence is imperative before considering investment in DJT.

The recent surge in DJT’s stock price may signal the start of sustained growth, but it could also be a temporary peak driven by market speculation. Only time will reveal the true trajectory of Truth Social’s success in the competitive landscape of social media platforms.

Therefore, it’s crucial for investors to remain vigilant and well-informed as they navigate the uncertainties of DJT’s journey. By adopting a careful and informed approach to investment, stakeholders can better position themselves to respond effectively to the dynamic shifts in Truth Social’s market performance.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.