The S&P 500 has been on fire this year. Wall Street’s favorite index has already broken record after record, and some analysts are daring to call 7000 by year-end.

Sounds extreme? Maybe not. Between rate cuts, booming earnings, and the unstoppable AI trade, the stars are lining up for another potential leg higher.

Let’s break down the three big reasons why the S&P 500 could keep climbing and potentially smash through 7000 before the year is over.

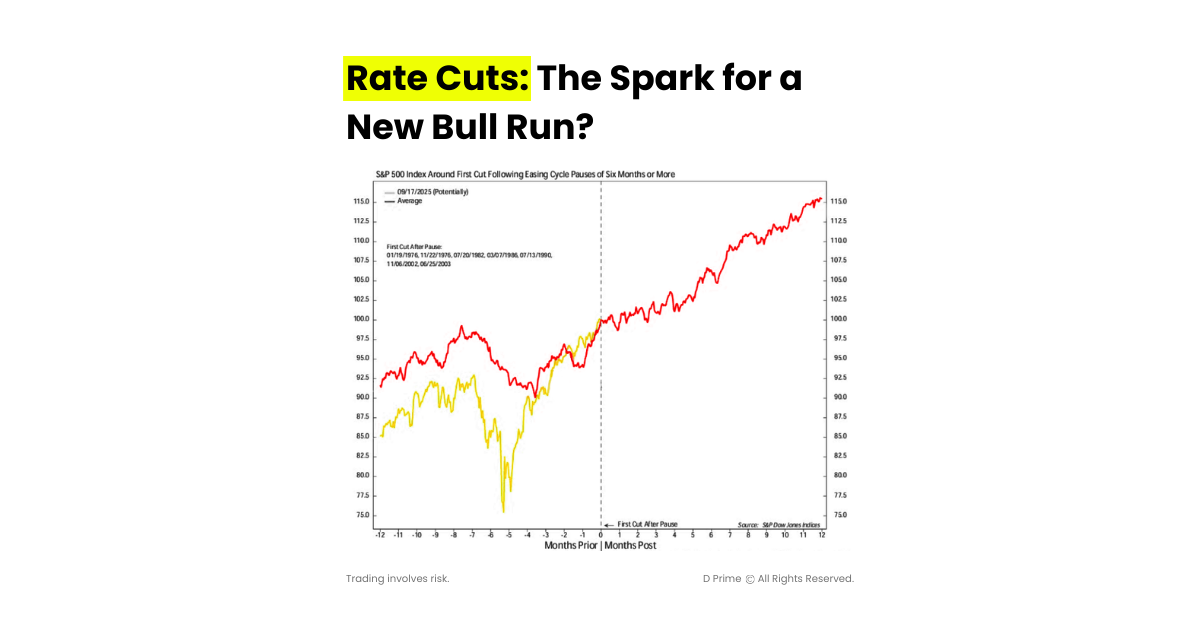

1. Fed Rate Cuts Could Fuel the S&P Rally

The first and most obvious tailwind: Rate cuts.

The Federal Reserve has already pivoted from a “higher for longer” stance to easing. Markets are pricing in more cuts in the coming months, and that means cheaper borrowing costs across the board. Lower rates push investors out of cash and into risk assets, and nothing absorbs liquidity like the US stock market.

History backs this up. Whenever the Fed starts cutting, stocks usually enjoy a short-term boost. It’s like giving the market an adrenaline shot. Even if a recession lurks down the road, the initial wave of liquidity tends to send equities ripping higher.

For the S&P 500, rate cuts provide a potential setup for risk-on positioning. If yields stay in retreat, the gravitational pull is toward equities, and that could be exactly what pushes the index closer to 7,000.

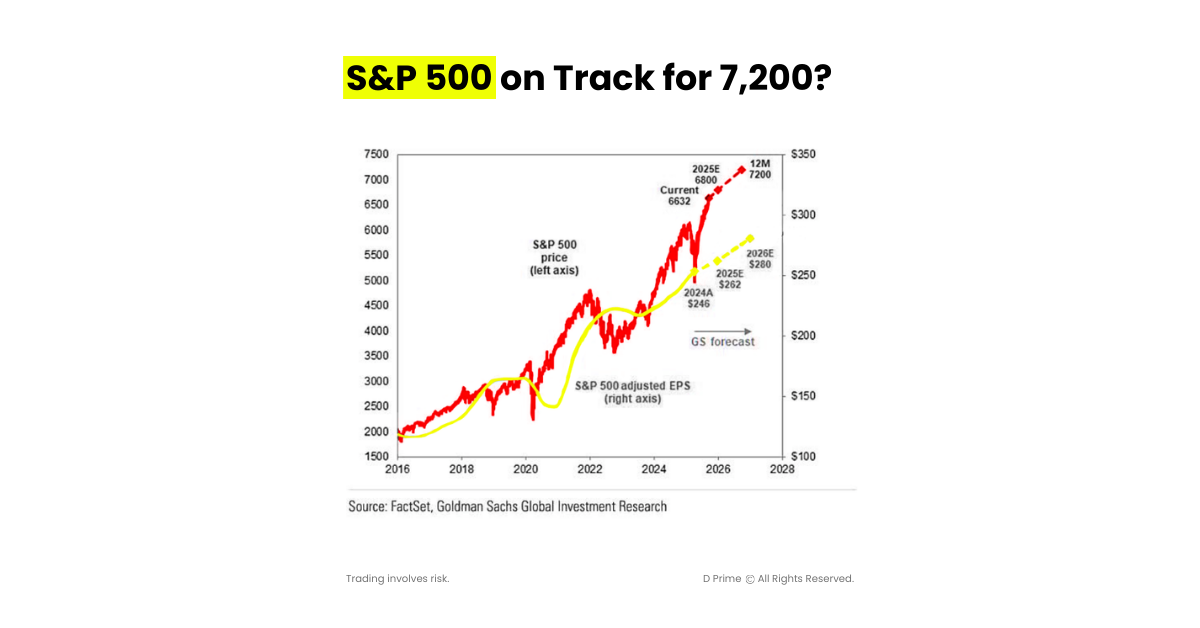

2. Strong Earnings and Resilient Economy

The US economy just refuses to roll over. Growth has cooled, but consumers are still spending, unemployment remains historically low, and corporate profits keep coming in better than expected.

Take Q2 and Q3 earnings: Wall Street analysts expected a slowdown, but many companies delivered double-digit growth. Tech giants like Microsoft, Apple, and NVIDIA have been leading the charge, but the strength goes beyond Big Tech. Industrials, financials, and even some consumer names are surprising to the upside.

This matters because the S&P 500 isn’t just a speculative tech index, it’s a broad basket of the US economy. When companies are posting strong profits, investors gain confidence that stocks can sustain high valuations.

In fact, Goldman Sachs recently lifted its year-end S&P target to 6,800, citing the combination of Fed cuts and better-than-expected earnings. That’s only 200 points away from the 7,000 mark.

3. The AI and Tech Boom is Unstoppable

The third, and perhaps most powerful, reason is the AI megatrend.

Artificial intelligence is reshaping the entire market. NVIDIA is printing record revenues, Palantir is winning government contracts left and right, and Microsoft and Alphabet are embedding AI across their platforms. This isn’t just hype. It’s turning into real earnings growth and real capital inflows.

Global investors are piling into US tech because nowhere else offers the same scale of innovation. And since the S&P 500 is so tech-heavy, this AI demand lifts the whole index. Inflows into AI-themed ETFs are at all-time highs, and hedge funds continue to overweight semiconductors, cloud, and software names.

Think of it this way: if AI stocks keep running, the S&P 500 gets pulled higher whether the rest of the market likes it or not. It’s a rising tide that lifts everything. And right now, there’s no sign of the tide going out.

Key Takeaways for Traders

Is 7000 guaranteed? Of course not. Risks remain, inflation could reaccelerate, geopolitics could flare, or the Fed could fumble its messaging. And let’s not forget, markets rarely move in straight lines.

But the setup is clear. The combination of Fed rate cuts, resilient earnings, and the AI boom is creating conditions that many see as supportive for equities.

For traders and investors, the key question may be how to navigate this environment if the index does test new highs.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. D Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. D Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution