The Middle East is once again at the center of global market tension, and this time it’s not a drill. The escalating conflict between Iran-Israel has erupted into a full-scale war, targeting oil facilities, refineries, and critical infrastructure.

The fallout? A spike in geopolitical risk that could send oil prices soaring above $100 and gold breaking new ground toward $4,000.

But it’s not just about price targets. The implications ripple through currencies, inflation, interest rate expectations, and investor behavior.

Here’s how it’s all unfolding and what traders and investors should watch next.

Iran-Israel All-Out War

What makes this Iran-Israel conflict different is the sheer scale and directness. Both nations are now hitting each other’s oil infrastructure head-on, from Iranian refineries to Israeli storage depots.

We’re no longer in a world of proxy strikes or covert sabotage. This is open warfare, with global supply chains in the crosshairs.

And that brings us to the Strait of Hormuz.

Roughly 20% of the world’s oil supply passes through this critical waterway. Any disruption could send oil prices into triple digits overnight. Historically, even threats to close the Strait have triggered massive price spikes.

If Iran decides to shut it down or if shipping becomes too risky, Brent crude at $110–120 is no longer a wild forecast. It’s a base case scenario1.

Will Oil Explode Past $100?

Oil prices are already reacting to rising tensions with Iran-Israel. WTI and Brent futures are climbing on speculation that supply disruptions could tighten an already fragile market. Add in speculative positioning and rising insurance costs for tankers, and it becomes clear that oil could break through key resistance levels quickly.

Technically, oil is now testing a major descending trendline that has acted as resistance since 2023. A confirmed breakout above this zone could clear the path toward the $90–100 range with momentum.

We’re entering a zone where every new headline adds volatility. This isn’t just about barrels; it’s about perception, fear, and risk premiums. And that’s when commodities start to run hot.

Can Gold Reach $4,000?

Usually, in times of war, gold isn’t just a safe haven, it becomes a statement. A hedge against chaos, inflation, and financial repression. With the dollar under pressure and the Fed boxed into a corner (more on that below), gold could finally break above its recent all-time highs and aim for the $4,000 mark.

Technically, gold is forming a classic ascending triangle pattern just beneath its all-time high of $3,500. A clean breakout above this level could trigger a strong bullish wave, with $3,800 and $4,000 as the next key zones to watch.

If geopolitical tensions escalate further, especially involving allies or neighboring countries, it is highly likely that even more institutional flows will move into metals.

The 2020s are shaping up to be the decade of gold and this Iran-Israel war might be the catalyst that propels it into its next phase

The Fed’s Dilemma: Between Rates and Iran-Israel

Normally, a war combined with economic uncertainty would push the Fed toward rate cuts. But rising oil prices create a new problem: inflation. The very thing rate cuts are supposed to tame may now be reignited by energy shocks.

So, what happens when the market expects easing, but the macro picture demands tightening?

We’ve been here before. Think of 1970s stagflation or even the early days of 2022.

If oil breaks out and CPI starts climbing again, the Fed will be forced to either hold rates higher for longer or risk losing control of inflation expectations.

Either way, the dollar may suffer. And that brings us full circle to the next domino.

USD: Caught in the Crossfire

The dollar has traditionally been the global safe haven during geopolitical turmoil. But this time, things are different.

Yes, fear can spark temporary demand for USD. But with oil prices rising and the Fed stuck between inflation and recession risks, that support may not last. The market is already pricing in rate cuts, but sticky inflation could delay them, trapping the Fed in a tough spot.

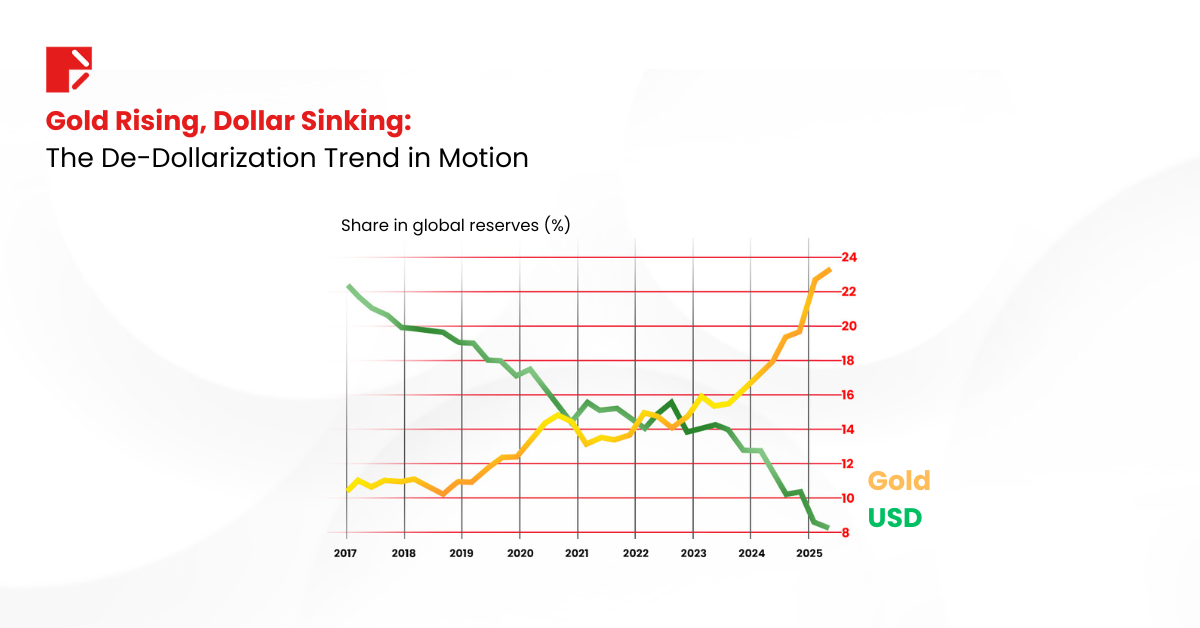

The chart above tells the bigger story: global reserves are shifting. Gold’s share is climbing fast while the dollar’s is in sharp decline. Central banks are diversifying, not just for yield but for safety from dollar-based volatility.

Add fading foreign appetite for Treasuries and a weakening DXY index, and the message is clear: the USD is losing its dominance. And in that vacuum, gold and commodities are stepping in.

Trump the Deal-Maker Between Iran-Israel?

While the Iran–Israel conflict escalates, there’s rising speculation that Donald Trump could attempt to broker peace before things spiral completely out of control.

Why would he step in? Because a prolonged war in the Middle East could hurt one of Trump’s key economic goals: lowering inflation.

A surge in oil prices means higher energy costs, higher shipping costs, and ultimately, a fresh wave of inflation, exactly what Trump doesn’t want.

If crude breaks above $100 and stays there, it complicates everything from consumer confidence to Federal Reserve policy.

For that reason, according to some market analysts, Trump may use his influence to push for a ceasefire or at least a cooling-off period. If successful, it could calm oil markets, pull back gold prices, and re-anchor inflation expectations.

Markets would likely cheer such a move. But until then, traders should expect volatility across energy, metals, and currencies to remain elevated.

What Traders & Investors Should Know

| Asset | Key Catalyst to Watch | Potential Market Scenario |

| Oil | Strait of Hormuz tensions | Supply shock could trigger a breakout above $100 |

| Gold | Inflation signals, safe haven flows | Escalation could fuel Gold toward $4,000 |

| USD | Fed policy, de-dollarization trends | De-risking and reserve shifts weaken the dollar |

| Equities | Rising oil prices | Volatility rises, sector rotations likely |

Final Word: Volatility Is the New Normal

The Iran-Israel war isn’t just a regional crisis, it’s a trigger for global market repricing.

Oil, gold, and the dollar are now at the center of this macro storm. Traders and investors must stay sharp, focus on price levels, not panic, and manage risk effectively.

In this environment, headlines move markets, but discipline protects capital.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This material constitutes general market commentary and is not prepared in accordance with legal requirements designed to promote the independence of investment research. As such, it is not subject to any prohibition on dealing ahead of the dissemination of investment research. This article is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. Any price levels discussed are illustrative only and do not constitute a forecast or advice.

The information provided herein is not intended for residents of any jurisdiction where its distribution or use would violate local laws or regulations. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.