The melt-up in the Tech Giants shows no signs of slowing down, defying gravity and investor expectations.

However, some experts warn that this euphoric “risk-on” sentiment will eventually lead to a deep market correction. Others are warning that a “Great Depression 2024” might be just around the corner.

But are these fears overblown, or are there legitimate warning signs we should watch for?

This article dives into three key indicators that could signal an economic downturn in 2024, urging us to look beyond the headlines and ask: Are we heading for a recession in 2024?

The Fed’s Narrative: No Recession in 2024

The Fed sees sunshine and rainbows and says “no recession” for 2024, pointing to two reasons: booming jobs and strong economic growth.

It makes sense, right? After all, the economy grew a whopping 4.9% in the last quarter and is expected to stay strong at 3.3% in the current one. Plus, January’s job report was stellar, adding way more jobs than anyone predicted. So, case closed, right?

Not so fast; every story has two sides.

While the Fed might be very optimistic about the future of the economy, other indicators like the inverted yield curve that we wrote about in our previous article, state-level slowdowns, and commercial real estate delinquency are flashing warning signs, prompting investors to take a closer look. Let’s dive deeper and see what else is brewing beneath the surface.

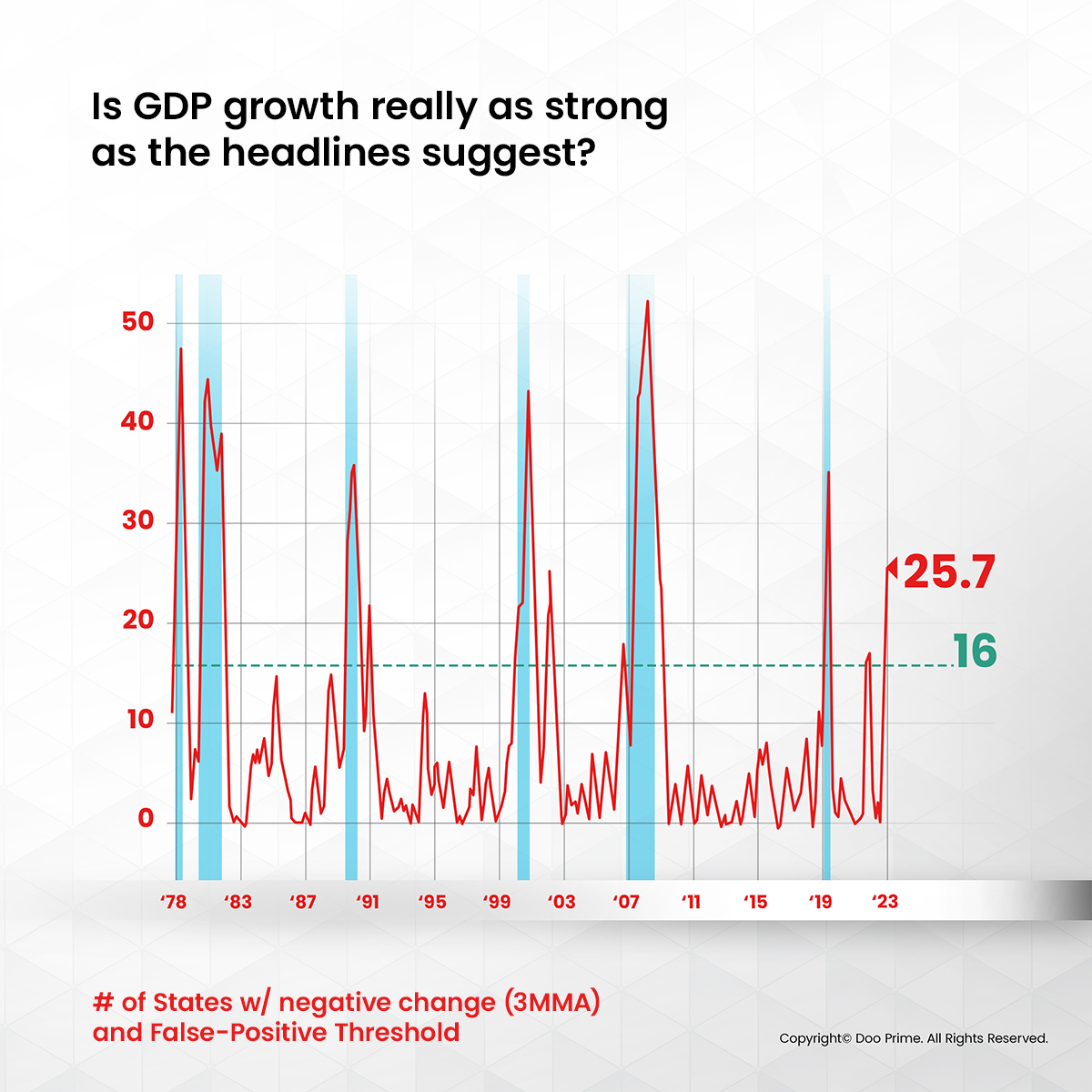

State-Level Slowdown: An Early Warning of Recession in 2024?

In November 2023, a warning sign emerged. The Philly Fed Coincident Indexes, which track economic activity in individual US states, revealed a worrying trend.

Monthly activity slowed in a staggering 30 out of 50 states. Even more concerning, this slowdown persisted for three months, with an average of 26 states experiencing sluggishness each month.

This data holds historical significance. Every time more than 16 states witnessed a slowdown, the National Bureau of Economic Research (NBER) subsequently declared a recession.

While national GDP figures might paint an optimistic picture, this state-level data suggests potential cracks beneath the surface, raising concerns about the true health of the US economy.

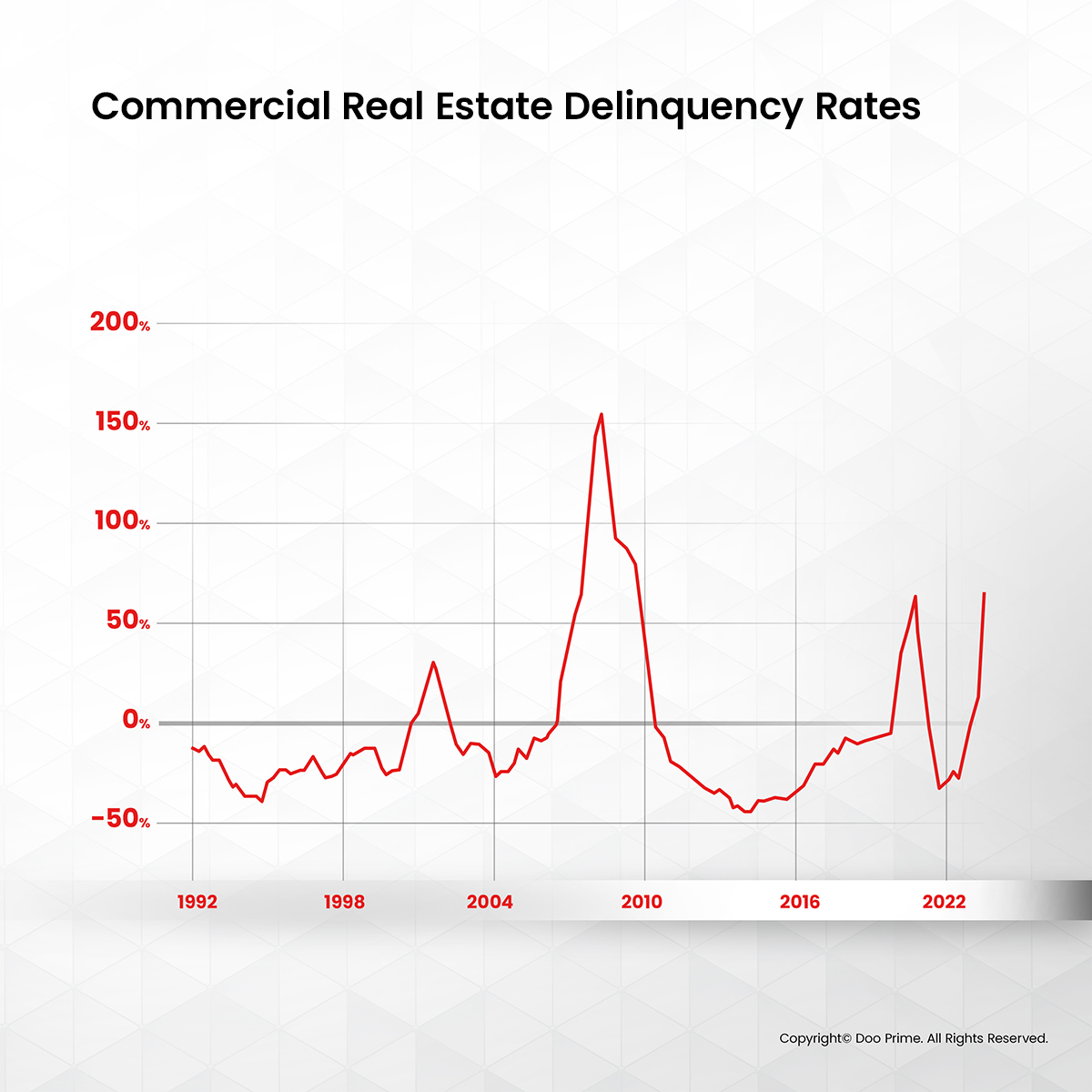

Delinquency in Commercial Real Estate

Rising interest rates and economic uncertainty are casting a shadow over the seemingly stable world of commercial real estate.

Delinquency rates, representing unpaid rent or mortgages on commercial properties, tend to spike just before recessions. And here’s the unsettling truth: these rates are creeping upward.

This could be due to various factors, such as overleveraged landlords struggling with debt, declining tenant demand in a weakening job market, or a combination of both.

While the national spotlight might be elsewhere, keeping a close eye on these delinquency rates is crucial. They can offer valuable insights into the health of the commercial real estate market and its potential impact on the broader economy, hinting at potential trouble ahead.

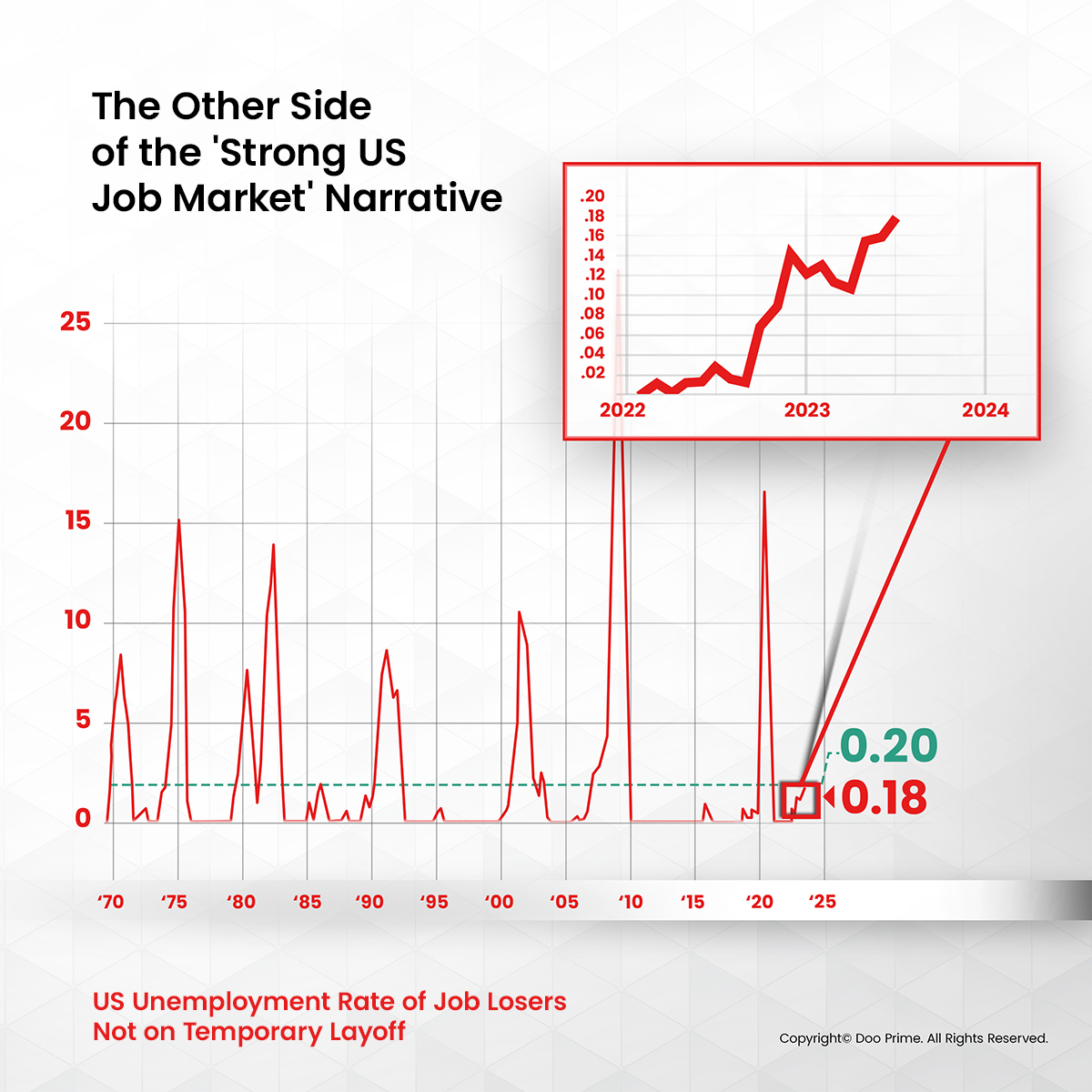

The Joshi Rule Indicator

While most economic indicators focus on the big picture, the Joshi Rule zooms in on a specific detail: those permanently losing their jobs, not just temporary layoffs. It compares the average rate of these “job losers” over the past 3 months to the lowest point in the past year.

Historically, when this difference rises above 0.20%, it’s signaled an increased risk of recession. Right now, we’re worryingly close at 0.18%. While not in recession territory yet, these potential job losses and economic hardships should grab our attention.

The Joshi Rule’s 0.20% threshold accurately predicted the last 8 US recessions, with no false alarms!

Will history repeat itself? Or is this time different?

Stay Vigilant: Prepare for The Worst

These warning signs shouldn’t trigger panic, but they do underscore the importance of staying informed and prepared. Here are some steps you can take:

- Keep checking in with Doo Prime’s economic news and articles to stay ahead and monitor any possible changes.

- Diversify your investments across different asset classes to mitigate risk and protect your portfolio.

- Be aware of potential challenges and opportunities in the market and adjust your trading strategies accordingly.

By staying vigilant and taking proactive steps, you can navigate economic uncertainties with greater confidence and resilience. Remember, knowledge is power, and being prepared can make a significant difference in weathering any potential storm, be it a blip or the much-feared “Great Depression 2024.”