Gold moves first, silver moves fast.

Up 11.1% so far in June alone and now trading at a 13-year high, silver has officially caught the market’s attention. From long-term investors to short-term traders, everyone is watching silver test levels not seen since the 2011 peak.

Here’s what traders want to know: Is this the beginning of a historic breakout? Or just another rally that fades at resistance?

Why Silver’s Move Matters Now

In a market flooded with AI hype and crypto headlines, silver’s strength is quietly signaling something deeper.

Historically, the precious metal has served as a store of value, an industrial metal, and a monetary hedge. And when it moves, it doesn’t tiptoe.

Back in 2011, silver surged from $35 to nearly $50 in just six weeks. That’s a 40% move in less than two months. It was a fast, furious rally fueled by inflation fears, dollar weakness, and safe haven demand.

Fast forward to today, and we’re seeing a similar setup.

- Real yields are under pressure

- The dollar is weakening

- Global debt is surging

- Investors are once again turning to hard assets

And silver is answering the call.

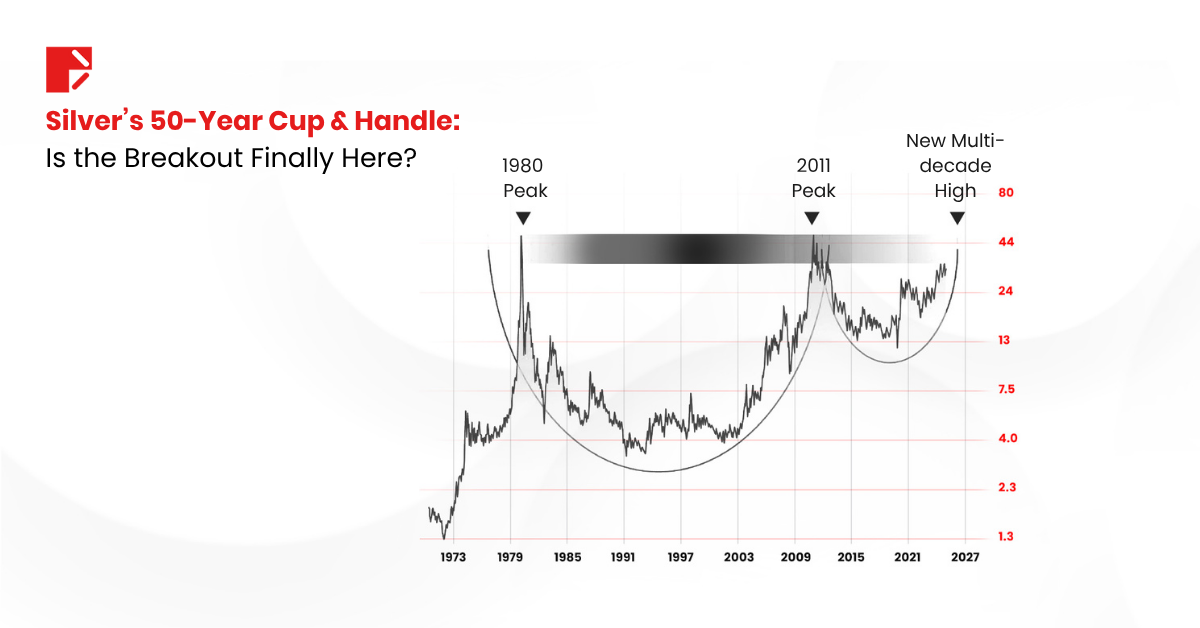

A 50-Year Chart With a Story

The chart above paints a compelling technical picture. This precious metal appears to be forming a giant cup-and-handle pattern, a bullish formation often seen before major breakouts.

It’s very similar to what gold formed before breaking above $2,000.

The horizontal resistance zone around $44–$50 has capped silver’s upside for over four decades. Once in 1980. Again in 2011. And now, in 2025, the metal is charging back toward that zone.

A clean break above $50 would mark a new all-time high and potentially open the door to a fresh, long-term bull cycle.

The handle phase may already be behind us. What comes next could be explosive.

Silver Momentum Is Picking Up Fast

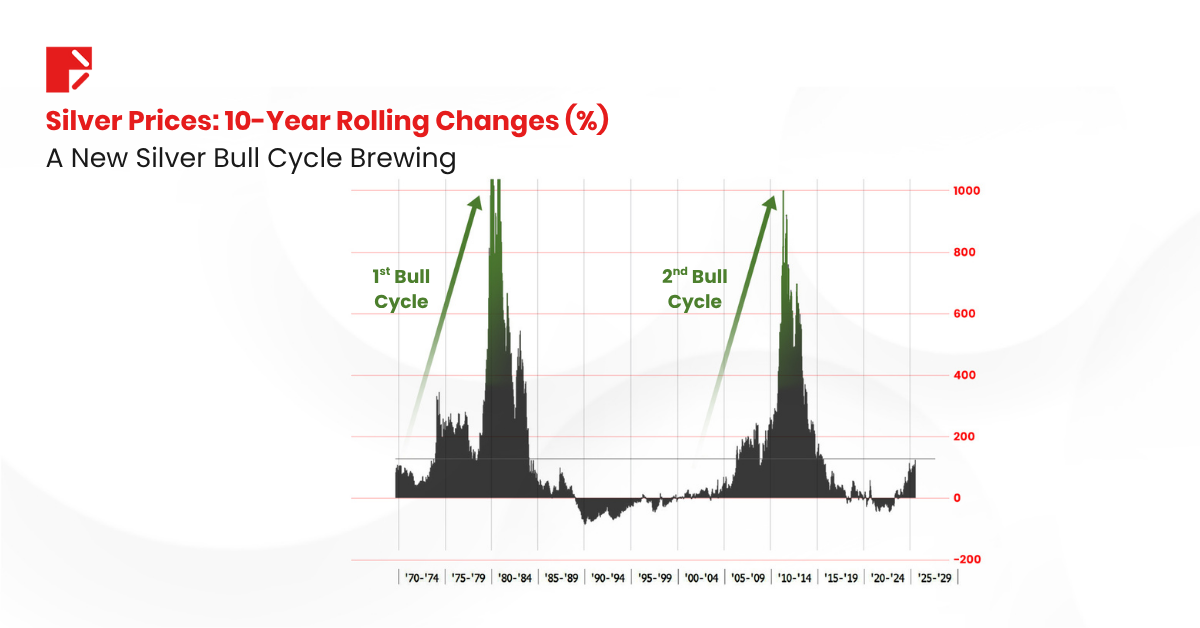

The chart above shows silver’s 10-year rolling price changes, highlighting two major bull markets: the 1970s and the 2000s. Each cycle saw enormous gains as the metal went from forgotten to front-page.

Now? We’re seeing the early signs of a potential third bull cycle.

Silver’s rolling return has crossed back into positive territory, and momentum is accelerating. From a macro lens, this rally looks like it has legs.

Here’s another historical kicker:

In 2011, silver took just 6 weeks to go from $35 to $50.

With the metal currently hovering around $36-$37, that kind of move isn’t far-fetched, especially if we get the right mix of falling dollar, rising inflation, or geopolitical shock.

Why the Macro Picture Favors Silver

Let’s zoom out.

Silver isn’t just about shiny coins or industrial demand. It reflects global macro conditions, and right now, the setup is notable:

- Central banks are stuck: Inflation is still sticky, but economies are slowing. Rate cuts are likely ahead, which tends to weaken fiat currencies and lift metals.

- The dollar is sliding: As discussed two weeks ago in our USD article, the greenback is facing structural pressure, which historically benefits silver and gold.

- Industrial + Monetary demand: Silver plays both sides. It’s used in solar panels, batteries, and electronics, but it’s also held as a safe haven. That dual role makes it unique.

Is $50 Silver Possible?

From a technical, historical, and macro point of view, yes $50 is back in the conversation.

But let’s be clear: silver is volatile. It’s prone to violent swings both ways. It’s not a straight line up, and there will be sharp corrections along the way.

Still, the ingredients for a breakout are in place:

- Multi-decade resistance retest

- Long-term bullish pattern

- Strong May-June performance

- Supportive macro backdrop

- Historical precedent of fast rallies

The $50 level is more than just a price target. It’s a psychological milestone, a multi-decade ceiling that, if broken, could reprice silver entirely.

Key Takeaways

- Silver is up 11.1% in June so far, reaching its highest level since 2011

- Technicals point to a long-term cup-and-handle pattern

- History shows silver can move fast, as it did in 2011

- Macro trends like dollar weakness and rate cuts support the case

- A breakout above $50 would mark new all-time highs and a potential secular bull market

Whether you’re a long-term investor or a short-term trader, silver is back on the radar.

Watch the resistance. Track the momentum. Stay nimble and always manage your risk.

Because if this breakout sticks, it could be one for the history books.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.