The Met Gala 2025 once again delivered its signature spectacle — a dazzling display of haute couture, celebrity stardom, and social media buzz. Luxury brands like Louis Vuitton, Chanel, and Valentino dominated headlines with their stunning designs and star-studded ambassadors. But beyond the red carpet flashbulbs, the fashion industry is facing a growing crisis: a perfect storm of rising tariffs, soaring costs, and unstable global trade dynamics.

At the heart of the turmoil is President Donald Trump’s revived trade agenda, which threatens to squeeze even the most dominant players like LVMH and Hermès, while putting massive pressure on fast fashion disruptors like Shein.

Even as haute couture stuns on the Met steps, the financial seams of the fashion world are straining. Could tariffs turn the runway into a red alert?

Trump’s Trade Policy: A Looming Threat to Fashion’s Bottom Line

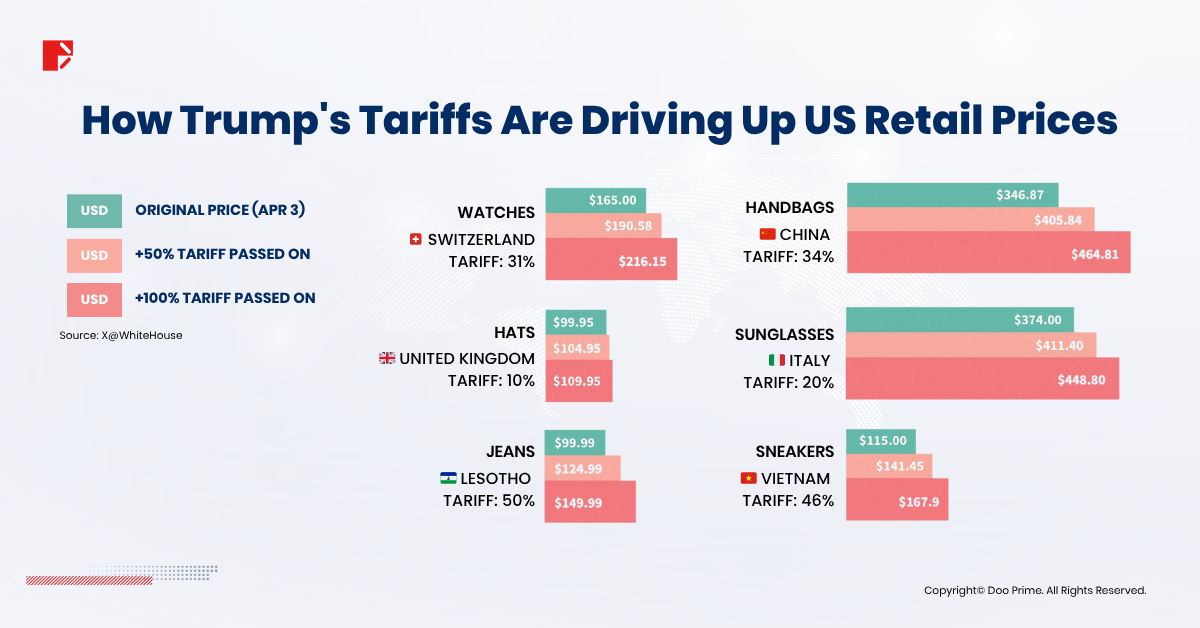

President Donald Trump’s revived tariff agenda is sending shockwaves through the global fashion ecosystem. While a temporary 90-day delay has postponed retaliatory tariffs on the European Union, the US has already imposed a 10% baseline duty on European fashion imports, directly impacting luxury exports from France and Italy — the home turf of brands like Louis Vuitton, Gucci, and Valentino.

Even more severe proposals are in the pipeline:

- 20% tariffs on European clothing and leather goods

- 31% tariffs on Swiss watches

At the same time, US trade policy is tightening on fast fashion. On May 2, the US eliminated the de minimis exemption for Chinese packages under $800, effectively introducing import duties on previously tax-free items. This policy strikes at the heart of fast fashion logistics, targeting brands like Shein that rely on low-cost, high-frequency global shipments.

Luxury & Fast Fashion Respond with Strategic Price Hikes

As tariff pressure builds, fashion houses are choosing to protect profitability through pricing power. A recent study from Joor shows that 85% of fashion brands plan to raise retail prices to offset added costs.

- LVMH, the world’s largest luxury conglomerate, confirmed in its latest earnings call that it will adjust pricing in the US, while also reducing overhead and recalibrating marketing budgets to defend margins.

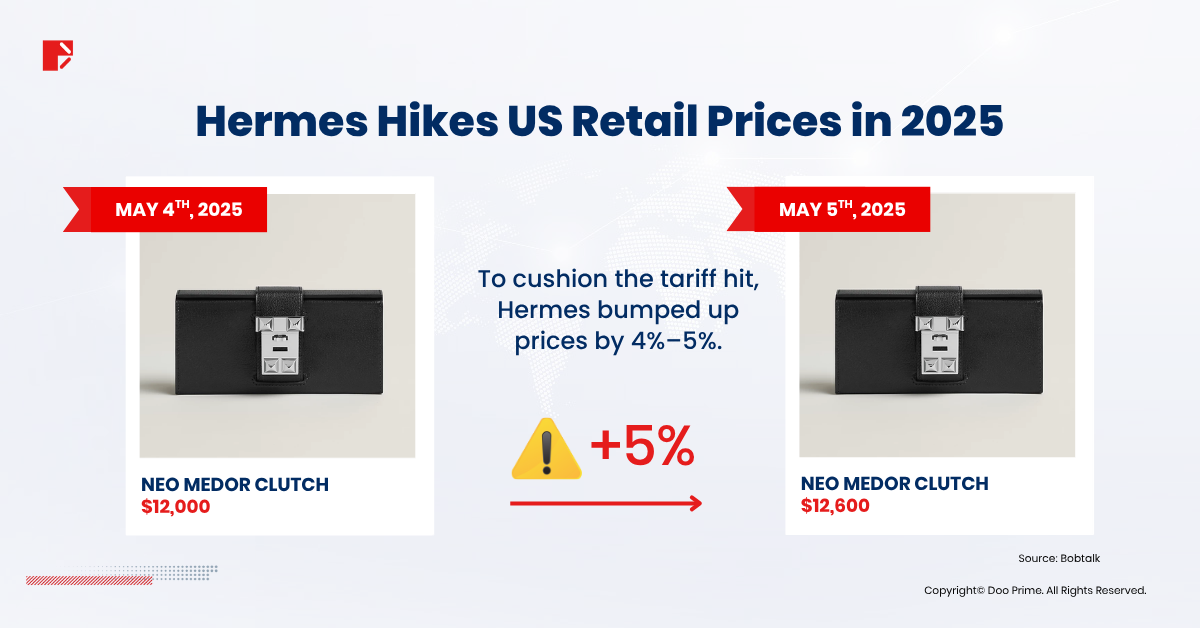

- Hermès, known for its ultra-exclusive positioning, raised US retail prices by 4–5% starting May 1, atop its usual 6–7% annual adjustments — a clear move to cushion tariff impacts.

- Shein, operating on razor-thin margins, increased its US prices by 10% between April 24–26, blaming rising global trade barriers. Notably, prices in the UK remained unchanged — highlighting the brand’s strategic dependence on the American market.

Even the athletic sector isn’t immune. The Footwear Distributors and Retailers of America (FDRA) — joined by Nike, Adidas, and Skechers — issued an open letter to the White House on April 29, urging a rollback on proposed tariffs. They warned that existing footwear tariffs (already 20–37% for kids’ shoes) could spike to 150–220%, triggering widespread bankruptcies and inventory shortages nationwide.

In a dramatic turn, Skechers announced a surprise privatization on May 5, with analysts speculating the move aims to escape public-market scrutiny and gain agility amid the brewing tariff war.

3 Key Ways Tariffs Are Reshaping Fashion’s Future

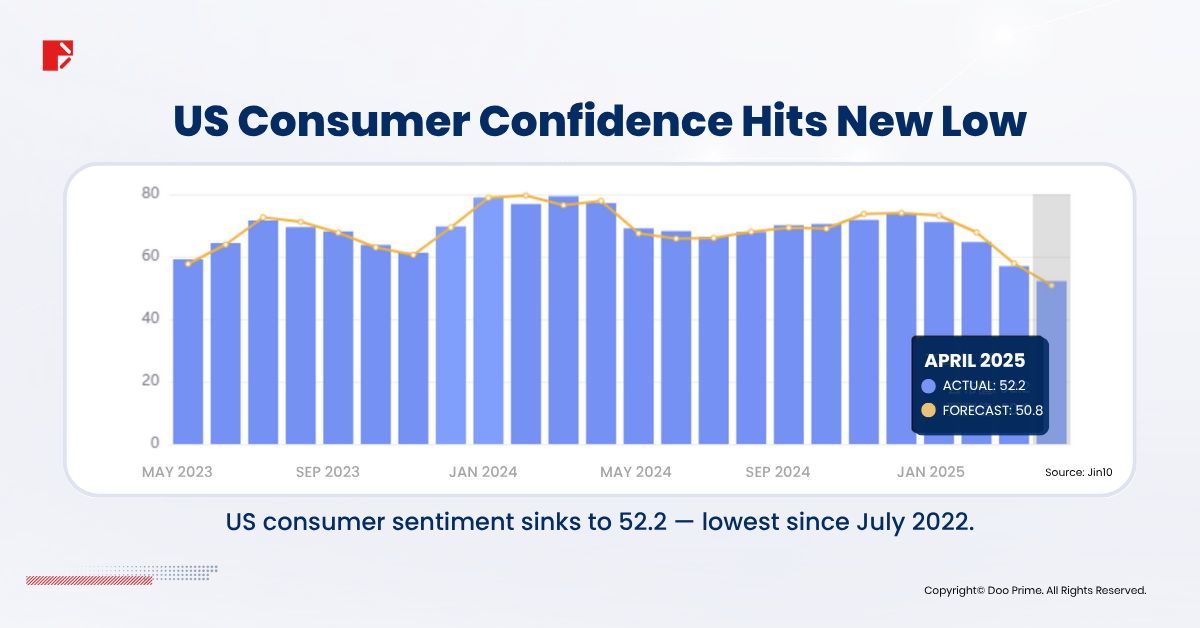

- Shrinking Consumer Demand

Price-sensitive consumers are increasingly pulling back, especially in non-essential luxury categories. As tariffs drive up end-user costs, both aspirational and high-end buyers are reevaluating their spending.

- The US Consumer Confidence Index fell to 52.2 in April 2025, the lowest level since July 2022, signaling mounting hesitation in discretionary purchases.

- Brands heavily dependent on the US — the world’s largest fashion market — are feeling the heat. LVMH’s Q1 2025 results confirmed a significant shift:

- Revenue dropped 3% YoY to €20.3 billion, versus expected 2% growth

- Fashion & leather goods fell 5%, the company’s largest division

- US revenue dropped 3%, Asia-Pacific was down 11%, and Japan fell 1%

This decline triggered an 8% plunge in LVMH’s stock, briefly dethroning it as the most valuable CAC40-listed company — a title that passed, momentarily, to Hermès.

- Global Supply Chains Under Pressure

Luxury brands may tout European craftsmanship, but behind the label lies a highly globalized supply chain. Materials and components are often sourced from Asia, assembled in Europe, and shipped to North America.

Tariffs have thrown this delicate balance into chaos. In an effort to mitigate risks, brands like LVMH are increasing US-based production. However, these efforts come with growing pains. Reports from LVMH’s Texas factory cite a 40% material waste rate, double the industry average — casting doubt on the scalability of reshoring luxury production.

As long as Europe remains the heart of manufacturing, rising US import duties will continue to erode profitability.

- Currency Volatility Compounds the Challenge

The fashion industry’s global footprint makes it extremely sensitive to currency swings. In light of Trump’s aggressive trade stance, the US dollar has shown signs of weakening, adding another layer of uncertainty for international brands.

While a weaker dollar can boost euro-based earnings for companies like LVMH and Hermès, it poses a challenge for dollar-pegged players like Shein — whose pricing model relies on US consumer affordability.

Even Warren Buffett has voiced concern, suggesting the US may no longer be committed to defending the dollar’s value. “We don’t want to hold a currency we believe will significantly depreciate,” Buffett warned — a sentiment that could signal wider shifts in capital allocation across markets.

Luxury Fashion’s 2025 Outlook: Turbulent, Fragmented, and Fiercely Competitive

The road ahead for fashion is no longer lined with gold. Bernstein has revised its 2025 forecast, predicting the luxury sector will contract by 2%, down from an earlier projection of 5% growth. While titans like LVMH and Kering may leverage pricing power to shield margins, even affluent consumers are growing cost-conscious.

Several trends are reshaping the landscape:

- Value-driven alternatives are rapidly eating into the market share of traditional luxury houses.

- Brand fatigue is setting in as product innovation stalls and launch cycles become predictable.

- Frequent price hikes are testing consumer loyalty, eroding the emotional connection that luxury once commanded.

What emerges is a luxury fashion sector in deep flux where legacy brands must either adapt with agility or risk irrelevance.

Navigating the Trade Storm with Doo Prime

As the fashion industry grapples with trade turmoil and macroeconomic headwinds, investors need smarter ways to hedge and diversify.

Doo Prime offers over 10,000 CFD products, across global markets — including:

- 60+ currency pairs (EUR/USD, USD/JPY, etc.)

- Equities, gold, silver, oil, and futures

- Leverage up to 1:1000 for flexible capital allocation

Stay ahead of the trends shaping global markets and protect your portfolio with tools built for volatile times.

Disclaimer

The information contained in this article is intended for general informational purposes only and should not be construed as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation or particular needs and should not be regarded as personalized advice. Past performance references are not reliable indicators of future performance.

The views and opinions expressed in this article are for reference only and should not be considered as the views or opinions of Doo Prime or its affiliates. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of the information provided and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

Do not rely on the above content to replace your independent judgment. You should consider the appropriateness of this information concerning your personal circumstances before making any investment decisions. The market is risky and investments should be made with caution.

© 2025 Doo Prime. All Rights Reserved.