The global financial market has endured an arduous journey in 2022. With volatile foreign exchange news cycles and evident swings across the board this year, the currency market is undoubtedly not immune.

To add, the markets have primarily dealt with one common shock – the global pandemic recovery – and the foreign exchange performance has been dependent on some shifts in global risk sentiment and policy responses to this shock.

Dollar’s Dominance In 2022

While the majority asset class has seen apparent miserable returns in 2022, the US dollar seems to be less affected.

The dollar is the world’s reserve currency. It is also perceived as the most stable and safest currency in the world. In times of uncertainty, investors flock to safety, and hence the dollar has risen historically.

The dollar has strengthened dramatically over the course of the year as the Federal Reserve hiked interest rates in an effort to quash sky-high inflation. The U.S. Dollar Index, which measures the greenback against a basket of other currencies, is up more than 17% so far this year.

“We have seen a tremendous rise in the dollar,” said Matt Forester, chief investment officer of Lockwood Advisors at BNY Mellon Pershing. “It’s a juggernaut in the middle of every securities transaction and payment around the globe.”

The dollar’s strength is even more pronounced when compared to the poor performance of stocks, bonds, real estate and cryptocurrencies—and that’s before considering the impact of inflation.

Major Currencies Movements In 2022

Dollar

On 12th July 2022, the euro reaches parity with the US dollar (1 EUR equals 1 USD) for the first time in 20 years, signaling the market’s assumption that the European economy is heading for a deep recession as a result of Russia’s invasion of Ukraine.

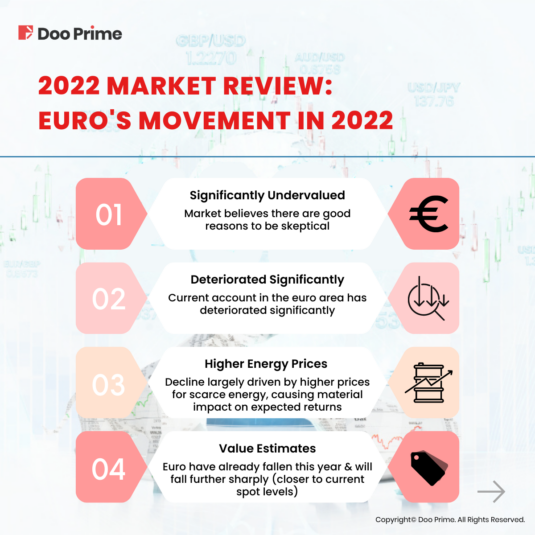

Euro

The euro is significantly undervalued by most traditional standards, but the market believes there are good reasons to be skeptical of these valuations.

The current account in the euro area has deteriorated significantly in recent months, and the size of the current account for the whole year may fall by more than 500 billion euros.

The decline was largely driven by higher prices for scarce energy, which, in our view, could have a material impact on expected returns in the euro.

Fundamentally, valuation estimates are based on the assumption that past relationships still hold, which is far from clear in the current context.

Goldman Sachs’ commodity analysts expect Europe to continue to face gas shortages and higher prices next year to rebuild storage levels again. At the base level, as euro area import prices rise, it needs a cheaper euro to achieve the same external balance as before.

As a result, Goldman Sachs’ model estimates for the fair value of the euro have already fallen this year and will fall further sharply (closer to current spot levels) if the current account holds around current levels.

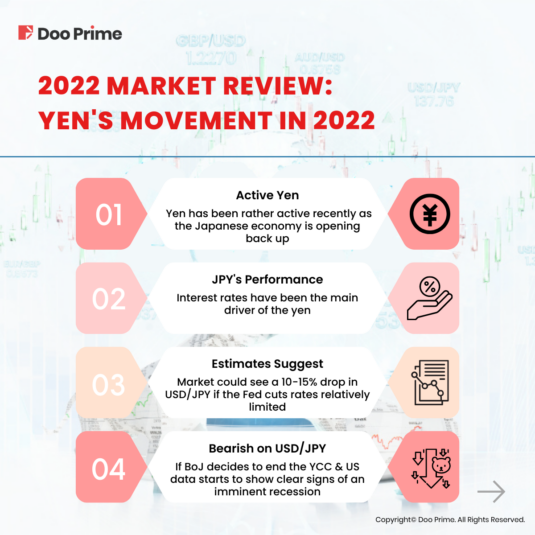

Yen

The Japanese yen is another highlighted currency in 2022. The Yen news has been rather active recently as the Japanese economy is opening back up. To add, the Bank of Japan’s unconventional monetary policy has also supported the yen.

Interest rates have been the main driver of much of the JPY’s performance this year, and the market them to remain unchanged over the next 12 months, with two potential paths.

The first path, in line with Goldman Sachs’s economic outlook, calls for renewed USD/JPY upside:

i) the US economy will most likely avoid a recession next year (even if the Fed raises terminal rates higher than initially expected)

ii) the Bank of Japan’s yield curve control (YCC) policy remains at least until Haruhiko Kuroda’s term 2023 H1.

If interest rate differentials continue to widen in favor of the dollar, the possibility of additional forex market intervention by the Japanese Ministry of Finance also looks unlikely to be sufficient to prevent further depreciation. This is despite the fact that the operations in dampening the impact of changes in US yields have succeeded, especially at a time when spreads widen against the yen.

That said, this backdrop will drive USD/JPY to rebound again to 155 in the coming months. The US bond rally looks likely to reverse, with USD/JPY’s recent decline clearly outpacing fundamentals.

At the same time, the risk of a further prolonged JPY depreciation cycle in the US skews JPY yields towards higher levels and could lead to JPY depreciation more than the market already expected.

But under the Goldman Sachs baseline outlook, the second half of 2023 should be more constructive, as the dollar is likely to see the necessary conditions to move lower for most crosses: mainly according to their economists’ forecasts, the Fed rate hike cycle is finally imminent Closing — cheap valuations will play a bigger role.

The second approach sees an earlier and larger drop in USD/JPY over the next year. Analysts see three key downside risk scenarios in the USD/JPY benchmark outlook: a faster-than-expected end to YCC, a US recession, or both.

While the economists see risks tilted in the opposite direction, the market is increasingly focused on Japan’s monetary policy as foreign exchange intervention has begun as core inflation measures rise to target and US Treasury yields appear likely to continue rising Potential shift in stance.

If the market sees changes to the YCC, they think ending the policy entirely (rather than raising the target or shortening the duration) would make the most sense for JPY – and even then, it may not work out as some expect a big impact.

The bigger driver will be a recession in the US and the Goldman Sachs estimates suggest the market could see a 10-15% drop in USD/JPY if the Fed cuts rates relatively limited.

This means that if the Bank of Japan decides to end the YCC and US data starts to show clear signs of an imminent recession, the market would be more bearish on USD/JPY.

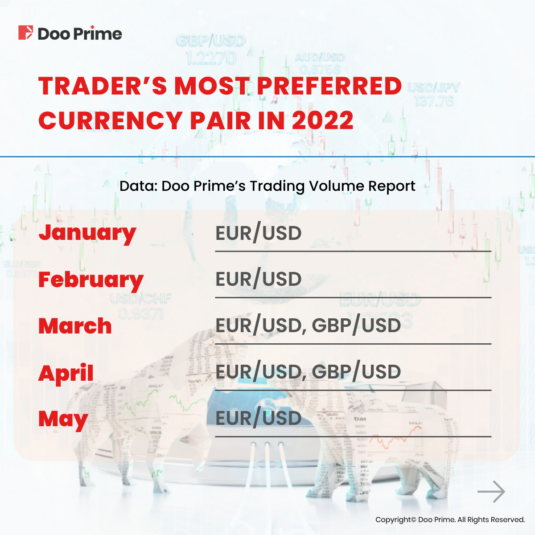

Trader’s Most Preferred Currency Pair In 2022

Here, we made a list of the most popular currency pair traded in 2022 according to Doo Prime’s trading volume report.

With this, it is evident that the EUR/USD marks the main currency pair, both by the volume traded and its popularity among retail traders.

What To Expect In 2023

Now, as we prepare to enter 2023, this environment is entering a new phase. The COVID-19 recovery has been uneven, policy tightening has been very rapid, the war in Ukraine has brought Europe to the brink of recession, and economic activity may be subject to lasting physical restrictions.

So far, this shifting landscape has proven to be a meaningful boost to the dollar, which benefits from both the relative resilience of the economy and its safe-haven appeal to challenge already stretched valuations force.

However, with the monetary policy cut, China is expected to ease its grip on COVID-19, and Europe to experience longer-lasting physical restrictions.

Against this backdrop, the market would expect a more differentiated tactical environment in the global foreign exchange market in 2023, with the USD eventually peaking.

The factors are of course the main ones. However, we have to keep in mind that the uncertainty sees no sign of abating anytime soon, as sentiment is still bearish and fear high.

While the Fed remains ahead of other central banks in hiking rates, it, therefore, doesn’t feel like this dollar strength will reverse anytime soon. Of course, this is all speculation and the energy pricing is still a wildcard (who knows what happens in Ukraine) and may affect things.

Nevertheless, on an overall basis there is nothing to suggest an abrupt curtailment of the dollar’s strength.

| About Doo Prime

Our Trading Instruments

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime is an international pre-eminent online broker under Doo Group, which strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 90,000 clients, with an average trading volume of more than USD51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 10 different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe : +44 11 3733 5199

Asia : +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China : +86 400 8427 539

E-mail:

Technical Support: [email protected]

Account Manager: [email protected]

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.

Home

Home