In our last economic events roundup article, we covered the Russia-Ukraine war, the Federal Reserve rate hike, the Japanese Yen crisis, and other major events that have affected the financial market in 2022. In this article, we will continue to review what other key events of the year are worth reviewing.

7. China’s State-Run Giants Delisted From U.S. And Moved To H.K.

In August this year, five Chinese state-owned companies – China Life Insurance, Sinopec, PetroChina, Aluminum Corporation of China and Sinopec Shanghai Petrochemical – announced they would voluntarily apply to be delisted from the New York Stock Exchange (NYSE).

The cause of this incident can be traced back to the passage of the Holding Foreign Companies Accountable Act (“HFCAA”) passed in 2020. The Act requires listed companies in the NYSE. to face mandatory delisting if they fail to provide audit papers to the U.S. for three consecutive years.

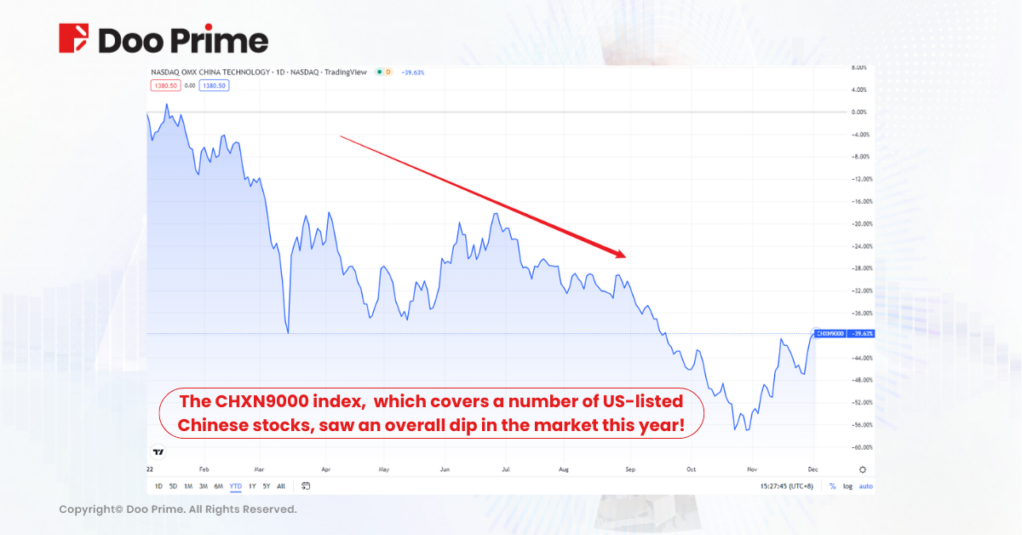

At present, hundreds of Chinese companies listed in the U.S. are at risk of being blacklisted by the U.S. for delisting.

As early as 2021, three major telecommunications operators, China Mobile, China Unicom and China Telecom, were delisted from the NYSE. This, coupled with the fact that five high-quality Chinese state-owned enterprises have taken the initiative to delist from the NYSE, has sparked market concerns that Chinese stocks will be delisted in the U.S. on a large scale.

According to some analysts, the five Chinese SOEs listed in the U.S. have a relatively small share of ADRs, so even if they are delisted in the U.S., the impact will be limited. And since the companies are listed on both the A-share and Hong Kong stock markets, their exit from the U.S. market will not affect their subsequent financing activities. The delisting move is more of a symbolic expression of the increased focus on financial security between the U.S. and China.

But even so, the loss of the U.S. stock market would mean the opportunity to connect a large amount of funds is lost.

The funds to buy these Chinese stocks in the market are bound to decrease, which will naturally put pressure on the stock price in the short term, so investors need to be aware of the risk of stock price volatility in this regard.

8. Extreme Weather In Various Corners Of The World

This year, various types of extreme weather have emerged around the world, constantly affecting the normal economic life of human beings.

Especially this summer, extreme heat waves swept the world. Several Chinese provinces and regions have seen extreme heat with maximum temperatures of 40°C or more for several days in a row.

The National Meteorological Center of the China Meteorological Administration (CMA) has issued its first national red alert for high temperatures, as the water levels in the Yangtze River continued to dry up.

Europe and the United States also failed to escape the heat wave. Many places in Europe in the summer this year continue to break the highest temperature records, and even caused frequent forest fires. At the same time, the United States is also in an extreme drought.

High temperatures also have a significant socio-economic impact. High temperatures initially force people to pay more for electricity, which not only poses a challenge to the already fragile energy structure in Europe, but also makes inflation in the short term more difficult to ease.

Although Europe developed a carbon emission reduction plan last year, after the energy crisis this year, many European countries have to suspend the carbon neutral plan, but increased the demand for traditional energy sources.

Extreme weather has undoubtedly sounded the alarm for the future energy security, food security and environmental security of all countries. Reflected in the financial markets, the price trend of commodities may be more frequently affected by extreme weather in the future. With this, the stock sector with the theme of “new energy” may also have long-term strategic development significance.

9. Europe Falls Into Recession, The Euro In Crisis

The Russia-Ukraine war at the beginning of the year was like a fuse. It has directly or indirectly triggered a series of crises and difficulties in the European region this year.

Energy Crisis:

Europe has long been depended on Russia for low-cost energy supplies. However, after the outbreak of the Russian-Ukrainian war, European countries have followed the U.S. lead in imposing sanctions on Russia, making it difficult for Russia’s low-cost energy to enter the European market.

In September, the Nord Stream gas pipeline connecting Russia and Europe was suspected of being sabotaged. But because of this, Europe’s fragile energy structure is also facing a major crisis.

To add, the heat wave that swept through Europe this summer has greatly increased energy demand in Europe. And this year’s winter is expected to be a “cold winter” in Europe.

Although Europe is frantically storing natural gas energy and actively promoting energy financial subsidies to cope with the winter, this can only be used for emergency purposes in the short term, and the long-term problem of a fragile energy structure has not been solved in essence.

Inflation:

The energy crisis has caused European governments to continuously increase their fiscal expenditures, resulting in a sharp increase in the cost of energy purchases and, in particular, the price of natural gas. As a result, the general public is also forced to pay higher energy bills, leading to the already existing inflation problem in Europe to become more serious.

The surge in energy costs is pushing up inflation, and naturally, it is also spilling over into the rising costs in industrial production and other areas, which ultimately has a negative impact on the entire European economy.

Exchange Rate Crisis:

Under the influence of multiple unfavorable factors, the European economy has been stagnant for a long time. Consumer confidence levels are relatively low, the United Kingdom political volatility and the U.S. dollar interest rate hikes have harvested the world.

Ultimately, the market’s confidence in the Eurozone economy has gradually declined, which in turn dragged down the Euro exchange rate.

As things stand, there is no quick solution to Europe’s various crises in the short term.

10. British Prime Minister Resigns

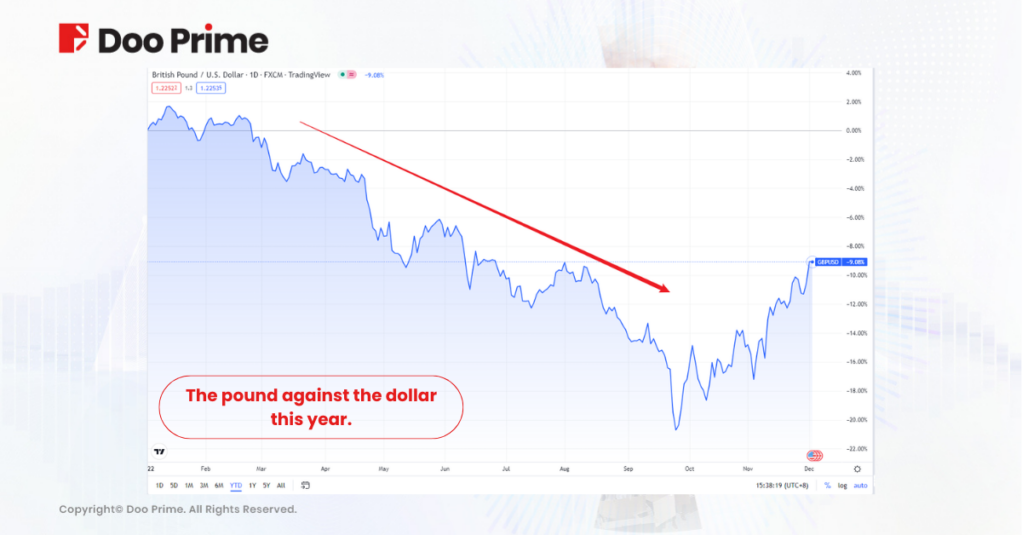

Since the former British Prime Minister Liz Truss took office in September this year, the British pound, the United Kingdom, and the British stock market have plummeted across the board, eventually leading to Truss’s resignation after only six weeks in office, making her the shortest-serving prime minister in British history.

Then, Rishi Sunak, a former finance minister, took over as prime minister. Behind Truss’s resignation lay the grim state of affairs facing the British economy.

In the wake of the energy crisis caused by the Russia-Ukraine war this year, high energy prices have led to higher inflation in the UK. In order to curb inflation, the Bank of England had to raise interest rates continuously. However, after taking office, Truss ignored the inflation situation and continued to introduce fiscal stimulus measures to boost economic growth.

Thus, this made the previous efforts of the Bank of England to raise interest rates in vain, further pushing up the inflation trend.

Not only that, as the British 10-year Treasury rate rose rapidly, the price of British government bonds plummeted and suffered a panic market sell-off.

Under the chain reaction, the market gradually lost confidence in the British economy, selling British assets, the pound exchange rate and the British stock market plummeted along the way.

While Truss has resigned, the newly appointed Sunak will have to confront a deeply economically troubled Britain. At this stage, Sunak has yet to reveal much detail about his economic policy as prime minister. But the priority is to stabilize the economy and implement a prudent fiscal policy.

11. U.S. Tech Companies See Waves Of Layoffs

After more than half a year of tug-of-war, the world’s richest man, Elon Musk, finally completed his acquisition of the U.S. tech giant Twitter at the end of October this year and became its new CEO.

But, just upon his process of acquiring Twitter, Musk immediately started laying off a large number of employees. In an internal company email on 4th November 2022 alone, Musk fired nearly 3,700 Twitter employees directly.

The wave of layoffs at Twitter was like a fuse that quickly spread throughout the Silicon Valley tech community. Meta, the parent company of social media giants Facebook and Instagram, also announced 11,000 job cuts, approximately 13% of its workforce, while e-commerce giant Amazon also announced plans to lay-off tens of thousands of their employees.

The reason behind this wave of layoffs in Silicon Valley technology companies is mainly due to the current global economic downturn and weak consumer demand, which has slowed their business growth.

If the wave of layoffs at U.S. tech companies continues unabated, it may also be a reflection that the impact of successive interest rate hikes by the Federal Reserve has been effective.

If the wave of layoffs leads to a further increase in unemployment in the future, it could give the Fed a clearer sense of recession, thereby reversing fiscal policy.

12. FTX Files For Bankruptcy: Cryptocurrency’s Lehman Moment

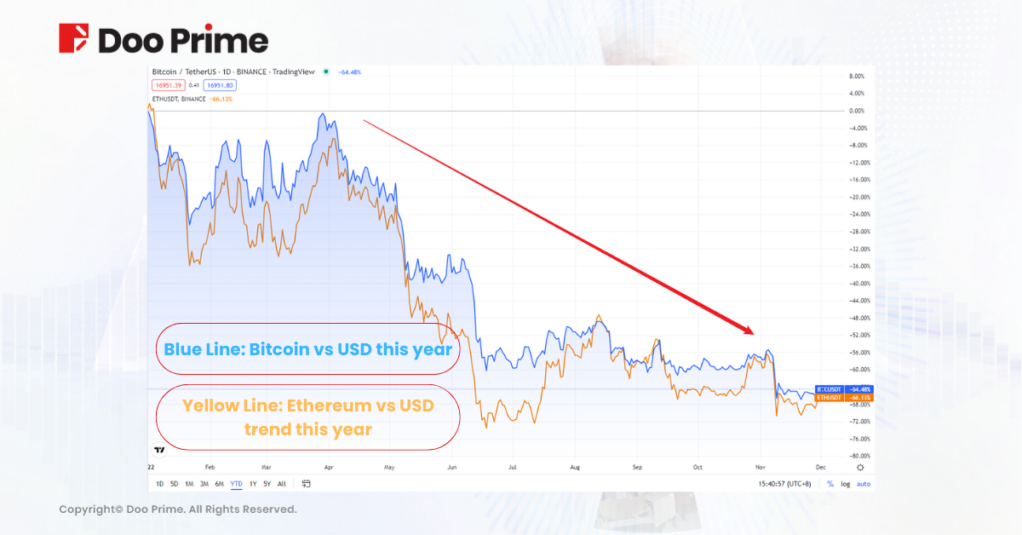

In November this year, FTX, the world’s third largest digital currency exchange, filed for bankruptcy, triggering a “Lehman moment” in the cryptocurrency world, and causing the price of Bitcoin, Ethereum and other leading digital currencies to plunge instantly.

The incident began when an online article pointed out that a digital currency hedge fund called Alameda Research had debt exposure. It is currently US$8 billion in debt, and US$6 billion of its US$14.6 billion in assets came from FTT, a token issued by the FTX exchange.

Both FTX and Alameda Research were founded by Sam Bankman-Fried often referred to online as SBF. So, leaving aside the US$6 billion in assets, one wonders about its true ability to service its debt.

As the market grew skeptical, creditors began to demand that Alameda Research repay its debt, forcing SBF to pay it off by selling their coins. But that dented the market’s confidence in FTX, and a number of investors, including Zhao Changpeng, chief executive of Binance, the largest digital currency exchange, began withdrawing their money. Eventually, the price of FTT coins plunged 90% in three days!

The media then revealed that SBF was using FTX user funds to finance Alameda’s debt repayment, which further triggered the panic among FTX users and caused a run on FTX, resulting in the exchange declaring bankruptcy.

Looking back at the FTX bankruptcy, the essence of the problem lies in the system. The lack of government regulation in the digital currency sector has long emphasized the “decentralized” nature of digital currency exchanges like FTX, but the “centralized” nature of digital currency exchanges is particularly prominent.

The 2022 market review for global economic events has come to an end, but the pace of trading in the financial market will not stop. With this, let’s learn from the past, reflect on the review, and work together to take on the future!

| About Doo Prime

Our Trading Instruments

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime is an international pre-eminent online broker under Doo Group, which strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 90,000 clients, with an average trading volume of more than USD51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 10 different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe : +44 11 3733 5199

Asia : +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China : +86 400 8427 539

E-mail:

Technical Support: [email protected]

Account Manager: [email protected]

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.

Home

Home