2022 has been a rather gloomy year for investors across the board. The market saw a number of factors that have played a role in the bear market of 2022, skyrocketing inflation — the highest in over 40 years — with aggressively rising interest rates, thanks to the Fed, have combined to drive share prices down in most sectors.

While this is certainly painful to endure, the silver lining for long-term investors is that this could prove to be a good year to buy stocks. Although past performance is not an indicator of future results, the stock market as a whole has recovered from every prior bear market in history and gone on to make new all-time highs.

To this end, the curtain will officially close on 2022 in two weeks, and there’s little doubt this year will go down as one of the most challenging on record for investors.

In hindsight, let’s take a look at the breakdown of exactly how the stock market has performed in 2022.

Overall Performance & Key Events In 2022

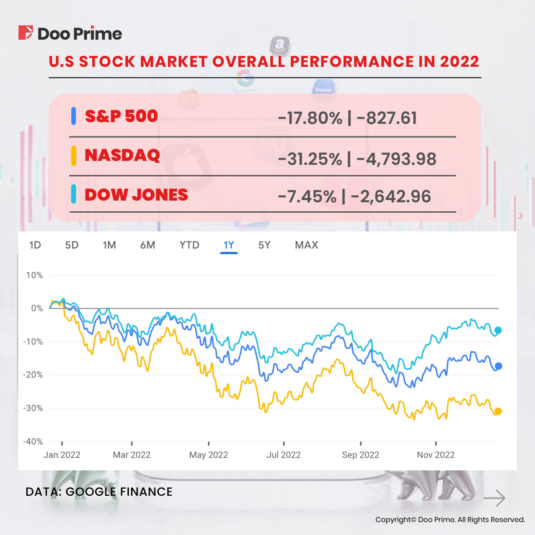

At the beginning of 2022, the U.S. stock market saw its worst first month of the year since the global financial crisis in 2009.

Check our take on The 2022 Global Stock Market Crash – What, How, What’s Next.

The ageless Dow Jones Industrial Average, benchmark S&P 500, and growth-driven Nasdaq Composite have all tumbled into a bear market at some point this year, with the S&P 500 posting its worst first-half return since Richard Nixon was president!

That said, let’s get down to the major events for the stock market in 2022:

S&P 500 Index

On 23rd February 2022, the S&P 500 sank into correction territory as markets continue their sell-off in light of the changing tone in Eastern Europe. The S&P 500 is down over 10% from its January high, confirming a correction for the first time in nearly two years, the last of which came when COVID-19 crashed the market in 2020.

On 8th March, U.S. indices continue their march into the red as the pressure of war, proposed oil sanctions, and inflation continuously shook the confidence of investors. The S&P 500 was in the bear market territory and had its worst day since October 2020, sinking at a staggering 2.95%, followed by a further decline of 0.5%.

In April, the S&P 500 saw major declines as the stock market stumbled due to a hawkish Fed whilst the Bank of America warned about “recession shocks”.

On 16th June 2022, 16 stocks in the S&P 500 crumpled by at least 9% a day after the Fed raised interest rates, leading the index to fall by 3.25% during the day.

By 13th September 2022, the S&P 500 recorded a 4.32% on that day after a stronger than expected inflation.

The S&P 500 has posted a mild recovery since its bear market lows in mid-2022, when it fell more than 25% from its high. As of Nov. 29, the S&P 500 is down a more modest 16.75%, but still enough to be in a severe correction phase unless the market stages a huge December rally; it will likely finish down double digits for the year.

NASDAQ Composite Index

On 5th May 2022, the Nasdaq index tumbled 4.99%, dragged down by megacap growth stocks, and on track to erase most of the gains recorded in the previous session’s rally after the Federal Reserve’s less aggressive tone.

On 13th June 2022, NASDAQ was at 10,809.23, down –530.79 points or 4.68%. The total shares traded for the NASDAQ was over 5.69 billion. On the NASDAQ Stock Exchange, 9 stocks reached a 52-week high, and 954 those reaching lows totaled.

On 27th July, Nasdaq jumped by 4.06%, its biggest daily percentage gain since April 2020 as the Federal Reserve raised interest rates as expected and comments by Fed Chairman Jerome Powell eased some investor worries about the pace of rate hikes.

However, on 13th September 2022, Nasdaq saw a 5.16% decline as IT stocks plunged, mirroring a slide in the tech-heavy Nasdaq Composite of the U.S. a day earlier after hotter-than-expected inflation data triggered risk-off bets.

By 30th November 2022, Nasdaq was rising again by 4.41%, closing above 11,000; up 484.22 points at 11,468.

Dow Jones Industrial Average Index

In early 2022, 25th February, Dow Jones Industrial Average surged by 2.51% on that day as the President of Russia, Vladimir Putin tightens grip on Ukraine. The Dow Jones Industrial Average rallied strongly as Putin is demanding a binding agreement that Ukraine will give up attempts to become part of NATO.

On 18th May 2022, Dow briefly jumped 380 points on Tuesday, as Home Depot and Walmart reported results ahead of Tuesday’s market open. Twitter stock dropped after Elon Musk’s latest comments cast doubts on his $44 billion planned takeover. And Fed Chair Jerome Powell is scheduled to speak at The Wall Street Journal’s Future of Everything Festival later today. Despite these factors, Dow fell by 3.57% on this day.

Following this, Dow then rallied by 2.43% on 19th July as stocks broadly gained. Twitter gained after Tesla’s CEO Elon Musk lost a legal bid. To add, Netflix surged before earnings, while Apple and Goldman Sachs were among blue-chip gainers on that day.

In Q3, 13th September 2022, U.S. stocks opened sharply lower as investors reacted to a stronger-than-expected inflation reading for August. The Dow Jones Industrial Average dropped more than 500 points, or 1.7%, soon after the opening bell, leading to a 3.94% decline on the same day.

Edging towards the end of the year, Dow Jones gained 3.7%, or more than 1,200 points, to 33,715.37 on Asian stock surge after U.S. inflation eased by more than expected, spurring hopes the Federal Reserve might scale down plans for more interest rate hikes.

Benchmark Performance By Month

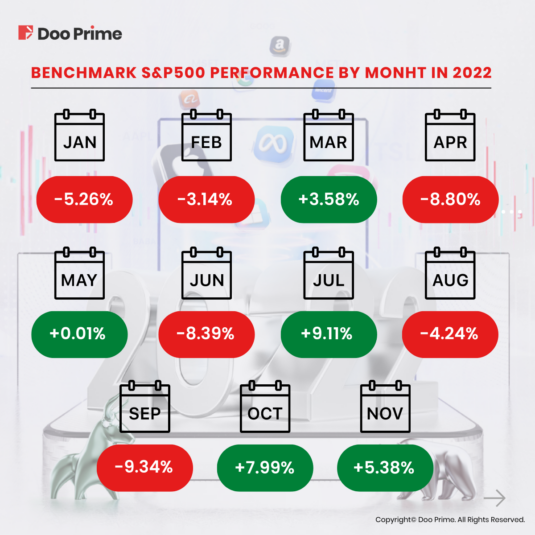

The performance of the S&P 500 has varied greatly from month to month in 2022. In fact, for the most part, the S&P has exhibited some rather large monthly moves, with more than a few months flirting with a 10% move either up or down. Here’s the month-by-month performance of the S&P 500 in 2022 thus far:

As the monthly readouts show, investors have been whipsawed on a monthly basis by the erratic market in 2022. While December is generally a favorable month on a seasonal basis, there’s no guarantee that the market will bounce before the year ends.

Stocks That Made Big Moves In 2022

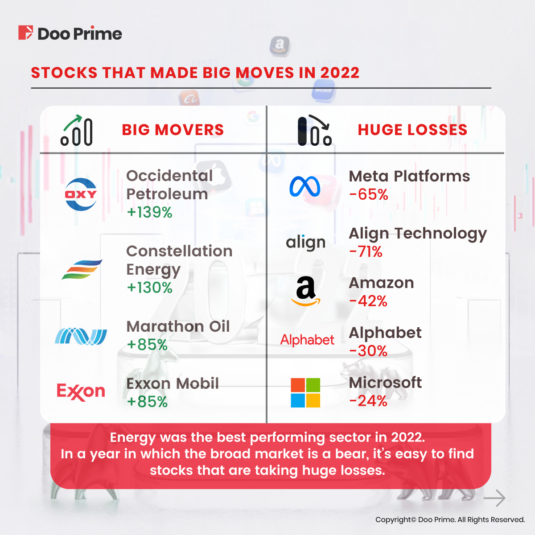

As energy was the best performing sector in 2022, it is no surprise that many of the top performing stocks are energy-related. This is particularly true for smaller companies, which are typically more leveraged than big companies and are able to make spectacular moves, such as Scorpio Tankers, up over 300% YTD.

In a year in which the broad market is a bear, it’s hard to find stocks that are posting big profits. But it’s easy to find stocks that are taking huge losses.

But among the well-known S&P 500 names, here are some of the biggest movers and big-name S&P 500 stocks that are taking a bath so far in 2022:

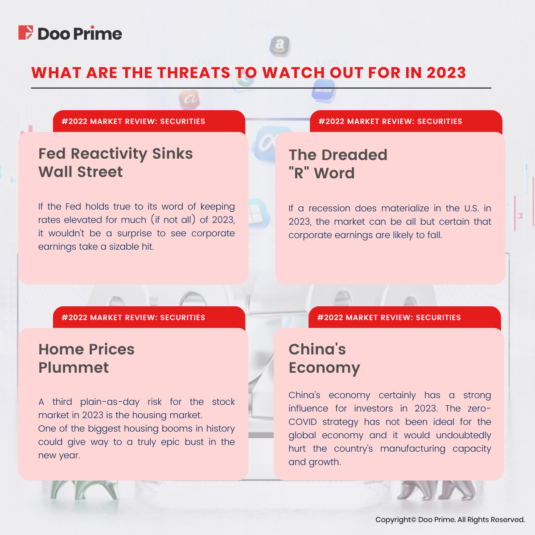

What Are The Threats To Watch Out For In 2023

1. Fed Reactivity Sinks Wall Street

Arguably the most front-and-center concern for Wall Street would be the Federal Reserve’s handling of historically high inflation. The nation’s central bank has been left with no choice but to aggressively raise interest rates into a plunging stock market to tame inflation.

The well-known issue with the Fed is that it’s a reactive, data-driven institution rather than one that proactively adjusts monetary policies. Since the data the Fed utilizes is backward-looking, there’s a tendency to overshoot to the upside and downside when it comes to rate hikes and reductions.

If the Fed holds true to its word of keeping rates elevated for much (if not all) of 2023, it wouldn’t be a surprise to see corporate earnings take a sizable hit.

2. The Dreaded “R” Word

Another significant risk for the stock market in 2023 is the growing likelihood of a U.S. or global recession – the dreaded ‘R’ word.

When the interest rate yield curve inverts and longer-dated maturing bonds have lower yields than short-term bonds, the U.S. is at a heightened probability of entering a recession over the next six to 18 months.

Recently, the magnitude of inversion between the two-year Treasury bond yield and 10-year Treasury bond yield widened to its largest difference in 40 years. That’s a telltale warning that a recession could be brewing.

If a recession does materialize in the U.S. in 2023, the market can be all but certain that corporate earnings are likely to fall. Anywise, Wall Street analysts have yet to fully price in the impact of aggressive Fed rate hikes.

3. Home Prices Plummet

A third plain-as-day risk for the stock market in 2023 is the housing market. One of the biggest housing booms in history could give way to a truly epic bust in the new year.

Investors do not have to look far to see why all facets of the housing industry could struggle. After more than a decade of ultra-favorable mortgage rates, Fed policies helped 30-year mortgage rates skyrocket to a 16-year high of nearly 7% in October. To say that homebuyers have been spoiled with low borrowing rates would be an understatement. With 30-year rates hovering around 7% and the likelihood of a recession growing, homebuying activity should be minimal next year.

The bigger issue is that if home prices plunge 20%, 30%, or perhaps even 40% in a number of previously overheated markets, it might make financial sense for some buyers to simply walk away from their loan rather than pay a monthly mortgage on a property that’s dramatically decreased in value. If that happens, a day of reckoning could be at hand for lenders.

4. China

China is known as one of the world’s biggest economies. Thus, it certainly has a strong influence for investors in 2023.

On one hand, China’s zero-COVID strategy has not been ideal for the global economy. This move, in the long term, would undoubtedly hurt the country’s manufacturing capacity and growth.

At the same time, this would lead to persistent supply chain problems for many big businesses.

On the other hand, if China relaxes its COVID-19 policies and largely returns to normal, we could see U.S.-China trade-war tensions reemerge. Let’s not forget that, in early September, U.S. regulators banned U.S. semiconductor companies from shipping high-powered, artificial intelligence-driven chips and graphic processing units to China.

| About Doo Prime

Our Trading Instruments

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime is an international pre-eminent online broker under Doo Group, which strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 90,000 clients, with an average trading volume of more than USD51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 10 different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe : +44 11 3733 5199

Asia : +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China : +86 400 8427 539

E-mail:

Technical Support: [email protected]

Account Manager: [email protected]

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.