2022 is counting down to its last few days. Yet, the global market and economy still hold a series of unresolved issues that could not see the light of being solved in the remaining days left.

It seems like someone has flopped their 2022’s resolution…

That said, the market cannot move forward with the ongoing global inflation, U.S. Federal Reserve interest rate hikes and recession fears still weighing their shoulders. The market has no choice but to carry this umbrella of unresolved issues into 2023.

To add, let’s not forget about the macroeconomic and geopolitical factors weighing on markets as a consequence of the Russia-Ukraine war in early 2022.

For those who hasn’t been keeping up with the news in the past 11 months, don’t worry, we’ve got you all covered. Here are all our breakdown and key takeaways of the market dynamics in 2022 you can pick up before we dwell into the 2023 market outlook.

Global Economic Growth

Let’s start with the global economic growth forecast for 2023.

2022 was a staggering year. In the face of the historical volatility of 2020 and 2021 – which experienced the worst global recession on record, followed by the strongest rebound – the growth outcome in 2022 is much more stable.

However, 2022 has also been remarkably turbulent, with the global economy hit by multiple adverse shocks — from supply and demand issues spilling over into labor markets and a third major wave of COVID-19 to Russia’s invasion of Ukraine.

As for 2023, the drag of tighter monetary policy is growing, and central banks are still moving forward. Of the 31 countries tracked by J.P. Morgan Research, 28 have already raised rates, and more are likely to do so.

Based on current guidance, the U.S. Federal Reserve (Fed) has adjusted rates by a cumulative total of nearly 500 basis points (bp) by the first quarter of 2023. Central bank activity has somewhat overshadowed the outlook for next year, as the Fed, followed by other major central banks, is expected to stop rate hikes by the end of the first quarter of 2023.

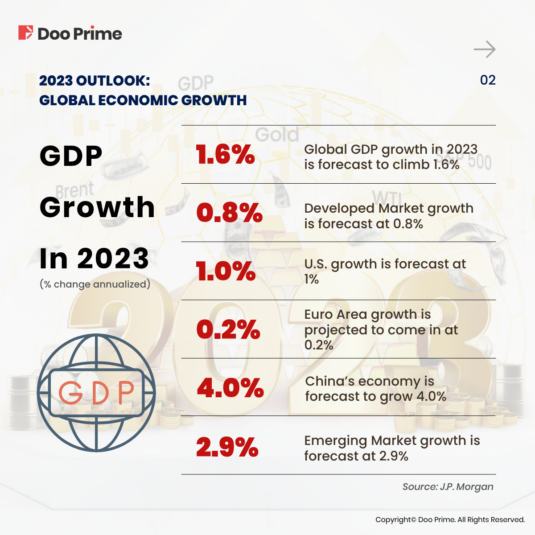

In J.P. Morgan’s 2023 market outlook, it shows that the global GDP growth in 2023 is forecast to climb 1.6%. The Developed Market growth is forecast at 0.8%, U.S. growth is forecast at 1%, and Euro Area growth is projected to come in at 0.2%. China’s economy is forecast to grow 4.0%, while Emerging Market growth is forecast at 2.9% in 2023.

“With the winter set to aggravate China’s COVID problems and Europe’s natural gas crisis, the global growth outlook remains depressed, but we do not see the global economy at imminent risk of sliding into recession in early 2023. The financial conditions drag is being cushioned by a fading of supply chain and commodity price shocks,” said Bruce Kasman, Head of Economic and Policy Research at J.P. Morgan.

Conversely, the global consumer price index (CPI) inflation is on track to slow toward 3.5% in early 2023. This is after inching towards 10% in the second half of 2022.

“Circumstances warrant considering a range of scenarios. The dominant event across different scenarios presented is a U.S. recession before the end of 2024. But the timing of this break, the path of Fed policy and the reverberations for the rest of the world vary,” added Kasman.

Stock Market Outlook

The market experienced macroeconomic and geopolitical shocks this year. Against these setbacks, investors reacted by lowering the benchmark S&P 500 price to earnings (P/E) ratio by as much as seven times, while some speculative growth segments plunged 70-80% from their highs.

While fundamentals have been resilient throughout these shocks, the constructive growth backdrop of this year is not expected to persist in 2023. Fundamentals are likely to deteriorate as financial conditions continue to tighten and monetary policy will become even more restrictive.

That said, the economy could also enter a mild recession, with a shrinking labor market and unemployment rate rising to around 5%.

“Consumers with a cushion of savings from lockdown have mostly exhausted their post-COVID excess cash and for the first time are getting hit by a broadening negative wealth effect from all assets simultaneously — whether that’s housing, bonds, equities, alternative/private investments or crypto,” said Dubravko Lakos-Bujas, Global Head of Equity Macro Research at J.P. Morgan.

“This proverbial snowball should continue to gain momentum next year as consumers and corporates more meaningfully cut discretionary spending and capital investments.”

Given these factors, J.P. Morgan Research has lowered its below-consensus 2023 S&P 500 earnings per share (EPS) from USD225 to USD205 due to weakening demand and pricing power, further margin compression and reduced buyback activity.

The upside and downside of this base case will depend heavily on the depth and duration of the recession and the speed of the Fed’s counter-response. Market volatility will also remain high (with the Volatility Index or VIX averaging at about 25).

“In the first half of 2023, we expect the S&P 500 to re-test the lows of 2022 as the Fed overtightens into weaker fundamentals. This sell-off combined with disinflation, rising unemployment and declining corporate sentiment should be enough for the Fed to start signaling a pivot, subsequently driving an asset recovery and pushing the S&P 500 to 4,200 by year-end 2023,” said Lakos-Bujas.

Commodities Outlook

As we step into 2022, the global oil market’s expectation was that it would remain tight but balanced, with Brent crude oil averaging at USD 90 per barrel (bbl). With the Russo-Ukrainian War ongoing, J.P. Morgan Research has chosen to revise its average Brent crude oil price upward to USD104/bbl in 2022 and USD98/bbl in 2023, with prices peaking at USD114/bbl in the second quarter of 2022.

“After maintaining our price view for eight months, we now opt to shave USD8 off our 2023 price projections, on our expectations that Russian production will fully normalize to pre-war levels by mid-2023. Despite more pessimistic expectations for balances over the next few months, we find the underlying trends in the oil market supportive and expect global Brent benchmark price to average USD90/bbl in 2023 and USD98/bbl in 2024,” said Natasha Kaneva, Head of Global Commodities Strategy at J.P. Morgan.

According to the J.P. Morgan Commodities Research, the commodity price forecasts for 2023 see Brent crude oil averaging USD90/bbl, West Texas Intermediate (WTI) crude oil averaging USD83 and gold averaging USD1,860 in the fourth quarter of 2023.

Although the global economy is expected to grow at a below-par rate of 1.5% in 2023, there are good reasons to expect oil demand to grow relatively strongly by 1.3 million barrels per day next year. The cyclical rebound is driven by the continued normalization of demand for motor fuels such as gasoline, diesel and jet fuel to pre-COVID levels.

“Our forecast of a USD90 Brent in 2023 centers on the view that the OPEC+ alliance (Organization of the Petroleum Exporting Countries and allies) will do the heavy lifting to keep markets balanced next year,” added Kaneva.

For base metals, 2023 will be a transition year, with prices testing the lows hit earlier this year again around mid-2023.

“After bottoming over mid-year, a more sustained recovery in base metals prices is set to unfold in the last few months of the year,” said Greg Shearer, Head of Base and Precious Metals Strategy at J.P. Morgan.

The outlook for precious metals is more favorable than for base metals, with all but palladium expected to move higher through 2023. With the Federal Reserve pausing to raise interest rates, lower U.S. real yields will drive the bullish outlook for gold and silver prices in the second half of 2023. Gold prices are expected to push higher to an average of USD1,860 per troy ounce in the fourth quarter of 2023.

“Even with a bullish baseline gold and silver forecast, we think the risk is skewed to the upside in 2023. A harder-than-expected economic landing in the U.S. would not only attract additional safe-haven buying, but the rally could become supercharged by more dramatic decreases in yields if the Fed more rapidly unwinds tighter fiscal policy,” added Shearer.

Forecast For Rates And Currencies

This year, the Fed has been forced to tighten aggressively, outpacing every tightening cycle over the last three decades to curb U.S. inflation.

As for 2023, it is no surprise that inflation and Fed interest rate policy remain top of mind for investors: in the J.P. Morgan Research 2023 Outlook Survey, respondents ranked these two factors as the most important for U.S. fixed income markets in 2023, followed by U.S. recession risks.

With inflation indicating a slowdown, the Fed delivered a 50bp hike in December, and is expected to break the rate hikes thereafter.

“The almost 500bp of expected cumulative hikes is already delivering a commensurate tightening of financial conditions, which we believe will tip the economy into a mild recession later next year. With a slowing in aggregate demand, we project the unemployment rate will rise to 4.3% by the end of next year,” said Jay Barry, Co-Head of U.S. Rates Strategy at J.P. Morgan.

10-year U.S. Treasury yields are expected to fall to 3.4% by the end of 2023 and real yields are expected to decline.

Heading into the currency markets, greater U.S. dollar strength is still expected in 2023, but of a lower magnitude and different composition than in 2022.

The Fed’s pause on rate hikes should give the dollar a break from its rally. Moreover, unlike in 2022, lower-yielding currencies such as the euro are expected to be safer as central banks pause rate hikes and shift their focus to addressing slower growth — but this in turn makes high-beta, emerging market currencies more vulnerable.

Weak growth outside the U.S. should also continue to be a pillar of a stronger dollar in 2023. “Some growth signals suggest an improvement outside the U.S., but we are skeptical of the longevity of this theme,” said Meera Chandan, Co-Head of Global FX Strategy at J.P. Morgan.

| About Doo Prime

Our Trading Instruments

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime is an international pre-eminent online broker under Doo Group, which strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 90,000 clients, with an average trading volume of more than USD51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 10 different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe : +44 11 3733 5199

Asia : +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China : +86 400 8427 539

E-mail:

Technical Support: [email protected]

Account Manager: [email protected]

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.