What Are The Possible Inequitable Market Behaviors

Market abuse applies to the practice of exploiting information with the aim to disfavor financial market investors or to gain an unfair advantage as an investor. That said, such practice includes:

- Exploiting advantageous forms of data that the general public does not have

- Spreading incorrect information

- skewing price-setting mechanisms of financial instruments.

Market manipulation is the most common inequitable market behavior under the umbrella of market abuse. Market manipulation generally suggests deliberate attempts to tamper with the market. It is one of the manners to reap profits by misleading investors. To add, market manipulation cripples and possibly sabotages the public’s confidence in the stock market and leads other investors to an unfair disadvantage.

The Market Abuse Regulation (MAR)

In 2016, the EU Market Abuse Regulation (MAR) was introduced, with the aim to protect investors in the financial markets and stifle market abuse by heightening transparency.

With the purpose of standardizing market abuse regulations across all issuers of financial instruments covered by the MAR, this new European Union regulation sets resolute measures accordingly to expand the scope of pre-existing regulations.

The MAR also aims to address and withstand the accelerating complexity of technology in the financial markets and the growing remit of financial crime worldwide.

The market abuse offense includes:

Insider Dealing – Exploiting and utilizing internal information as a means to make, change, or cancel deals, or to stimulate a third-party to deal using this information.

Unlawful Disclosure of Inside Information – Publishing and disclosing information without correct consent.

Market Manipulation – This is the umbrella term for a series of actions that distort market performance.

Examples of Addressed Market Manipulation Lawsuits

In this article, we will be addressing a few market manipulation cases which seem to be the most recurrent affairs.

1. China Regulator Levied Record Fine for Market Manipulation

According to the Clifford Chance report, the China’s securities regulator, China Securities Regulatory Commission (CSRC), ramped up its enforcement efforts and levied one of its largest ever fines for market manipulation in 2017.

The authorities, in this case, the CSRC, imposed the penalty on the trader and his associates as they violated the market abuse regulations. In specific, more than RMB1.2 billion (USD174 million) worth of confiscated orders and fines were levied for manipulation of the Chinese mainland listed stocks.

“The latest action follows the regulator’s RMB3.5 billion (USD507 million) fine of a separate party in February 2017 for market manipulation arising from false information disclosures. The news comes as the CSRC, and Hong Kong’s Securities and Futures Commission (SFC) ramp up their joint efforts to tackle cross-border market manipulation.”

These two cases alone have already made 2017 a record year for CSRC fines, just a quarter of the way through the year 2017 itself. In 2016, the CSRC levied RMB4.3 billion in fines, which is up by nearly three times 2015’s total. To add, 2015’s amount was already a record itself.

“The CSRC alleged that Tang Hanbo was involved in manipulating the stock price of Zhejiang China Commodities Group, a stock listed in Shanghai that also traded under Shanghai Connect. As a result of the price manipulation, Tang made illegal gains of RMB42 million (USD6 million).”

“The CSRC also found that Tang was involved in manipulating the prices of five other domestic stocks unrelated to Shanghai Connect from 2014 to 2015 and as a result made an illicit gain of around RMB250 million (USD36.2 million). Tang supposedly achieved the manipulation through the use of various Hong Kong and China accounts to conduct the trades.”

The CSRC alleged that Tang and his associates artificially drove up and kept trading prices and volumes as desired with the aim to mislead the market’s investors into trading in the same stock.

The CSRC declared that these violations had severely disrupted market order and damaged the interests of other investors. Tang’s trading activities via the Hong Kong accounts was apparently intended to disguise his activity.

Whereas regulators and stock exchanges in China maintain a system for identifying traders in real time, and the SFC requests the identities of investors after trades have taken place.

“The CSRC ordered the confiscation of Tang’s illegal income of RMB280 million and imposed fines on him totaling RMB896 million. The total illegal income confiscated from Tang and his associates amounted to RMB290 million and the total fine imposed was RMB952 million.” as reported by Clifford Chance.

Cited from: Clifford Chance

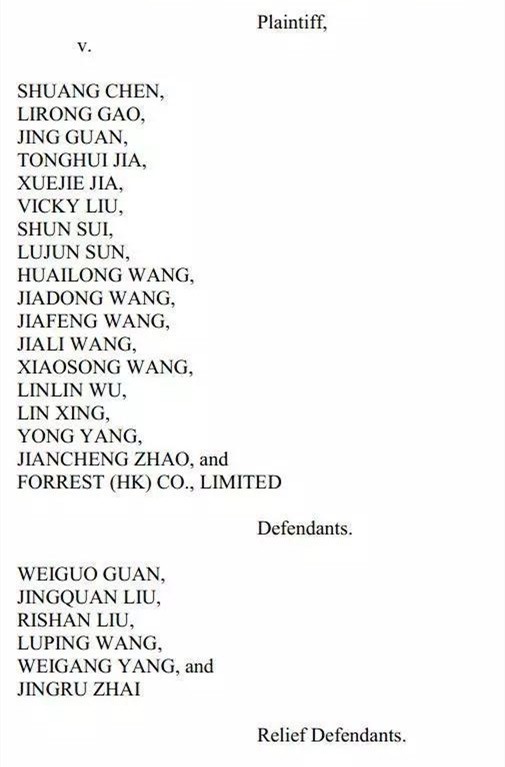

2. 18 Chinese Traders Manipulate Nearly 4,000 U.S. Stocks For USD220 Million in Profits

In 2019, the U.S. Securities and Exchange Commission filed charges against 18 Chinese traders for allegedly manipulating the stock market. It is reported that the core of this trading group is located in Shandong Province.

Since August 2013, the group of traders used dozens of accounts at several different brokerage firms to artificially manipulate the prices of multiple publicly traded stocks in order to create a false appearance of specific stock trading activities and generate illicit gains by artificially raising or lowering stock prices.

The group’s main illegal tactic was to manipulate stocks with low trading volume by using multiple accounts, issuing multiple small volume sell orders to suppress stock prices, and then use a series of different accounts to buy more quantities of stocks at artificially manipulated low prices. After accumulating a certain position, these traders issue a number of small buy orders to drive the stock price, thereby manipulating the price to sell their holdings for a profit.

Through the above market manipulation acts, they earned a total of USD31 million in illegal proceeds, or approximately RMB 220 million, over a six-year period, and the number of manipulated U.S. stocks exceeded 3,900.

Upon confirmation of this group of traders’ violations, the SEC immediately took emergency measures, including establishing temporary protective orders and emergency asset freezes for specific violations of U.S. federal securities laws to preserve necessary assets.

At the same time, it also required to seek clarification immediately, removal orders, expedited discovery and preservation of evidence orders to resolve the matter in a timely manner based on the facts of the case.

Cited from: Finance.sina.com.cn

3. GameStop Market Manipulation

In January 2021, millions of retail investors were brought together by a Reddit discussion board named “WallStreetBets”. It is a forum, also known as a subreddit where participants discussed stock and option trading. In this case, individuals who have purchased GameStop stock in an apparent rebellion against hedge funds.

Based on Villanova Law Review’s analysis, “many hedge funds had sold short on GameStop; this means they stood to profit when GameStop’s stock price declined and would lose money when the stock price rose.”

In specific, “the “Reddit traders” joined forces to initiate a “short squeeze”; by collectively purchasing massive amounts of GameStop stock and thus driving up its stock price, the traders reaped significant profits and also inflicted huge losses on the hedge funds that had sold short.

The ongoing frenzy continues to send shockwaves through the stock market. Numerous lawsuits have ensued. But the issue that hits closest to home for many Americans, especially in light of social media’s ever-increasing influence, is whether the horde of Reddit traders violated any existing securities laws by openly coordinating and executing the short squeeze.”

Here, Villanova Law Review laid out that the Reddit traders did possibly violate securities laws, and market manipulation is the most plausible source of liability.

“Although the exact definition of market “manipulation” is unclear, the Supreme Court has indicated it is a term of art that covers conduct “intended to mislead investors by artificially affecting market activity.” Liability arises from the Securities Exchange Act of 1934’s prohibitions of price manipulation and securities fraud:

- Section 9(a)(2) forbids price manipulation, making it unlawful to effect “a series of transactions in any security . . . creating actual or apparent active trading in such security, or raising or depressing the price of such security, for the purpose of inducing the purchase or sale of such security by others.”

- Section 10(b) is typically employed together with SEC Rule 10b-5 in securities fraud cases. Rule 10b-5 outlaws “employ[ing] any device, scheme, or artifice to defraud” or “engag[ing] in any act, practice, or course of business which operates or would operate as a fraud or deceit upon any person, in connection with the purchase or sale of any security.”

To be liable for market manipulation under either theory, defendants must specifically intend to artificially affect the market. Therein lies the first challenge: although the Reddit traders undoubtedly created a colossal increase in demand for GameStop stock, it was arguably organic, rather than artificial, demand.”

Cited from: Villanova Law Review

To maintain market integrity and transparency, the financial regulatory authorities, whether in the U.S. or China, namely the U.S. Securities and Exchange Commission and China Securities Regulatory Commission, or other financial regulatory authorities of other jurisdictions, have an arsenal of market abuse penalties at their disposal.

To stay compliant, ensure that all inside information processes and procedures are kept up-to-date according to the stipulations outlined in the Market Abuse Regulation(MAR) or other applicable laws and regulations.

At the same time, we would also like to remind all investors to pay attention to their personal investment behaviors regardless of any products they invest in. To avoid violating the market abuse regulations or other applicable laws and regulations, please be wary of any so-called insider information and avoid spreading uncertain or undisclosed information to mislead others.

Ultimately, investors are advised to avoid listening to “insider information” and blindly gather to place and follow orders.

Whether you are investing in stocks, bonds, precious metals, futures or currency pairs, any participation in market abuse and artificial market manipulation may be subject to legal accountability and fines.

In order to create a healthy and fair investment environment, it is worth regulating your own investment behavior, continuously optimize and improve your professional knowledge, and understand relevant and prevailing laws and regulations. This is your responsibility and the greatest protection for your own assets.

It’s also worth noting that all suspicious market behavior should be reported to relevant financial regulatory authorities immediately. Otherwise, you run the risk of breaching the MAR or other applicable laws and regulations, too.

| About Doo Prime

Doo Prime is an international pre-eminent online broker under Doo Group, which strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Commodities, Stock Indices, and Funds. At present, Doo Prime is delivering the finest trading experience to more than 40,000 professional clients, with over 1 million trade orders fulfilled each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 10 different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe : +44 11 3733 5199

Asia : +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China : +86 400 8427 539

E-mail:

Technical Support: [email protected]

Sales Representative: [email protected]

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand the any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.