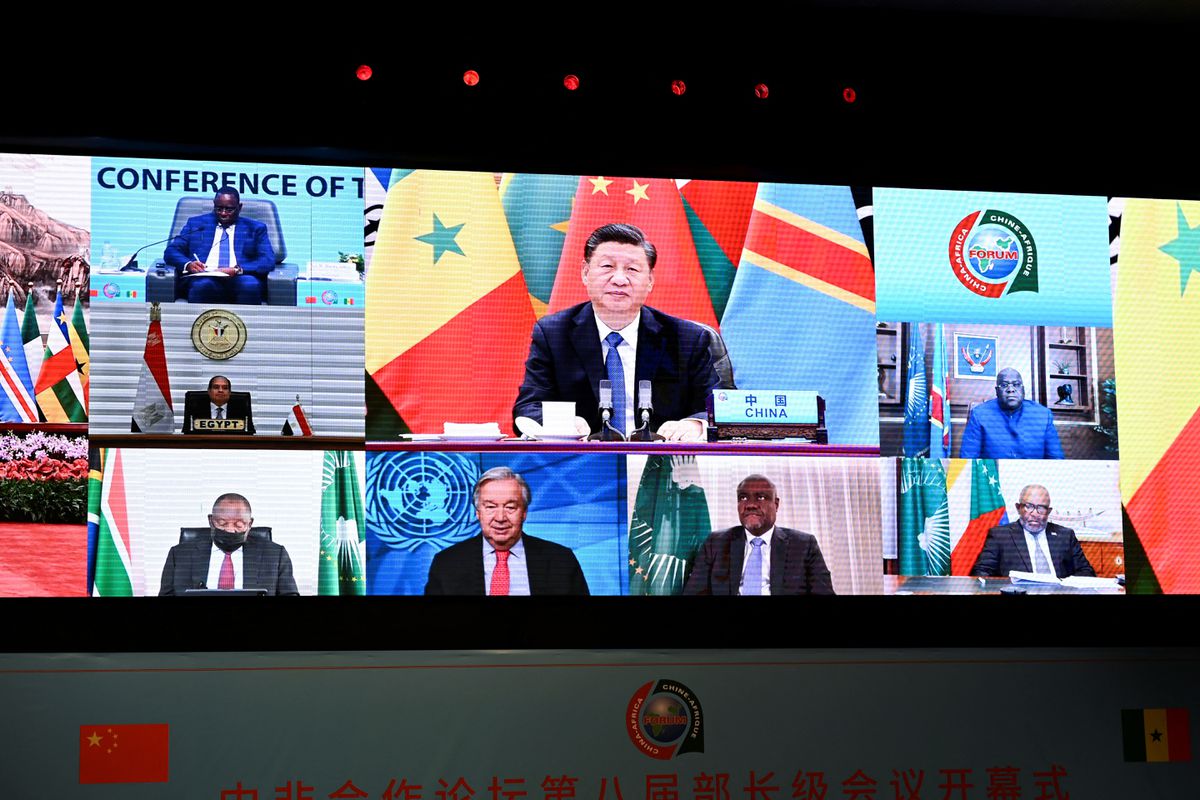

LONDON/BEIJING, Sept 8 (Reuters) – In August, China’s ambassador to Zambia took to the stage at a new conference centre in the capital Lusaka, which he called “a gift from the Chinese government to our Zambian friends”, to speak about lending to the debt-laden southern African country.

China is the world’s largest bilateral lender but discloses little on lending conditions and also on how it renegotiates with borrowers in distress, so interest in how it handles Zambian debt is intense, particularly as more countries such as Sri Lanka struggle to repay loans.

Full coverage: REUTERS

Oil Prices Climb On Tight Supply Worries

Sept 8 (Reuters) – Oil prices rose nearly $1 per barrel on Thursday after dropping through key technical support levels in the previous session, as an energy standoff between European nations and Russia focused investor minds on how tight fuel supply may become.

Brent crude futures rose by 91 cents, or 1%, to $88.91 per barrel by 0331 GMT after closing at their lowest since early February in the previous session. U.S. crude futures were up 95 cents, or 1.2%, at $82.89 per barrel.

Full coverage: REUTERS

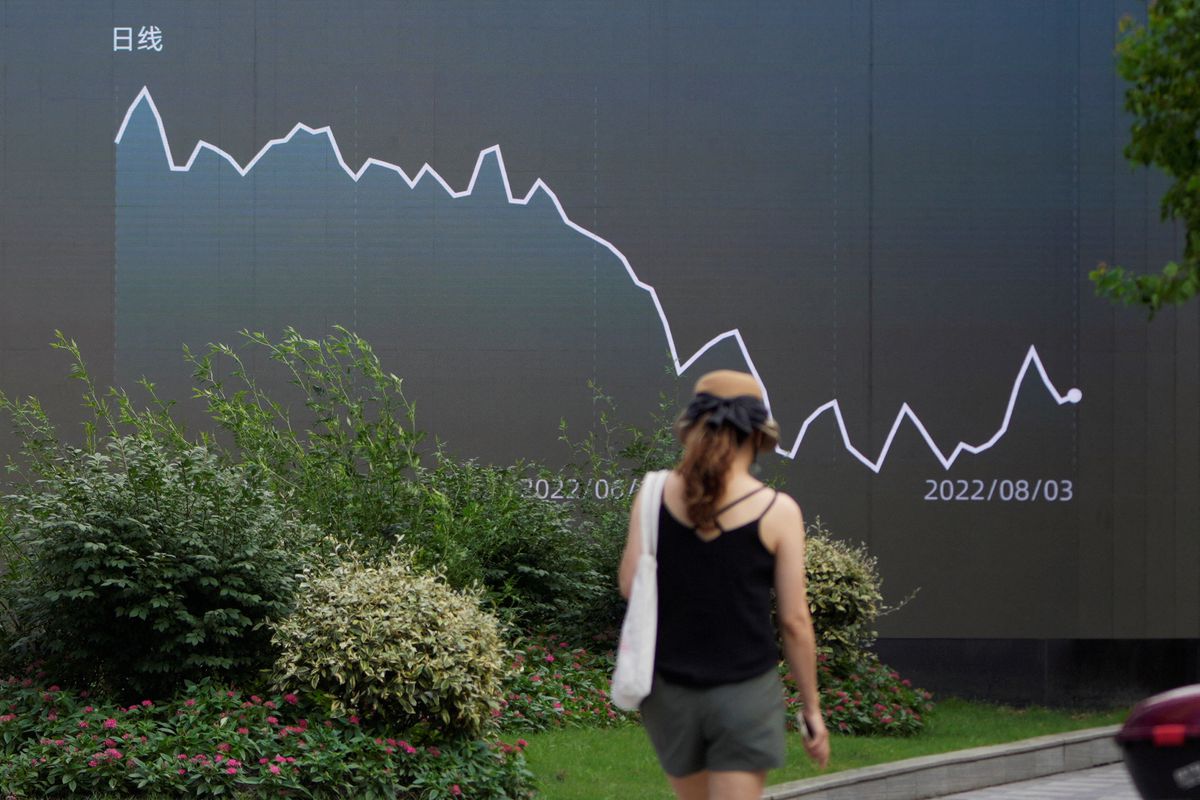

Asian Stocks Extend Rally; Oil Steadies At Pre-Invasion Levels

Sept 8 (Reuters) – Asian stocks made broad gains on Thursday, extending an overnight global rally, while oil prices steadied at levels not seen since before Russia’s invasion of Ukraine.

Japan’s Nikkei share average (.N225) jumped 1.96% in early trading. MSCI’s broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) rose 0.33%, while Australia’s S&P/ASX 200 (.AXJO) gained 0.72%.

All three major Wall Street indices made significant gains overnight.

Full coverage: REUTERS

Dollar Resumes Climb In Asia As Powell Speech, ECB Loom

TOKYO, Sept 8 (Reuters) – The dollar resumed its rise in Asia on Thursday after falling back from a two-decade high overnight, as investors pondered the path of global monetary policy ahead of a European Central Bank rate decision and comments from Federal Reserve Chair Jerome Powell later in the day.

The U.S. dollar index, which measures the currency against six major peers, added 0.1% to 109.80, edging back toward Wednesday’s peak at 110.79, a level not seen since June 2002.

Full coverage: REUTERS

Markets To Fall Further As Econ Fundamentals Worse Than 2007, Says GMO’s Grantham

Sept 8 (Reuters) – Financial markets should brace for further pain, with global economic health at its most precarious level in years, due to stubborn inflation, hawkish central banks and geopolitical tensions, veteran investor Jeremy Grantham said late Wednesday.

“This is a more dangerous looking moment in global economics than even the madness of the housing bubble of 2007,” Grantham, co-founder and chief strategist of asset manager GMO, told the Reuters Global Markets Forum (GMF).

Full coverage: REUTERS