WORLDWIDE: HEADLINES

Bank Of Korea To Raise Rates Again On May 26, To Hit 2.25% By Year End: Reuters Poll

South Korea’s central bank is likely to hike its benchmark rate at a second consecutive meeting on Thursday to combat inflation running at more than double its target, taking rates higher by year end than previously thought, a Reuters poll showed.

Inflation in Asia’s fourth-largest economy rose to more than a 13-year high of 4.8% in April, as repercussions from the Russia-Ukraine war and a weakening won , down 7% this year, ramped up prices. Inflation has stayed above the central bank’s target of 2.0% for more than a year.

All but one of the 28 economists polled May 17-23 forecast the Bank of Korea (BoK) will raise its policy rate (KROCRT=ECI) by 25 basis points to 1.75% at its May 26 meeting.

Among the first central banks to start raising rates since the pandemic, it has already hiked the base rate by a cumulative 100 basis points since August 2021.

The BoK is expected to follow up on a May move with two more hikes, one per quarter, taking rates up to 2.25% by year end, based on a majority view of 17 of 28 economists.

Three expected rates to end the year at 2.50%, seven said 2% and one said 1.75%.

The majority view is up 25 basis points compared to the April poll, taking rates to a level last seen in the second half of 2014.

Full coverage: REUTERS

Japan’s May Factory Activity Grows At Slowest Rate In 3 Months – Flash PMI

Japan’s manufacturing activity expanded at the slowest pace in three months in May, as supply bottlenecks due to parts shortages and China’s COVID-19 lockdowns caused output and new orders growth to slow.

Activity in the services sector improved for the second consecutive month on stronger domestic demand due to the fading impact of the pandemic, though service-sector firms faced a drag from the sharpest rise in input prices on record.

The au Jibun Bank Flash Japan Manufacturing Purchasing Managers’ Index (PMI) slipped to a seasonally adjusted 53.2 in May from a final 53.5 in April. The 50-mark separates contraction from expansion.

Output and overall new orders both expanded at their slowest rate in three months, as uncertainty over the outlook for price and supply developments lingered.

New overseas orders shrank at the fastest pace since July 2020 in a sign of cooling demand from China, Asia’s top economy and Japan’s biggest trading partner.

Manufacturers’ input prices rose for the 24th straight month at an increasingly fast pace, while delivery times lengthened to the greatest extent since April 2011.

Full coverage: REUTERS

WORLDWIDE: FINANCE/BUSINESS

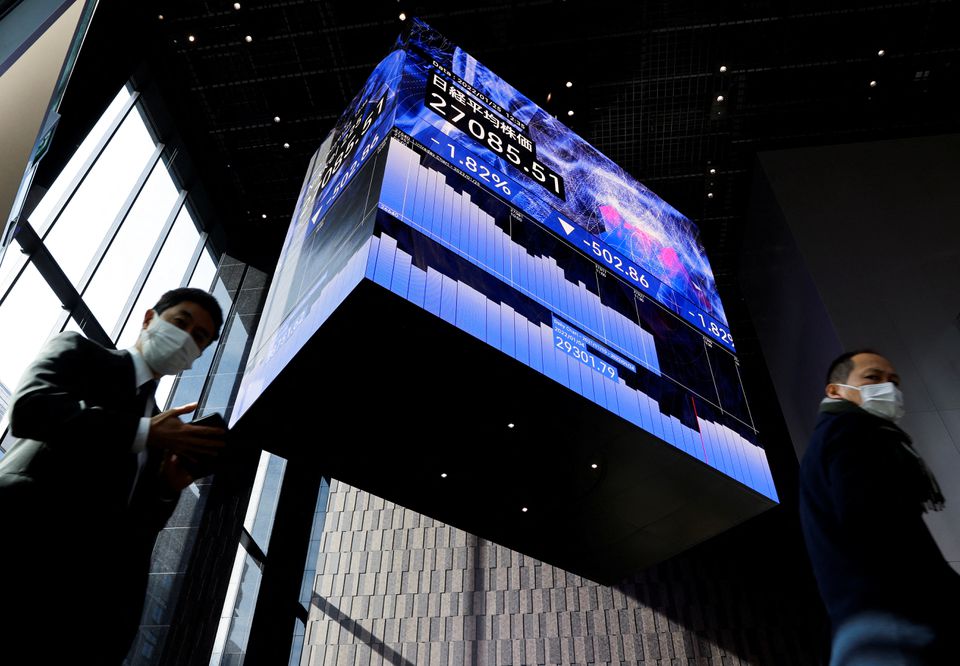

Asia Stocks Slip With U.S. Futures, Euro Holds Gains

Asian shares slipped on Tuesday as relief at a rally on Wall Street was quickly soured by a slide in U.S. stock futures, while the euro held near one-month highs as odds narrowed on a July rate rise by the ECB.

After ending Monday firmer, Nasdaq futures lost 1.4%, with traders blaming an earnings warning from Snap (SNAP.N) which saw shares in the Snapchat owner tumble 28%.

S&P 500 futures also slipped 0.8%, surrendering some of Monday’s 1.8% bounce.

MSCI’s broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) dipped 0.3% in hesitant trading. Japan’s Nikkei (.N225) fell 0.4% and Chinese blue chips (.CSI300) eased 0.3%.

Markets had taken some comfort from U.S. President Joe Biden’s comment on Monday that he was considering easing tariffs on China, and from Beijing’s ongoing promises of stimulus.

Unfortunately, China’s zero-COVID policy, with attendant lockdowns, has already done considerable economic damage.

“Following disappointing April activity data, we have downgraded our China GDP (gross domestic product) forecast again and now look for 2Q GDP to contract 5.4% annualised, previously ‒1.5%,” warned analysts at JPMorgan.

“Our 2Q global growth forecast stands at just 0.6% annualised rate, easily the weakest quarter since the global financial crisis outside of 2020.”

Full coverage: REUTERS

Safe-haven Dollar Bounces, Aussie Slides As Snapchat Sours Mood

The safe-haven dollar clawed back some of its overnight losses on Tuesday and the yen also strengthened as U.S. stock futures sank following a profit warning from Snapchat, souring the mood after Wall Street’s strong start to the week.

The dollar index , which measures the currency against six major peers, added 0.1% to 102.24, bouncing after Monday’s 0.85% tumble took it further from the nearly two-decade peak above 105 marked mid-month.

The greenback, though, slipped against pre-eminent haven currency the yen , dropping 0.18% to 127.695 yen.

The euro retreated 0.21% to $1.0672, although barely denting the 1.17% surge from Monday, when European Central Bank President Christine Lagarde said policymakers were likely to lift the euro area deposit rate out of negative territory by the end of September.

The risk-sensitive Aussie dollar dropped 0.46% to $0.70775, and sterling declined 0.22% to $1.2558.

U.S. stock futures indicated a 0.81% slide for the S&P 500 and 1.41% tumble for the Nasdaq at the restart, tarnishing a strong session on Monday that saw the indexes climb 1.86% and 1.68% respectively.

Traders pointed to an after-the-bell profit warning from Snapchat owner Snap (SNAP.N), which saw the stock tumble 28% in extended trading.

Full coverage: REUTERS

Oil Prices Ease On Concerns Over Recession, Weaker Consumption

Oil prices eased in early trade on Tuesday as concerns over a possible recession and weaker consumption outweighed an expectation of tight global supply and a pick-up in fuel demand in China after Beijing’s promises of stimulus.

Brent crude futures for July slid 35 cents, or 0.3%, to $113.07 a barrel by 0122 GMT. U.S. West Texas Intermediate (WTI) crude futures for July delivery dropped 36 cents, or 0.3%, to $109.93 a barrel. Both benchmarks declined by more than $1 earlier in the session.

Brent gained 0.7% on Monday while WTI settled nearly flat.

Multiple threats to the global economy topped the worries of the world’s well-heeled at the annual Davos economic summit, with some flagging the risk of a worldwide recession.

International Monetary Fund Managing Director Kristalina Georgieva said she did not expect a recession for major economies but could not rule one out.

Full coverage: REUTERS