SINGAPORE, Jan 31, (Reuters) – Like many rich Chinese, graduate student Zayn Zhang thinks Singapore could be ideal to park his family’s wealth.

He’s hoping that studying at a university in the Asian financial hub will lead to permanent residency and while the 26-year-old hits the books, his wife is out looking for a S$5-7 million ($4-5 million) penthouse.

“Singapore is great. It is stable and offers a lot of investment opportunities,” Zhang told Reuters at a business and philanthropy forum here late last year. His family might establish a Singapore family office to manage its wealth in the future, he added.

Full coverage: REUTERS

Adani’s Crucial Share Sale 85% Subscribed As Institutions Pump In Funds

MUMBAI, Jan 31 (Reuters) – Indian billionaire Gautam Adani’s $2.5 billion share sale inched closer to full subscription on Tuesday as investors pumped in funds after a tumultuous week for his group in which its stocks were pummeled by a scathing short-seller report.

The secondary share sale of flagship Adani Enterprises (ADEL.NS) was subscribed 85% on Tuesday, including the anchor investor portion, Indian stock exchange data showed. The share sale needs at least 90% subscription to go through.

Full coverage: REUTERS

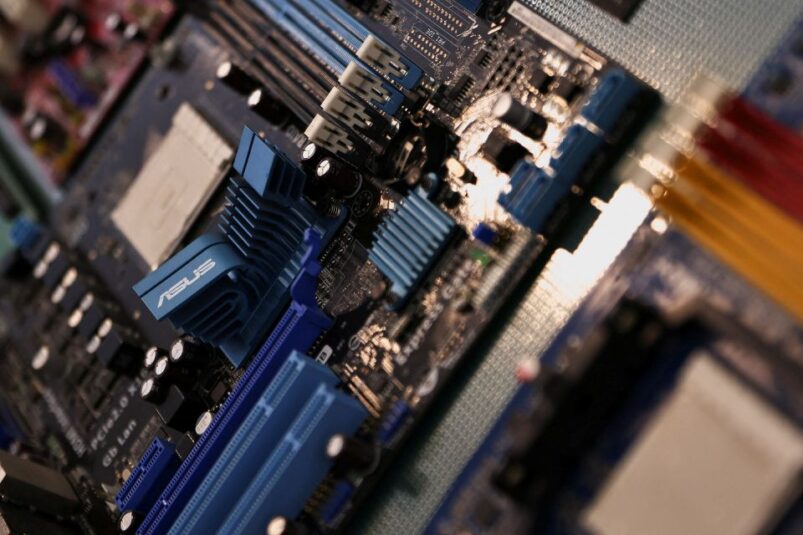

Factbox: Chinese Chipmakers Caught In U.S. – China Tech Spat

SHANGHAI, Jan 31 (Reuters) – China’s semiconductor industry has become a key target of the United States, which has imposed a slew of export restrictions targeting several parts of the country’s chip sector supply chain as it bids to slow its rival’s technological advancement.

While Beijing has ploughed vast sums of money into cultivating a domestic chip industry, its fabrication plants, known as fabs, still heavily rely on foreign-made equipment that they use to turn slabs of silicon into chips that power hardware.

Full coverage: REUTERS

Central Banks Bought The Most Gold Since 1967 Last Year, WGC Says

LONDON, Jan 31 (Reuters) – Central banks added a whopping 1,136 tonnes of gold worth some $70 billion to their stockpiles in 2022, by far the most of any year since 1967, the World Gold Council (WGC) said on Tuesday.

The data underline a shift in attitudes to gold since the 1990s and 2000s, when central banks, particularly those in Western Europe that own a lot of bullion, sold hundreds of tonnes a year.

Since the financial crisis of 2008-09, European banks stopped selling and a growing number of emerging economies such as Russia, Turkey and India have bought.

Full coverage: REUTERS

Squeezed Mining Companies Face Growth Dilemma

JOHANNESBURG, Jan 31 (Reuters) – High costs and the prospect of shrinking earnings have made big miners nervous about expansion, even as shareholders demand investment in response to robust commodity prices, China’s reopening and the role of minerals in decarbonising the economy.

Although years of cost discipline have repaired balance sheets from past over-spending, full-year results announcements in February are expected to show a fall in miners’ earnings and in shareholder payouts from the record levels reported in 2022 after disruptions lowered output and costs rose for energy, explosives and equipment.

Full coverage: REUTERS

Home

Home