WORLDWIDE: HEADLINES

Japan’s exports jump most in decade as trade recovery perks up

Japan’s exports grew the most since 2010 in April while capital spending perked up on surging global demand for cars and electronics, lifting hopes that an improvement in trade could help lead the world’s third-largest economy back to growth.

Also brightening the outlook, confidence among the nation’s manufacturers hit a more than two-year high in May on the back of solid overseas orders, a Reuters survey showed on Thursday.

While the stronger exports and imports are partly helped by the favorable statistical base effects from the major plunge in trade seen a year earlier, real demand is also on the mend.

Global appetite for cars and electronics has picked up since last year, driven by a recovery in the U.S. and Chinese economies — Japan’s key markets — although global chip shortages put a drag on overseas shipments in recent months.

Exports rose 38.0% in April from a year earlier, official data showed on Thursday, compared with a 30.9% increase expected by economists and following a 16.1% rise in March. That was the fastest gain since April 2010, led by U.S.-bound shipments of cars and car parts and Chinese demand for chip-making equipment.

“The trade data confirmed that exports were recovering steadily. Particularly car exports, which fell a lot last year, are picking up,” said Yuichi Kodama, chief economist at Meiji Yasuda Research Institute.

“In Japan, capital spending tends to move in sync with external demand, so an export recovery is encouraging for machinery orders and capital expenditure.”

By destination, exports to China, Japan’s largest trading partner, rose 33.9% year-on-year in April, led by shipments of chip-making equipment, hybrid cars and scrap copper.

Full coverage: REUTERS

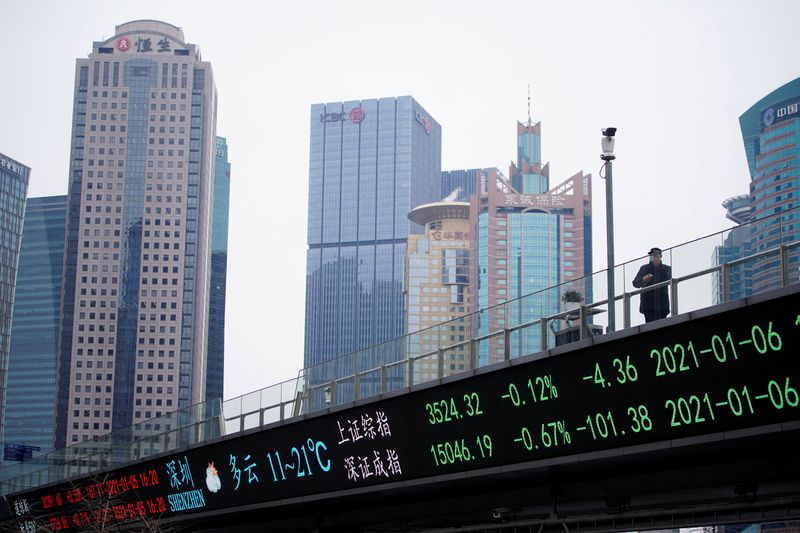

Stocks struggle as taper talk, crypto crash put markets on edge

Stock markets struggled for traction on Thursday after a jittery session on Wall Street where cryptocurrencies crashed and a hint of tapering talk from the U.S. Federal Reserve drove selling in the bond market and lifted the safe-haven dollar.

Benchmarks in South Korea (.KS11) and Japan (.N225) were either side of flat in morning trade and Hong Kong’s Hang Seng (.HSI) fell about 0.8% to pull MSCI’s broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) down by 0.2%.

Bitcoin, which plunged as much as 30% to $30,000 overnight, was struggling for support around $36,000. U.S. stock futures, wobbled just below flat.

Commodities also fell, Treasuries nursed losses while the dollar held overnight gains.

Fed minutes published on Wednesday said “a number” of officials thought that if the recovery holds up, it might be appropriate to “begin discussing a plan for adjusting the pace of asset purchases”. read more

“This is very much the market view, really,” ING economist Rob Carnell said on the phone from Singapore, with traders expecting strong hints over summer that the taper is coming and that policy support could start to ease in December.

“This is taking us to where we think we’re going to go, and perhaps this removes a little bit of uncertainty around that – so you get a slight increase in bond yields and the dollar rallying a little bit.”

On Wall Street overnight the S&P 500 (.SPX) closed 0.3% lower and the Nasdaq (.IXIC) was flat, something of a recovery after each dropped more than 1.6% during the session.

Full coverage: REUTERS

WORLDWIDE: FINANCE / MARKETS

Japanese shares inch higher as chipmakers track overnight gains in U.S. peers

Japanese shares erased early losses on Thursday, led by chipmakers tracking overnight gains by U.S. peers, but investors refrained from making active bets awaiting fresh cues after most companies announced their earnings.

The Nikkei share average edged up 0.07% to 28,063.39 by 0201 GMT, after losing as much as 0.8% earlier in the session, while the broader Topix was down 0.18% to 1,898.64.

“The Japanese market does not have its own reasons for a movement right now after most of corporate outlook is out,” said Takatoshi Itoshima, strategist at Pictet Asset Management.

“While there are uncertainties surrounding Japan that weigh on sentiment, such as slow rollouts of vaccines and whether and how the Olympics will be held.”

U.S. main indexes closed lower overnight, however, Japanese chip related firms tracked the Philadelphia Semiconductor index’s higher, with Tokyo Electron rising 1.58% and Advantest jumping 2.63%.

Index heavyweight Fast Retailing lost 0.94% after a report said that its Uniqlo brand shirts were blocked at the United States border in January on concerns they violated a ban on cotton products produced in the Xinjiang region of China.

Full coverage: REUTERS

Oil falls for third day on rising coronavirus infections, U.S. stockpiles

Oil prices fell on Thursday after a slump in the previous session, as rising U.S. stockpiles added to concerns about a hit to demand from surging coronavirus infections in Asia and possible U.S. rate hikes.

Brent crude was down 6 cents, or 0.1%, at $66.60 a barrel by 0141 GMT, having fallen 3% on Wednesday. U.S. oil fell 7 cents, or 0.1%, to $63.29 a barrel, after a 3.3% drop in the previous session.

“A resurgence in COVID-19 cases across parts of Asia is doing little to support the market in the near term,” ING Economics said in a note.

Almost two-thirds of people tested in Indian show exposure to the coronavirus, suggesting a spiraling spread of the virus as the daily death toll rose to a record 4,529. read more

The decline in prices this week was given added impetus on Wednesday after media reports said the U.S. and Iran have made progress in talks over Tehran’s nuclear program that could result in sanctions being lifted and more supply coming to the market.

Later reports indicated that more time was needed to reach an agreement. read more

Speculation the Fed might raise rates weighed on the outlook for economic growth and prompted investors to reduce exposure to oil and other commodities. read more

Rising U.S. stockpiles of crude also weighed on prices, although the gain in the most recent week was below expectations.

Crude inventories (USOILC=ECI) increased by 1.3 million barrels last week, against analysts’ expectations in a Reuters poll for a 1.6-million-barrel rise.

Full coverage: REUTERS

Dollar bounces as Fed minutes revive tapering jitters

The dollar bounced off three-month lows against European currencies on Thursday after minutes from the Federal Reserve’s last policy meeting revealed there was more talk of tapering its bond purchases than investors had expected.

In the Fed minutes, several policymakers said that a discussion about reducing the pace of asset purchases would be appropriate “at some point” if the U.S. economic recovery continues to gain momentum.

That surprised investors, given Fed Chair Jerome Powell had said right after that meeting last month that it is not time yet to begin discussing any change in policy.

“The minutes contained wordings that appear to seek to start discussion on tapering at an earlier timing than expected,” said Takafumi Yamawaki, head of fixed income research at JPMorgan.

“If the next jobs data due on June 3 is strong, markets will start bracing for the Fed making a specific mention on tapering at its next meeting in June.”

The euro changed hands at $1.2174, flat on day after having slipped 0.4% in the previous session and off a three-month high of $1.2245.

The British pound slipped to $1.4104, down 0.1% so far on Thursday and slipping further from above $1.42 earlier this week while the Swiss franc eased to 0.90415 per dollar from Tuesday’s 0.89605, its highest in nearly three months.

The dollar rose to 109.15 yen from a one-week low of 108.575 yen touched on Wednesday.

The dollar’s index bounced back from Wednesday’s three-month low to 90.209.

The dollar has been declining over the past few weeks as key Fed officials have repeatedly said they were not ready to discuss reducing stimulus, judging spikes in inflation would be transient.

Cryptocurrencies were volatile after suffering one of their biggest losses on Wednesday in the wake of China’s decision to ban financial and payment institutions from providing digital currency services.

Bitcoin last traded up 4.5% at $38,464 , having fallen to as low as $30,066 on Wednesday, which represented a whopping 54% fall from its record high hit just over a month ago.

Ether stood almost flat at $2,470 after having plunged more than 10% to as low as $2,160 earlier. On Wednesday, it fell 22.8%, its biggest daily fall since March 2020.

Full coverage: REUTERS