Today’s News

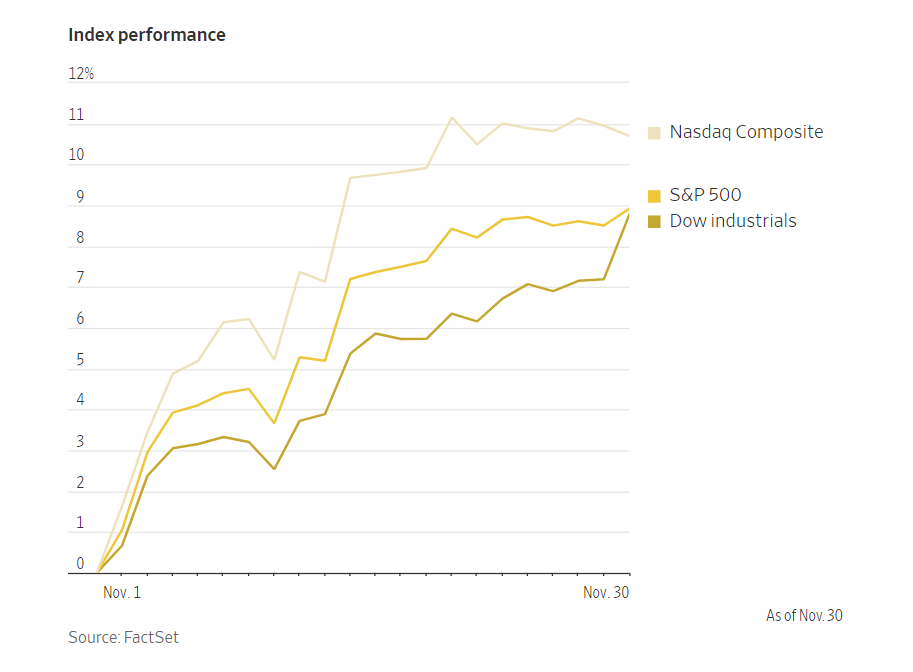

In an impressive display, U.S. stocks accomplished their most remarkable monthly performance in over a year, catapulting the Dow Jones Industrial Average to a peak for the year on Thursday. This surge, alongside a substantial bond rally, marked a significant turnaround after enduring three consecutive months of decline.

The latest data from the Commerce Department unveiled a slowdown in American spending for October, accompanied by a continued ease in inflation. These factors collectively fueled expectations that the Federal Reserve might halt its rate hikes.

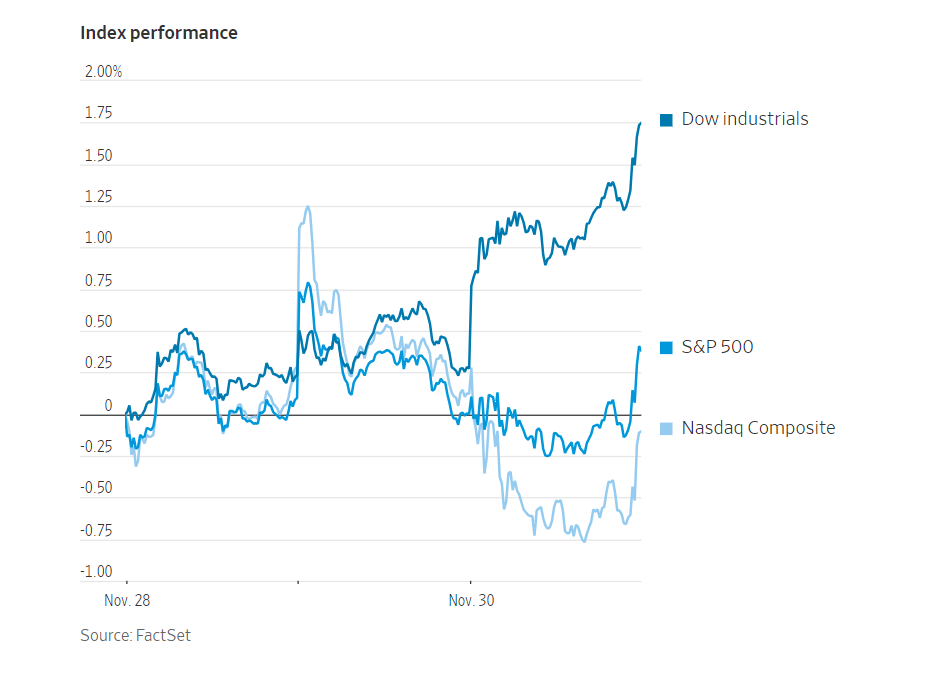

All three major U.S. stock indices demonstrated robust growth, culminating in an increase of at least 8% by the end of November, effectively breaking their downward trends from the past three months. The Nasdaq Composite, primarily representing technology stocks, emerged as the frontrunner, concluding the month with an impressive 10.7% surge despite a minor setback of 0.2% on Thursday. The S&P 500 also experienced a gain of 8.9% for November, with a 0.4% uptick on Thursday.

Image Source: Wall Street Journal

The Dow Jones Industrial Average soared by 1.5% or 520 points on Thursday, showcasing an 8.8% rise for the month and achieving its highest close since January 2022, marking its most stellar month since October of the preceding year.

November’s notable stock market advancements were complemented by an exceptional bond rally, resulting in a sharp decline in the yield of the 10-year U.S. Treasury note from over 5% in late October to 4.349% on Thursday. This substantial movement marked the most significant monthly slide in yields since 2019.

Consequently, the widely-tracked Bloomberg U.S. Aggregate bond index surged by 4.8% this month through early Thursday, showcasing the most substantial gain of this magnitude since the mid-1980s. Such gains in bond prices coincided with a decrease in yields, a fundamental inverse relationship.

Leading the equity rally were sectors particularly sensitive to borrowing costs, including information technology, real estate, finance, and companies reliant on consumer discretionary spending. These segments within the S&P 500 experienced a minimum climb of 10% throughout the month.

Image Source: Wall Street Journal

The real estate sector witnessed its most significant monthly increase since October 2011, reminiscent of its recovery from the depths of the foreclosure crisis.

This notable market rally commenced following a peak in yields during October, gaining momentum mid-month after data revealed a more considerable decline in consumer prices than anticipated by Wall Street. Thursday’s data showed mildness of the personal-consumption expenditures price index, the Federal Reserve’s preferred gauge for inflation, during October.

Gregory Sachs, chief executive at SCG Asset Management, offered his perspective on the Federal Reserve’s potential actions, forecasting a probable easing of policies around the middle of 2024. “I’m in the camp that the Fed will begin to ease probably in the middle of 2024,” Sachs stated, emphasizing the Fed’s tendency to lag behind broader economic trends. He added, “They usually lag what everyone else is seeing.”

Evaluating Fed Perspectives

John Williams, president of the Federal Reserve Bank of New York, emphasized the necessity of keeping a vigilant eye on inflation, indicating that while he anticipates a decline toward the central bank’s 2% target, he isn’t prepared to relax the Fed’s hold on the economy.

The market’s attention now shifts to Fed Chairman Jerome Powell’s impending speech at Spelman College in Atlanta on Friday, which is poised to provide further insights into the central bank’s future direction.

Looking ahead, Adam Hetts, global head of multiasset at Janus Henderson Investors, speculated on potential rate cuts in 2024, deliberating on the circumstances that might trigger such actions.

“Is it a ‘Goldilocks cut,’ which is strong GDP and disinflation because the Fed has threaded the needle? If that’s the case, it’s pedal to the metal. Or is it a cut because it is a recessionary cut, which means hitting the brakes?”

Corporate Performances

Several corporations witnessed a surge in their stock values due to positive quarterly results and sales projections. Victoria’s Secret observed a 14% boost, while La-Z-Boy and Big Lots, engaged in furniture and discount retail respectively, saw their shares climb by 11% and 9.8%. Furthermore, Salesforce, a prominent business software giant, delighted investors with a 9.4% surge in its shares, leading both the Dow and the S&P 500 on Thursday.

The cardboard industry also experienced a surge in stock values, ascending atop the S&P 500 index following a notable development by two major box manufacturers—International Paper and Packaging Corp. of America. Both companies witnessed an increase of more than 3% in their stock values after announcing price hikes. This move marked the first time they raised prices since March 2022, coinciding with the period when the Federal Reserve initiated interest rate hikes.

Contrary to expectations, oil prices observed a decline despite the Organization of the Petroleum Exporting Countries (OPEC) and their market allies agreeing to further reduce output to bolster prices. Benchmark U.S. oil futures concluded Thursday at $75.96 per barrel, reflecting a 6.2% drop for the month.

On the global front, major overseas indices in Asia and Europe witnessed predominantly positive trends in November. Thursday’s closure revealed Japan’s Nikkei 225 index and the Stoxx Europe 600 achieving gains of 0.5%, summing up their monthly advancements to 8.5% and 6.4% respectively. However, Hong Kong’s Hang Seng concluded November with a 0.4% decline.

Other News

Wells Fargo Faces Alleged Overtime Pay Lawsuit

A Wells Fargo employee filed a lawsuit alleging the misclassification of “senior premier bankers,” denying them overtime pay due to chronic understaffing. The bank faces this legal action amid ongoing efforts to unionize its workforce.

Goldman Sachs Ex-Analyst Faces Insider Dealing Charges

Ex-Goldman Sachs analyst Mohammed Zina and his brother face trial in London, accused of insider dealing. Mohammed allegedly profited from shares in six companies, totaling over GBP 140,000, while Suhail is implicated for facilitating these actions.

Finra Fines BofA Securities USD 24 Million For U.S. Treasury Spoofing

Finra fined BofA Securities USD 24 million for 717 cases of U.S. Treasury spoofing involving two former traders. The scheme created false market activity, with BofA’s systems unable to detect manual spoofing.