WORLDWIDE: HEADLINES

Japan Govt Repeats Readiness To Act As Yen Nears 24-Year Low

Japanese policymakers on Wednesday reiterated their readiness to take “necessary action” against rapid yen moves, in the wake of a slide in the currency triggered by bets the U.S. Federal Reserve would raise interest rates higher and for longer.

When asked about the yen’s sharp overnight falls, top currency diplomat Masato Kanda told reporters he was “concerned” over currency market moves.

“We are monitoring yen moves with a sense of urgency,” said Kanda, vice finance minister for international affairs. “We will respond appropriately to currency moves without ruling out any options,” he said, repeating warnings made last week.

Chief Cabinet Secretary Hirokazu Matsuno told a briefing on Wednesday the government would take necessary action should excessive yen moves continue. Rapid currency moves were undesirable, he added.

Japanese policymakers have struggled to slow the yen’s recent sharp falls as investors have focused on widening policy divergence between the Fed’s aggressive rate hike plans and the Bank of Japan’s pledge to maintain ultra-loose monetary policy.

Full coverage: REUTERS

China Recaps Energy Windfall As West Shuns Russian Supplies

China is buying more and less expensive energy supplies from Russia this year, reaping the benefits of a plunge in European purchases just when Beijing needs it most as the Ukraine crisis pushes Moscow in search of alternative markets.

The growing cooperation, to be further deepened with Chinese President Xi Jinping’s meeting with Russia’s Vladimir Putin in Uzbekistan on Thursday, is a boon for both countries.

China has gained access to cheaper energy while Russia is able to offset losses from the European Union and other allies scaling back on purchases of Russian exports due to sanctions over its invasion of Ukraine. Moscow calls it a special military operation.

Closer Chinese-Russian ties have also promoted the use of their yuan and rouble currencies in commodities trade, lessening reliance on the U.S. dollar.

China, the world’s largest energy consumer and top buyer of crude oil, liquefied natural gas and coal, has imported 17% more Russian crude between April and July from the same period a year ago.

Full coverage: REUTERS

WORLDWIDE: HEADLINES

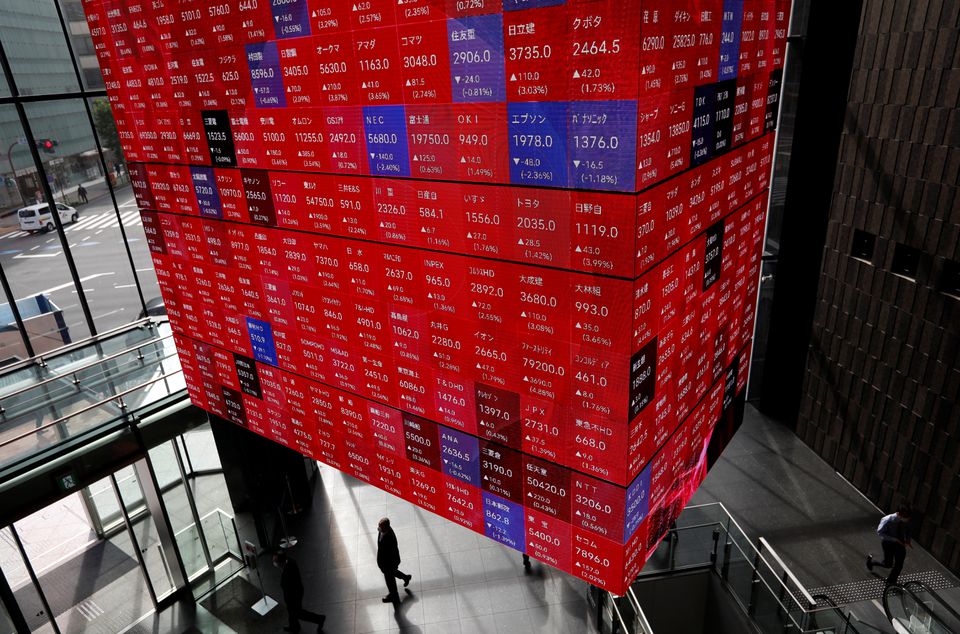

Asian Shares Extend Global Selloff Amid Bets On More Aggressive Fed

Asian shares tumbled, the dollar held firm and two-year Treasury yields hit a new 15-year high on Wednesday, as a U.S. inflation report dashed hopes for a peak in inflation, fuelling bets rates may have to be raised higher for longer.

U.S. Labor Department data showed on Tuesday the headline Consumer Price Index gained 0.1% on a monthly basis versus expectations for a 0.1% decline. In particular, core inflation, stripping out volatile food and energy prices, doubled to 0.6%.

Wall Street saw its steepest fall in two years, the safe-haven dollar posted its biggest jump since early 2020, and two-year Treasury yields, which rise with traders’ expectations of higher Fed fund rates, jumped to the highest level in 15 years.

MSCI’s broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) fell 2.1% on Wednesday, dragged lower by a 2.7% plunge in resources-heavy Australia (.AXJO), a 2.4% drop in Hong Kong’s Hang Seng index (.HSI) and a 1% fall in Chinese bluechips (.CSI300).

Japan’s Nikkei (.N225) tumbled 2.3%.

Full coverage: REUTERS

Dollar Pushes Towards Fresh 24-Year Peak Versus Yen After U.S. CPI Shock

The dollar climbed close to a 24-year peak against the yen on Wednesday amid a jump in U.S. yields after hotter-than-expected inflation boosted bets for even more aggressive monetary tightening by the Federal Reserve next week.

The dollar rose as high as 144.965 yen in the Asian session, taking it close to last Wednesday’s high of 144.99, a level not seen since August 1998, before last trading little changed at 144.56.

Overnight, the currency pair, which is extremely sensitive to rate differentials, surged 1.26% as 10-year Treasury yields climbed to a three-month high following an unexpected rise in the U.S. consumer price index (CPI) for August.

“This has really shattered the illusion … that inflation had peaked and was coming down,” Ray Attrill, head of currency strategy at National Australia Bank, said in a podcast. “Hence markets have decided that next week’s Fed decision is not between 50 and 75 (basis point increase), it’s now between 75 and 100.”

Full coverage: REUTERS

Oil Prices Creep Higher On Robust Global Demand Outlook

Oil prices inched higher in early trade on Wednesday as OPEC stuck to forecasts for robust global fuel demand growth, offsetting concerns of another U.S. Federal Reserve interest rate hike next week after consumer prices unexpectedly rose in August.

Brent crude futures rose 3 cents to $93.20 a barrel by 0116 GMT, after settling 0.9% lower on Tuesday. U.S. West Texas Intermediate crude was at $87.41 a barrel, up 10 cents, or 0.1%.

The Organization of the Petroleum Exporting Countries (OPEC) on Tuesday reiterated forecasts for growth in global oil demand in 2022 and 2023, citing signs that major economies were faring better than expected despite headwinds such as surging inflation.

Oil demand will increase by 3.1 million barrels per day (bpd) in 2022 and by 2.7 million bpd in 2023, OPEC said in a monthly report, leaving its forecasts unchanged from last month.

“The resilient moves in oil prices suggest that undersupply is still a primary issue in the physical markets, especially after OPEC kept its positive demand outlook on Tuesday,” said Tina Teng, an analyst at CMC Markets.

Full coverage: REUTERS