WORLDWIDE: HEADLINES

Japan Trade Gap Widens As Imports Surge, Capex Solid For Now

Japan’s imports jumped to a record amount in July, boosted by global fuel inflation and a weak yen, outweighing exports and deepening the trade deficit, in a sign of a further worsening in the terms of trade for the export-oriented economy.

The trade data came on the heels of Reuters Tankan, which showed improvement in Japan’s business sentiment in August, while a key gauge of corporate capital spending rebounded in June from the previous month’s decline.

While the mixed batch of data provides some evidence of resilience, policymakers are likely to maintain calls for more stimulus as the world’s third-largest economy struggles to shake off the hit from the pandemic and as the global outlook dims.

“Exports are likely to slow down ahead due to global tightening of monetary policy, which could sap corporate appetite for investment,” said Takeshi Minami, chief economist at Norinchukin Research Institute.

Full coverage: REUTERS

NZ Central Bank Hikes Rates 50 Bps, Signals Aggressive Tightening Pace

New Zealand’s central bank on Wednesday delivered its seventh straight interest rate hike and signalled a more hawkish tightening path over coming months to restrain stubbornly high inflation.

The aggressive tone of the Reserve Bank of New Zealand’s (RBNZ) statement warning of future hikes being brought forward lifted the local dollar and pushed swap rates higher.

The RBNZ raised the official cash rate (OCR) by 50 basis points to 3.0% as expected, a level not seen since September 2015, and crucially, it now sees rates at 4.0% by early next year, compared to a previous projection of 3.7%.

“It remains appropriate to continue to tighten monetary conditions at pace to maintain price stability and contribute to maximum sustainable employment,” the central bank said in a statement.

Full coverage: REUTERS

WORLDWIDE: HEADLINES

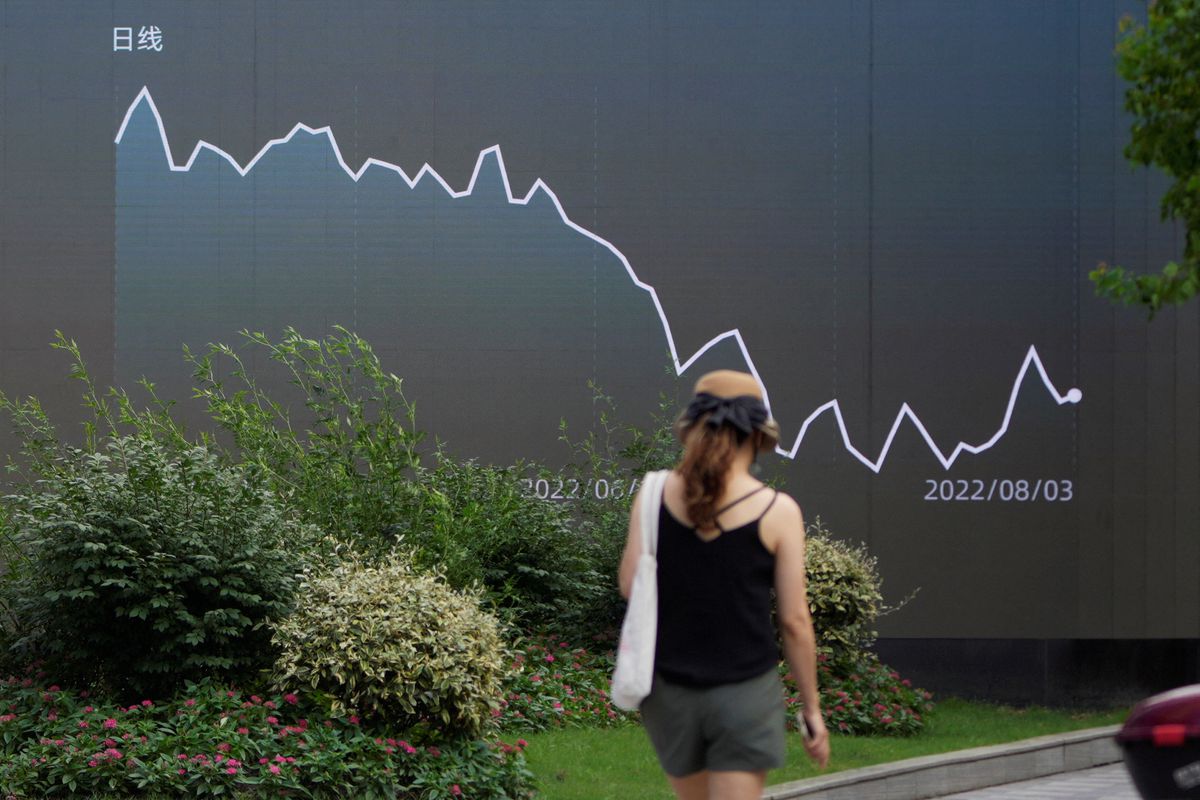

Asian Stocks Solid And Kiwi Jumps On RBNZ Rate Hike

Asian shares tracked solid Wall Street performance on Wednesday as strong overnight earnings for U.S. retail giants pointed to further scope for the Federal Reserve to tackle inflation with rate hikes.

Japan’s Nikkei (.N225) rose 0.81% to 29,101.33, breaking through the 29,000 barrier for the first time since Jan. 6.

MSCI’s broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) rose 0.02%.

Stocks in New Zealand (.NZ50) fell 0.285% and the kiwi dollar gained 0.35% after the country’s central bank announced a fourth consecutive 50 bps rate hike to 3.00%.

Full coverage: REUTERS

NZ Dlr Jumps After Rate Hike, Hawkish Stance; Aussie Hit By Jobs Data Miss

The New Zealand dollar rallied on Wednesday after the central bank reinforced its hawkish policy stance alongside its seventh straight rate hike, while the Australian dollar tumbled after wage growth data missed forecasts.

The news from the antipodes helped provide direction to markets that had been drifting ahead of the release of minutes of the U.S. Federal Reserve’s latest meeting.

The kiwi gained 0.58% to $0.6377 after the Reserve Bank of New Zealand hiked rates by an expected 50 basis points, and pointed to the need to bring forward the timing of future rate increases.

Across the Tasman Sea, the Australian dollar fell as much as 0.5% after data showed Australian wage increases missed forecasts and lagged badly behind inflation. It has since pared those losses to trade down 0.2%, holding back just above the symbolic $0.7 level.

Full coverage: REUTERS

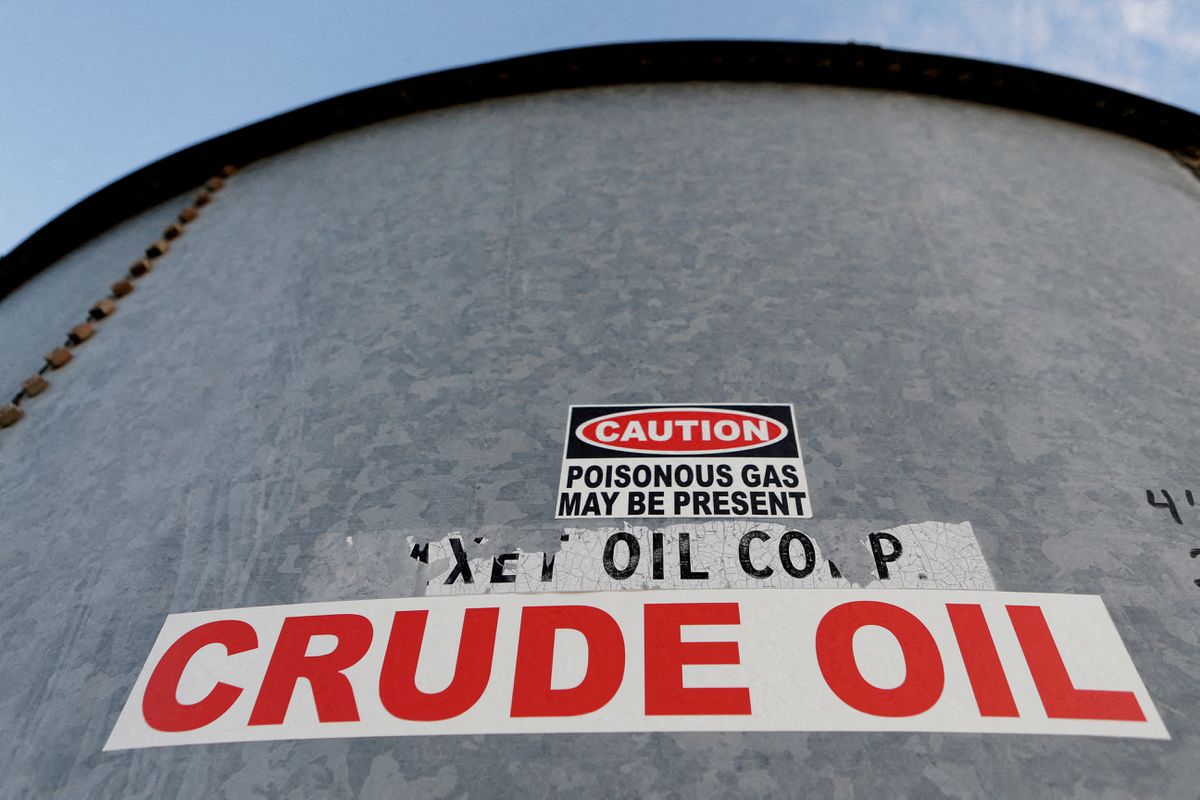

Oil Prices Recover From 6-Month Lows After Drop In U.S. Stockpiles

Oil prices rose on Wednesday, recovering from six-month lows hit the previous day, as a larger-than-expected drop in U.S. oil and gasoline stocks reminded investors that demand remains firm, if overshadowed by the prospect of a global recession.

Brent crude futures rose 13 cents, or 0.1%, to $92.47 a barrel by 0035 GMT. West Texas Intermediate (WTI) crude futures climbed 27 cents, or 0.3%, to $86.80 a barrel.

The contracts slumped about 3% on Tuesday as weak U.S. housing starts data spurred concerns about a potential global recession.

“A drawdown of U.S. gasoline stockpiles for a second straight week has reassured investors that demand is resilient, prompting buys,” said Kazuhiko Saito, chief analyst at Fujitomi Securities Co Ltd.

Full coverage: REUTERS