WORLDWIDE: HEADLINES

Japan’s Dec Exports, Imports Hit Record High By Value As Supply Bottlenecks Ease

Japan’s exports and imports in December hit record highs in terms of their value in yen, data showed on Thursday, as supply bottlenecks eased at the end of 2021 amid rising prices.

However, a persistent semiconductor shortage remained a headache for Japanese firms such as automaker Toyota (7203.T), which slashed its near-term output target this week, in addition to uncertainties around the Omicron variant.

“There’re considerable uncertainties” from Omicron, Takeshi Minami, chief economist at Norinchukin Research Institute said, adding it could derail various aspects of Japan’s economy from firms’ overseas supply chains to domestic consumption.

Exports in December rose 17.5% from a year earlier, Ministry of Finance data showed, outstripping a 16.0% gain expected by economists in a Reuters poll but below a 20.5% rise in November.

Yen-denominated exports and imports hit records of 7,881.4 billion yen ($69 billion) and 8,463.8 billion yen, respectively, biggest since comparable data became available in January 1979, largely as rising inflation affected both flows.

Steel exports rose 75.1% year-on-year by value, but the gain in export volume was 10.2%, suggesting soaring commodity prices pushed up values of made-in-Japan goods sold overseas.

Full coverage: REUTERS

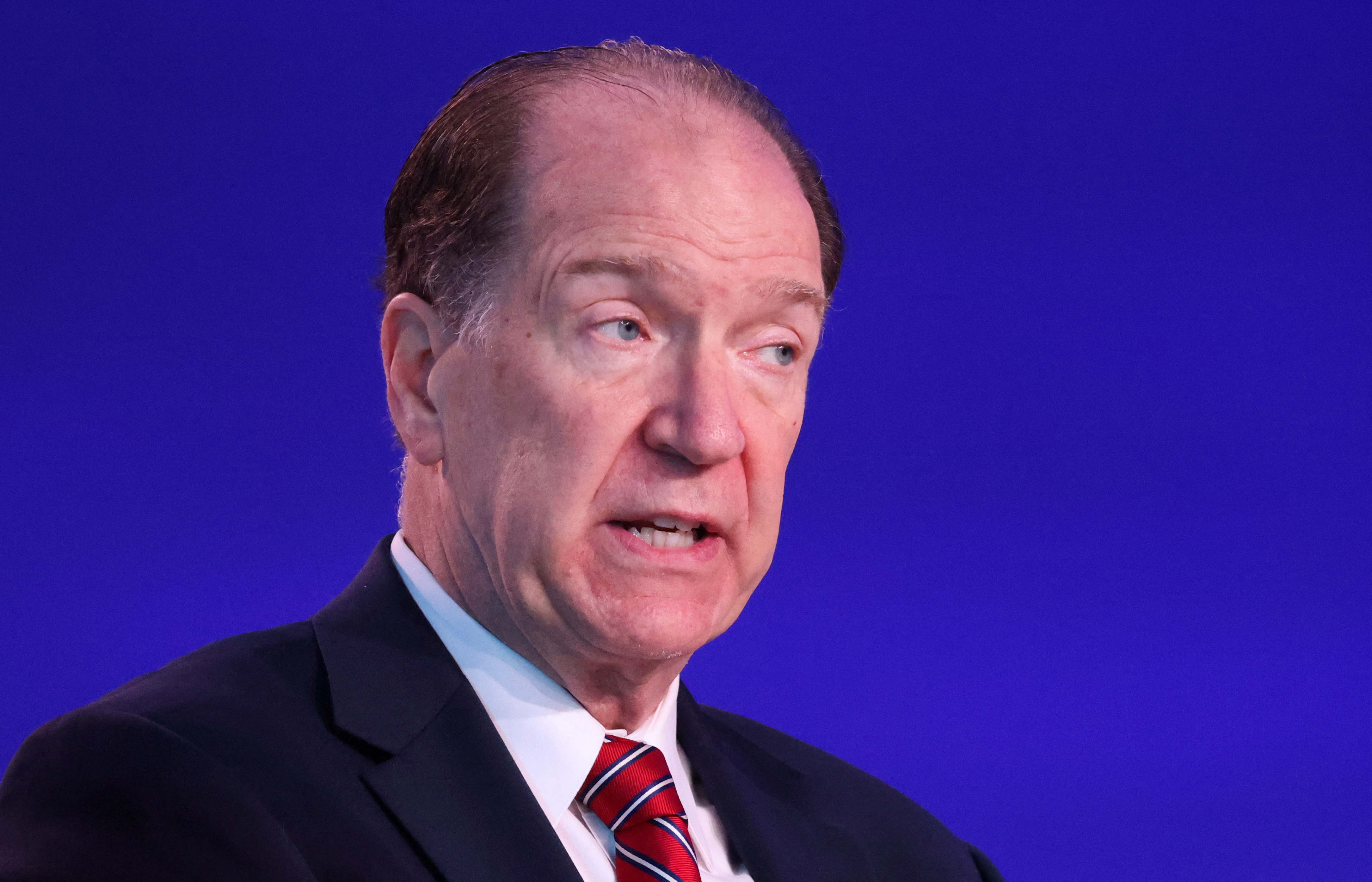

World Bank Chief Takes Swipe At Microsoft’s $69 Bln Gaming Deal As Poor Countries Struggle

World Bank President David Malpass on Wednesday criticized Microsoft’s (MSFT.O) $69 billion takeover of gaming developer Activision Blizzard (ATVI.O) as a questionable allocation of capital at a time when poor countries are struggling to restructure debts and fight COVID-19 and poverty.

Malpass said during a Peterson Institute for International Economics virtual event that more capital needed to flow into poor countries, but these flows have been disrupted by unusually easy monetary policies in developed countries.

He said he was struck by the scale of Microsoft’s acquisition deal for “Call of Duty” maker Activision Blizzard. This dwarfed the $23.5 billion in cash contributions agreed in December by wealthier donor countries to the International Development Association, the World Bank’s fund for the poorest countries — about $8 billion annually over three years, he said.

“You have to wonder: ‘Wait a minute, is this the best allocation of capital?'” Malpass said of the Microsoft deal. “This goes to the bond market. You know, a huge amount of (capital) flows are going to the bond market.”

A very small portion of the developing world has access to such bond financing, while too much capital remains bottled up in advanced countries, especially in central bank reserve assets used to back long-term bond purchases, he added.

A spokesperson for Microsoft did not immediately respond to a Reuters request for comment on Malpass’ remarks.

Full coverage: REUTERS

WORLDWIDE: FINANCE/MARKETS

Asian Shares Rise As China Cuts Key Mortgage Rate

Asian share markets broke a five-day slide to edge higher on Thursday, shrugging off drops in Europe and on Wall Street overnight as China underscored its diverging monetary and economic picture by cutting benchmark mortgage rates.

Despite the steadier start in Asia, analysts at ING said geo-political risks, notably the possibility of Russia invading Ukraine, could continue to weigh on global shares, adding to existing pressure from the rising rates outlook.

“Markets may soon start to take into account a greater risk of a conflict flare-up between Russia and Ukraine, which is one reason why stocks may continue to sell and why Treasury yields aren’t on a one-way ticket higher.”

U.S. President Joe Biden predicted on Wednesday that Russia will make a move on Ukraine, saying a full-scale invasion would be “a disaster for Russia” but suggesting there could be a lower cost for a “minor incursion.”

Expectations that the U.S. Federal Reserve will move more quickly to hike interest rates to combat inflation hit technology shares particularly hard overnight, pushing the Nasdaq down more than 1% into correction territory.

The sell-off hit bonds as well, pushing U.S. Treasury yields to two-year highs on Wednesday, and taking Germany’s 10-year yield into positive territory for the first time since May 2019 as investors bet policymakers will curb years of stimulus in order to fight rising inflation exacerbated by supply chain disruption.

Full coverage: REUTERS

High Oil Prices Boost Commodity Currencies, Dollar Rally Stalls

Higher commodity prices were supporting the Canadian and Australian dollars on Thursday, while a pause in this week’s rally in U.S. Treasury yields meant the dollar also marked time.

The Aussie firmed 0.5% on Thursday extending advances the previous day. The Canadian dollar touched a touched a 10-week high on Wednesday with one U.S. dollar worth C$1.245, before paring gains, also supported by higher Canadian inflation figures.

“Overnight commodity prices were the big driver for commodity currencies, but you’ve still got the undertone that (COVID-19 variant) Omicron is not going to have a lasting detrimental impact on the global economic outlook,” said Kim Mundy, senior economist and currency strategist at Commonwealth Bank of Australia.

Governments worldwide are easing quarantine rules and reviewing coronavirus curbs as they bid to launch their economies back into some version of normality, motivated by the lower severity of the Omicron variant. That has helped commodities rally.

In the short term, Brent crude futures touched $89.17 on Wednesday, its highest level since Oct. 2014, supported in by a tight short-term supply outlook. Newcastle coal futures are at their highest since October.

Elsewhere the euro continued to edge higher to$1.1347, gradually regaining some ground after having its worst day in a month on Tuesday, when the dollar caught a lift from a jump in U.S. Treasury yields.

Full coverage: REUTERS

Oil Prices Ease From 2014 High, Supply Concerns Limit Losses

Oil prices slipped back on Thursday after hitting their highest levels since 2014 in the previous session on the back of strong demand and short-term supply disruptions, underlying factors that limited losses as investors took profits.

Brent crude futures dropped 72 cents, or 0.81%, to $87.72 a barrel, as of 0152 GMT. The global benchmark touched $89.13 a barrel in the last session, its highest since October 2014.

U.S. West Texas Intermediate (WTI) crude futures gave up 96 cents, or 1.1%, to stand at $86 a barrel.

“The International Energy Agency said global oil demand is on track to hit pre-pandemic levels,” analysts at ANZ bank said in a note.

“Shorter-term supply disruptions are also helping tighten markets. Brent crude rallied sharply after reports a key oil pipeline running from Iraq to Turkey was knocked out by an explosion.”

However, the flow of crude oil through the Kirkuk-Ceyhan pipeline has resumed, after it was halted on Tuesday due to a blast near the pipeline in the southeastern Turkish province of Kahramanmaras, officials said on Wednesday.

Supply concerns have mounted this week after Yemen’s Houthi group attacked the United Arab Emirates, the third-largest producer in the Organization of the Petroleum Exporting Countries (OPEC). Meanwhile Russia, the world’s second-largest oil producer, has built up a large troop presence near Ukraine’s border, stoking fears of invasion and subsequent supply uncertainties.

Underpinning oil prices is the broad post-coronavirus pandemic recovery in demand for fuel.

Full coverage: REUTERS

Home

Home