WORLDWIDE: HEADLINES

Microsoft Offers Strong Forecast, Lifting Shares

Microsoft Corp (MSFT.O) on Tuesday forecast revenue for the current quarter broadly ahead of Wall Street targets, driven in part by its Intelligent Cloud unit.

The outlook soothed concerns about growth sparked by results for the December quarter, which initially dragged on Microsoft’s shares in after-hours trade. But the shares reversed course following the outlook, trading 3% above the closing price.

Investors were seeking assurances that the enterprise cloud business is still growing strongly and got it from Microsoft.

“So the quarter itself was, ho hum. Good, but not as great as we’ve seen past quarters,” said Brent Thill, an analyst at Jefferies. “But then the guidance for the third quarter really turned the tape around and saved the Nasdaq, if you will.”

Thill said Microsoft’s guidance that Azure revenue would be up sequentially was strong assurance that cloud demand was solid.

Microsoft forecast Intelligent Cloud revenue of $18.75 billion-$19 billion for its fiscal third quarter, driven by “strong growth” in its Azure platform. That compared with a Wall Street consensus of $18.15 billion, according to Refinitiv data.

Thill said the strong momentum for cloud computing benefiting Microsoft will likely also be reflected in upcoming results for rivals Amazon.com Inc and Alphabet Inc’s (GOOGL.O) Google.

Microsoft delivered strong outlooks in other areas, too.

The More Computing unit expects revenue of $14.15 billion-$14.45 billion for the third quarter, ahead of the Wall Street target of $13.88 billion, and Productivity and Business Processes of $15.6 billion-$15.85 billion compared with the consensus target of $15.72 billion.

Full-year operating margins are forecast to be up slightly from the previous year.

Full coverage: REUTERS

BOJ Debated Chance Of Inflation Pick-up Towards 2% As Price Hikes Broaden

Some Bank of Japan policymakers saw consumer inflation briefly accelerating towards their 2% target as price pressures build up on changing corporate price-setting behaviour, a summary of opinions at the bank’s January meeting showed on Wednesday.

Many board members, however, stressed the need to maintain ultra-loose monetary policy to support a fragile economy facing fresh risks from a spike in Omicron coronavirus cases, the summary showed.

“There’s a chance year-on-year growth in consumer inflation may briefly approach 2%. If that happens, what’s important is to look at facts behind the rise and whether they’re sustainable,” one of the BOJ’s nine board members was quoted as saying.

“Consumer inflation may temporarily reach levels of around 1.5% in the first half of 2022. Whether that momentum is sustained enough for inflation to stably approach the BOJ’s 2% target would depend on wage and inflation expectations – or in sum the strength of demand,” a second opinion said.

At the January meeting, the BOJ raised its price forecasts but said it was in no rush to change its ultra-loose policy with inflation still distant from its target.

Japan has not been immune to impact of global commodity inflation with wholesale prices rising at a record pace.

But decades of low inflation have made many Japanese firms cautious of raising prices for fear of scaring away consumers, and instead have absorbed costs by streamlining operations.

Full coverage: REUTERS

WORLDWIDE: FINANCE/MARKETS

Asian Shares Cautiously Higher As Investors Await Fed Policy Update

Asian share markets got off to a cautious start on Wednesday, after another volatile Wall Street session, as investors braced for the outcome of the Fed’s meeting late in the day and any hints about faster tightening of monetary policy.

MSCI’s broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) was up 0.26% early on Wednesday, but the index has skidded 2.4% this year, and is testing mid-December’s one-year low.

Concerns that the Fed’s expected interest rate hikes could hammer Asia’s equities markets have dragged on the regional benchmark, though moves elsewhere have been even more dramatic.

Globally, U.S. stocks posted their worst week since 2020 last week, and MSCI’s world index (.MIWD00000PUS) is on course for its biggest monthly drop since the COVID-19 pandemic hit markets in March 2020.

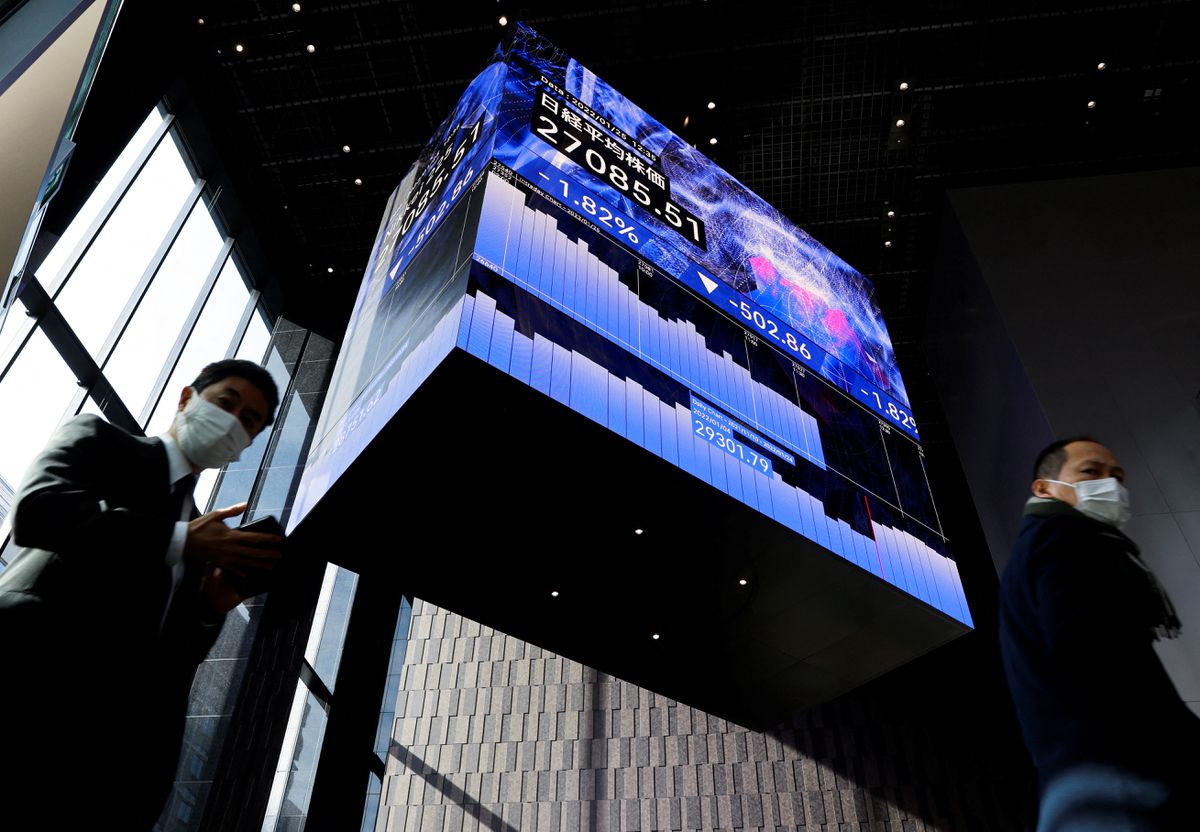

Japan’s Nikkei (.N225) lost 0.8% to hover around its lowest level since Dec. 2020.

The Fed is due to update its policy plan later on Wednesday, likely fleshing out timing for expected rate hikes and shrinking its massive balance sheet.

“Asian markets are currently being affected by volatility in global markets, concerns about Fed tightening in the face of higher inflation and uncertainty about events in Russia and Ukraine,” said Mansoor Mohi-uddin, chief economist at Bank of Singapore.

Growing tensions as Russian troops massed on Ukraine’s border have added to a risk-averse environment for investors.

Full coverage: REUTERS

Euro On Defensive As Traders Fret Over Ukraine Tension, Hawkish Fed

The euro hovered near its weakest in a month versus the safe-haven dollar and yen on Wednesday as traders fretted over a potential military conflict in Ukraine and the possibility of accelerated Federal Reserve policy tightening.

The euro was about flat at $1.1303 after dipping to $1.1264 overnight for the first time since Dec. 21. It slipped 0.06% to 128.64 yen , after touching 128.25 in the previous session, also a first since Dec. 21.

Western leaders stepped up preparations for any Russian military action in Ukraine while Moscow said it was watching with great concern after 8,500 U.S. troops were put on alert to deploy to Europe in the event of an escalation.

Meanwhile, the Fed ends a two-day policy meeting later in the global day, with market players anxiously awaiting further clues on the timing and pace of interest rate hikes, as well as how the central bank will go about slimming down its almost $9 trillion balance sheet, a process dubbed quantitative tightening (QT).

Money markets are currently priced for a first hike in March, followed by three more quarter-point increases by year-end.

The dollar index, which measures the currency against six major peers, was flat at 95.973, after climbing to 96.273 on Tuesday, the highest since Jan. 7. It has climbed as much as 1.74% from a two-month low touched on Jan. 14.

“Market sentiment remains fragile,” TD Securities strategists wrote in a client note.

From the Fed, “any hints around the starting point for QT or ‘sooner’ and ‘faster’ on hikes could be market-moving,” but “we don’t expect definitive signals, unfortunately, and the result could be mixed messages,” they wrote.

Full coverage: REUTERS

Oil Dips On Profit-taking Ahead Of Fed Update

Oil prices eased on Wednesday as investors booked profits ahead of an update from the U.S. Federal Reserve, although fears over tighter supply amid tensions in Ukraine and the Middle East capped losses.

Brent crude futures were down 15 cents, or 0.2%, at $88.05 a barrel at 0105 GMT, having jumped 2.2% in the previous session.

U.S. West Texas Intermediate (WTI) crude futures slipped 31 cents, or 0.4%, to $85.29 a barrel, having climbed 2.8% on Tuesday.

“Some corrections have kicked in as investors wanted to adjust their positions ahead of the Fed meeting,” said Hiroyuki Kikukawa, general manager of research at Nissan Securities.

“But downside is limited due to heightened tensions between Russia and Ukraine and the threat to infrastructure in the United Arab Emirates,” he said, adding that oil was likely to continue its upward run after the Fed update.

The Fed is expected to firm up plans to raise interest rates and shrink its holdings of U.S. Treasury bonds and mortgage-backed securities, which have swollen its balance sheet to about $9 trillion.

Oil prices hit seven-year highs last week on worries that supplies could tighten due to Ukraine-Russia tensions and worries about the conflict in Yemen.

U.S. President Joe Biden said on Tuesday he would consider personal sanctions on President Vladimir Putin if Russia invades Ukraine, while Western leaders stepped up military preparations and made plans to shield Europe from a potential energy supply shock.

Full coverage: REUTERS

Home

Home