Today’s News

Image Source: The Wall Street Journal

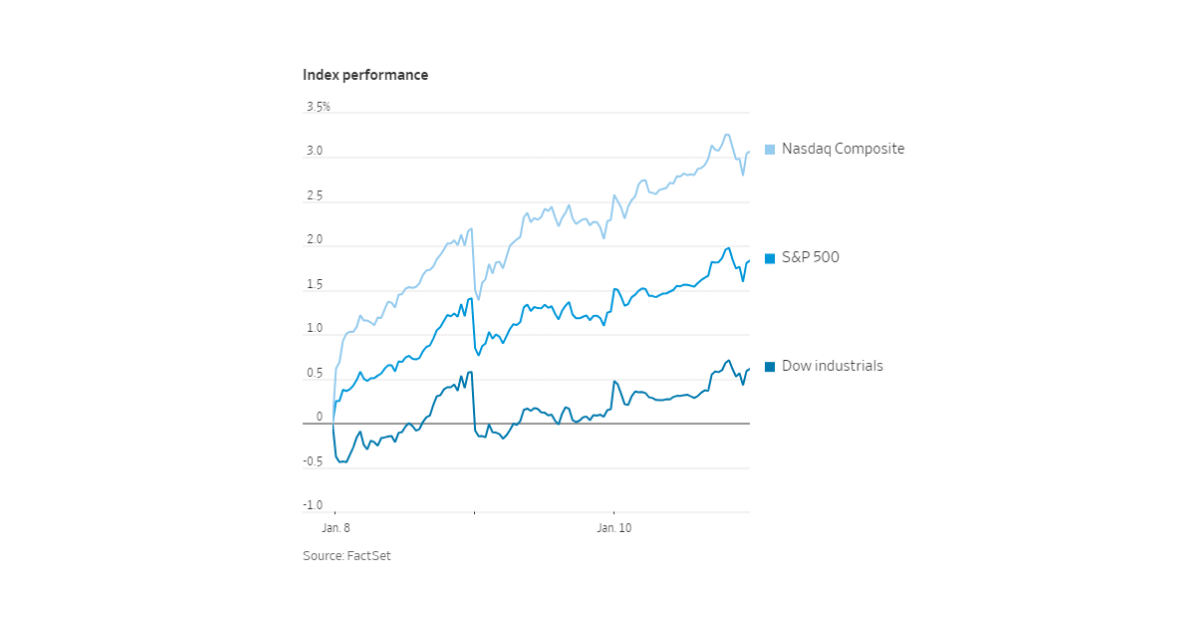

On Wednesday, the major stock indices experienced an upward trend in a subdued trading session leading up to critical inflation data and impending bank earnings. The S&P 500 registered a 0.6% gain, closing within 0.3% of its record high established just over two years ago. Both the Nasdaq Composite and the Dow Jones Industrial Average also showed positive movements, rising by 0.8% and 0.5%, respectively. Despite a decline in the first week of 2024, stocks have rebounded, with the S&P 500 turning positive for the year during Wednesday’s trading.

Investors are eagerly anticipating Thursday’s release of consumer-price data for December, seeking insights into inflation trends following the Federal Reserve’s indication last month of potential interest rate cuts in response to declining inflation. Some analysts are expressing caution, particularly due to hotter-than-expected payrolls and wage growth data for December.

Jason Hsu, Chief Investment Officer at Rayliant Global Advisors, emphasized the significance of persistent inflation risks, noting, “With wages rising year-over-year more than twice as fast as the Fed’s 2% target, we see persistent inflation as a significant risk.”

Treasury yields remained relatively stable, with the benchmark 10-year yield hovering just above 4%. Simultaneously, Bitcoin saw a 1% increase, reaching just under USD 46,000, following the Securities and Exchange Commission’s clearance for the first U.S. exchange-traded funds holding the cryptocurrency to be publicly sold.

The upcoming earnings season, commencing on Friday with reports from Bank of America, Citigroup, JPMorgan Chase, and Wells Fargo, is poised to provide crucial insights. Investors will closely scrutinize CEOs’ statements regarding the economy’s health. The ability of companies to sustain price increases is a focal point, impacting both corporate profits and the inflation outlook.

Image Source: FactSet

Larry Adam, Chief Investment Officer for Global Wealth Solutions at Raymond James, emphasized, “It’s going to be very critical to see how much the consumer is pushing back on price increases.”

On Wednesday, Meta Platforms shares surged by 3.7% following a bullish analyst report from Mizuho Financial Group. Microsoft, nearing the title of the most valuable company by market capitalization, experienced a 1.9% increase in its shares, pulling within 2% of Apple’s market value. Boeing shares stabilized with a 0.9% rise after facing a sharp decline earlier in the week due to a door-plug failure affecting approximately 170 of its planes. Intuitive Surgical emerged as the best performer in the S&P 500, rising by 10% after releasing preliminary quarterly revenues that surpassed estimates.

Internationally, stock markets presented a mixed picture, with Japan’s Nikkei 225 climbing 2% to its highest closing level since 1990, while the Stoxx Europe 600 edged lower. In the commodities market, Brent crude, the international oil benchmark, fell by 1% to USD 76.80 a barrel.

Other News

Democrats Raise Concerns Over Semiconductor Grants

Senators Elizabeth Warren and Pramila Jayapal express worries about potential conflicts of interest as former Wall Street employees oversee the distribution of USD 39 billion in semiconductor grants by the Commerce Department.

Fed’s 2024 Rate Cut Raises Election-Year Questions

The Federal Reserve’s plan to cut interest rates in 2024, addressing inflation, sparks election-year scrutiny. Concerns arise over potential political impacts, especially on mortgage rates, as former President Trump and leading candidates focus on Fed policies.

Citigroup Faces USD 1.3 Billion Charges

Citigroup reveals one-time charges totaling USD 1.3 billion for exposures to Argentina’s debt market, Russia’s instability, and its own restructuring plan. The bank also anticipates a USD 780 million charge for severance costs.