Today’s News

Image Source: AP News

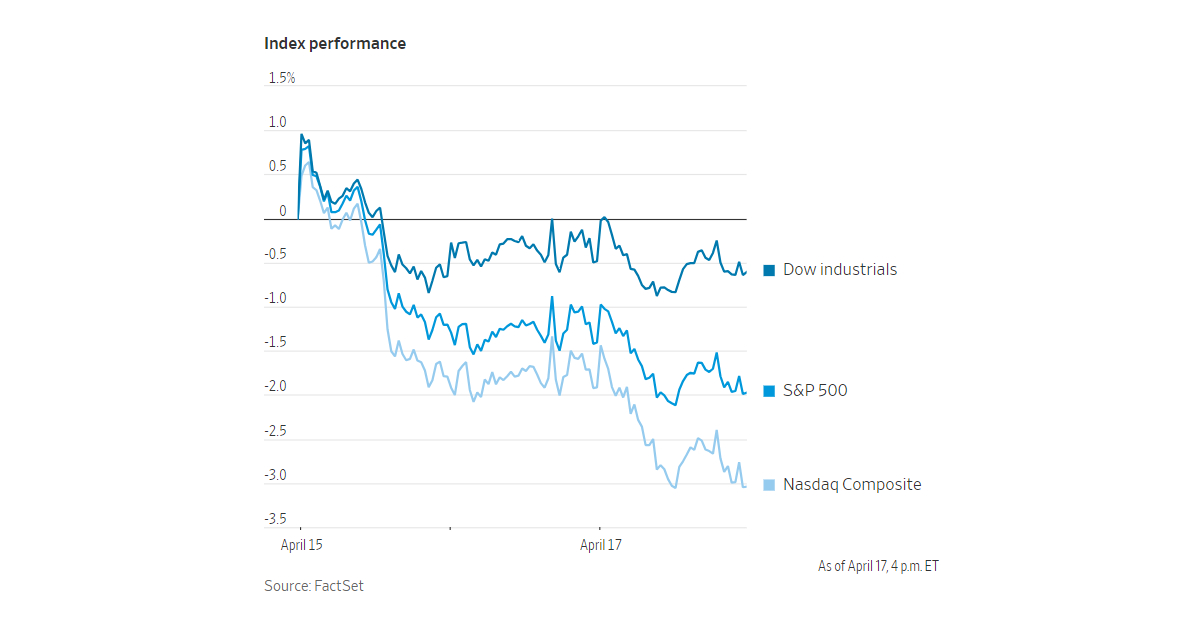

Stocks extended their downward trajectory on Wednesday, deepening the April selloff as investors shifted away from expecting imminent interest-rate cuts. The S&P 500 experienced a 0.6% decline, marking its fourth consecutive session of losses, while the Nasdaq Composite dropped 1.1%, and the Dow Jones Industrial Average dipped 0.1%, losing 46 points.

This losing streak for the S&P 500 is its longest since the initial week of 2024. Additionally, for the third successive session, the index initially rose before ultimately closing lower, marking the longest stretch of such reversals since 2022.

The beginning of the year witnessed a significant stock market rally, largely fueled by widespread expectations of potential Federal Reserve interest-rate cuts in 2024. This optimism propelled the S&P 500 to its best first-quarter performance since 2019. However, the situation took a turn in April, as a consistently robust economy prompted Fed Chair Jerome Powell and other central bank officials to cast doubt on the likelihood of such rate cuts.

Sinead Colton Grant, chief investment officer at BNY Mellon Wealth Management, noted the shift in market expectations, stating, “We had forecast two rate cuts this year, now we’re at just one in December, which is very different from what markets had expected” at the beginning of the year.

Traders in interest-rate derivatives have responded to this shift by reducing the probability of a rate cut at the Fed’s June meeting. Just a month ago, the likelihood stood at 55%, but it has since decreased to 16%, according to CME Group’s FedWatch tool. Consequently, bond yields have risen, putting pressure on stock prices. As a result, all three major indexes have experienced declines of 4% or more this month.

Despite the recent downturn, both the S&P 500 and Nasdaq remain in positive territory for the year, indicating that investors are not yet ready to abandon the bull market. Tony Roth, chief investment officer at Wilmington Trust, expressed his view that the market reaction may be excessive, stating, “We think the market is way overreacting.” He also pointed out that slight changes in economic indicators could significantly alter the narrative.

BNY Mellon’s Grant echoed Roth’s sentiment, suggesting that this period of consolidation may present a buying opportunity for equities. Meanwhile, the benchmark 10-year Treasury yield saw a slight decrease, settling at 4.584%.

In terms of commodities, U.S. crude oil prices fell 3.1% to USD 82.69 a barrel, while gold futures dropped 0.8% to USD 2,371.70 a troy ounce. Chip stocks continued their decline, with the PHLX Semiconductor Index falling 3.2% and experiencing a 6.9% decline for the month.

Despite the overall downturn, United Airlines emerged as the top performer in the S&P 500, with its stock rising by 17% after reporting stronger-than-expected quarterly results. Other airlines also benefited from the news, with American Airlines Group gaining 6.6% and Southwest Airlines advancing 2.6%. Conversely, J.B. Hunt Transport Services was the worst performer in the S&P 500, experiencing an 8.1% decline after reporting disappointing results.

Other News

Peltz’s Disney Defeat And Unilever’s Fate

Nelson Peltz’s failed Disney proxy fight casts doubts on his hedge fund’s prospects, while attention shifts to the fate of his substantial Unilever investment amidst internal shake-ups and uncertain future strategies.

Banking Regulator Warns Of Risks In AI

Bank of Spain Governor Hernandez de Cos cautions banks to anticipate and manage risks arising from AI and ML adoption, stressing the importance of proactive risk management and regulatory oversight in safeguarding financial stability.

Insurers Face “Alarming” Losses As Risk Models Lag

A report by Capgemini reveals “alarming” underwriting losses among global property insurers in 2022, attributed to increasing natural catastrophes and inadequate risk models.