Today’s News

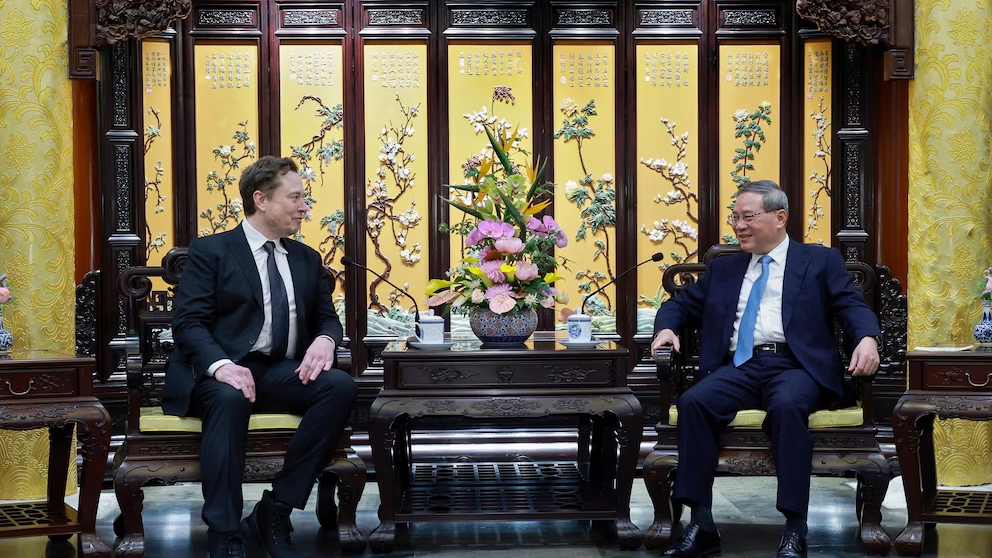

Image Source: AP News

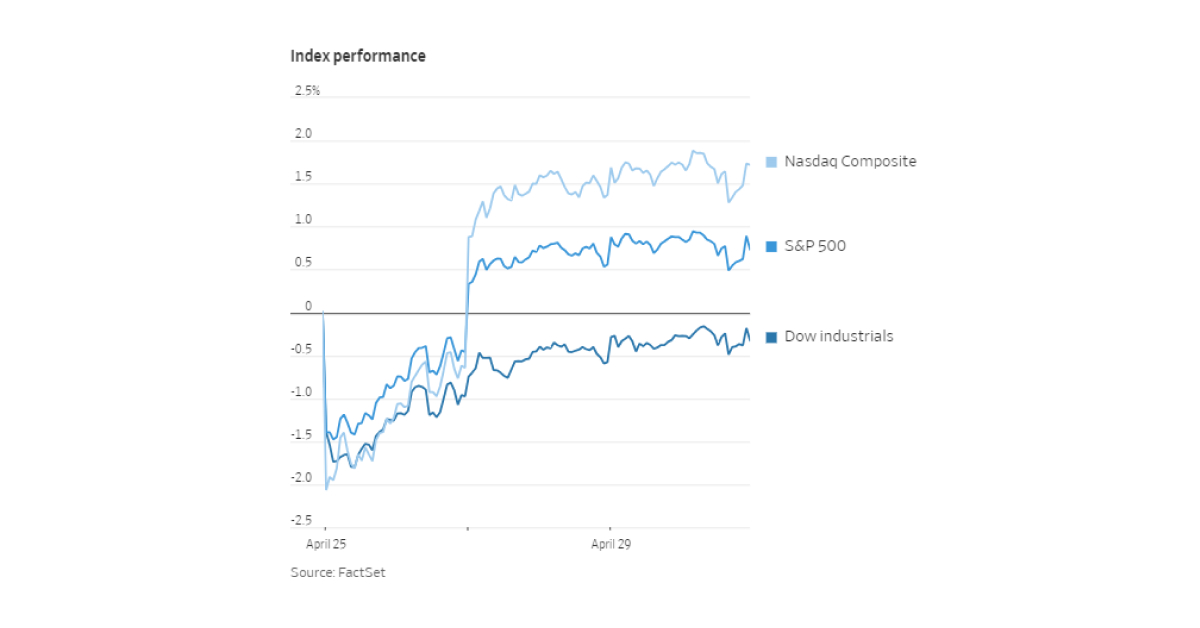

A 15% surge in Tesla’s stock played a pivotal role in extending the market’s rally as the week commenced with a flurry of corporate earnings and economic data. Despite hotter-than-expected inflation figures casting doubt on anticipated interest-rate cuts, major U.S. indexes managed to inch upwards on Monday. The S&P 500 climbed by 0.3%, the Nasdaq Composite nudged up by 0.4%, and the Dow Jones Industrial Average gained 0.4%, equivalent to 146 points.

Despite concerns over inflation, investors like Jim Masturzo, Chief Investment Officer at Research Affiliates, noted a gradual acceptance of the likelihood of sustained higher interest rates. Masturzo cautioned against excessive rate cuts, suggesting they could signal a drastic economic slowdown, a view he considered risky.

As attention turns to the Federal Reserve meeting scheduled to conclude on Wednesday, investors anticipate potential clues regarding future rate adjustments. The upcoming April jobs report on Friday promises further insights into the ongoing expansion of the U.S. economy.

While government bond yields saw a slight decline on Monday, they remain significantly higher compared to the beginning of the year. This trend has attracted investors seeking stable returns, thereby pressuring stocks for much of April and positioning all three major indexes for their weakest monthly performances of the year.

Jason Hsu, Chief Investment Officer at Rayliant Global Advisors, emphasized the appeal of avoiding market volatility while securing steady returns, particularly amid the current climate. His firm’s preference for investments in countries like Japan, where government intervention supports currency stability, reflects a broader strategy aimed at minimizing risk amidst market uncertainties.

Despite a recent aversion to riskier assets among traders, one of the year’s most volatile stocks, Tesla, took the lead in the S&P 500 on Monday. The impressive 15% surge in Tesla shares marked their largest single-day gain since 2021, fueled by Chief Executive Elon Musk’s successful negotiation with Beijing to introduce the company’s driver-assistance service in China. However, Tesla’s overall share price has faced a challenging year, experiencing a 22% slump amid dimming prospects for electric-vehicle sales growth.

In contrast, other notable movements in the market included a 7.6% increase in shares of Fulton Financial following its acquisition of regional bank Republic First in a government-backed deal. Additionally, media conglomerate Paramount Global saw a 2.9% rise, anticipating the announcement of CBS owner Bob Bakish’s resignation amid ongoing sales discussions.

However, not all stocks experienced gains, as evidenced by Google-parent Alphabet and Instagram owner Meta Platforms. Alphabet, which had seen a surge in its stock price on Friday due to better-than-expected earnings, retreated by 3.3% on Monday, while Meta Platforms shed 2.4%. These losses weighed heavily on the S&P 500’s communications-services sector, turning it into the index’s primary laggard.

As earnings season gains momentum, investors eagerly anticipate the release of results from key players such as Amazon.com, McDonald’s, and Coca-Cola, which are due to be announced on Tuesday.

Other News

Japan Intervenes as Yen Hits Record Low

Japan took action to bolster the yen as it reached a multi-decade low against the dollar, responding to market speculation and highlighting the currency’s susceptibility to changing U.S. interest rate expectations.

WeWork Restructuring Deal Leaves Out Neumann

WeWork’s senior creditors invest USD 450 million, gaining control and sidelining Adam Neumann’s bid. The deal, approved by a bankruptcy court, values WeWork at USD 750 million post-restructuring.

Shell’s USD 1 Billion Profit from U.S. Crude Trading

Testimony in a lawsuit unveils that Shell’s U.S. crude trading division consistently earns around USD 1 billion annually, constituting 13% to 15% of its overall U.S. pre-tax profits.

Home

Home