In May 2022, the U.S. saw its biggest interest rate hike in 22 years announced by the U.S. central bank to curb surging inflation.

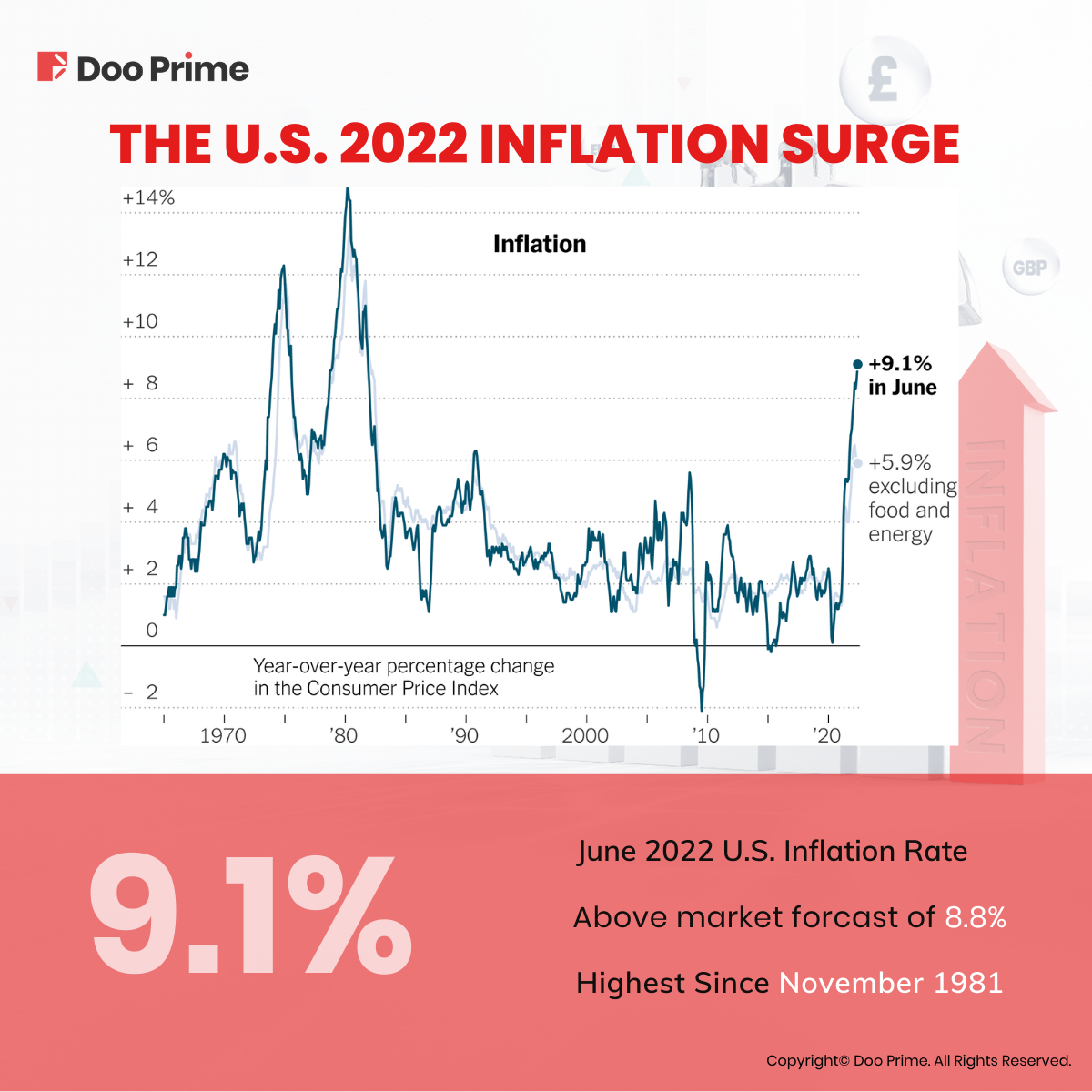

The U.S. Bureau of Labor Statistics reported that the annual inflation rate accelerated to 9.1% in June of 2022 above market forecasts of 8.8%, the highest since November 1981, from 8.6% in May. This marks one of the highest rates in the world.

What Is Inflation

Before we dwell deeper into the U.S. inflation surge, let’s take a quick look at what inflation is, and how it is measured.

Inflation is a general increase in the prices of goods and services over a given period of time. So, when inflation hits, consumers will be getting the same goods and services at a higher price.

Next comes the question of, what determines the rate of inflation?

The government and policy makers measure the inflation rate with the Consumer Price Index (CPI) and Wholesale Price Index (WPI). These are the two most common inflation indicators watched by traders, also known as “headline inflation”.

The other inflation indicators include the Producer Price Index (PPI) and the Retail Prices Index (RPI).

How Is The U.S. Inflation Surge Affecting The Market

The U.S. inflation rate has reared its ugly head, surging at a pace not seen in decades.

In general, inflation impacts consumer prices, wages, and growth. By which, it erodes purchasing power as consumers will not be able to afford as many goods and services. Upon this, it leads to damage in the economy as businesses will face hardship with discouraged consumers.

Interest Rates

Inflation and interest rates are significantly tied. After all, the U.S. Federal Reserve has been following the inflation figure closely and raising interest rates accordingly.

As of Wednesday, 27th July 2022, the Feds enacted its second consecutive 75 basis points interest rate hike, taking the benchmark rate to a range of 2.25%-2.5%.

Plus, the Fed has increased the key interest rate four times so far this year as the price of consumer goods is rising continuously.

This was done in hope to curb inflation without creating a recession, and this also marks the most stringent consecutive action since the Fed began using the overnight funds rate as the principal tool of monetary policy in the early 1990s.

Given this, the interest rate climbs as inflation climbs and slides if one of them was to topple.

However, on the flip side, some are arguing that the Fed’s interest rate hike campaign has not been ideal to tame inflation.

Senator Elizabeth Warren, the Massachusetts Democrat, argued that the Fed’s demand-crushing rate increases are not the ideal policy to fight the current inflation as fuel costs and supply chain turmoil push up prices. The policies will hurt workers, she said, and “it doesn’t have to be this way.”

Meanwhile, others argued that the Fed should continue to be forceful. Lawrence H. Summers, the former Democratic Treasury secretary, argued during an interview on CNN this week, that the Fed needed to take “strong action” to control inflation and that allowing inflation to gallop out of control would be a “bigger mistake” than causing a recession.

Read more about the Fed Rate Hikes On Decade High – What, How, What’s Next.

Biggest Impact on Currencies

Historically, the dollar’s value and inflation have an inverse relationship. The dollar’s strength tends to weaken in times of high inflation.

In the current inflation the U.S. is experiencing, the dollar’s value has been soaring most of the time. The dollar is even seen as the “only safe haven left” in the financial world.

By this, the dollar saw an increase of 11.5% in value against the inflation rate, which has risen from 7% to over 9%.

The dollar is now on track for its biggest gain since 5th May, and investors are heading to buy dollars upon the accelerating U.S. inflation of a fresh 40-year high in May 2022.

According to Bloomberg, the dollar jumped 0.8% on 10th June 2022, heading for its biggest gain in five weeks after the U.S. consumer prices accelerated 8.6% from a year earlier, topping estimates.

The greenback’s strength sent nearly all of its Group-of-10 and emerging-market peers tumbling.

“Markets are shifting expectations toward a higher terminal rate for the Fed. That’s supportive for the US dollar and bad for risk assets,” said Bipan Rai, head of foreign-exchange strategy at Canadian Imperial Bank of Commerce. “The need to take settings into the restrictive territory has increased.”

The British pound led losses among Group-of-10 currencies, weakening by as much as 1.4% to the lowest in three weeks, as traders bet the local monetary authority will lag global peers in the race to increase rates.

The rush for dollars comes as swap contracts referencing Fed policy meeting dates repriced to levels suggesting that the U.S. central bank, which was already expected to raise rates by half a point in June and July, will do so again in September. To add, it might also come with some risk of a three-quarter point increase in months to come.

On the other hand, this contrasts with a more dovish stance held by the Bank of Japan, which has sapped some safe-haven appeal from its currency.

The Japanese yen edged higher against the dollar, but still traded near a 20-year low. The Swiss franc is also failing to lure traders, falling as much as 1% for a sixth straight decline versus the greenback.

“With the U.S. rates much higher and stocks way lower, the dollar is a safe-haven trade,” said Brent Donnelly, president of Spectra FX Solutions. “The only safe haven left is the US dollar.”

Market Commentary: What’s Next

Now that we have all the facts laid out, let’s take a look at what Doo Prime’s in-house analyst, James Gomes, who has been in the finance industry for over 30 years, has to say about this ongoing U.S. inflation surge.

Last week, the Federal Reserve raised benchmark interest rates by 75 basis points.

It was the 4th straight increase and the 2nd increase of 75 basis points.

The market’s reaction after the hike, and comments from Chairman J Powell, was a massive rally. To be fair it was helped out by stronger than expected earnings of some mega tech companies.

The perception is that the Fed will pivot soon, meaning they will soon end their hiking and start to be more dovish going forward. The thinking behind this is that inflation is reaching its peak and will start to fall very soon.

The other concept is that even with the rate hikes and higher interest rate cost, companies can continue to deliver and therefore prevent a recession.

While this may be possible, the Fed is still a long way from bringing inflation down to the 2% level. Being behind the curve for so long, it is hard to see the Fed backing off until there are clear signs that inflation is under control.

Federal Reserve Bank of St. Louis President James Bullard said, “The Federal Reserve may be able to slow inflation without sparking a recession in the U.S. economy”.

If the other board members agree with this, there is little to stop them from making greater increases in interest rates.

Thus, the risk is always going to be that the Fed will overdo its rate hikes and bring forth a recession. So, the battle is still going to be hard landing vs soft landing.

Right now, the market is voting for a soft landing.

The market will carefully analyze the monthly U.S. jobs report to be released on Friday to find clues about what the Fed will do next to deal with inflation, which is at a multi-decade high.

Even though inflation is high in the U.S., the country is not alone in facing this problem. Countries all over the world are experiencing high levels of inflation.

A difference, though, is that the U.S. Central Bank, the Federal Reserve Bank is moving more aggressively to curb inflation than its global counterparts.

Hence, this has led to higher interest rates in the U.S., making it an attractive place for capital. So, even though prices are rising in the U.S., the dollar is increasing in value relative to other currencies.

| About Doo Prime

Doo Prime is an international pre-eminent online broker under Doo Group, which strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Commodities, Stock Indices, and Funds. At present, Doo Prime is delivering the finest trading experience to more than 40,000 professional clients, with a 25.9+ billion monthly trading volume.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 10 different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe : +44 11 3733 5199

Asia : +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China : +86 400 8427 539

E-mail:

Technical Support: [email protected]

Account Manager: [email protected]

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future results. Doo Group makes no representation and warranties to the information displayed and shall not be liable for any direct or indirect loss or damages as a result of any inaccuracies and incompleteness of the information provided. Doo Group shall not be liable for any loss or damages as a result of any direct or indirect trading risks, profit, or loss associated with any individual’s investment.