WORLDWIDE : HEALDINES

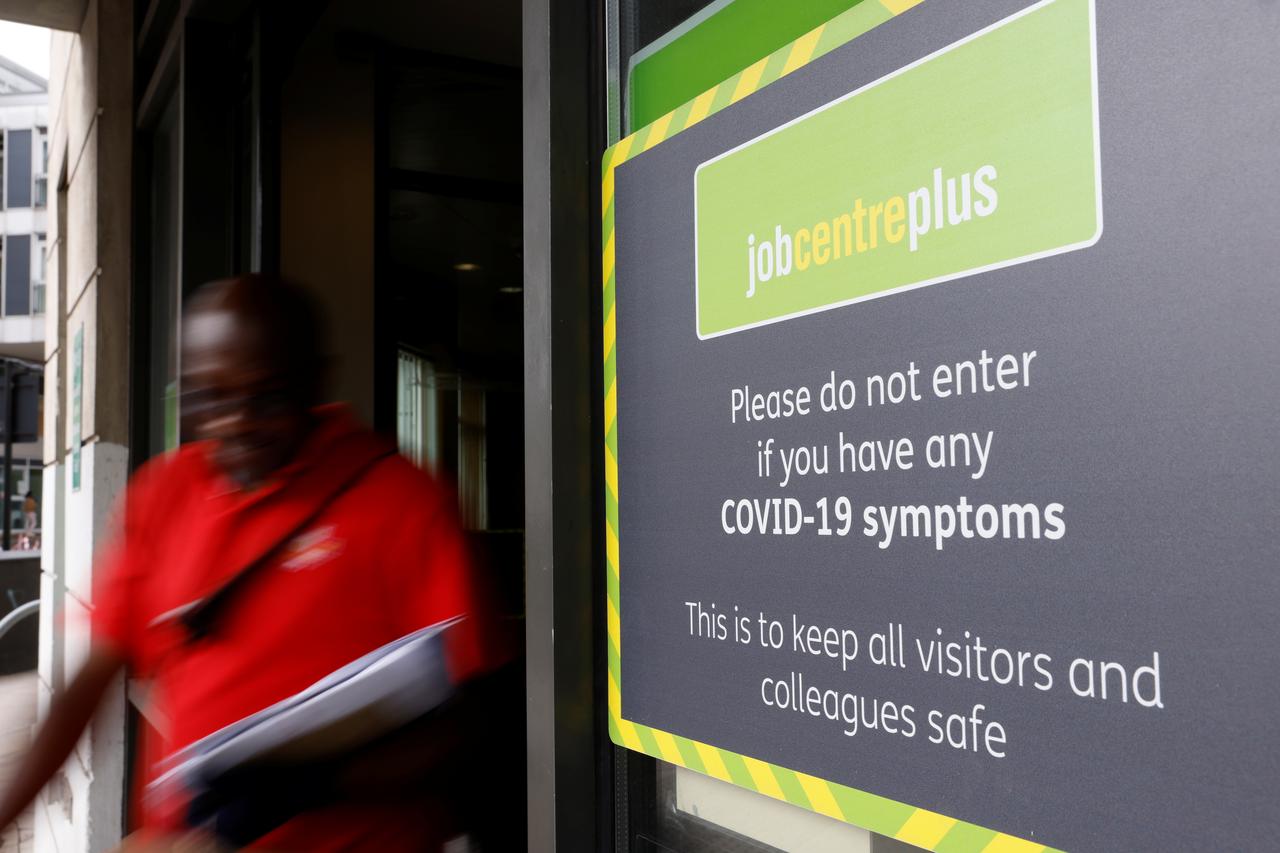

Economic cost of coronavirus seen in UK jobs data says minister

LONDON – Coronavirus was always going to have an economic cost said junior health minister Edward Argar, when asked about UK jobs data which showed the biggest fall in employment in the country since 2009.

“We always knew that sadly this disease would not only have a health cost but would have an economic cost and I think we are seeing the consequences of part of that,” he told Sky News on Tuesday.

Full coverage: REUTERS

OECD sees South Korea growth to outperform all others this year

SEOUL – South Korea will take the smallest hit to growth of any advanced economy this year after it was able to limit the spread of the coronavirus without imposing severe lockdowns, the OECD said on Tuesday.

South Korea’s gross domestic product will fall just 0.8% in 2020, a slight improvement from the 1.2% downturn in GDP forecast in June, the Organization for Economic Co-operation and Development (OECD) said in a report on Asia’s fourth biggest economy.

That is considerably milder than the OECD average of a 7.5% contraction for this year, and far outperforms the 7.3% and 6.0% shrinkage seen for major economies the United States and Japan, respectively.

Full coverage: REUTERS

Short-time work hits German wages in second quarter

BERLIN – Gross monthly earnings for full- and part-time workers in Germany fell 2.2% on average in the second quarter from a year ago, due mainly to the wide use of short-time work during the coronavirus crisis, the Federal Statistics Office said on Tuesday.

The hardest-hit sectors were hotels and hospitality, the auto sector and tour operators, it said.

“The broad use of short-time working due to the coronavirus pandemic had a negative impact on the level and development of gross monthly earnings and working hours,” the Office said in a statement.

It added, however, that the short-time work programme, under which employees temporarily work shorter hours but keep their jobs while the state makes up the shortfall, cushioned the loss of income for employees to a large extent.

Full coverage: REUTERS

WORLDWIDE : FINANCE / ECONOMY / STOCK MARKET

Asian stocks make gains despite Sino-U.S. tensions

HONG KONG/SINGAPORE – Asian stock markets rose on Tuesday on relief that another round of Sino-U.S. sparring appears not to have spilled over into trade, while hopes for U.S. stimulus lent support to oil and commodity currencies.

European markets were expected to open higher with EUROSTOXX 50 STXEc1 futures up 0.86% and FTSE futures FFIc1 up 0.77%.

MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up nearly 1%. Japan’s Nikkei .N225 returned from a holiday with a 1.85% gain led by healthcare and industrial stocks and the Hang Seng .HSI bounced 2.3%.

South Korean stocks .KS11 shrugged off a drop in exports and rose for a seventh straight session, adding 1.4% for a 7.5% gain already in August.

Singapore’s benchmark .STI, however, lagged after the country said it expected its biggest recession in history.

Investors are awaiting a meeting between top U.S. and Chinese trade officials on Saturday to review the first six months of the Phase 1 trade deal.

Full coverage: REUTERS

Oil edges higher on hopes for U.S. stimulus, demand recovery

SINGAPORE – Crude oil gained more ground on Tuesday, with prices underpinned by expectations of U.S. stimulus and a rebound in Asian demand as economies reopen.

Brent crude LCOc1 added 22 cents, or 0.5%, to $45.21 a barrel, as of 0441 GMT. West Texas Intermediate U.S. crude CLc1 rose 32 cents, or 0.8%, to $42.26 a barrel.

“Crude oil gained amid signs of further stimulus measures,” ANZ said in a note.

“U.S. lawmakers continued negotiations on the massive virus relief economic package with Treasury Secretary Steven Mnuchin saying there are areas where compromise is possible and a fair deal could be agreed upon. Sentiment was also boosted by comments from Saudi Aramco that demand is improving.”

Prices found support after U.S. President Donald Trump tweeted that top congressional Democrats wanted to meet with him on coronavirus-related economic relief.

Full coverage: REUTERS

Dollar holds its ground as investors await U.S. stimulus talks

TOKYO – The dollar held overnight gains on Tuesday following seven weeks of an almost relentless fall as investors clung to hopes of a bipartisan stimulus deal in Washington and U.S. bond yields rebounded from multi-month lows.

The dollar index jumped back to 93.568 USD= from Friday’s two-year low of 92.495. Having fallen for seven straight weeks, the currency was due for a short-term corrective bounce, traders said.

The euro changed hands at $1.1745 EUR= up slightly on the day, having eased 0.5% in previous trade. The dollar stood little changed at 106.07 yen JPY=.

“The dollar’s decline appears to have come to a halt for now. Although talks on fiscal spending are locked in a stalemate, we are at least avoiding a complete cutoff of extra jobless benefit,” said Minori Uchida, chief currency analyst at MUFG Bank.

Full coverage: REUTERS