Daily Insights – Dollar rebound while other currencies, gold and U.S. stocks plunge

Fundamental Factors:

The dollar index surged to a near-six-week high on Monday, while U.S. stocks fell sharply and gold hit a more-than-one-month low at $1,882.53. Markets are keeping an eye on Federal Reserve Chairman Colin Powell’s speech at 22:30 tonight, in which the market will look for the Fed’s statement on adjusting its inflation target. If the Fed continues to play down the issue while there is divergence within the Fed itself, the dollar may continue to strengthen and this will weigh on gold prices. Dallas Fed Chairman Kaplan has hinted at the possibility of an early rate hike, while the Fed had said that it will not expand stimulus in its recent policy meeting.

The euro is maintaining at the current level after the European Central Bank’s September policy meeting. The central bank’s president Christine Lagarde’s speech on Monday has been providing support to the euro while putting pressure on the dollar.

House Speaker Nancy Pelosi and Democrats released a stopgap government spending bill yesterday without the support from White House, thus increasing the risk of a federal shutdown at the end of the month. The bill is expected to extend the current levels of government spending from the end of September to mid-December. But that does not include the $30 billion in agricultural aid sought by the White House, and Democrats want to negotiate additional fiscal stimulus, which has been agreed upon in both parties in addition to agricultural aid funding.

Technical Analysis:

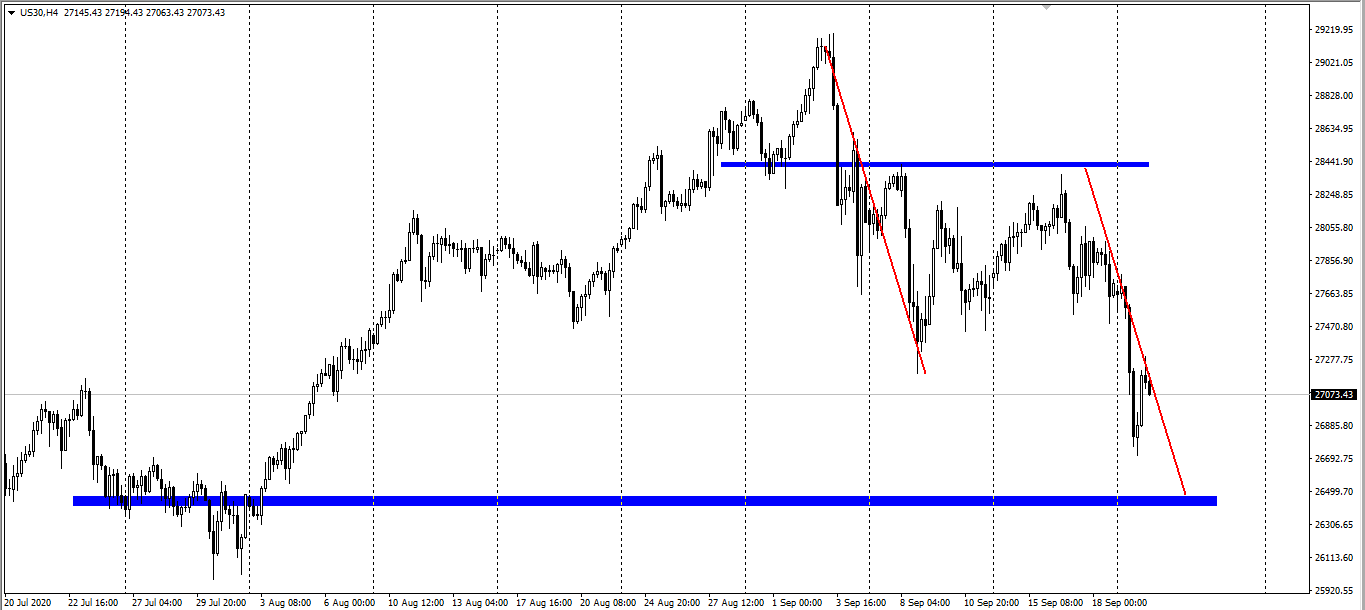

Dow Jones: All three major U.S. stock indices, namely Nasdaq, Dow Jones and S&P 500 closed lower. Dow Jones was down by 509.7 points or 1.84% at 27,147.7; S&P 500 was down by 38.4 points or 1.16% at 3,281.06; and Nasdaq was down by 14.5 points or 0.13% at 10,778.8. Dow Jones is rebounding after a plunge. Keep an eye on the short interest and the target support level of 26,500.

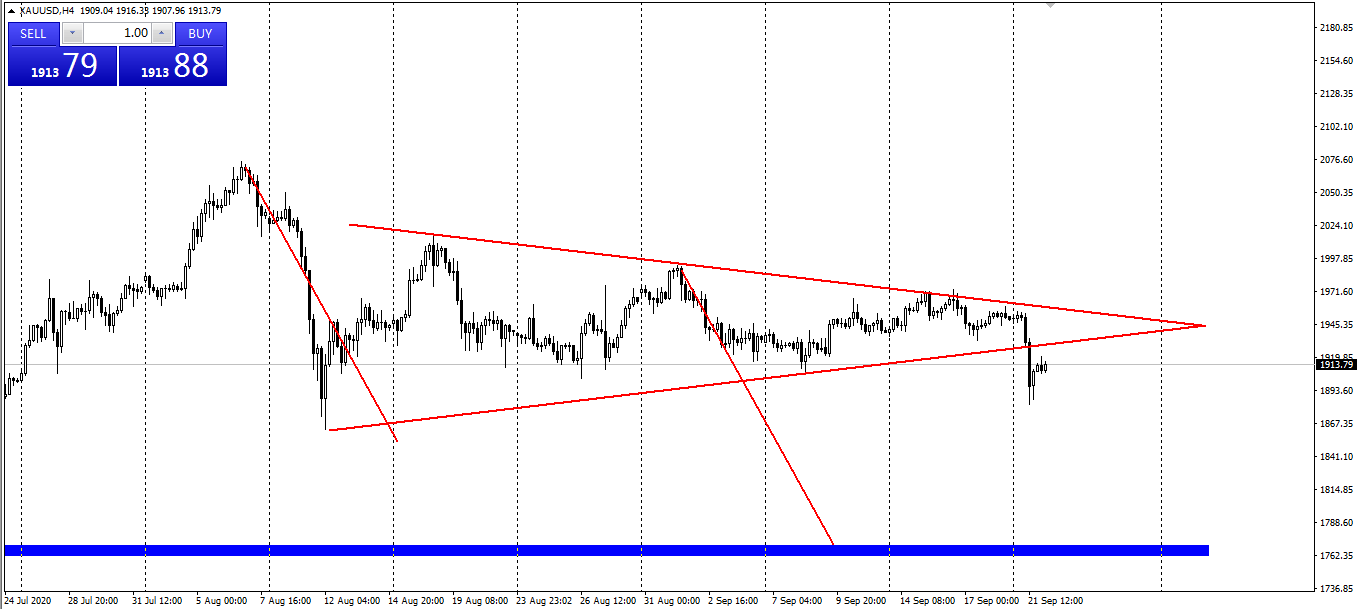

Gold: The worsening of COVID-19 outbreak in Europe has depressed the euro and sent the dollar sharply higher, with the dollar index soaring to a near-six-week high on Monday. U.S. stocks and gold are down, of which the latter has declined by $70 before a slight rebound this morning. From a technical point of view, gold is entering a new downtrend after its support level is broken. Keep an eye on the target support level of $1,760.

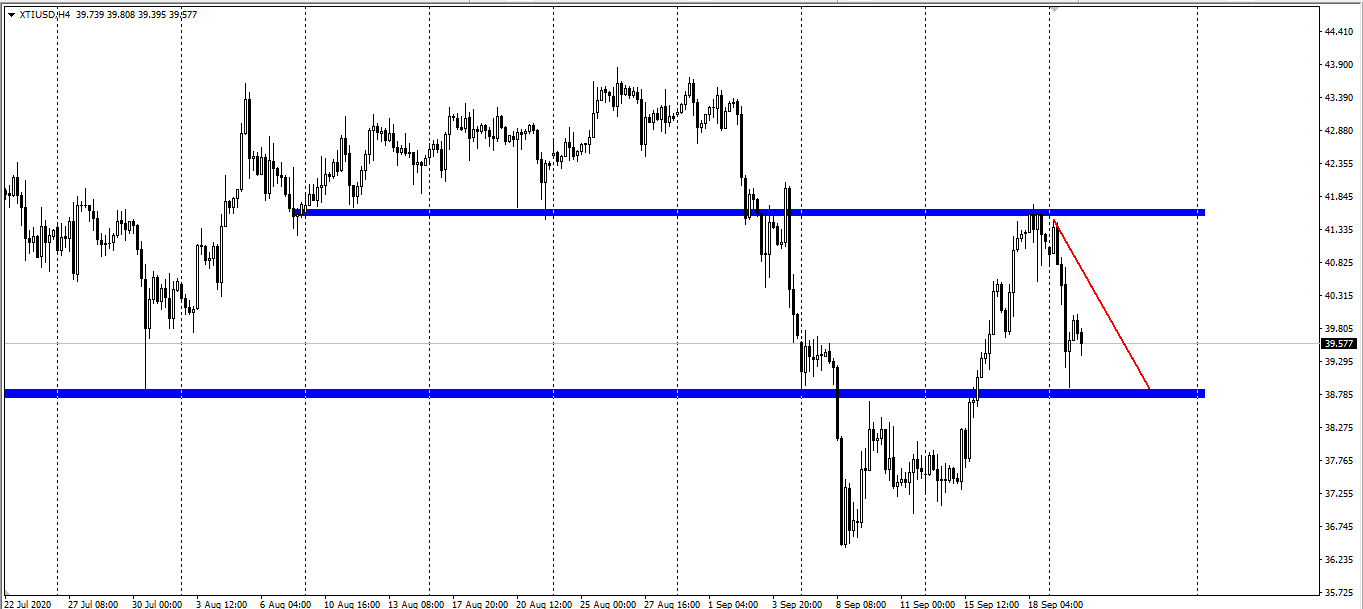

Crude oil: Oil prices suffered their biggest drop in nearly two weeks on Monday as U.S. stocks fell amid concerns about the long-term implementation of anti-epidemic restrictions. Libya said it would add about 220,000 barrels of oil supply to market a day going forward, thus dragging down oil prices. U.S. oil has returned to the level below $40. Crude oil has reached $38.8. Keep an eye on the range of $38.8 to $41.5.

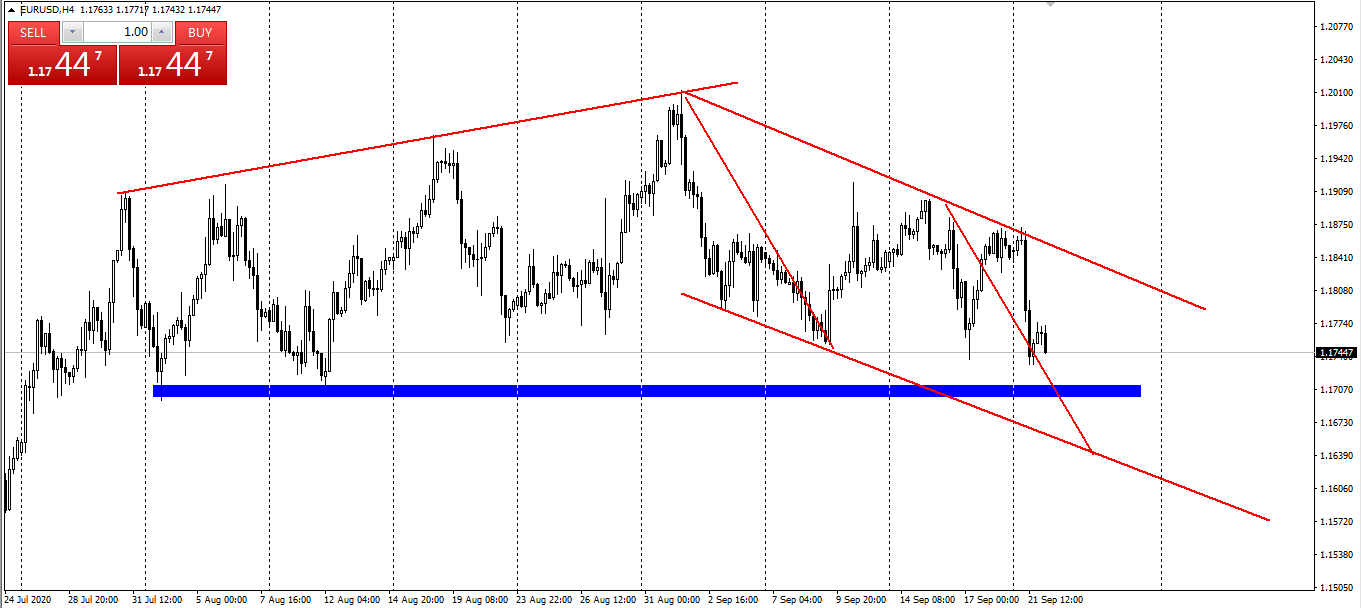

EUR/USD: The second wave of new COVID cases in other European countries has also intensified. This may prompt governments to re-implement lockdown. European Central Bank President Christine Lagarde said the strength of the economic recovery remained highly uncertain, thus dragging down the euro. This has apparently led to a further deterioration in sentiment, with European stock markets falling sharply and the euro falling 100 points against the dollar. The short interest for the euro remains strong. Keep an eye on the support level of 1.170 and 1.16 as the currency pair may enter a downtrend if the 1.170 support is broken.

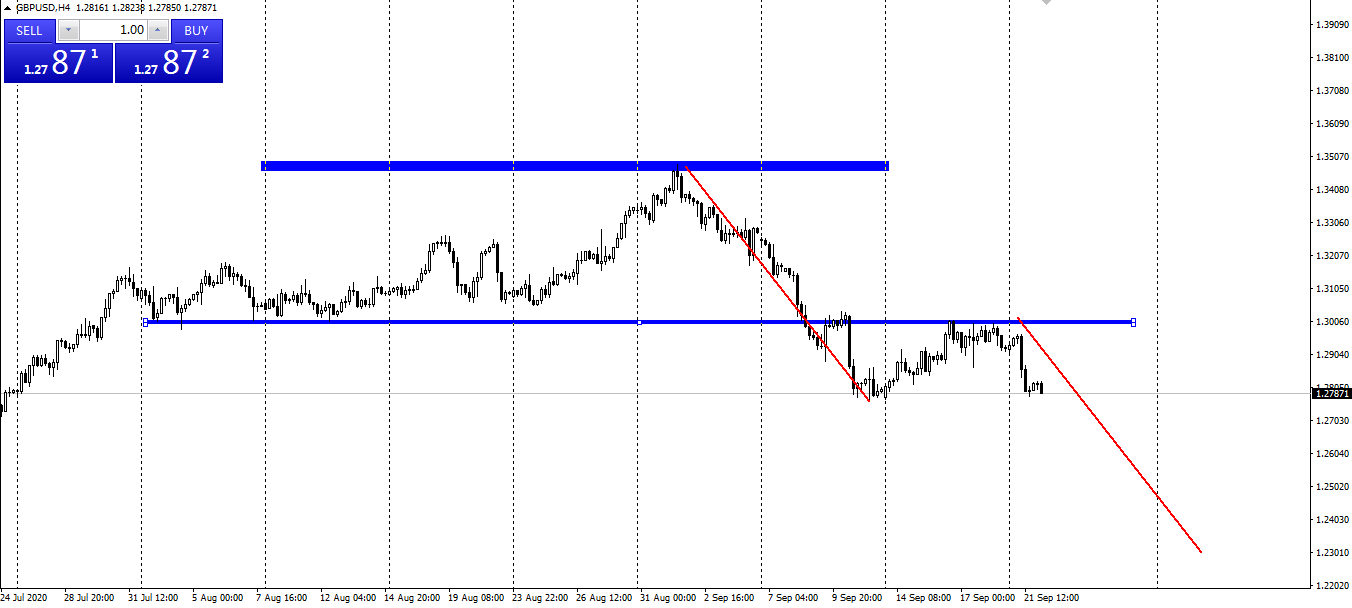

GBP/USD: The pound fell 140 pips against the dollar in European trading session. The drop was widened to 200 pips later as a rise in new COVID cases is prompting the UK to consider a second national lockdown. Focus on the UK-EU trade negotiations. Uncertainty also continues to weigh on the pound. GBP/USD is retreating from the 1.28 level that it hit earlier. Keep an eye on the short positions and the target level near 1.23.

The information and analysis included in this report only represent the research analyst’s views. Forex trading involves risk and you are advised to exercise caution in relation to the report. If you are in any doubt about any of the contents, you should obtain independent professional advice.