1. Forex Market Insight

EUR/USD

As results so far, the U.S. midterm election results have shown no evidence of the “red wave” of Republican victories that some expected.

If the Republican’s end up in control of the Senate, it could support the idea of reducing fiscal support and potentially lowering the Fed’s peak terminal interest rate, which would be bad for the dollar.

Attention is now shifting as the market awaits Thursday’s, 10th November 2022, U.S. Consumer Price Index (CPI) data to see if it will spur the Federal Reserve to continue raising interest rates long into next year to curb inflation, or if they might ease policy tightening.

In recent weeks, the dollar has retreated from multi-decade highs as markets take profits after a months-long rally and in anticipation that the Federal Reserve may be inching closer to dropping the curtain on interest rate hikes.

The euro fell 0.7% on Wednesday, 9th November 2022 but closed above parity.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 0.9999 line today. If the EUR runs below the 0.9999 line, then pay attention to the support strength of the two positions of 0.9999 and 0.9852. If the strength of EUR rises over the 0.9999 line, then pay attention to the suppression strength of the two positions of 1.0116 and 1.0190.

GBP Intraday Trend Analysis

Fundamental Analysis:

The British pound weakened against the U.S. dollar on Wednesday, 9th November 2022 after three consecutive days of gains, with the pound down 1.60% against the dollar at 1.1355 on the day.

The market is looking forward to UK Chancellor of the Exchequer David Hunt’s fiscal statement scheduled for November 17, with signs that the government will impose a squeeze on public spending and possibly raise taxes. The news seems unfavorable for the pound.

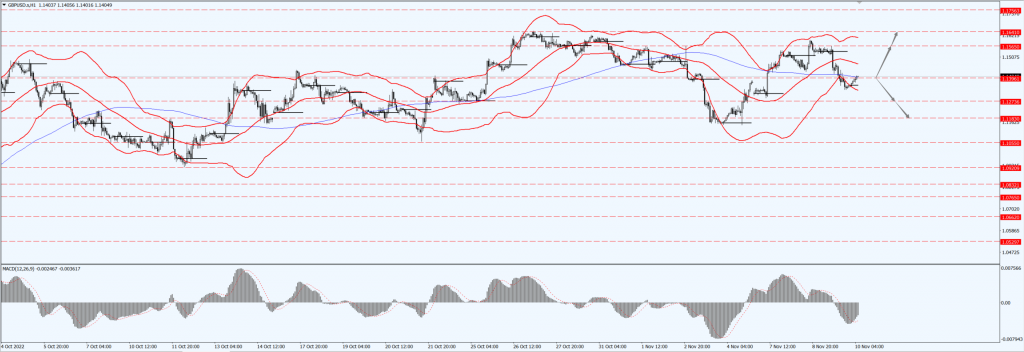

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1396-line today. If GBP runs below the 1.1396-line, it will pay attention to the suppression strength of the two positions of 1.1273 and 1.1183. If GBP runs above the 1.1396-line, then pay attention to the suppression strength of the two positions of 1.1565 and 1.1641.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell Wednesday, 9th November 2022 retreating from more than one-month highs as the dollar rose while investors awaited the release of key U.S. inflation data.

Earlier in the session, gold prices hit the highest since Oct. 6 at $1,722.19. After the Fed’s aggressive rate hike, the October Consumer Price Index (CPI) data will reflect the latest situation of U.S. inflation.

Economists expect core price increases to slow to 0.5% and 6.5% year-over-year, respectively. Higher interest rates are also boosting the dollar, putting pressure on dollar-denominated precious metals.

Facing a Ukrainian offensive near the southern city of Kherson, Russian Defense Minister Sergei Shoigu on Wednesday, 9th November 2022 ordered his troops to withdraw from the west bank of the Dnieper River in a major retreat and what could be a turning point in the war. Investors are also eyeing the hotly contested U.S. midterm elections, but the outcome is unclear.

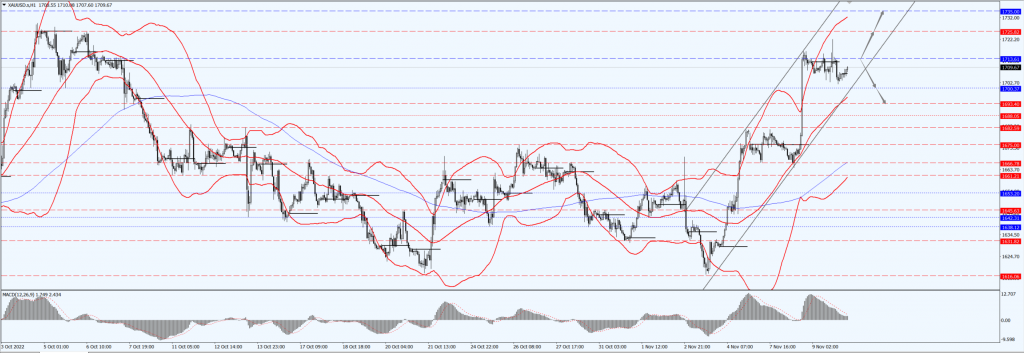

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1713 -line today. If the gold price runs below the 1713 -line, then it will pay attention to the support strength of the 1700 and 1693 positions. If the gold price breaks above the 1713-line, then pay attention to the suppression strength of the two positions of the 1725 and 1735.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices sank more than 3% Wednesday, 9th November 2022 after industry data showed a larger-than-expected increase in U.S. crude inventories and concerns that an epidemic backlash could hit fuel demand.

The EIA said gasoline stocks fell by about 900,000 barrels to 205.7 million barrels, the lowest level since November 2014.

Market expectations were for a drop of 1.1 million barrel. Distillate stocks, which include diesel and heating oil, fell about 500,000 barrels to 106.3 million barrels, compared with expectations for an 800,000-barrel decline.

The stronger dollar has made oil more expensive for buyers holding other currencies, which has also had an impact on crude oil prices.

The dollar has risen and so far, the U.S. midterm elections have dampened expectations of a big Republican win.

Meanwhile, supply issues remain. The EU will ban imports of Russian crude oil from Dec. 5 and Russian oil products on Feb. 5 to sanction Russia’s invasion of Ukraine.

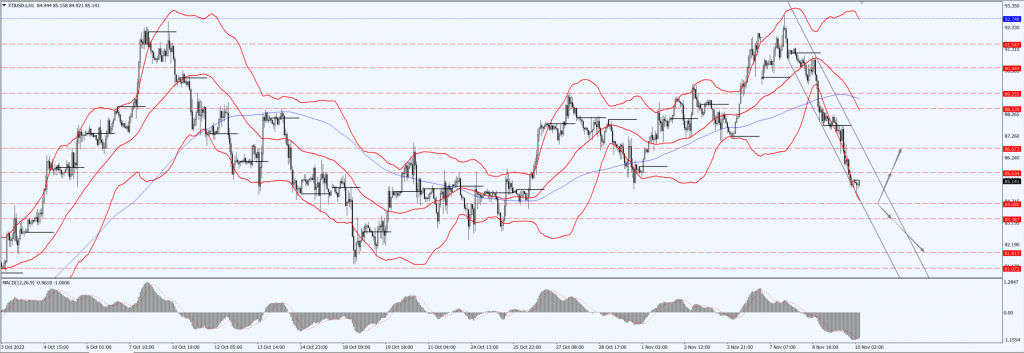

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 84.08 line today. If the oil price runs above the 84.08-line, then focus on the suppression strength of the two positions of 85.53 and 86.67. If the oil price runs below the 84.08-line, then pay attention to the support strength of the two positions of 83.38 and 81.81.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.