Good Morning.. So, that’s Q2 behind us and it was quite a ride. We saw quite a bit of month end activity in FX but the USD move was unclear with gains against EUR and JPY but decent losses against GBP and AUD. EURGBP suffered a squeeze but I am not sure the fundamentals or risks have changed that much. I still think there is a chance that the EU rides out of the crisis easier than the UK and US. A big call but so far it holds for me and is part of why I put out the long recommendation in EUR yesterday. The techs on the likes of EURGBP remain in place on the daily charts and it seems to me the UK is no nearer a deal with the EU. But the USD is hard to fathom here. We get the Fed minutes tonight and I will be looking to see what message they want to send on YCC as I think its coming. That could see stocks rise again. We also get more PMIs from the EU, US and UK today, ADP employment and ISM from the US.

Keep the Faith..

Details 01/07/20

A very confused finish to the quarter:

–

So, quarter end and all the chatter of rebalancing and fixes are now behind us and hopefully, this month may be a little easier. The distortions into quarter end saw some strange moves and GBP was a beneficiary and the EUR took a hit across the board. Whether that continues seems unlikely to me as far as EURGBP goes which took a dive to .9060 yesterday, as Barnier seems to suggest that the UK and EU are still miles apart on trade talks. Late yesterday afternoon, Barnier dismissed Britain’s desires, which he said would let firms keep operating from the City of London, with employees flying in and out of the EU for short business trips. The proposals could even “create a significant risk” of avoiding regulation altogether. “There is no way member states or the European Parliament would accept this” Barnier said on Tuesday in the speech to the Eurofi financial conference. The U.K. “would like to make it easy to continue to run EU businesses from London, with minimal operations and staff on the continent.”

Barnier is also concerned over subsidies which may undercut the EU. Barnier does not want a competitor on its doorstep but that is exactly what the UK needs to be. A gap too wide to bridge? UK companies are starting to think it may be and have collectively written to Johnson over their fears of no deal. This dip in EURGBP may be a gift. I was a little surprised by the recent EUR weakness as European stocks have outperformed those of Wall Street over the past month, driven by what investors see as progress in holding down the Covid-19 outbreak and a strong response from policymakers. Maybe quarter end had something to do with that. According to the FT; the catch-up in Europe comes as several of the biggest investment banks and fund managers have advised clients to take profits from the dizzying rally on Wall Street and look across the Atlantic. BlackRock this week upgraded European equities to overweight, arguing that the region was well placed to benefit as the global economy restarted, “against a backdrop of solid public health measures and a galvanising policy response”. I think I agree with that.

Barnier also warned the banking industry to prepare for Jan. 1, saying there will be “big changes” when U.K. financial firms lose their passports to offer their services across the EU. Fighting talk from Barnier and he made himself very clear.

The quarter end distortions (and possibly comments from Haldane) put a dent in EURGBP on the daily chart but the trend is intact and I think a good opportunity to add. These talks are not going anywhere at present but the Pound did seem to get some support after a rousing speech from Johnson but on closer scrutiny, the additional spending is not that big. Maybe GBP was also boosted by Haldane, the BoE’s chief economist who somehow suggests that his research leads him to believe the UK is headed for a V-shaped recovery. Quite what he is looking at is a mystery and I have to say that there is not a model built yet than can forecast where the UK or any other economy is headed in my view.

Maybe he is guessing like the rest of us but that is NOT his job. He seems unusually bullish these days having been bearish when things were better. If spending levels were maintained from current levels on the path the bank forecast in May, he said; the economy would be 3 per cent larger than expected over the next few years, implying inflation would be one percentage point higher than forecast. Inflation; are you kidding? If we get any growth it would be amazing and we still don’t have a trade deal with the EU or anyone else for that matter. What is he smoking? Applying rules of thumb used by economists, Mr Haldane said that these considerations suggested the official interest rate should be about one percentage point higher than it was currently to maintain stable inflation around the BoE’s 2 per cent target. Ahhh, so that’s it; he is using his thumb; great. Either way GBP raced higher yesterday against everything. I am sorry but sitting there looking at a spreadsheet for forecasting the current state of economies is not going to work. Of course recent sentiment data surveys are stronger as we are all naturally slightly more confident having been locked in recently.

4hour Cable chart above from last night. In addition to all this GBP strength, the UK gilt market saw UK yields fall yet again. In fact, the UK’s 30-year government bond yield has dropped below the equivalent borrowing cost for Japan for the first time, despite a huge expansion in gilt issuance to tackle the coronavirus crisis. Clearly any buyers believe they will be able to offload this stuff to the BoE who is now actively monetising UK debt from Johnson’s spending habits. The UK is fully embracing MMT.

Meanwhile, US data was mixed to say the least with a big miss for Chicago PMI but a beat on the consumer confidence index. This was the biggest miss in expectations since 2015 (below).

US PMI has been a disappointment compared to others and Consumer confidence was collated at the start of June and probably missed the recent spikes and lockdowns. Maybe that is why the USD moves are so mixed. The USD was up against the EUR yesterday, down against the AUD and GBP and up against the JPY. Stocks climbed through most of the session and saw the strongest quarter since 1998 with the S&P closing above 3100 but just about everything seems in a something of a range right now including the S&P. We have had a lot of noise but markets have generally been going sideways for a week or so.

So where next for the USD? That is a good question and to be honest I can make a good argument for both camps but not all economies will emerge from this crisis at the same time and that could be the key; be selective now and try and figure out who is leading this escape. (I think the EU may fare better than many and I maintain the bullish recommendation in the EUR from yesterday). But can we rely on current data as so much of it is skewed by the recent lockdowns and re-openings that it is almost useless. Maybe we should look at who is throwing the most at this or who has the most flexible economy. You can see why things are unclear at present, as it is difficult to find something to base a decision on unless of course we can all use Haldane’s rule of thumb! There was a feeling, just a few days ago, that the EU may actually lead the US and UK out of all this but again it is difficult understanding the data right now. We saw a strong rally in the EUR only to see it all reverse this week.

Maybe it is worth comparing what has happened in China. Like Europe, China is an export-dependent, highly interconnected economy, but which is also months ahead in terms of both easing restrictions and recording falling Covid caseloads. But the rebound in the economy is still sluggish to be honest and they have thrown a lot at this economy recently. The BIS had a report out on this. In summary, the return to work in China has been slow. Three months after containment measures were eased, mass transit was below its pre-crisis level, production fared better, but inventory in some sectors remains elevated. Personal consumption was the laggard, perhaps reflecting the fall in income resulting from layoffs and pay cuts. I would think that some reluctance to fully engage in socialising also an issue. China seems the epitome of a U-shaped recovery and many others will be seeing the same.

But China has supported its consumers and this is something the US needs to do. If the US do not pass a bill to bridge the gap between furloughed or unemployed workers when the programme finishes this month, then the US economy is going nowhere. It is the consumer that we need to watch as unemployment looks set to remain a lot higher than some imagine. Yes, Thursday’s NFP data may be better again but there is every likelihood that 10% are still unemployed at year end and they will need help. Meanwhile, companies continue to fail and job losses will continue; no matter what the Fed does and that nasty feed-back loop is in full swing. A record number of U.S. retail companies filed for bankruptcy in the first half of 2020 than in any other comparable period. NPC International, the owner of over 1,200 Pizza Hut restaurants and 385 Wendy’s stores, is expected to file for bankruptcy.

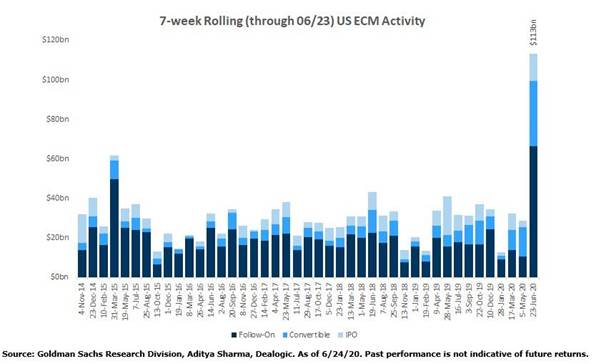

Canary in the coalmine? One of the biggest US junk-bond ETFs, which trades as JNK, just had a record one-day withdrawal of $1.05 billion. While this could just be a one-off tactical move on the part of a small group of investors, other junk-bond ETFs, including HYG, also saw big outflows over the last couple of days. Not only that but it is reported that companies sold a mind-blowing $113bln in stock in Q2. This is insiders selling equities. What does that say about the sustainability of this US equity rally? (Nobody knows the prospects for their companies better than the people who run them and they are selling).

Corporations have also been rushing to raise cash with equity issuance and we have again seen record numbers with 400n deals last quarter ending in June. I think all that needs bearing in mind.

As well as the global consumer being so crucial to the recovery, we must also be aware of the damage that high unemployment has on those who are lucky enough to have jobs; and in the US, it is very unclear what that number is, or will be in 6 months’ time. But the recovery also needs to see strong global trade and there we have a problem, not only with Trump walking back from globalisation, which will be so damaging but also geopolitical and trade spats. I am not sure that this is priced in and it will certainly hit global trade and will likely escalate this year, as China has disputes or strained ties with 12 of its top 20 export destinations (thanks for the stats Neal). While countries individually need China more than it needs them, collectively this argument is harder to make. The damage that could come from an expanding trade war over and above that of the US and China is frightening and certainly not priced anywhere that I can see.

Surely equity investors need to be aware of the risks here. To my mind, there is a very real danger that the second phase of a trade war between the US and China is about to start and China will be fighting on many fronts with the EU, Australia and many others that they see as standing in front of their technological advancement. This from the China Global Times: Based on what I know, China will announce reciprocal restrictions on US media branches in China. It’s regrettable that deteriorating China-US ties have harmed work of media outlets of both sides. I strongly urge that the US not to escalate suppression of Chinese media further. In a move that will essentially cut Huawei off from a critical US market and infuriate the Chinese: it will hit the smaller, more rural-focused telecoms providers who rely on cheap Huawei components to maintain its wireless infrastructure.

According to Bloomberg, the FCC has designated Huawei and ZTE, two Chinese telecoms giants, as national security threats. The Chinese have infuriated Trump by passing the security Law in HK. We are yet to see the counter measures from Trump but we have already seen the US paring back the special status privileges for HK. Eventually we could see sanctions and businesses are going to have to decide if they want to stay. The trade war is about to heat up and that is bad for global growth. Keep an eye on this as a few shocking headlines may be coming and markets are already nervous; they do not need a trade war issue on top of the virus issue; but I think it is building.

Investing is no easy game these days and a lot depends on your capital and time horizons but fundamentally, there actually are two risks in investing: One is to lose money, and the other is to miss an opportunity. You can eliminate either one, but you can’t eliminate both at the same time. So the question is how you’re going to position yourself versus these two risks: straight down the middle, more aggressive or more defensive. Many large asset managers have to be invested all the time as cash is not really an alternative with yields here but maybe they are diversifying somewhat and that may be what is behind the gold move. Many will rotate to more defensive strategies in times of economic stress but remain invested and yield matters, especially now. In these strange times, even a zero yield is better than negative. Gold is at highs not seen since 2011 and one has to ask why?

A loss of faith in Fiat or the USD as the Fed debases the currency? But maybe it is just the danger of missing an opportunity for some; FOMO if you like. I would think a lot of the move is speculative but if asset managers allocate just a tiny amount to their portfolio diversification, then gold could take off. But gold is not a deep pool of liquidity like FX or some bond markets and at times it has a very small exit door. Investing should not be about fear and greed; that is for traders and hedge funds, investing is supposed to be a long-term return on capital but gold does hold some attractive benefits for an investor portfolio in a small percentage. Zero and negative rates have seen to that.

Gold futures top $1,800/oz, highest level in more than eight years

Chart above is gold futures on Comex not spot gold (It’s a better headline breaking $1800) but cash is up at $1785.

Talking of the Fed and debasing the USD, we have the minutes of the last meeting tonight and I will be looking to see how the discussion on YCC is going as I think it may be on its way, listening to Fed speakers recently. Just over half of the economists surveyed by Bloomberg said they anticipate the Fed will eventually set target yields for certain maturities of Treasury securities., with most saying an announcement could come in September. Should curve control go global, it could spark a “buy everything” rally that ripples across credit, equities, gold and emerging markets, sending the S&P back to the top of the range at 3250. But I still have reservations about the sustainability of the rally and the equity selling from insiders is a concern. Maybe July is not going to be much easier than June, as after all, we are still going to have negative headlines on the virus, there is no vaccine in sight, a potential increase in trade war tensions, active central banks, retail accounts ploughing into stocks they know nothing about, rising geopolitical tensions and border skirmishes and data which is hard to understand. Oh well.

—————————————————————————————————————-

Strategy:

Macro:.

Long EURGBP @.8978 added @ .8940. Raising stop to .8940

Long EURCAD @ 1.5340.. Stop at 1.5220

Long EUR @ 1.1210.. Stop at 1.1150

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.

Risk Warning

This information is powered by Strategic Alpha. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice.