Good Morning.. A mixed session again in Asia but we had quite a busy start to FX trading as Europe walked in. We had the BoE meeting announcement at the ridiculous 7am in which they sound less dovish than some expected. GBP rallied and the EUR hit a load of stops above 1.1900 but these levels were rejected quiet aggressively as the DXY held firm at 92.50. I am not sure much has changed in the fundamentals for a lower USD but we do have a busy session or two in front of us so some book squaring seems sensible. Equities however, suffer from no such lack of confidence and again Wall St closed higher. I guess the Fed has their back. Overall, despite this profit taking bout, I feel there is more downside for the dollar but we may have to wait now. US weekly Claims the main event today but also waiting to hear what Bailey has to say at 10:30 am.

Keep the Faith..

Details 06/08/20

Equities show little fear into a volatile end of weak. UK economy: Fed manipulation.

–

Equity markets, especially those in the US, are showing little fear still even as we run into a busy end to the week. If we look at weekly charts in the S&P we saw that heading onto the weekend last week, we still had no bout of nervous profit taking and finished again with a strong weekly close and that has funnelled into this week.

This allowed the USD to resume its downtrend but in FX markets a few levels have held. We failed to make a new high in EUR above 1.1908 (1.0916 now) and in some of the crosses we saw chart levels hold; like EURJPY failing to break 125.50 and EURGBP failing to close above the mid-point ma in the Bollinger bands on the daily. With some tier1 data due out today in the form of US weekly jobless claims and NFPs tomorrow, I am not surprised we are seeing some profit taking but we are yet to see much of that in stocks. Asia was mixed with Nikkei down 0.43%, Shanghai was down 0.4%, HK down1.5% and Kospi and Oz higher. But S&P futures are unchanged; no fear at all about what is coming up (so far). That maybe because that any shocking data will probably harden the reserve of the Fed to keep pumping. Again, with all the issuance piling up, it seems to me that they will be back buying USTs again soon. That will also see further USD weakness in my view and so this small rally in the USD and dip in these crosses may not last long. I still like EURGBP higher (BoE early as I type) and see EUR and indeed EURJPY breaking higher. Luckily the stop in EURAUD held as we dipped to just above 1.6400 but we need stocks lower for this to really break its 1.6700 range high. But the DXY support at 92.50 seems to be a big barrier for now.

In the UK and according to the Recruitment & Employment Confederation, UK recruiters are reporting the steepest rise in the number of people seeking work since the depths of the financial crisis, as companies dismiss staff who had previously been furloughed. The increase in the supply of temporary staff in July was the biggest in 23 years of records. This is concerning and is something I have suggested may happen as furloughed workers return to work, only to find that the company they work for is cutting costs and shedding staff. The UK has done a lot to help furloughed staff but the government cannot stop firms firing staff no longer needed. The report showed the supply of permanent staff rising at the sharpest pace since December 2008. I am sure this report will not be lost on the BoE who meet ridiculously early today. This new wave of unemployment may tip the BoE into guiding us to more policy actions and strengthen the support for negative rates; not that I think that would help at all to be honest.

While we may well start to rebound in EURGBP if we close above .9050, the chart is still not convincing with the mid ma moving flat and the bands narrowing on the daily. The MACD is still suggesting pressure but I am hoping that fundaments shift this stance. Right now the fundamentals do not have a massive support from the tech outlook; hence the tight stop at .8950.

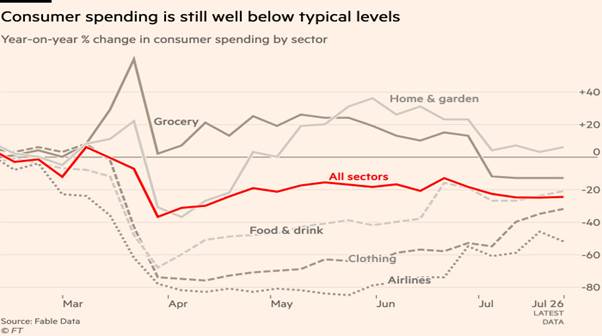

Card use in the UK suggests that consumer spending, which comprises almost two-thirds of the UK’s gross domestic product, began to fall sharply in March as the Covid-19 lockdown became inevitable. Even though online spending has increased steadily, total expenditure remains depressed.

Chart showing that consumer spending is still well below typical levels

Further job losses will hit the consumer psyche and job insecurity is already prevalent. The UK economy is looking very fragile and we still have the EU/UK Brexit trade deal looming over us. The issue here is similar to many others as it raises the question regarding longer term high unemployment; how much more spending to support those out of work, will the government allow? The danger is a similar one to the US situation, as the idea of a speedy return to low levels of unemployment disappears and funding those out of work has already cost a fortune. Can the UK afford to do more and support the unfortunate who have lost their jobs through no fault of their own into next year? High Streets are deserted and so are the cities in many cases and the lack of footfall is killing non-online retail and the hospitality industry and many may not get through.

Chart showing that retail footfall picked up when shops reopened on June 15, but remains well down on normal levels

(BoE left all rates unchanged and the vote was 9-0). But the statement not as dovish as I expected with them citing a stronger consumer (did they not get that data above) and housing. Why do they think it is sensible to have the announcement before Sstg and Gilts open? Mad.

In the US, the Treasury has announced plans to sell a record $112bn of debt maturing in 3, 10 and 30 years. The numbers are getting to a level where I feel the Fed may have to step up and become and active buyer of USTs again as supply is about to engulf demand. It also announced large increases to the auction sizes of its long-term debt over the next three months to fund the record-setting relief packages passed by US legislators since March and the new stimulus bill currently being hashed out by Congress.

Line chart of 10-year US Treasury yields, % showing US Treasury ramps up long-term issuance

The Fed will be under pressure to move support up the curve to the 10yr+ space again. We still don’t know if this package will be $1trln or $3trln but I would think even these political idiots realise that some form of deal has to materialise, or US markets and the economy may tumble. If a deal is not struck by tomorrow, markets may start to get nervous; right now everyone says a deal will be forthcoming; where is it? Auction sizes for 10-year bonds will increase by $6bn from the previous quarter to $38bn, the Treasury said on Wednesday, while those for the 20-year and 30-year bond will rise by $5bn and $4bn, respectively. Is there the demand for these huge amounts? It’s a lot to swallow for potential buyers as taken together with the planned uptick in auction sizes for two-, three- and five-year notes as well as other instruments, the Treasury said that amounted to an additional $132bn of issuance over the next three months compared to the previous period. This sent US yields higher yesterday.

Despite serious questions about how quickly the economy will ultimately rebound from the global shutdown, investors are pricing the stock and bond markets for perfection. Many individual stocks sit at new all-time highs, and credit spreads are tighter today than before the COVID-19 outbreak. Of course we know the Fed sits firmly behind this anomaly but can it go on? Bankruptcies are about to hit hard and I am not sure the loan provisions set aside from the banks will be enough. No wonder economists are confused as when Treasury yields fall, for example, it is not unreasonable to think it suggests undetected economic weakness. But if credit spreads tighten, it is plausible to believe that the cause is strengthening corporate revenue and earnings. This is what happens when central banks mess with things to the extent the Fed has. It stops market signalling and we are all left guessing. In just 13 weeks, the Fed provided over $3 trillion of liquidity to financial markets. The Fed’s efforts in 2008 pale in comparison.

But the assets held by the Fed look likely to increase again and as stated above, they may have to move to longer duration than Bills. But we also know that with yields at zero (ish) QE does not impact the broad economy and so it seems the mandate of the Fed is now to shore up markets and that is exactly what they are doing.

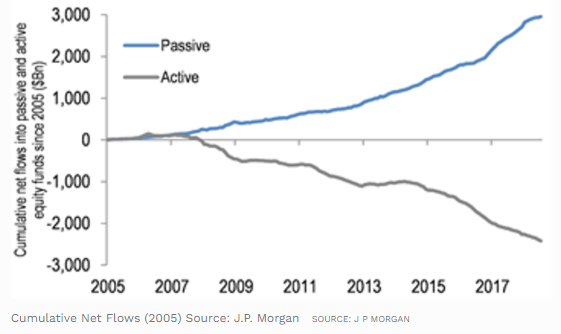

Why is the Fed so protective (over-protective) of Wall St? I think there are a few reasons and one is that they realise that a crash in financial markets and especially the credit space, will usher in a much deeper recession and after all it is their policies that have seen savers forced into higher risk assets. But it seems now that markets have a worrying hold over the Fed and that is driving misallocations and leverage. The retail sector has never been as dominant in stocks as we see today and all are leveraged. ETFs have grown exponentially and is a favourite form of passive investing for many; the wave of passive investing has become a tsunami. Money is leaving active managers who regularly hold 5% cash on average and is going into passive ETFs which hold less than 0.10% cash.

Active managers have historically been the police on the beat patrolling overvalued stocks and selling them when those conditions are clear. They are losing funds to ETFs where there seems no consideration of “value”. ETFs are becoming a risk in themselves and a nasty downturn may have huge implications for ETFs.

Investors see no danger in all this as the Fed tells them its all OK. This is moral hazard if ever I saw it and how do the Fed ever decouple from this? The danger here, on a macro basis, is that the Fed will be too slow to take back these measures if and when we do get a recovery as equity markets with struggle without the drugs. This is where we see the big problems arising and the irony here is that it maybe the recovery that brings the roof in on inflation and the debt issue. I think this is partly why gold is higher as bonds are not the signalling vehicle they used to be. Yes, we have deflation now, but Fed policies are in real danger of overstimulating if and when the Fiscal boost kicks in. Governments too will likely be slow to take back benefit spending as these are populist governments and want to stay in power. More spending will be promised and Trump is talking more before the election on top of what is being negotiated now; anything to get elected at any cost.

—————————————————————————————————————-

Strategy:

Macro:.

Short USDJPY @ 105.25.. Stop at 106.75

Long EURAUD @ 1.6250 Raising stop to 1.6400.

Long EUR @ 1.1762 looking to add at 1.1705. Stop at 1.1530.

Long EURGBP @ .9030.. Stop at .8950ish.

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.

Risk Warning

This information is powered by Strategic Alpha. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice.