Good Morning.. Asian stocks seem to have received the email on risk that the US seems to have missed. The 5 mega-caps again driving Wall St higher last night but Asian stocks took a turn lower. Gold traded as high as $2075 and the USD rallied marginally. Gold is an interesting story and central banks started this move by replenishing gold reserves (see below). But everywhere I look I see risks, whether it is the ongoing and dangerous phase2 of the trade war, Trump tariffs, US prodding China over Taiwan and their tech industry, or the crisis in Turkey; none of this seems to impact US investors anymore and that suggests a complacent bubble similar to the ridiculous Dot. Com bubble. Risks do matter and can easily become events that can change sentiment very quickly. US data today could be a spark and yet there was no fear into the close last night in the US. The Fed has created this euphoria and it seems likely to me that the Fed will be forced to increase the balance sheet as the Treasury dumps billions of issuance into USTs. Maybe that is why stocks don’t care about risks. The world may also be looking for USD alternatives and I think there is a danger that this dollar fall continues and may accelerate. Trump is losing friends fast. For the first time ever, the EUR may be an alternative for global trade and that has huge implications. Its early days for that call but there is evidence of more deals circumventing the USD. A lot of noise expected around the NFPs of course as no one has a clue what this data will mean and it’s also a Friday, so “Be careful out there”..

Keep the Faith..

Details 07/08/20

Risk off signals flash red but the 5 mega-caps keep US stocks up: Gold reserves and why.

–

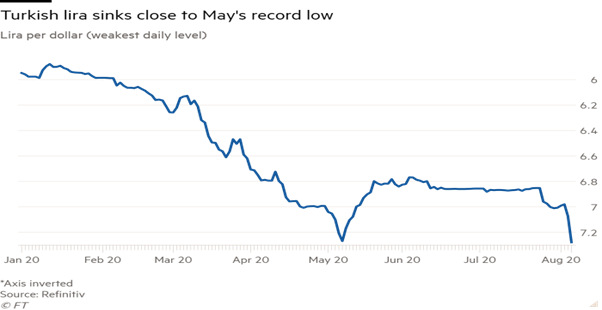

Within a backdrop of risk off headlines and an ongoing crisis in the TRY, US stocks, led yet again by just 5 stocks, rallied into the close to finish up another 1% on Wall St. The fact that stocks, in the US at least, are now ignoring some serious issues, suggests a bubble is forming and may go bust at any moment. The complacency of longs is becoming extreme. A Turkey has replaced the “elephant in the room” and is a crisis that may have implications elsewhere as the lira crumbles and reserves are depleted.

Line chart of Lira per dollar (weakest daily level) showing Turkish lira tumbles to record low

In an effort to shore things up and to help stop a run on the banks, Turkey are trying to relax some restrictions on foreign banks but right now, trading in Turkey remains high risk to say the least. Foreign banks wanting to take advantage of the exemption need to invest in Turkish assets and park excess lira liquidity with local lenders, according to the decree. The ruling comes as the lira plunged to a record low on Thursday after interventions by state banks failed to reassure investors but why would you? I think at some point there will come a time when the CEO of some banks may face angry shareholders regarding huge losses and EU banks are exposed to this already.

Then we have Trump on his tariff wagon again threatening Canada over aluminium and reasserting a 10% tariff. In addition to this, talks between Republicans and Democrats over the bail-out have failed to conclude and time is running out. I think if things are not sorted today then markets may get concerned as it is believed today is the last day to get it done. On the virus front, data signalled that infections are picking up again in Europe (France notably), while modelling by the University of Washington saw the U.S. death toll almost doubling by December if the pandemic’s pace doesn’t change. Asian equity markets seem to get the risks out there as all exchanges were lower overnight but US markets seem to think they are bullet proof. US/China relations are souring by the day and Trump is giving US companies 45 days to stop dealing with ByteDance, the Chinese owner of TikTok and WeChat, the messaging platform owned by Tencent, as he stepped up a campaign to clamp down on apps that he described as a threat to economic and national security. Tencent stocks fell 10% on this and dragged Asian markets lower with Shanghai down 1.5% (HK was down 2.25% when I last looked). The resilience of US markets is quite incredible as bond markets everywhere are flashing danger signals and most rallied again last night.

The “phase2” of the trade war, which is now escalating, will be damaging and long lasting and in the past has spooked investors but not now for some reason but it should as this is going to hit global trade, global growth and global earnings and may delay any recoveries from the Covid crisis. This clampdown on the apps is just one action in an increasingly broad US campaign against China over everything from its trade practices and alleged human rights abuses in Xinjiang to its recent imposition of a security law in Hong Kong to crack down on pro-democracy protesters. Washington is upping the ante on China with what will be interpreted as a new direct frontal assault on the decades old ‘One China’ official policy which has preserved the status quo in Taiwan. Over the past days it’s been clear something big was coming, given the Chinese Foreign Ministry on Wednesday slammed a planned-for trip later this week of “the highest-level visit by a U.S. cabinet official” to Taipei in forty years, namely led by Health and Human Services Secretary Alex Azar. For the first time ever, the US is moving to sell high-tech military drones to Taiwan, which is sure to unleash fury from Beijing. The US is also concerned by Chinese naval manoeuvres in the South China sea close to Taiwan. Keep an eye on headlines on this.

US unemployment remains doggedly high and the danger here is that it lasts a lot longer than originally expected as cost cutting will see many more returning from being furloughed, soon back out of work. NFP data due today failed to spark any signs of stress from longs last night as all US indices closed higher. The number today is rather a wild guess for most of us and the ranges of expectations are very wide. Claims data did beat expectations marginally but the reality is they are still a disaster in the making. Central banks are so active in many economies that bonds are losing their signalling power, especially for future threats on inflation. It is interesting as western central banks all seem prepared to follow the dangerous path trodden by the BoJ, that China is on a different path and unequivocally ruled out any chance that the Chinese central bank might resort to the tools deployed by some of its western counterparts: negative interest rates, monetisation of the budget deficit, or a big expansion of the central bank’s balance sheet.

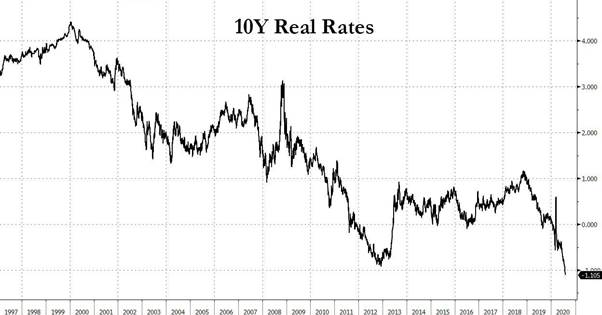

Chinese policymakers eschew what Beijing calls “flood irrigation” stimulus and China is emerging from the crisis without all this talk of negative rates and I do wonder why they seem to attractive to so many central bankers. Meanwhile Fed policy is about to debase the USD even further as I am pretty sure they will be required to buy USTs further down the curve soon as the Treasury swamps the bond market with debt issuance. US real yields are already extremely low and sit at -1%.

Maybe that is why stocks in the US never fall, as the Fed has clearly stated they will act whenever needed. This is such a dangerous scenario from the Fed and I am surprised at Powell, he has gone a lot further with this than I expected after his views when he first started in the job. Also, Central banks around the world have been replenishing gold reserves and obviously questions are being asked as to why. Meanwhile, inflation expectations have room to rise, with U.S. 10-year breakevens about 20bps shy of the 2020 peak. They could get a boost should questions ring louder over the Fed relaxing its inflation mandate, which has been in place since January 2012.

Powell alluded to tweaking the price-stability mandate in the forthcoming policy review, while member Brainard coined the “opportunistic reflation” strategy to explicitly welcome an inflation overshoot. Such a stance would be a material departure for the Fed, given policy lags of at least one year and overshooting inflation is a dangerous game with the debt mountain the US has. They may get inflation but will they be able to contain it without crashing the markets with rate rises? Should markets believe the Fed will do what it takes for inflation to go beyond 2% in pursuit of full employment, then in theory 10-year U.S. real yields could tumble 40bps-50bps more from roughly -1.07% currently. That’s assuming nominal yields remain range-bound which looks very likely and would be well below the estimated real neutral rate. That opens the door to risks such as stagflation — a more plausible scenario now given the unique combination of unprecedented monetary and fiscal stimulus; a deglobalisation trend sparked by Trump that’s creating supply constraints and elevated unemployment that’s quashing any hope for a quick economic recovery. It seems to me that central bank policies from the Fed to the BoE are failing to target the real economy now and are just there to hold asset markets up and actually suppress growth and productivity.

This build up in gold reserves has been going on for a year or so and Russia seemed to start it at the same time they reduced UST holdings to zero. The Russian Central Bank became one of the world’s largest buyers of bullion last year (at least among the world’s central banks). They are not alone.

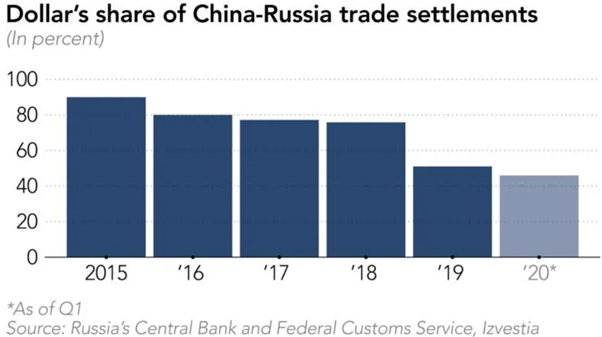

It is reported that Russia and China have been quietly weening off of the dollar and using Rubble’s and Yuan to settle transnational trade. As Putin once exclaimed, the US’s aggressive sanctions policy risks destroying the dollar’s reserve status by forcing more companies from Russia and China to search for alternatives to transacting in dollars, if for no other reason than to keep costs down (international economic sanctions can make moving money abroad difficult). There certainly has been a global shift in sentiment to the USD and I think this may last a lot longer than many think.

I also think Trump’s campaign to hit nations with large tariffs will backfire and send the USD into a potential tailspin if he is not careful and the Fed is certainly adding to this through debasement via policy and now we have a potential alternative in the form of the EUR. Could the EUR become the new safe haven? Only very recently did the Chinese state and major economic entities begin to feel that they might end up in a similar situation as Russia; being the target of the sanctions and potentially even getting shut out of the SWIFT system. Trump is playing a dangerous game here to get elected and the cost maybe the world looking for alternatives. Is that partly why the EUR and gold is so bid?

Position update: I was stopped out of the EURAUD position but in a profit. I will take another look if I see US stocks ever looking likely to have a wobble. EUR remains a buy on dips for me but EURGBP looks and trades heavy which is why I have a tight stop. Techs don’t back this trade yet. USDJPY downside lost momentum and there is some fear that an “official hand” may be supporting USDJPY but my stop seems to be in the right place. I am less convinced on this move now.

—————————————————————————————————————-

Strategy:

Macro:.

Short USDJPY @ 105.25.. Stop at 106.75

Long EURAUD @ 1.6250 Stopped at a profit at 1.6400.

Long EUR @ 1.1762 looking to add at 1.1705. Stop at 1.1530.

Long EURGBP @ .9030.. Stop at .8950ish.

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.

Risk Warning

This information is powered by Strategic Alpha. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice.

Home

Home