Good Morning.. A quiet and mixed session overnight and not surprising really with US CPI and the FOMC later today but some of the data was disappointing, especially from China. CPI and PPI missed expectations and I think quite a few problems lie ahead for China. Relationships are fraying and many are looking at shifting away from reliance on China for manufacturing and indeed trade (even the UK apparently). I am wondering what the longer term ramifications of this are, especially for Australia, who at present have an ongoing spat with China. I have added a long EURAUD recommendation today (see below) looking to add on a dip. Techs still suggest lower but I think fundamentals may be shifting. A hard Brexit is still a possibility and so I keep the EURGBP view and I see EUR testing the recent highs of 1.1497 as this USD is starting to trend lower and is headed down in my view. But a lot may rest on what Powell says tonight. It may be a quiet one till then.

Keep the Faith..

Details 10/06/20

Bond market stress into the Fed: Stocks start to resemble the Dot.Com bubble. It’s all about the Fed today but the USD down-trend continues:

–

To be honest, the bond markets moves in the last 3 or 4 sessions have been somewhat extreme with a spike late last week in US 30yr yields to 1.74% which strangely took the USD lower only to be reversed this week with the 30yr yield trading at 1.55% at one point yesterday but the USD sold off on that too (after an early rally yesterday). It is difficult to get a handle of exactly what markets are expecting, if indeed anything from the Fed tonight. But I do wonder if Powell has any concerns over this rather speculative and euphoric equity rally. Is it time for an “irrational exuberance” speech? Personally I think one is due but it is unlikely as the health of asset markets seems to trump all else at present. Actually I should not say the “health of the asset markets” as they clearly are not trading in a healthy fashion but the Fed seems totally focused on keeping stocks rising. While policies may not change or suggest anything new, his forward guidance and ideas about what could come next, may impact. Looking at bond markets, there are clearly some conflicting views out there, a few of which I covered here yesterday, whereas stocks are acting rather as if common sense has finally flown. For instance, shares in Hertz have surged more than 800% since car hire group filed for Chapter 11.

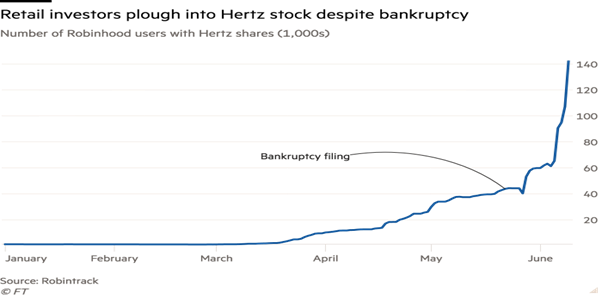

Line chart of Number of Robinhood users with Hertz shares (1,000s) showing Retail investors plough into Hertz stock despite bankruptcy

This, apparently, driven by retail investors! I have heard everything now. Forget sorting your company out if you want your share value to rise; just file for chapter 11 and sit back and wait. Blimey!

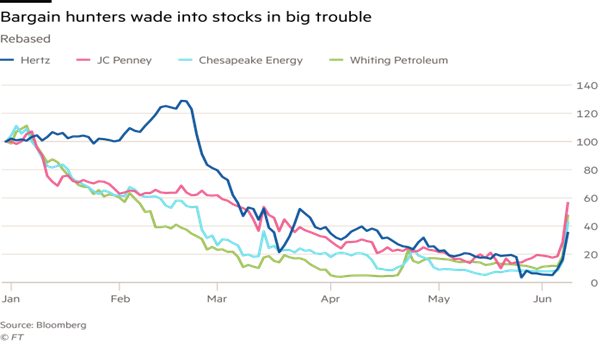

So, let’s see what other endangered companies are doing as surely this is a one-off anomaly.

Bargain hunters wade into stocks in big trouble

Nope; exactly the same thing. If it’s cheap; buy it and to be honest they have made a cartload out of this. (So far). But this smacks of the Dot.Com bubble to me and the Fed should be pricking this before it gets ridiculous. What am I saying; it IS ridiculous. Apparently, so I am told, millions of bored sports gamblers are turning to stocks and so far it seems that all you need to do is buy something that is stressed and you have a one-way bet to a new Rolex or Porsche. I am old enough to remember the bursting of the Dot.Com bubble and many retail accounts lost all their savings as greed bred leverage and arrogance. One-way bets in this business have a habit of ending badly. But will Powell highlight the dangers of this madness and who is leading this herd to the slaughter?

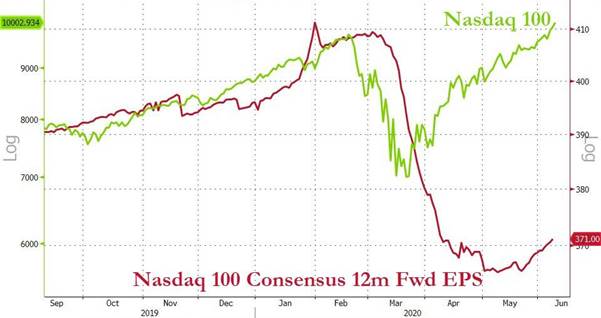

He will be asked many questions and regarding policy, bond investors want to know what is coming for bonds. Are we to expect YCC coming soon, or negative rates or more QE as issuance swamps USTs? As bond traders tried to figure all this out, we saw the S&P start to fall but it couldn’t go far with a rally in the NASDAQ; a clear rotation again. In times of uncertainty, rather than sell, investors still only rotate from value to growth or vice versa. But the NASDAQ is also ignoring some basic fundamentals.

But I guess the common theme is; what else is there to buy and there seems to be money sloshing around looking for a home that returns more than zero. But while markets may be doing great, the economy still seems rather in neglect but while the disastrous data was ignored by markets, any sign of a recovery is seemingly jumped upon. If that is not some form of euphoria then I am not sure what is. Surely Powell has to acknowledge or at least warn of a market dominated now by retail and unprofessional traders. I am not sure he has the commitment to do this but a comment should be made about the risks here; again, along the lines of “irrational exuberance”. The integrity of the market is at stake here.

The problem is, that if the Fed is feeling it may have to stop tapering bond purchases, due to the massive supply coming and recommit to buying more USTs, there is every likelihood that investors will see that as a green light to buy more stocks. He has to head this off or he will be trapped into policies that just see stocks skyrocket. But rockets run out of fuel. Maybe the alternative will be YCC. The Fed has clearly signalled it is discussing YCC. Since introducing YCC (through 10y), the BOJ has intervened on multiple occasions to steepen the curve by encouraging yields in the over-10y zone to move higher with a view to mitigating side-effects of falling super-long yields for life insurers and pension funds. In the US, excessive declines in long-term (over 5y) yields are becoming an issue due to the side-effect of excessive risk-taking by investors with fixed required rates of investment return (pension funds, life insurers, individuals).

The US unemployment issue is an interesting one. This is how it works: the Payroll Protection Program is a grant if you don’t fire anybody and if you fire people, as long as you bring them back, then you don’t have to repay the loan. So, there probably was a lot of pressure on a lot of businesses to rehire people that they probably don’t even need. But if they don’t bring them back, they’re going to have to pay back the PPP loan, so they brought them back anyway. The issue now is that they do not have to keep those re-employed workers after the grant is cleared. So, if we look at airline companies and many others, I would think in the name of cost cutting, a huge amount will be laid off gain as soon as is financially possible. The recovery may not be what it seems and we are NOT rushing back to 5% or less unemployed anytime soon.

So, not only do we have central banks extremely concerned about the state of the recovery but Trump and many other governments are thinking of more spending, which suggests they all see a slow recovery. The problem in the US and other economies is that the support packages are not infinite, they are due to run out soon. If Congress does not act by July, millions of Americans will lose enhanced unemployment benefits, which have served as a cushion during the recession. Meanwhile, the impact of $1,200 per person cheques sent to households by the federal government is fading and have certainly been used to reduce debt. We heard just last night that Labour Secretary Eugene Scalia opposes an extension of the extra $600 in Unemployment Benefits; saying that they will have served their usefulness by the time they expire in July.

The good news is that a steeper yield curve is a blessing for banks and a lower USD helps global trade and the EM space. We may not see this as policy now but my fear is Powell may allude to YCC as policy in the not too distant future. A sad day for bond markets that will be. We need to keep an eye on this as YCC design and balance sheet policy are factors that could lead to changes in long-term interest rates. Right now bonds are sending mixed signals but Powell may set us on a new path but can he control the long end? Another question he should be asked is, if he feels the Fed may have done too much now. I guess a look at economic forecasts may give us some of the answer on that and I guess it will be hard for Powell to be anything but dovish. This is interesting as there is now a massive divergence between what central banks tell us and how stocks react. That’s is clearly due to the fact that the only focus investors have right now, is central bank liquidity provisions. The Powell put is clear for all to see until he eradicates it. But how can Powell ever raise rates, or start reducing the balance sheet when asset markets are literally feeding off current policies? The danger here or the irony if you like is that the recovery does happen and we start seeing growth and inflation. Be careful what you wish for as that is the game changer as debt will then be an issue that could see the roof fall in.

The Fed will release economic forecasts for the first time since December. If we extract the comments from Powell and Fed speakers recently, it would seem that we could expect forecasts to show the US economy shrinking by 6 per cent in 2020, with joblessness around 10-11 per cent and interest rates stuck close to zero for years. Fed officials have clearly suggested that the economy is heading for a protracted slump. A deviation to the upside, such as officials signalling they expect interest rates to rise will unsettle markets. Also, the Fed has ruled out moving to negative rates, so any projection of below-zero rates would be a surprise to say the least. But Powell needs to balance being concerned and sticking to aggressive liquidity packages with the impact on an already euphoric rally in equities and other risk assets. I would like to know if there is any feeling that the speed of this asset rally is in danger of threatening financial stability.

Meanwhile the USD continues to fall and I think, as suggested recently, that this is the start of a significant trend lower. The chart below is the Bloomberg USD Index which doesn’t have such a heavy weighting on the EUR.

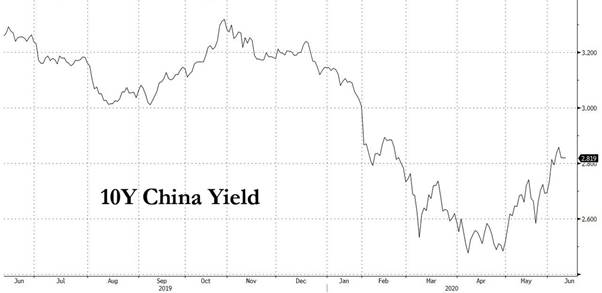

I think we shall take out that recent low and we could see a surprise move in coming weeks. Clearly, we could see an impact in bonds tonight if we get something unexpected from Powell but I do think the USD has turned. I also have some concerns over the Chinese economy and whether they may consider they need a much weaker currency. Data last night was disappointing with misses in CPI and PPI data.

Wasn’t China supposed to recover quickly after the lockdown? CPI slid from 3.3% Y/Y yoy to just 2.4%, below the expected 2.7%, and the lowest since March of 2019. PPI meanwhile slumped from -3.3% to -3.7%, the lowest gate inflation since early 2016, and a testament to just how much pricing power Chinese companies are losing. There is also continuing talk from many countries looking elsewhere for trade and manufacturing to be housed. The FT noted that even here in the UK, the government is drawing up a strategy to reduce the UK’s reliance on Chinese imported goods! This could become an extremely worrying theme for China and has all sorts of economic and geopolitical implications. Why is China not cutting rates; after all, they said they would?

The EUR is grinding higher; and on my charts, it looks like it will take out recent highs at 1.1497 at some point. After that we have something of a gap.

Chart above is a weekly chart and the widening bands suggest more of a move coming. It certainly will if the EU 27 pass the Franco/German joint bond idea but it may take a while for some “horse trading” to be done. I think some fudge where grants and loans are rebalanced slightly from the original plans may see this through. AUD is a tough one as I see an uncertain future ahead with relations between China and Oz and indeed China and the world. Broad USD weakness has been seen but we may be at a point where we need to become selective. EURAUD might be an interesting long term buy but I would step into this here (1.6260) in small and buy again down at 1.6100) with a stop below 1.6000.

The techs suggest this is still in a down-trend; but I think the fundamentals may be about to shift. If we should break back above 1.6500 I would buy some more as the tech picture changes up there.

—————————————————————————————————————-

Strategy:

Macro:.

Long EURGBP @.8978 added @ .8940. Stop at .8825

Long EUR @ 1.1360.. Stop at 1.1200ish. Added at 1.1285.

Long EURAUD today @ 1.6260 looking to add at 1.6100

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.

Risk Warning

This information is powered by Strategic Alpha. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice.