Good Morning.. Stocks just keep going and this time led by tech and we seem to flip-flop between leading and lagging almost daily. August often brings some random moves and liquidity is not great but the USD is back under pressure and EUR strength is an interesting leader in all this ( I recommended a new long in EURJPY today). It seems some real money buyers are possibly re-weighting EUR against the continually debased USD and that debasement looks set to continue and is at the heart of a weaker USD, firmer gold and rising inflation. EUR looks set to retest the recent high above 1.1900. That USD debasement is not going to change anytime soon and the US politicians still rely on the Fed to repair the economy as they still can’t find a compromise with Mnuchin saying that talks are going nowhere. Global equity investors seem to care little about that as it probably means the Fed will have to do more but monetary policy is now unable to impact the broad economy and markets don’t need any help! No new bailout deal, rising geopolitical tensions between the US and China, high unemployment and other risks are all being ignored due to Fed policies. Weekly Jobless and continuing claims the main focus today. But we need to ask what the deliberate debasement of the USD will bring. Not much good in my view.

Keep the Faith…

Details 13/08/20

Strong US 10yr auction, EUR bid across the board. Random moves but buying EURJPY.

–

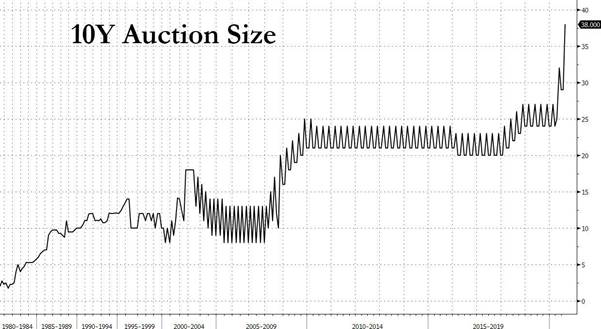

With US yields on the rise all week and the sheer size of the issuance this week, one could have thought that the supply would be too much to handle but after a strong 3yr auction earlier this week, the 10yr knocked it out the park as well. All eyes were on yesterday’s sale of a record amount of 10Y paper, and at some $38BN for sale, I do mean record (consider that in 1981 the 10Y auction was under $2BN), it is now well above that!

In bond parlance, Indirects took down 65.4%, up from 63.4% last month, and above the 61.3 recent average and with Directs taking down 14.7%, just above the 13.2% recent average, Dealers were left with 19.8%. All you need to know is that it was a strong auction. We now look forward to a record issuance of 30yr paper. But the USD move yesterday and indeed overnight was rather mixed with a strong performance from the EUR against the USD, JPY, GBP and AUD amongst others; in other words EUR demand against everything; why?

EURJPY drifted with some ease through resistance at 125.58 and broke 126.00 and looks set to be trending higher from here, while EURAUD traded back above 1.6500 and EURGBP made a high above .9050 (a close above could suggest a new test of the recent highs at .9175). After a serious rout that took many late to the party in gold, out of speculative longs, gold also rallied back strongly. But I failed to see why the EUR was so strong on the day. Is this real money accounts reweighting their exposure to the USD as the Fed seems on track to debase the dollar further? I am not sure but the rally in the EUR and the move in the last few weeks in gold and other “stores of value” may suggest a shift in sentiment against the USD and Fed monetary policies. If so, then these moves are far from done but right now I am guessing to be honest. US stocks had a strong session (this time with tech leading) so it does not seem as if this was capital flow based on stocks and in fact the DAX rather disappointed yesterday. US inflation data was worryingly high and US yields remained elevated and one would have assumed the USD may rally on that but the DXY was stuck on the lows of the day for most of the session.

The moves are a little random and we flip from rotation from tech stocks to value and back on a regular basis at present. With regard the USD, it seems we need to be selective and it does seem to me that some of these JPY crosses may have based out now. In fact this break of 125.58 in EURJPY is a bullish break for me and I will look to buy here at 126.00 with a tight stop below 125.17 (the mid-point ma on the 4hr chart below).

Stock markets again focus on hope of a vaccine and hope of more stimulus but financial markets do not seem to need much more help looking at stocks and it was another strong night for some in Asia with Nikkei benefitting from a weaker JPY again and closing up almost 2%. With the USD rather mixed, I think some of the JPY crosses may be a better bet right now. My first target on EURJPY is 129.30ish and to me that would see the new uptrend firmly established. In the bigger picture, the whole downtrend from 137.49 (2018 high) could have completed at 114.42 already and a new uptrend is possibly in the early stages of developing.

Looking at the daily, I may even be a little late to the party (hence a tight stop) as a trend has been developing but I think we may have confirmation of that and that the lows are solidly in place now and only a break below 124.30 would change that. The DXY is back testing 93.00 due mainly to EUR strength and the USD may be heading back down again and EUR looks likely to retest recent highs above 1.1900.

Following firmer PPI data the day before, (led by a surge in energy costs and day-trading), analysts expected US CPI to accelerate modestly yoy in July but no, it accelerated significantly (rising 1.6% yoy vs +1.1% expected). On a month over month basis, the headline CPI rose 0.6% (doubling the expected 0.3% rise).

Is the market starting to get nervous about all the stimulus building up to a re-emergence of inflation? That is not clear and if anything we are still in a deflationary phase for a while. I am still not 100% sure what recent data has told us about the US economy but I fail to see inflation as a concern in the s/t but I am perplexed over the EUR rally. But Fed policies are debasing the value and spending power of the USD and that is a fact we do know. The Fed had to act in the early phase of the crisis as we had a supply shock and a demand shock, which came together during the Pandemic and it produced chaos in the pricing environment. There was a sudden collapse in demand in some segments of the economy – restaurants, gasoline, jet fuel, for example – and a surge in demand in other segments, such as eating at home and anything to do with ecommerce, including transportation services focused on it.

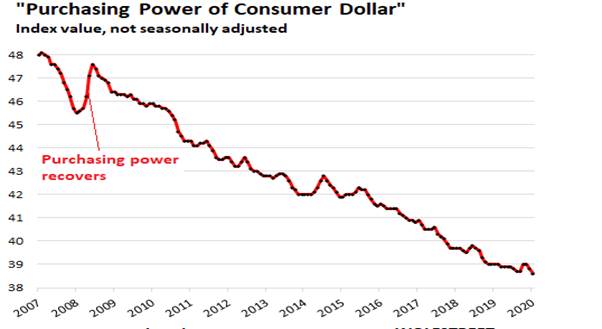

But the stimulus was huge and is on-going and has seen the Fed move into asset markets never before visited. I am not even sure that CPI tells the whole story with inflation but you can almost feel the shift in sentiment against the USD in the longer term. The Bureau of Labour Statistics offers us the corollary index, the “Purchasing Power of the Consumer Dollar” and it just hit a new all-time low. Note the purchasing power recovery during the Financial Crisis, when consumers could actually buy a little more with their labour for a few quarters; alas no more:

What you see above is the debasement of the USD right in front of your eyes. In the EUR heavy DXY, 92.50 is the level to watch now.

This is a deliberate debasement to spark inflation as most commodities are priced in USDs and they should rise if the USD falls. Quite simply, basic economics suggests that if there is no corresponding wage inflation, a decline in the purchasing power of the consumer dollar means a decline in the purchasing power of labour. For employers that are able to raise prices but don’t have to raise wages, it means “cheaper labour” – and for decades this has now been one of the big issues in the US economy among the lower 40% of workers who provide this cheaper labour. The poor and low paid stay poor due to Fed activity; nice. How can they expect growth to occur when 90% are out of the wealth effect from higher asset prices? But who cares right, as US equity prices make a new all-time high; unofficial Fed mandate completed!

Don’t ever tell me that Fed policy is anything else. No wonder Fed policies do not revive growth as their policies make goods and services more difficult to pay for, and the lower paid incomes get eaten up by rising costs and there is less money left over to make mortgage payments and other essential costs. Consumer price inflation, given the multi-decade wage environment, means the further impoverishment of the people in the lower income categories and means making debt payments harder – not easier. This is close to a crime. Corporate America is in no mood for pay rises now as they are focused fully on cost cutting and that means wages and staff if need be.

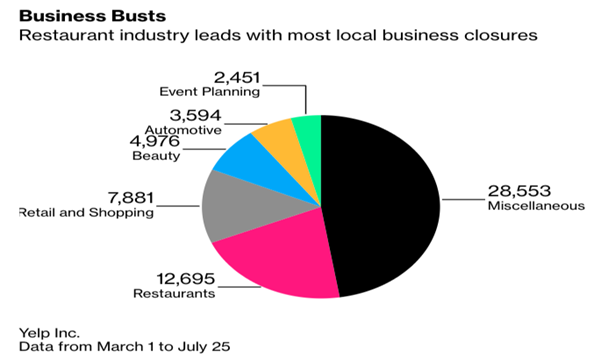

We are also no closer to a bail-out deal as Mnuchin says “talks are going nowhere”. This is yet to register with US equity investors but the gap still seems as wide as ever between the two parties. Can they afford to not get this done? Unemployment remains a serious issue for the US economy and I am not convinced at all things are headed back to normal. Workers are being taken back so firms can get their furlough payments but staff will be let go again soon in my view as the economy is still suffering from insecurity and consumers are reluctant to venture out and spend. Job insecurity can have a powerful impact even if you have a job to go back to. Those that don’t are desperately hoping the US government can get a new programme sorted out to help. The problem is that Congress have relied so heavily on the Fed to deal with this stuff, that they do not feel pressured enough to find a compromise but there is a massive difference between monetary policy (now ineffective on the broad economy) and Fiscal policy. Small businesses are really suffering and many will not reopen. US bankruptcies of large companies are on pace to hit a 10-year high, with even more devastation seen among smaller firms.

Again, I am surprised that US equity investors ignore this. The collapse of small business is absolutely shocking, considering firms with under 500 employees account for about 44% of US economic activity. Bloomberg notes a “wave of silent failures goes uncounted in part because real-time data on small business is notoriously scarce, and because owners of small firms often have no debt, and thus no need for bankruptcy court.” Yelp’s latest data on business activity shows more than 80,000 companies permanently shuttered operations from March 1 to July 25. What’s concerning is that 60,000 of these closings were small firms. That is a lot of employed people who no longer have a job to go back to.

A July report from the US Chamber of Commerce survey showed 58% of small business owners are worried about permanently closing. The problem today is that the economic recovery stalled in June and has started to reverse, a fiscal cliff has been festering underneath the surface in August, which could result in lower consumption among tens of millions of Americans that would pressure sales. Yes, Trump helped a bit with an executive order but Trump’s orders to provide more direct transfer payments to broke Americans have tremendous consequences; first, a quarter of all US income is derived from the government, and second, this transfer of wealth creates unsustainable artificial growth. The reality lies ahead.

—————————————————————————————————————-

Strategy:

Macro:.

Long EURGBP @ .9030.. Stop at .8950ish.

Long Gold @ $1875 Stop at $1820

Long EURJPY ´126.00 Stop at 125.10.

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.

Risk Warning

This information is powered by Strategic Alpha. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice.