Good Morning. Markets were calm in Asia with tight ranges for FX markets as we head into what could be a rather nervous weekend with a holiday in the US on Monday. GBP is holding gains after the Javid resignation and markets believe Boris will spend. The virus threat is keeping the USD bid which is a clear safe haven but EUR weakness also an issue and looks to extend through support at 1.0810 in my view (see below) and I can see EURGBP lower too. Keep an eye on oil as I am not sure it will take much more weakness to see quite a large capitulation from longs and falling oil will have an impact on a whole host of things from sentiment to Capex and possibly even credit risk (see below). EU GDP could follow German GDP and disappoint this morning and to my mind Lagarde is about to face her first real challenge. Just how strong is the pushback against more QE or further cuts at the ECB? Looking at the EU economy, that is a conversation for now; not the end of the year. US Retail sales always worth a look but so far US data keeps outperforming and that will keep attracting the capital inflows; maybe the S&P is a safe haven now. My recommendations remain the same but this could be a nervy finish to the week as it’s a Friday so, “Be careful out there”..

Keep the Faith

Data.. All Times GMT

10:00.. EU GDP qoq Q4 Prelim Cons: 0.1% Prev 0.1%

EU GDP yoy Q4 Prelim Cons: 1.0% Prev 1.0%

13:30.. US Retail sales mom Jan Cons: 0.3% Prev 0.3%

US Retail sales Control Group mom Jan Cons: 0.3% Prev 0.5%

US Core Retail sales mom Jan Cons: 0.3% Prev 0.7%

14:15.. US Capacity Utilisation mom Jan Cons: 76.8% Prev 77.0%

US Industrial Production mom Jan Cons: -0.2% Prev -0.3%

15:00.. US Business Inventories Dec Cons: 0.1% Prev -0.2%

US University Michigan Consumer sentiment Feb Cons: 99.5 Prev 99.8

Details 14/02/20

Javid quits and GBP rises: We still do not know how much damage we shall get from China being in shutdown.

The news broke that Javid had quit as UK chancellor and for a brief moment, markets were unsure what this meant but it was decided that this may open up more spending as Boris puts his team in the Treasury at No11 Downing Street. To my mind, this is why GBP took off and EURGBP traded below .8300 on the back of it. In fact all EUR crosses remained under pressure yesterday as longs were unwound. Investors like spending governments and with all the promises Boris has made, spend he will. No longer is debt seen as an issue; it is a problem for someone else when interest rates rise and is the case the world over now. The new guy has got a budget to put together soon but Johnson’s office could not confirm that the budget will go ahead as planned on March 11, or that the government will keep to fiscal rules — announced by Javid — which require day-to-day public spending and revenue to be in balance within three years. Good luck with that idea; Johnson now has a yes-man in place. I think this Javid loss is a big one for Johnson as he commanded respect and had experience outside of politics which is something sadly and dangerously lacking in most senior government officials.

Cable is still in a range after the rally with resistance up at 1.3210 but EURGBP is breaking down and it think may extend. The break of 0.8386 support suggests resumption of the fall from 0.8595 and the Intraday bias is back on the downside for 0.8276 low on my charts.

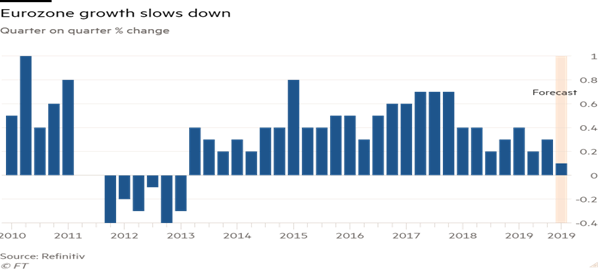

Then, mind the gap! A lot of this is due to continuing EUR weakness as seen across the board of EUR crosses including EURCHF which traded as low as 1.0610. Where is the SNB? We get a look at EU GDP data today and while rather backward looking and may not have picked up the full impact of the virus fears, it is already expected to show the eurozone’s economy is growing at the slowest rate since the bloc’s debt crisis seven years ago. Growth of just 0.1% is expected for qoq for Q4 and may even miss that!

This coming on top of very weak December industrial production figures published earlier this week which showed the biggest monthly fall in almost four years.

That followed a 1.6 per cent drop in eurozone retail sales in December, the steepest monthly fall for a decade. This EUR still looks a tad high to me and a break of 1.0810 looks likely and will open up another leg lower and Germany looks like it is headed back into recession. Is the ECB going to be forced to ease further or expand the balance sheet? One thing is for sure, they are not going to be able to wait till the end of the year for that review on policy, as action may be needed now but I note with interest that pricing is still for no move this year as they believe the bar is set higher for any further easing. Lagarde is about to face her first real test in my view and even though traditional economic thinking suggests that low rates boost demand, empirical evidence is starting to challenge the theory, even at the ECB and some central banks have started to listen –the Riksbank, for example, moved rates back to zero last year. Germany is also facing political instability with the rise of the far right.

So, I guess the risks are still with us but you would not know it looking at stocks; but hedging is happening elsewhere. Commodities and bonds have all seen hits and the EM space has taken the brunt of the FX risk. The USD is bid; US economic data remains relatively strong, US stocks continue to hit record highs and is importantly considered less exposed to the coronavirus. The Citi Surprise index is a very clean read on USD performance. Retail investors are all-in with stocks now as commissions hit zero; what could possibly go wrong? Isn’t it true that you should not buy anything at the peak of its popularity?

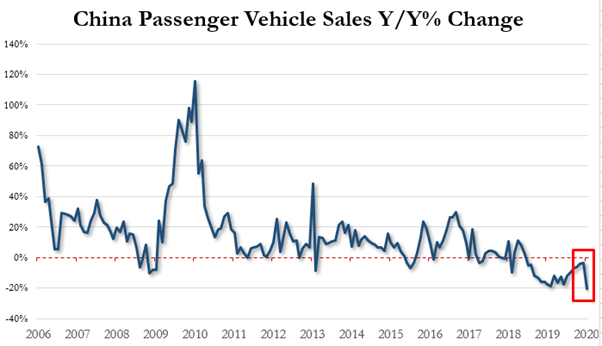

The surprise index measures the performance of the outcome of US data relative to expectations. It implies the US is still outperforming and US stocks are still attracting capital and so the USD is set to rise further; and it is clearly seen as a safe haven currency now. Maybe the S&P500 has become a safe haven now too, a view offered here a while back. The impact of the virus is still unknown but it is starting to take its toll on many parts of the Chinese economy from retail to travel. Two-thirds of China’s passenger planes have been grounded as travel restrictions and fear sparked by the coronavirus outbreak batter passenger numbers and force the country’s airlines to scale back operations dramatically. Who on earth would take a cruise now and risk confinement? Auto sales in China were crushed in January, declining 20.2% on a year over year basis, according to the government-backed China Association of Automobile Manufacturers and this month is expected to be worse! Oil demand is expected to fall further and supply chains remain in danger of never recovering in some instances.

Alibaba, whose platforms sell two-thirds of everything bought online in China, has long been an indicator of the health of the country’s economy. On Thursday, the diagnosis was bleak. The spread of the coronavirus has brought China to a standstill and will hurt Alibaba’s businesses across the board. Delivery staff are being laid off and the ripple effect is starting. The EU and Oz still remain exposed here and a resolution needs to be seen soon.

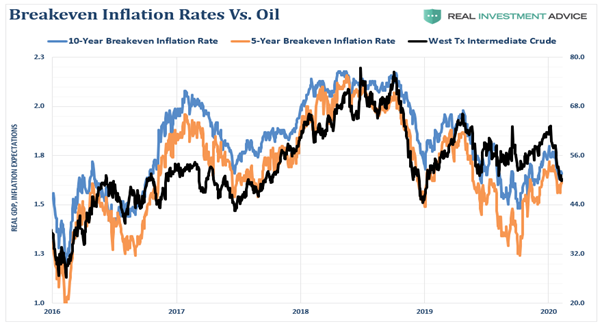

The USD was bid for most of the day yesterday and held above 99.00 for most of it but for US stocks it was business as usual as weakness seen in Asia and the EU was yet again snapped up by US specs working on the idea that what’s another 15,000 deadly virus cases when we have central banks at our back? Who is buying up here? The US sees itself as so far away from all the problems facing Asia that they are immune; and they might well be or… The issue is that we simply do not know yet but even if the weakening global economy does impact the US, the Fed will act; that is all they care about. The USD is likely going to stay bid for a while in my view but that could also do some damage to already weak commodities and oil; both of which could be sending deflationary signals if this continues. A strong USD is not great for the US economy right now but like stocks, there seems to be little alternative for a safe haven currency. Are the SNB going to allow further CHF strength; I am sure parity with the EUR is NOT an option they would consider. Oil demand is weakening fast and WTI looks like it is setting up for a look at $45.00! Again, this is deflationary stuff; and no one cares; it will pass; right?

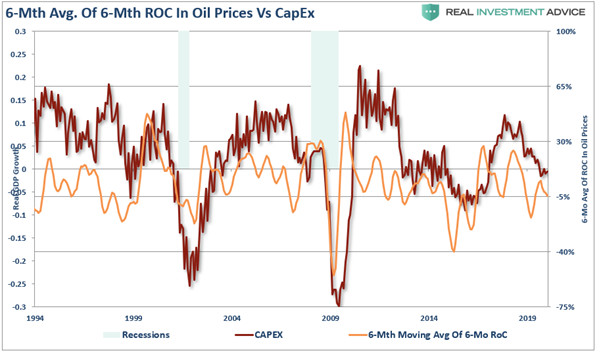

Importantly, since the oil industry is very manufacturing and production intensive, breaks of price trends tend to be liquidation events which has a negative impact on manufacturing and CapEx spending and feeds into the GDP calculation. Keep an eye on oil as I am not sure it will take much more of a slide to see some serious liquidation of longs and Russia is taking an age to come to an agreement with OPEC on cutting production. If we look at oil historically, it should not be surprising that sharp declines in oil prices have been coincident with downturns in economic activity, a drop in inflation and a subsequent decline in interest rates.

Falling oil prices over time impact CapEx, which in the US is already dangerously weak. Energy companies are going to feel this loss of revenue and many companies teeter on the edge at the bottom of the credit bucket.

I bring up CapEx a lot and the fact is that once CapEx is reduced the need for employment declines and do you remember those JOLTS data I showed earlier this week? Given that oil prices are a reflection of global economic demand, falling oil prices have a negative feedback loop in the economy as a whole; it’s just a matter of time. So far, the US CPI data is not picking this up.

But the big question for all investors is still what economic damage this virus, so far contained in the second largest economy on the planet and the centre of global manufacturing and supply chains, is having or going to have. The reality is that no one knows.

What investors are doing is hiding in assets which benefit from central bank liquidity while shunning what depends on growth. Even though liquidity-proxy assets are already expensive, money keeps pouring in. The largest capital flows in 2020 have been in bonds – $88bn, off the charts for a first quarter – leaving distressed credit, European and emerging market stocks and US small caps relatively unloved. The irony is investors are doing exactly the opposite of what central banks expected to achieve in the first place but central banks are now trapped by their own policies. What worries me is that central bank policies have removed almost all risk premia on high risk assets (Greek 10yr at 1%!). The issue now, with rates already low, how aggressive central banks will be if the impact in China hits global growth. They may feel this virus issue is transitory and won’t last into Q2 and so do nothing. That could be a mistake as policy needs setting for the future and the future impact of this virus is still unknown.

—————————————————————————————————————-

Strategy:

Macro:.

Short AUD @ .6875 at .6917 (average .6896).

Short USDJPY @ 109.95.. stop above 110.35 (s/t position just in case).

Short EURJPY @ 119.45. Tight stop above 120.20.

Macro Long FTSE250 20,900

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.

Home

Home