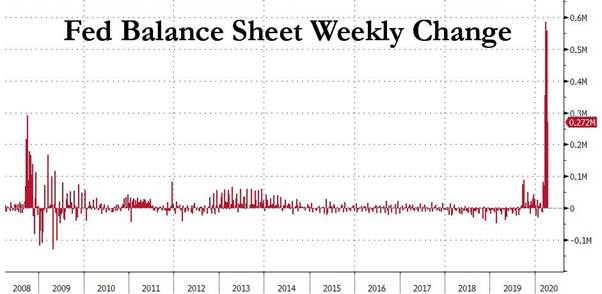

Good Morning.. Wall St surged again with the NASDAQ rallying another 4% and to be honest I have missed this. It seems many believe that the CB and government stimuli negate the risks but really? It has been a huge package thrown at this but a global economy expected to hit -3% growth is something almost unfathomable. And what if we do get a V-shaped recovery, will the central banks and governments be prepared to risk an asset collapse if they withdraw the drugs? Let’s face reality here, the equity bounce is purely on Central Bank provisioning. Earnings look set to collapse and how long will it take to recover? I guess for those still in cash, we have to ask if all the low hanging fruit is gone. The danger now is that Trump and other governments want workers back in the workplace; lives over livelihoods. While the Fed is prepared to help the banks, the banks are being forced to build a huge amount to deal with the credit defaults which are on their way. Are all non-bank lenders doing the same. I am not sure they are all safe and their loans look high risk now. The Fed actions saw the USD fall yesterday but not far and AUD slumped after weak consumer data . We get a look at US Retail sales and other US data today, all of which will be awful; but does it matter? 17million Americans lost their jobs in 3weeks and look at stocks!! How can that be… I am still scratching my head. CAD rate decision later..

Keep the Faith..

Data.. All Times BST

13:30.. US Retail Sales m/m Cons: -8.0% Prev: -0.5%

US Core Retail Sales m/m Cons: -4.8% Prev -0.4%

US Control Group Cons: -2.0% Prev 0.4%

US Empire Mfg Cons: -35.0 Prev: -21.5

14:15.. US Ind Prod m/m Cons: -4.0% Prev: 0.6%

US Capacity Utilization March Cons: 73.8% Prev 77.0%

15:00.. Canada BoC Rate Decision Cons: 0.25% Prev: 0.25%

Details 15/04/20

US stocks blast higher ignoring all sorts of risks:

–

I have to say right at the start of this piece that I have totally underestimated this global recovery in stocks, especially that of the US, which saw the NASDAQ rally another 4% yesterday. This as there is no sign of a vaccine on the horizon and uncertainty about if we have even reached peak virus with governments seriously considering pushing people back into the workplace. Investors have latched on to the signs that the death rates and infections may be slowing but this still seems a dangerous time to be unlocking economies. But stocks are not focused on shocking earnings or the state of the economy as investors seem to believe that the central bank and government actions counter all that.

Shares in Tokyo reversed earlier losses but still finished lower, though volume was about 25% lower than average. Chinese and Hong Kong stocks were little changed, while Australian equities fell as a record slump in consumer confidence reminded investors of the impact of the pandemic on spending. Aussie consumer sentiment came in at -17% after -3.8% last and AUD took a knock back to .6350.

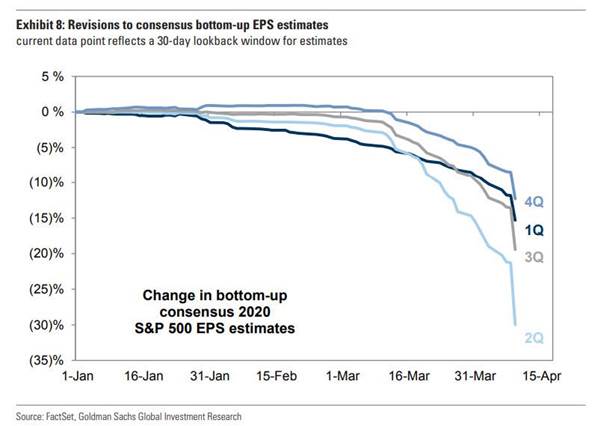

I admire their optimism and I have missed the move due to a belief that earnings and a global economy producing negative growth is not good for global equities; it seems I am wrong and I have missed a massive bounce. JPMorgan Chase & Co. said first-quarter profit tumbled 69% to the lowest in more than six years as credit costs surged, giving investors a first glimpse at the extent of the damage Covid-19 is wreaking on bank results and this is the strongest bank out there! The company set aside $8.29 billion for bad loans, the biggest provision in at least a decade and more than double what some analysts expected, as it grappled with the effects of the coronavirus pandemic on the economy. That prompted JPMorgan’s first drop in profit since the fourth quarter of 2017 and there is a lot worse to come from its competitors and this at the start of the crisis. The USD showed some signs of weakness yesterday and after all the Fed has done, I was not surprised by that but I am a little surprised the USD is not lower. EURGBP continues to nudge lower and the EU still faces a lot of headwinds.

I am not sure this move is done yet.

We will get a look at a lot of US data today that will encapsulate most of March and include the start of the lockdown and US and global data are about to show just how deep this problem is; but does it matter? Is data irrelevant as the stimulus measures negate it?

Again we are not far into this problem and the global economy is forecast by the IMF to fall to -3%; that is a massive hit and they suggest the biggest hit since the ‘30s depression; and stocks rallied. The IMF is usually rather conservative but this is a shocking set of forecasts. Banks are preparing for credit defaults and we shall see companies fail to recover and Chapter11 is going to be a long chapter in this story. Banks are also facing a demand drought for loans and the curve is flattening. The Fed may have to fix that too, as suggested yesterday by taking control of the whole yield curve. Equities rallied on the news that Trump will make important announcements in the next few days regarding the lockdown but Fauci still sees early May as rather too early. Trump is prepared to gamble lives for livelihoods and is desperate for re-election.

Wall St has clearly turned a blind eye to the fact that 17mln people have lost their jobs in 3weeks and we get a glimpse at what US Retail sales have been doing and other data today. Data is only going to get worse as we cover the end of March and early April. How bad seems to matter little at present but surely earnings cannot be ignored for long but the BoA Fund Management Survey suggests there is still large cash holding out there as managers remain extremely fearful. Even as China is seen to be getting through the worst of the virus, the People’s Bank of China trimmed its one-year medium-term lending facility rate by 0.2 percentage points to 2.95 per cent to help boost a still flagging economy; it will take a long time to heal and that is the point elsewhere. Earnings estimates keep falling even as S&P races back above 2800.

I am not sure it is advisable to ignore this. But the present meme is “buy whatever the Fed is buying” and fund managers are laughing at how easy that is (again). Front running the Fed works again and while this is not investing, it is free money! But can it last and has the low hanging fruit been picked?

While GDP is now expected to slump 14% in the first half of 2020 according to JPM, resulting in the US losing a “stunning and unprecedented 25 million workers and pushing the unemployment rate to a level last seen in the Great Depression”, a more important question is what happens to corporate profits. It is here that the real pain – at least for those tasked to find a connection between profits and stock prices – comes because according to JPM, since global profits are leveraged to GDP and not to the Fed’s balance sheet, the bank expects global profits to plunge by 70% in Q2 2020. I guess they could be wrong but it seems fair to me but can stocks survive that? Just how long will it take for businesses to get back to sustainable profitability that comes anywhere close to stock valuations? Some may never recover. This is a crisis like no other as each country is experiencing both a loss of external demand (typical for a global recession) and a unique hit to domestic demand from containment policies. We have never seen this before and stocks seem to be forgetting this. The reality may yet dawn and is why I cannot reach up here and buy equities.

What if we do get a quick V-shaped recovery? Will the central banks be prepared to suddenly turn off the taps? If there is indeed a very quick turnaround in the economy the Fed, whose policies have contributed to roughly 80% of the S&P’s upside, would be forced to withdraw said programs, surely and ironically leading to another period of stress. What damage would be done by too much stimulus in the system? We are not sailing into calmer waters in my view. This could be just getting started and it is clear that banks are making provisions for some serious credit default risk; what about the non-bank lenders; are they doing the same? I doubt that. The Fed is trying desperately to head this credit stress off but I am not sure they can and some will fail but maybe some non-bank lenders too are heavily exposed as well as weak borrowers. But fighting the Fed when it seems prepared to go further than its legal remit is not going to be easy. One thing is clear, we still have some very choppy waters to navigate.

—————————————————————————————————————-

Strategy:

Macro:.

Short EURGBP @ 8901.. Stop @ entry now (took substantial profits at.8760)

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.

Home

Home