Good Morning.. Headline GDP from China beat forecasts but it was not all good news as retail sales more than disappointed and I note the fall into the close in Shanghai stocks. It shows just ho uneven any recovery will be and highlights that China needs the rest of the world as much as they need China. The trouble with that is the world is becoming more protectionist and nationalistic led by the US who seem happy to walk away from globalisation. I come back again to the damaging impacts from high unemployment (see below) and the impact is a global one. ECB today is not expected to give us much but a couple of points. Less aggressive buying of bonds likely to be announced over the summer break (as usual) and I am wondering if we hear anything on further flexibility in the PSPP parameters, especially regarding the 33% issuer limit as they must be pretty full with Bunds right now. Apart from the ECB and Lagarde, we also have US jobless claims and I am sure US Retail sales will impact. Could be a choppy day later with stocks also looking a tad tired this morning…

Keep the Faith..

Details 16/07/20

China data shows the uneven and unpredictable path to recovery: ECB and the US consumer.

–

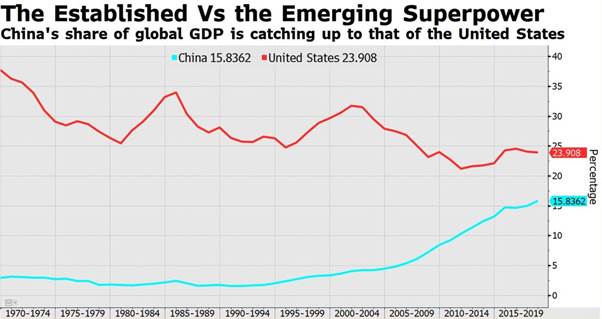

China GDP was expected to improve and it didn’t disappoint driven by a recovery in production and spending amid coronavirus-induced headwinds. The 3.2% year-on-year growth announced by the National Bureau of Statistics on Thursday eclipsed the 6.8% contraction in the first quarter as China unlocked their economy and contained the virus.

China GDP growth by quarter

China is the template that economists are watching for forecasting how other economies may develop. Surveys had suggested a 1.1% gain, so the beat was significant for the April-June data. Trade in U.S. dollar terms returned to positive territory in June, from negative in May and exports grew by 0.5%, thanks to demand for personal protective equipment and pharmaceutical products, while imports increased 2.7%, largely powered by electronic components and commodities.

Now the bad news; While Fixed Assets (excluding rural) YTD came in a tad better at -3.1% y/y vs. expected -3.3%, it has to be said that Retail Sales were very disappointing for an economy becoming more reliant on the consumer spending. They came in at -1.8% y/y vs. expected 0.5%, Retail Sales YTD -11.4% y/y vs. expected -11.2%. This shows a consumer reluctant to get back to normal and in China, they do not have the unemployment issues of the US but even the Chinese consumer is still suffering some anxiety and for many of the developed world, looking at this data, it will be suggesting how uneven any recovery may be. The question is; is this a recovery or just a rebound? We saw some euphoria over some advancement in vaccine testing yesterday but any cure and delivery in scale is still many months away. But China needs the rest of the world to recover and it is hard to see how China can remain on a firm footing at a time when the rest of the world is still coping with a very deep recession.

It has had its bounce after the unlocking but it remains an uncertain future and the world needs a strong and recovering China going forwards as much as the ROW needs China. But when it comes to global trade, that still looks threatened on many sides as the world turns more protectionist and countries become insular. Phase 2 of the trade war has just started and the chart below may suggest why!

Stocks across Asia fell on the China data with Nikkei down 0.72%, HK down over 1.2% and Shanghai down 3.4% into the close.

The market rally yesterday on the vaccine update may have stalled as scientists are questioning whether waning immunity to Covid-19 could affect how useful a vaccine will be in tackling the pandemic. According to the FT, a study from King’s College London, which has yet to be peer-reviewed, showed recovered patients’ antibodies declined significantly within months of infection, raising the critical issue of how long a vaccine could prevent people catching the disease. Again, the road to full recovery is going to be a rocky one and certainly not linear. The director at the Feinstein Institutes for Medical Research in New York, said the Moderna results were “encouraging” but more information was needed about how long the response will last. We also need more information about how long the recovery will take across the globe and on that, we may have quite a wait. Clearly data is improving but I still have some considerable concerns over the desperately slow recovery in unemployment. This is as dangerous to the economy as the virus itself and could set back recoveries in many economies still.

Yesterday saw the USD push lower with the DXY breaking 96.00 and EUR is making higher highs and higher lows as it builds on its gains but we do have the ECB meeting today and the start of the EU leaders meeting on the recovery fund and joint bond issue starting tomorrow which runs into the weekend so some profit taking looks likely. But this could be a definitive moment for the EU IF they can get an agreement at this meeting. Some disappointment may be seen if talks need to continue as the summer break may kill the momentum.

But the Bollinger bands are expanding suggesting some extension still possible and the MACD is above zero with the moving average suggesting the trend is developing (pointing up). The technicals, at least, support further gains but if we did get an agreement and a compromise that that does not involve veto’s on spending, then I think the whole status of the EU and EUR changes. Even if talks are delayed until after the summer, I think an agreement can be found because one has to be found and they all know it and so dips will remain a buy in my view and I am not sure the USD is going up anyway.

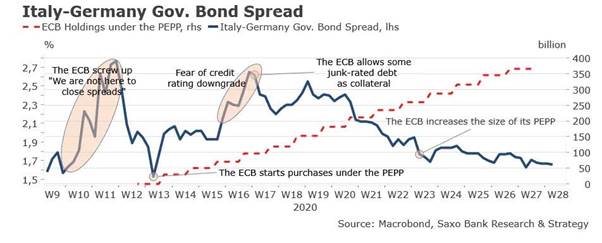

Regarding the ECB meeting, I doubt we will see any additional policy moves as they have done a huge amount and need time to see how things pan out. A delay to any further policy is the correct thing to do and so my expectations from this meeting are minimal. I think Lagarde will be making strong calls for the EU leaders to get an agreement done but the ECB has done all they can and need to for now. After all, the ECB Balance sheet hit fresh all time high at €6,309.2bn just before this week’s meeting as Lagarde keeps printing press rumbling. Total assets rose by another €20.2bn on QE and the balance sheet is now equal to 53% of Eurozone GDP vs Fed’s 32%, BoJ’s 119% and BoE’s 31%. The ECB now has a huge arsenal to defend EU bond markets and seems determined to do so. Add to this a joint bond and the EUR will become a very dominant currency and a very viable alternative to the USD. The whole future of the EU could take a serious boost IF they get this done and I really think that this is still under-priced (I guess because it has not been done yet) Can they afford NOT to get this done? In a way, the virus has done the EU a huge favour as it has seen Germany give up on austerity and seen them champion a joint bond, something I did not think they would ever do.

The Netherlands, Austria and a few others see this as a wealth transfer system but without it there will be a return to doubting the validity of the EU and before all this virus hit, the EU was under some serious strain. They have an opportunity to solidify the EUR as a major currency and the Bloc as a major global player; the implications are huge. I could see the EUR heading a lot higher against nearly everything if they get this done without too much compromise. The balance between loans and grants is an issue but they cannot allow any spending to be vetoed by the likes of the Netherlands as nothing will get done. Now is the time for the EU leaders to act as a union for the union; they may never get a better chance to secure the EU and its currency on the global stage. Lagarde has got off to a good start and manged this well.

I didn’t think I would be saying that. There is a chance that the ECB suggest a slowdown in the path of the bond purchases (which usually happens during the summer season) and might be the main point of interest for investors this week but that is normal.

It is also possible that we hear something on further flexibility in the PSPP parameters, especially regarding the 33% issuer limit. This issue needs to be addressed soon as there are many indications that the limits for German government bonds must be quite close. Again I think this would be a significant shift. I also think the markets may reward the ECB on their climate stance.

The EUR has done well into the meeting scheduled on Friday but the market is getting long now. But I think this is potentially far bigger than a speculative move as if they get this done, the real money flows into the EUR will be massive and helped by significant capital flows into EU stocks and there is a very good chance that the EU emerges from this crisis sooner and stronger than the US, UK or many others. If I see a dip in the EUR, I will be buying it; this is their moment and I am sure Merkel and Macron will press this upon the dissenters.

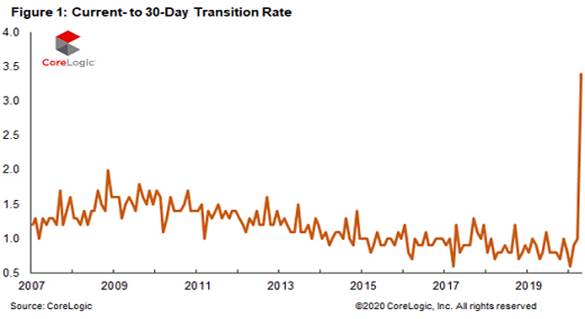

Back in the US, I fear that the impact of unemployment is yet to be priced and the signs are that many are really starting to struggle. The danger here is that we are yet to see the double whammy of both corporate and retail insolvency. On the retail, or consumer side of things the risks are beginning to become apparent. Mortgages that are in forbearance and have not missed a payment before going into forbearance don’t count as delinquent. They’re reported as “current.” And 8.2% of all mortgages in the US – or 4.1 million loans – are currently in forbearance, according to the Mortgage Bankers Association. But if they did not miss a payment before entering forbearance, they don’t count in the suddenly spiking delinquency data. The onslaught of delinquencies came suddenly in April, according to CoreLogic, a property data and analytics company (owner of the Case-Shiller Home Price Index), which released its monthly Loan Performance Insights yesterday and it came after 27 months in a row of declining delinquency rates. These delinquency rates move in stages – and the early stages are now upon us.

In April, the share of all mortgages that were past due, but less than 30 days, soared to 3.4% of all mortgages, the highest in the data going back to 1999. This was up from 0.7% in April last year. During the Housing Bust, this rate peaked in November 2008 at 2% (chart via CoreLogic):

I think we need to keep an eye on this as these delinquency rates are the first real impact seen on the housing market by the worst employment crisis in a lifetime, with over 32 million people claiming state or federal unemployment benefits. There is no way (despite rumours to the contrary) that a housing market sails unscathed through that kind of employment crisis. CoreLogic expects to see “a rise in delinquencies in the next 12-18 months – especially as forbearance periods under the CARES Act come to a close,” the report said. To what extent the delinquencies deteriorate further depends largely on the labour market and on unemployment; and that remains a horrible mess at the moment.

—————————————————————————————————————-

Strategy:

Macro:.

Long EUR @ 1.1210.. Stop at 1.1150

Long EURAUD @ 1.6250 stop at 1.6080

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.

Risk Warning

This information is powered by Strategic Alpha. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice.

Home

Home