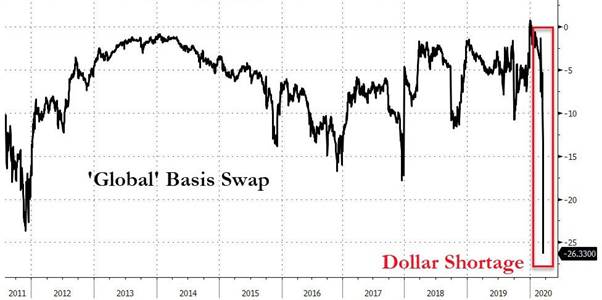

Good Morning.. Wild swings are the norm and S&P futures are limit up this morning after a very choppy session in Asia again. But I note the rise in the USD and I am not surprised by this with the FRA-OIS spread still suggesting a USD shortage out there and this could turn into a scramble soon, especially as I think there maybe a low in place in USD yields now. I would be a seller of USTs here with a yield equivalent of 0.815% and can see this way above 1% soon.. I am also thinking we see more pain in Cable and have recommended a short even down here and see a chance of testing the 1.1958 lows. I remain short the EUR but this has been slow so far. The issue for me is that the sheer size of the debt that governments are going to pile up to fight this economic collapse is so large it will create a Tsunami of debt hitting the bond markets. Central banks are going to have to monetize the debt or rates will have to go up as the beauty parade starts to attract global investors of debt. Even with the Fed pumping in $700bln, I think yields are in danger of rising and the USD with them. But it is the stress in the funding market that will drive the USD. JOLTS data today is worth a look as it is a good lead indicator on Jobs and as always retail sales but I am not sure sales capture all we now realise. Also UK jobs and earnings data may impact s/t. Goodness knows what German ZEW will look like..

Keep the Faith..

Data.. All Times GMT

09:30.. UK Avg Weekly Earnings 3m/y Cons: 3.0% Prev: 2.9%

UK Avg Weekly Earnings Ex Bonus 3m/y Cons:3.2% Prev 3.2%

UK ILO Unemployment Rate 3mths Cons: 3.8% Prev: 3.8%

UK Claimant count change Cons: 21.4k Prev 5.5k

10:00.. Germany ZEW Survey Expectations Cons: -26.4.0 Prev: 8.7

Germany ZEW Survey Current conditions Cons: -30 Prev -15.7

12:30.. US Retail Sales m/m Cons: 0.2% Prev: 0.3%

US Retail Sales Control Group Cons: 0.4% Prev flat

US Core Retail sales mom Cons: 0.2% Prev 0.3%

13:15.. US Ind Prod m/m Cons: 0.4% Prev: -0.3%

US Capacity Utilization Feb Cons: 77.1% Prev 76.8%

14:00 US JOLTS Job opening Jan Cons: 6.476mln Prev 6.423mln

Speakers:..

10:00.. ECB Speaker: Rehn (Very Dovish) in Finnish Parliament Hearing on Strategy Review

Details 17/03/20

The world shuts down from non-essential activities and the impact will be a deep recession. Short selling banned in many countries. Staying long the USD for now.

Reports from across Europe, the UK and US were of mass shutdowns and guidance to stay at home and refrain from any public gatherings and non-essential travel. The knock-on impact of this is going the be huge for a multitude of businesses and many are looking at a survival strategy. Jobs could be at risk here and this Thursday’s US jobless claims may start picking this up and a good forward indicator for Jobs data is the JOLTS data which we get from the US today and it was disappointing last month. The data for the next month or two is going to be off the scale bad. Oil looks set to hit mid 20’s with WTI and Brent already breaking $30 and the world should never forget the additional pain that the Russians and the Saudi’s piled upon us. It is inhumane to be flooding the markets with oil at a time like this to add pressure on already weak global economies. I guess the bright spots in all this are that mortgages and petrol are cheaper but there are few positives to be seen out there and we are still flirting with a credit crunch. Germany, like so many others and following Italy and France, are shutting down everything, while Spain and Italy have banned short selling. Quite how the EU will emerge from all this is unclear but it is looking grim as they were all pretty fragile going into this. Goodness knows what sort of levels will be seen in survey data in coming weeks. We get German ZEW data for March today.

Gold, platinum and silver (11yr lows) all dumped as investors dumped anything with a profit in it as margin calls forced most out of popular or hedge related positions. It seems 9% swings in equities are becoming the daily norm! I am struggling to see how companies can keep staffing levels here with margins and earnings collapsing. Meanwhile, the Fed continues to offer billions to the repo market but still it seems every day we have a different problem and the Fed is clueless (as indeed I am) as to where to bung the hole. One day it is ETF NAV discounts blowing out; The next day the Treasury Cash/Swap basis surges and funds suffer a historic VaR shock amid forced liquidations; Day three sees the FRA/OIS explode higher as a massive dollar funding margin call strikes; Then, day four sees the same repo crisis that was supposed to be fixed back in September return with a vengeance, as banks freak out about counterparty risk.

Is there a very sick counterparty out there which some banks are refusing to lend to? The USD attempted a rally yesterday but it was checked as US yields fell hard. What the Fed needs, is quickly to find the source of the counterparty risk and remove it. Trump said last night the US my be heading for recession. It is probably in one now. Of course the damage in the financial system is a major concern but so far, nothing the Fed has done, not the rate cuts, not the QE, not the $5TN in repos, not the enhanced FX swap lines, has succeeded in unlocking any of the liquidity that remains frozen deep inside America’s increasingly broken financial system. That is rather concerning and with US stocks losing 12.5% yesterday, questions will be asked about the Fed’s last bullet being a dud. Central banks have gone all in, governments have aligned billions of spending and here we are. That was a stinker of a close last night but this morning guess what; a limit up bounce! This is madness.

In a volatile session in Asia last night, which to say the least was mixed, we saw Japan’s share benchmark end up more than 2% after swinging between gains to losses. A day after a record slump, Australia had its biggest surge since 1997. Hong Kong and China fluctuated, while S. Korea fell and S&P 500 and Nasdaq futures reached their limit-up. Europe futures gained while US 10yr yields rose 5bps and the USD moved higher with USDJPY hitting as high as 107. 20 and AUD hitting .6070. Again we will have good news days and bad news days but at least the US are now realising that they face a major problem with all this and even Trump sounded a little concerned but his delivery yesterday just left my skin crawling again but he unusually warned of recession. As I said yesterday, many of us are already in one and the US maybe also. Last night we saw the Japanese March Tankan Manufacturing Sentiment: -20 vs -5 prior and governments around the world are stepping up and warning against recession, which these days is very unusual; they know what’s coming but this time, they are prepared to warn us.

So right now we have a broken economy as massive nations are shut down, a broken financial system, which the Fed has no idea what or who is to blame and a broken consumer who has been scared witless. In a services driven economy, the consumer is all-important. No wonder stocks are off 20%. Amazon is probably going to do OK as many sit at home and in the boredom, shop on line and they are talking of taking on an extra 100k workers for delivery and warehouse jobs. We have known for some time that there are some Zombie companies out there but even those more respectable names have issues and the reality is becoming clear. Companies with negative profits have no value other than the cash on hand and the near-zero auction value of other assets. Subtract their immense debts and they have negative net worth, and therefore the market value of their stock is zero. I wonder just how far could some of these could fall? I wonder if equity buybacks will be seen again; they look a little irresponsible and a waste of quality cash now. In the energy sector, Exon has been downgraded by S&P from AA+ to AA as Exxon’s “Lower Oil Price Assumption Weakens Cash Flow/Leverage Metrics”; and since the outlook is negative, it means more downgrades are coming and this could open the floodgates in this sector and some won’t make it.

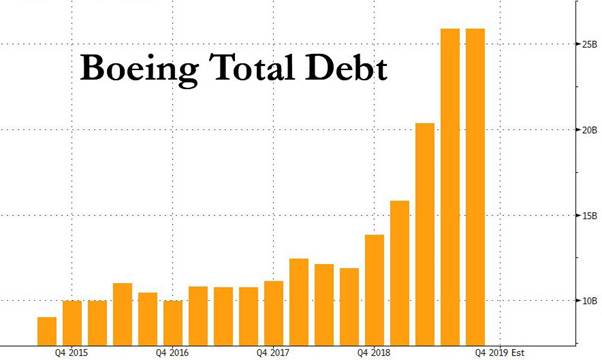

S&P also cut Boeing’s credit rating by two notches late on Monday, to BBB from A-, as its “cash flows for the next two years are going to be much weaker than we had expected, due to the 737 MAX grounding, resulting in worse credit ratios than we had forecast.” In addition, S&P notes, “the significant reduction in global air travel due to the coronavirus will likely result in an increase in aircraft order deferrals, further pressuring cash flows.” It’s started.

Why is S&P really taking this draconian action, which could topple one of the beacons of US manufacturing into junk status? Simple: in the past two years, Boeing feasted on cheap debt, doubling its debt load in one year and those equity buybacks seem rather a waste of money. Boeing has repurchased over $100 billion in stocks since 2013, helping push its stock to all-time highs not that long ago. Whoops; maybe they should have invested more heavily with all that cash in not taking short-cuts in their design and build of the 737 Max. Boeing is allegedly looking for a bail-out aid from the US government. So, the issue here is that Boeing privatised the profits and the management took millions home in bonuses but now they want to socialise the debt/losses. Get the money back from the execs first.

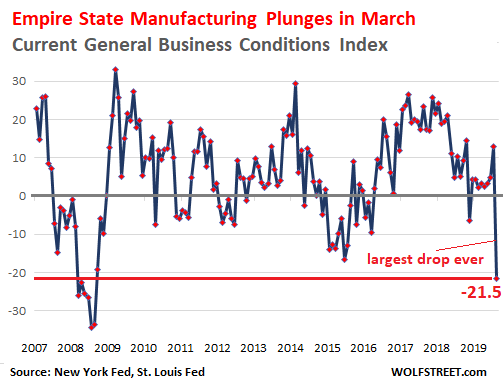

The data is about to start covering all this and as I said yesterday, the data from China was dreadful but we got a first glimpse of some US data covering the early phase as Empire manufacturing came in. No one really noticed it as many were distracted elsewhere but it was bad; really bad. The Empire State Manufacturing index of General Business Conditions plunged by 34.4 points, the largest point-drop on record, from a still relatively sanguine level of 12.9 in February, to the level in March of negative -21.5, the lowest since 2009, and right at where it had been in October 2008, following the Lehman bankruptcy in September.

And this was just the first reaction related to the impact of Covid-19 mitigation measures, so I would expect some record-breaking data to come. This survey was sent on March 1 to executives at manufacturing companies in New York State. Most responses normally come in by the 10th and the cut-off is the 15th. So this survey data released yesterday, reflects what the executives of manufacturing companies saw in the first half of March. New Orders plunged to a level of -9.3, down 31.4 points from February’s level of +22.1. This component caught my eye as well as we head towards the Jobless claims on Thursday: Number of employees dropped to a level of -1.5, down 8.1 points from February’s already low level 6.6. Average Employee workweek dropped to a level of -10.6 from February’s already negative level of -1.0. crikey! Non-farm payrolls could be interesting data next month and last night, GS cut q1 China GDP to -9%. Blimey!

The G7 major economies have pledged to do “whatever is necessary” to stabilise a global economy shaken by the coronavirus pandemic, with its leaders vowing to co-ordinate recovery plans in the face of a possible worldwide recession. The issue here is that any monies need to be targeted at the problem first. There should be targeted funds to help get ventilators and beds to where they are needed. But I think governments realise that they have to prop up the consumer and who knows what policies that will bring. A lot of helicopter talk is doing the rounds. Right now, I think if consumers are all given £1000 they would save it as they can’t go out and non-essential spending is not on their minds and there lies the problem; the consumer has drawn back and is hunkering down. The recovery time for the global consumer could be quite some time.

“We resolve to co-ordinate measures and do whatever it takes, using all policy tools, to achieve strong growth in the G7 economies, and to safeguard against downside risks,” they said. Well said but so far, they have been rather powerless to deal with implications of all this. The Fed and major central banks across the globe have thrown literally everything they have at this and markets are still not reacting. So, governments across the globe are going to shove billions at all this to bail out companies and economies alike; that means massive debt and massive issuance. Someone is going to have to buy all that; but we may need high rates to attract buyers. But maybe the age of CBs monetizing debt has arrived and the CBs buy all the debt the Treasury issues.. what a game. Issuance is the next big story and I think some laws my need to be changed and fast to allow CBs to take up the Tsunami of debt issuance about to cascade into the bond markets. Do we have a high in place in global bonds now? That’s a big call but I think we may.

Strategy wise, I am keeping the EUR short recommendation as I still think the USD is going bid with the stress in funding markets but it has been slow. GBP looks heavy still and I will add a GBP short recommendation here at 1.2225 but with a tight stop above 1.2310. I can see Cable testing the recent lows at 1.1958. The FRA-OIS spreads still suggesting a USD shortage. There may be a scramble soon for USDs in my view. I also think Bond yields are heading up!

—————————————————————————————————————-

Strategy:

Macro:.

Short EUR @ 1.1195.. Stop above 1.1250.

Short Cable today @ 1.2225 stop above 1.2310.

Long US 10yr yields @ 0.815%

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.