Good morning.. Quieter in Asia but concerns over the rising tensions between north and south Korea which saw JPY strength and a dip in equities. FX ranges were small but AUD and Kiwi were lower on poor data. Aussie unemployment especially so. I covered the BoE meeting due later today yesterday but I am going for an additional £150bln of stimulus as why do less and have to add again in August. They need the power to monetise all the debt coming down the pipe and we may get a move if Bailey is particularly dovish which seems likely. Markets seemed to have seen a more muted move on the concerning ongoing rise in hospitalisations in the US which I find interesting. I also think the USD move is an interesting one over the last day or so since the US retail sales data. But we have a massive option expiry in US equity markets tomorrow and there is talk of huge pension fund selling into quarter end. One thing is clear; this is NOT a time to be short vol. Jobless claims may impact later, especially if better than expected. Nothing expected from the Swiss or Norway CB meetings today..

Keep the Faith..

Details 18/06/20

Powell asks for more from Government: Vols to remain elevated which should be taken as a warning.

–

Jay Powell took his begging bowl to the House yesterday and asked again for more fiscal stimulus from politicians in an effort to help Main St back onto its feet as he is clearly aware that the Fed alone cannot deliver what is needed. The Fed can prop up markets and add liquidity but for the majority on Main St that is completely useless with rates down here now; only the very wealthy benefit. There have been calls from academics that this additional spending will do irreparable damage and send the USD crashing down and see the rebirth of inflation that eventually ends in economic disaster for the US and global markets.

Well, that may be the case but not for some while and as far as I can see right now, rates are going nowhere and that is why central banks and governments think they can get away with all this recklessness with deficits. BUT the key point is that during the good times these policies get unwound and that is where I may have to agree with the academics but for now, I feel we need to play what is in front of us still. But the USD and many other currencies are all becoming attached to the ebb and flow of global equity markets; in fact, just about everything is.

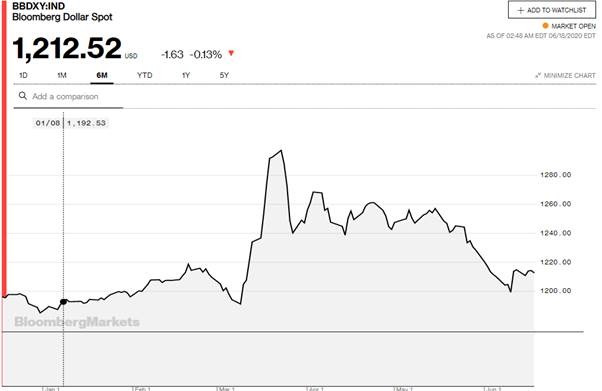

Due to the inverse correlation between the USD and risk recently, we have seen many currencies simply defy logic and FX traders have become so confused that traditional safe havens like the JPY have stopped reacting to risk on OR risk off (although we did see small gains in JPY last night as stocks drifted lower), as it used to. But as I said yesterday there are some cracks in the USD’s attachment to risk and I think what we may see is a period where certain currencies will do better than others based on how quickly a recovery is expected. If it is perceived that the US is going to race out of the crisis faster than anyone else, then we could see the USD and US stocks rise at the same time as demand for US assets sucks in USD buyers and I think we may have seen some of this in the last couple of session since the US Retail sales data. I am not 100% convinced yet but part of my reason for being long EUR was due to my view that stocks may find a base and that the massive stimulus from the ECB and Germany spending would attract global investors to EU markets. That still is in play but EUR has turned south against the USD and even fallen against a few others, almost triggering my stop just under 1.1200.

I will leave it there but I do have concerns about this move.

The path of the USD from here is unclear but in Asian markets we still see demand for the USD and safe havens when stocks fall, only for Europe and particularly the US, to reverse it, as seen yesterday with the EUR hitting the lows against the USD and AUD as stocks moved higher. I think we need to monitor this closely and blindly trading FX markets on the basis of equity market moves may be changing. The FT picked up on the confusing signals from FX markets this morning; The Australian dollar, for example, which usually weakens when demand drops, has gained about 18 per cent against its US counterpart over that period — despite Covid-19 disruption to global trade hitting the export-dependent economy hard. Sterling, meanwhile, has climbed about 9 per cent despite difficult Brexit negotiations, mounting UK unemployment and a collapse in economic output.

The OECD predicts the UK will suffer the largest contraction this year among advanced economies. But the point they are missing is that it was a global step down and all economies got hit. But is the USD still the “go to” in times of stress? Are we in fact still looking at the fact that there really are few alternatives to the USD in a crisis? If this is correct (it always will be in a real rout) and the US is also going to be the leader out of the crisis, the downside for the USD looks rather limited in the short-term; It goes up if markets stress and goes up if the US leads us out of this mess. I think we need to watch the USD closely over the next week or so and my stop in EUR looks rather vulnerable. The other issue clouding the picture in FX markets is central bank policies which distort everything and sometimes render and understanding of economics redundant. But right now the USD seems to be able to rally even as Covid-19 cases keep rising in the US and the country is run by a lunatic man who seems determined to break away from allies and break down the structure of globalisation and alienate America. But as ever in the financial world, timing is everything; but I am watching closely to see if the correlations in many FX markets are shifting.

Mind you, if there was a market totally divorced of economic drivers and focused solely on central bank policies, it is equities. Again we have conflicting drivers here with virus/economic concerns battling against monetary and fiscal policies and it seems the virus moves are slightly more muted now but we still are some distance from a vaccine. But data is just not impacting at all apart from possibly the US Retail sales data and to be honest, if shocking data was ignored on the way down, why should it matter if it recovers but of course it does as investors still look forward to a full recovery it seems and look through “rose tinted glasses”. To my mind, that could take a lot longer as for me, investors are still ignoring the massive impact from unemployment. Yes, data is set to recover as markets unlock but that is the same as saying yes, we knew the data would be bad when economies were locked down. But there is a huge belief that the Fed will go “all in” to stop equities dumping and this will see the “buy the dip” brigade continue to be active and who am I to fight that? There is a huge disconnect still between markets and fundamentals but at present the Fed is winning the battle but they may well be tested again.

But stocks, particularly in Asia are sensitive to geopolitical risks as seen again last night when tensions ratcheted up between North and South Korea. First, Yonhap reported that North Korea is preparing to redeploy troops to two inter-Korean business zones near the border and reinstall border guard posts removed under a tension reduction deal. Then, Yonhap confirmed that South Korea’s top nuclear envoy arrived in Washington on Wednesday for talks with U.S. officials. His visit was unannounced, leading to speculation that he may have been sent as a special envoy by the presidential office, Cheong Wa Dae, triggering another leg down in futures. “Our military’s patience has run out,” the paper added. “The military’s announcement that it is mulling a detailed military action plan should be taken seriously.” The JPY weakened on this and stocks fell but we have heard this sabre rattling before but it is worth keeping an eye on. I don’t think EU or US equity markets will be as sensitive to this later today though. But virus resurgence in China is an ongoing concern.

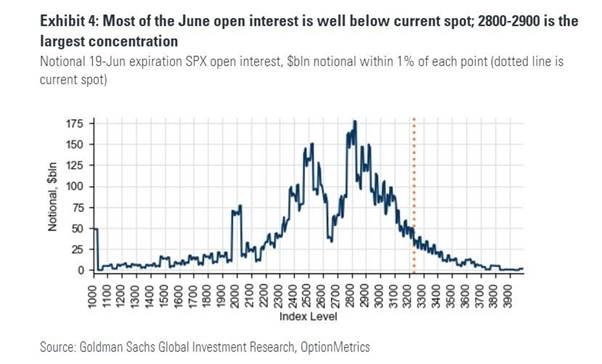

Then of course we have the usual uncertainty around month end coming up; just to make things really difficult. These distortions have been quite large recently and so an early heads up is required. Volatility is going to remain high as the next two weeks promise to be volatile for stocks for two reasons: first, there is a rather massive option expiration set for this Friday (with some caveats), and then for quarter end, we are facing what appears to be one of the biggest pension fund dumps in history. On the options front, June’s expiration is massive with $1.8 trillion in SPX options expiring on the 19th making it the third-largest non-December expiration on record, in addition to $230bln of SPY options and $250bln of options on SPX and SPX E-mini futures. But according to Goldman’s, as a result of the strike distribution heading into Friday, the gross gamma exposure is relatively modest (Open interest is not huge either).

There is some evidence that month end pension selling will be substantial, as a result of the outperformance of stocks over bonds this quarter. Indeed, according to Goldman, as of the close on Tuesday, the desk’s theoretical model estimates a net $76bn of equities to sell, the third largest estimate on record, only behind Mar 2020 and Dec 2018, both of which happened to be extremely volatile periods. So, over the next two weeks we have the above to consider, rising geopolitical risks in Korea, Turkey, Syria and many other places and a virus running wild with no vaccine. I am not sure the Fed can support all that if it all kicks off but they will make a fist of it; they already have. But my point here is that volatility and the VIX will remain high and into the end of this month is going to be very choppy indeed. Trade accordingly.

—————————————————————————————————————-

Strategy:

Macro:.

Long EURGBP @.8978 added @ .8940. Stop at .8900

Long EUR @ 1.1360.. Stop at 1.1200ish. Added at 1.1285.

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.

Risk Warning

This information is powered by Strategic Alpha. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice.

Home

Home