Good Morning.. A mixed session in Asia but the USD remained nailed to the floor. Cable seemed to be leading this and got another boost from inflation data this morning that saw significant beats in Core and headline inflation. The global inflation concern is growing and is becoming a serious topic of conversation among many funds and asset managers I would think. Gold is a little heavy now and maybe as, according to BoA, it is the second most crowded trade out there after tech stocks. But to my mind, the core reasons behind the move lower in gold and the US dollar is Fed monetary policy and that is not changing anytime soon. I find it rather frustrating that I missed this new leg lower in the USD as the rally petered out earlier than I thought but I think this move is in a new leg of the down move now. FOMC minutes tonight and EU and Canada CPI later and I am starting to take a lot more notice of these data releases now.

Keep the Faith..

Details 19/08/20

The USD takes another step lower.

–

Just about every G10 currency broke some significant chart levels yesterday as the USD entered another lower phase. It looks to me that I may have missed a buying opportunity in EUR and am rather stuck with crosses in a USD move, which I find rather annoying having been bearish for so long on the USD. The bounce we saw last week, did not extend as far as I thought it may but at least gold has been a saviour. Cable did a lot of work yesterday and took out 1.3205 previous highs and what looked like a double top and could be looking to test 1.3303 on a retracement or even 1.3354 a previous high close. (Weekly chart below).

But one word of caution on GBP here as Brexit trade talks have resumed and there still seems to be big gaps and negative headlines this week seem possible. There is some concern that Brussels has rejected the UK’s opening demands for continued wide-ranging access to the EU for British truckers, setting the stage for a clash when Brexit trade negotiations resume today. EUR took out the previous 1.1916 high and didn’t look back as the DXY broke the previous lows around 92.50 for the first time in 2years. AUD/USD’s break of 0.7243 resistance suggests rally resumption and again, I still think that sitting at the core of this dollar move and the move in gold, is the Fed and its continued debasement plans for the USD in some hope of creating inflation, which if and when it does show up, they may struggle to contain due to fears of destabilising equity markets. Meanwhile, US stocks make new all-time highs.

Fund managers now see a portfolio with equal holdings of stocks, bonds and gold as the most expensive since 2008, according to the latest monthly Bank of America poll of investors. Tech stocks are the most crowded trade but interestingly gold is second now. Cash balances reported by fund managers in the survey have slipped, indicating more money has been put to work in riskier markets. But cash still represents 4.6 per cent of portfolios, comfortably above the 4 per cent level that BofA analysts think signals the emergence of “greed” in market behaviour. “We do not think positioning is dangerously bullish,” they said; Blimey!

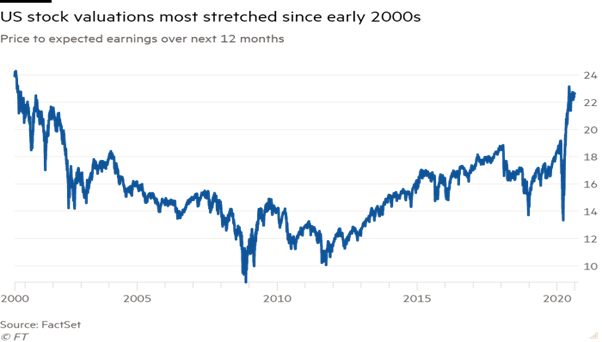

Chart showing price to expected earnings over the next 12 months

Wall St has turned quite bullish with GS predicting the S&P will rally another 6% into year end. The “everything rally” has been built on hopes that monetary and fiscal stimulus will succeed in steadying the global economy as scientists’ race to find a Covid-19 vaccine, investors and analysts have said. In fact there is a lot of “hope” driving a lot of assets right now. The danger is that hope can disappear very quickly.

Fed policies are driving investors into taking on more high-risk products which no longer hold any risk premia. I will be keen to see the minutes of the last FOMC meeting tonight to see how discussions on more policy initiatives are going. The additional yield above US government debt on corporate bonds with a triple C rating or lower, placing them near the bottom of the ladder, has fallen more than 1 percentage point to 12.38 percentage points over the past month, according to Ice Data Services. My point is these bonds are called Junk for a reason but pricing no longer reflects that. But again, investors have been told that the Fed will do all it can to support the credit space and therefore the small rewards for such high-risk debt are worth it in a zero-yield world.

The fact that central banks are creating moral hazard is concerning but these unelected officials will never be held to account but I do worry about what they are creating. Do they really know how to get out of all this? What happens if they do get what they want and growth and inflation do return? Can they ever seriously fight inflation if the markets continue to hold them to ransom? This deliberate suppression of the free moving capitalist structure that is at the core of free markets is a real concern of mine and we are now living through a new paradigm of socialised markets. Governments of course, support this strategy and are adding to the issue by piling on more debt but one day, debt will matter.

Just to add to the global rise in geopolitical tensions, I think we need to add Turkey and Greece to the list of concerns as France has ordered forces to the eastern Mediterranean to assist Greece, escalating a standoff between Greece and Turkey over oil drilling rights. Keep an eye on this as Erdogan may be keen to deflect attention for a cratering economy. The build-up follows Turkey’s deployment of a fleet of ships guarding the research vessel Oruc Reis as it sails in international waters between the Greek island of Crete and Cyprus, surveying the disputed seabed. Erdogan has also warned that Turkey will respond to any attack on its vessel. Let’s just say that Erdogan is unpredictable at times and so I think it is worth bringing this issue to the fore. It seems there are now a few pockets of geopolitical risk out there now. Again, global equity markets hope that nothing will happen and indeed so do I!

UK inflation came in higher today with RPI rising 0.4% above expectations. Headline CPI beat by 0.4% and came in at 1% while Core CPI came in 0.5% higher than expected in mom and yoy data. It is interesting that we are seeing rising inflation in many economies which are suffering from a deep recession. The inflation story is hotting up. In recent weeks, we have seen a series of upside surprises in inflation data, that mostly reflect the big imbalances in the economy following the COVID recession and some data noise. However, we cannot rule out that we will experience in the recovery phase, a prolonged period of high inflation due to a sudden change in regime shift characterised by rising protectionism and more redistributive policies to fight against inequalities. The sheer size of the government and central bank policies are beginning to set off a lot of talk about future inflation and whether the central banks would be able to deal with it.

It is clear that a deep recession is deflationary but we need to look forwards to what the build up is from central bank and government spending policies. In fact, it is also worth considering the idea that we still fail to get sustainable growth but inflation does arrive, creating stagflation. This is something that is rare but does happen and usually created by central bank monetary policies. Some argue that the massive surge in money supply will continue to inflate asset bubbles in real estate and in the stock market, as it has been the case since the GFC, but will have little impact on the real economy (I agree) as a whole due to the persistent decline of both the money multiplier (the amount of money that banks generate with each dollar of reserves) and money velocity (the rate at which money is exchanged in the economy).

We also arrive at a time when globalisation is at risk and we see a polarisation of the two biggest economies on the planet, which to my mind will stifle global growth/trade. Surely, rising protectionism is not good for continued lower prices. I think this is part of why gold has re-emerged as an inflation hedge and more macro funds do seem to be keen to have some hedge on the books, even though this is probably an issue for a couple of years down the road but some early signs are starting to show up. There is a lot of data “noise” and we still need data to settle down after the unlocking of economies.

In my view, inflation has not disappeared from the real economy over the past years, it is still here but it cannot be captured by CPI as it measures the average inflation in the economy. There are pockets of inflation in many parts like rent and healthcare and many still experience rising costs. A lot of the inflation created by the central banks resides in the financial markets but that could, one day, filter into the broader economy. In the US, it seems that inflation is split between the generations or that some feel it and some don’t as it is where the inflation lies that counts. Retired boomers, who generally own their homes, live in the small towns and suburbs, shop at superstores and get their medical expenses paid by Medicare have experienced deflation. Conversely, new job openings for younger generations have been almost exclusively created in major urban areas where costs have exploded (rent Medicare, food and utilities).

The point is that young generations (Millennials and Gen-Z-ers), who contribute most to society based on productivity measure, pay more than anyone else and still face no access to capital to buy a home and live properly. The irony here, as I have said before, is that the recovery may usher in the much-wanted inflation that central banks crave. I think they need to be careful what they wish for as markets will not be keen to see rates rise any time in the next couple of years at least. But for many, this is far too macro but aren’t central banks supposed to set policy 12-18 months ahead? I don’t see them doing that at all and will react when it slaps them in the face, by which time it will be too late.

—————————————————————————————————————-

Strategy:

Macro:.

Long EURGBP @ .9030.. Stop at .8950ish.

Long Gold @ $1875 Stop at $1875

Long EURJPY ´126.00 Stop at 125.10.

Long EURAUD @ 16515 looking to add at 1.6420 and Stop below 1.6235.

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.

Risk Warning

This information is powered by Strategic Alpha. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice.

Home

Home