Good Morning.. I closed the Cable short position last night and while suggesting we take back the EUR in front of the ECB meeting at 1.0900, the fact they have done the usual makes me think we cannot be anything but short and I have suggested going back in at 1.0932 (at the time of writing earlier). I fear that if the EU do not come round and help the citizens of Italy, Spain and Greece, then they will never be forgiven and the EU could face an existential threat. The EUR could also be the next capitulation trade (see below). Add to this that as US stocks keep falling, more hedges need to be taken off and that means USD buying. Add to that the fact that US yields may keep moving higher as the bull run ends in bonds and that the more growth stalls, the less dollars are moving around the system, I find it hard not being long the USD until Mnuchin does something about it. The EM space looks very fragile and I wonder how those huge non-bank lenders are getting on? This USD move is not over yet and 1.0500 on EUR looks likely to me. The RBA cut but did you see 10yr Aussie bonds? (see below). Markets are NOT responding to monetary policy but the fiscal cure is creating the mother of all debt crises. Oh dear.

Keep the Faith..

Data.. All Times GMT

08:30.. Swiss SNB Sight Deposit Interest Rate Cons: -0.75% Prev: -0.75%

09:00.. Germany IFO Business Climate Cancelled

12:30.. US Current A/C Cons: -108bln Prev: -124bln

US Initial Jobless Claims Cons: 220k Prev:211k

US Philly Fed Cons: 9.0 Prev: 36.7

14:00.. US Leading Index Cons: 0.1 Prev: 0.8

Details 19/03/20

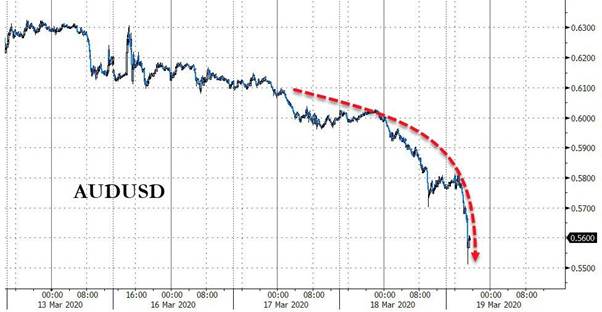

We have seen the capitulation in GBP and now AUD; EUR next? How on earth do we ever get rid of the massive debt mountain that our governments are building and at what cost?

I hope you all got my note last night, Cable got clubbed down to 1.1450 as we saw mass capitulation from some very large funds and asset managers. I recommended we took profits on such a move in the mid 1.1500’s after a strong rejection of the low. The reason for this, apart from the clear lack of liquidity is that an asset manager/fund (or two) in the UK that bought or was long US stocks would have hedged the USDGBP exposure and as they saw stocks dump and they started to get out, they had to sell GBP to close the hedge. I think this was one of the bigger boys getting some pretty big chips off the table in stocks. But the same applies to the rest of the investment world as they have spent years buying the US stock market as it out-performed everyone and the short in USD through the hedging must be pretty large against many currencies. We saw a similar capitulation in AUD last night (trading down to .5500) and to my mind the EUR could be next. Due to the ECB emergency meeting last night, I recommended bringing the stop in EUR down to 1.0900 and that got triggered but I am not sure at all that the EUR low is in place and I am also not sure that the ECB has gone anywhere near far enough and for those of a similar mind, you may want to re-establish shorts again at no loss above 1.0925 (at the time of writing) and just put a tight stop above 1.1000. I would think a lot of EU asset managers are now contemplating getting the hell out.

The ECB, last night, announced plans to buy an additional €750bn in bonds after holding an emergency call of its rate-setting committee on Wednesday night in response to the worsening economic and financial turmoil caused by the coronavirus pandemic. Here we go again; more of the same and not enough and not addressing the real problem. Italy needs bailing out; fully. Unless the EU can come together and go large to save Italy, I think the damage could be existential for the EU. THIS IS NOT ENOUGH. Who in Italy will this help? No one. When will the EU governments realise that the peripheral of the EU is shattering in front of their eyes and that the people need help; not just the markets? But there is a fundamental problem here and is why there has been no banking Union in the EU. Germany is not prepared to transfer its wealth to the likes of Italy, Spain or Greece. I really do think the EU is real danger hear, as if this all gets much worse, I do not think Italians, the Spanish or the Greeks will ever forgive the Group for not helping. So, while we have come lower in EUR, the real threat to the EU itself is just beginning and I am sorry to flip my view so soon but I find it hard not recommending being short the EUR still. I didn’t get the Bazooka from the ECB that I expected and while we can still see a very nasty blow-out in peripheral spreads, it is the politics now that may nail the coffin lid on the EU.

The RBA cut its key interest rate to 0.25% last night and adopted a Japan-style yield curve control among a raft of measures and there seemed to be a hint about intervention in the currency which turned the AUD off the lows. But the reaction of the AUD 10yr after the RBA cut sums up what happens when central banks don’t do enough of what the market is wanting or looking for: 10yr yields rose 128bp!!! The mkt was looking for QE across the whole curve but RBA only announced yield targeting in the 3yr tenor.

Central banks are trying to keep the curves steeper to help the banks and they are all turning Japanese. Maybe I was right; and Japan is the template for us all; just more ahead of things. But the move in GBP and AUD was weighed upon also by a surging USD just at a bad time as US yields continued to push higher and I am not at all convinced that this move in USTs or many other bonds is done yet unless the Fed has plans to do something about it. This rising USD will be a thorn in the side of Trump and I am sure there are discussions with Mnuchin going on about this break higher in the Buck. The DXY blasted through channel resistance at 101.15 and took off with a target now of the 2017 top at 103.82!

The EUR, to be honest, with all that faces the EU at present, has been remarkably resilient but I am not sure this can last. If there is a fragile economy with governments unwilling and a central bank ill-equipped to deal with this crisis, it is the EU. Virus cases are now higher in Europe than in China ever were and the problem is not going away as the whole EU is likely to shut down. Can they ever recover as they were weak economies going into this? The ECB is in this morning helping contract those BTP/Bund spreads but they are going to be busy for a while.

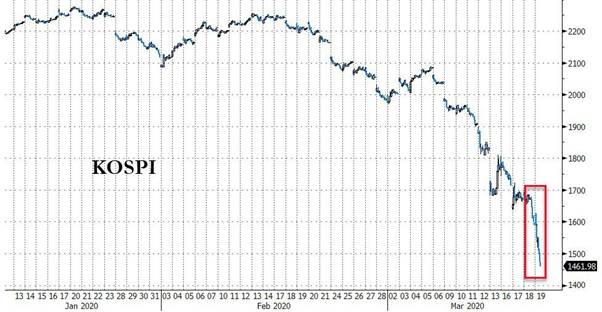

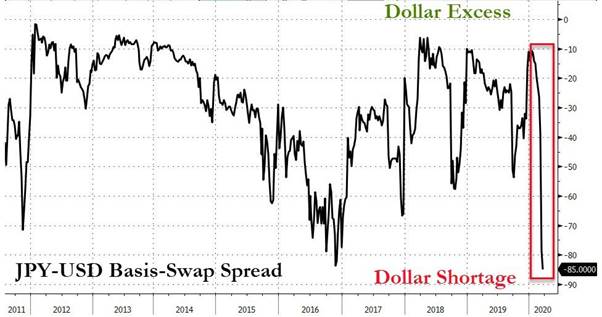

I have no clue who is buying the EUR but possibly short covering into the ECB meeting last night and the ECB was in supporting BTPs yesterday but it seems to me there is still a split on the ECB council with regard to a response. Merkel suggested the EU faced the toughest times since WW11. Meanwhile, the natural supply of USDs into the system is blocked up and hoarding is creating a scramble for the USD. The issue here is that the slower the global economy runs, the more the natural circulation of dollars recedes and ergo, the USD rises and we have not seen the total stall yet in trade and industry that may be coming. It is a vicious feed-back loop and is set to continue. Lagarde is about to realise that it is her job to close the spreads (as they are trying this morning). If not, then the EU will face an existential crisis and for the life of me I have no understanding of why anyone would want to buy that currency here. The world as we know it has stopped and it is like Atlas, who is holding up the globe, shrugged and sent a shock down the middle like a huge earthquake. The impending Tsunami may be on its way as global growth is going to go negative and that kills the EU and many of the weak components of the EM space and the massive reduction of USDs in the system will take the USD a lot higher and the problem is exacerbated by the end of the 11yr bond bull run. If that is not a perfect storm, then I do not know what is.

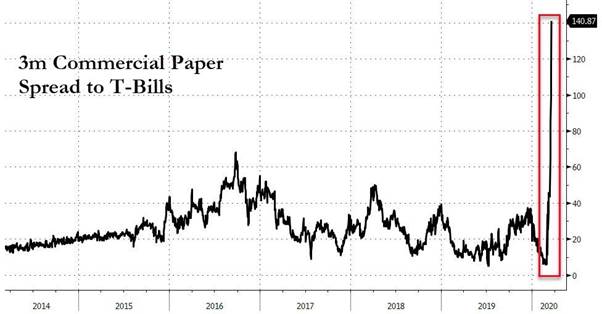

But as stocks fall, investors who hedged in bonds are being forced out of all the hedges and bonds look set to really dump here and the curve steepen. The Fed do not need to consider YCC with this going on. I will be very interested to see how US weekly Jobless Claims come in today as they may start picking up the disaster that is coming to part-time jobs and in some cases, full time jobs. I would think NFPs next month could be a stinker. The long end of the curve is falling with some ease and not just in the US. This is the worst thing that could happen right now and I wonder what the SNB will do/say this morning? The FRA-OIS spread was wider again last night and after all the Fed liquidity pumping, it seems it is not enough to quell the appetite for dollars. I think the only key outlook issue now is gauging the depth and the duration of the 2020 recession as we are in it and some will take a lot longer to get out of it than others. China’s first half growth is going to be abysmal and I can’t even put a number on it but it will surely hit the EU very hard indeed.

The EU is not even at peak virus let alone recovering from it and the mass shutdown in industry will take a very long time to recover. With the unprecedented seizing up in activity across a wide range of sectors, we should brace for a disturbing set of economic releases in March and April. Meanwhile, the Fed continue to go back to emergency measures from 2008 to deal with the funding crisis. The Fed has just announced the establishment of a Money Market Mutual Fund Liquidity Facility, or MMLF. As the biggest buyers of commercial paper, this bailout facility is clearly aimed, once again, at being another effort to reduce the spiking risks (and freeze) in the critical short-term liquidity markets. While yields did compress a little (positive) yesterday, risk increased notably despite CPFF.

Something is clearly amiss, and I wonder how many more times I will say that. This had better work, or the Fed is running out of emergency measures.

I still have huge concerns about what is stressing the credit markets and certain sectors look likely to see some serious casualties, especially in energy. We have tolerated Zombie firms as the central bank policies kept them alive driving margins to nothing and increasing debt. These businesses are finished unless the CBs decide to bail them all out but why would they; they should have gone years ago as they do NOT function. The CBs and governments are going to have to let some go to the wall and some of them are quite large. Quite how much these companies owe to the banks or non-bank lenders is anyone’s guess. Is this USD move about to end? Well, in my view, the dollar is the global funding currency for $12 trillion in USD-denominated global debt and the margin call has just come in. In addition the whole world was long US stocks and hedged the USD which now needs unwinding. That’s a lot of USDs to cover and at the same time the US bond market bull run may be over.

Add to that the Tsunami of issuance about to cascade into bond markets and one wonders if the Feds new QE programme is anywhere near big enough to stop bonds collapsing. Kudlow, last night before the close, said if it takes more than $1.3trln they will do it; so $2trln or 3? The Fed will buy a lot of this but remember that rates in the US have dropped a lot recently and bonds are a lot less attractive now to many foreign buyers. Are there enough buyers on the planet for that; let alone those that will discount the threat of default for an almost zero return? As they fix one problem another pops straight up. The world’s bond markets are all starting a global beauty parade to attract buyers of debt but that means yields may have to rise and there is simply more debt than buyers and that includes central banks unless they change the law.

Again, we had it all yesterday with Kudlow saying (more talk and no action) the US may even buy equities (anything to get them higher so Trump gets re-elected) and the ECB was sitting down after it got dark for a change to have a crisis meeting. Surely, they didn’t skip dinner and a glass of Rouge! Forecasters are struggling to compute all the unknowns but some are foolhardy enough to try and we heard GS trying the other day. Now we see JPMorgan has slashed its forecast for real US annualized GDP growth in Q1 to -4.0%, followed by an even weaker -14.0% in Q2, far, far worse than Goldman’s -5%. However, just like Goldman, JPM too sees a V-shaped recovery in Q3, when it expects the economy to recover to 8.0% in Q3 followed by 4.0% growth in Q4. For the full year (Q4/Q4) JPM now look for growth of -1.5%, a number which will be more of a Great Depression-like -10% if the second half rebound does not materialize. No wonder the CBs and governments are going all-in.

—————————————————————————————————————-

Strategy:

Macro:.

Short EUR @ 1.1195.. Stop above 1.1250. Took profits at 1.0900 but re-entered this morning at

1.0932 with a stop above 1.100.

Short Cable @ 1.2225.. Stop above 1.2310 Took profits last night at 1.1565

Long US 10yr yields @ 0.835% (short USTs)

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.