Good Morning… Oil bounced last night with WTI up 8% and Brent rising 10% as some hope that some sense can be drummed into Russia and Saudi Arabia emerges but we shall see. This seems to have helped stocks bounce of the lows after a weak Wall St close last night. The Fed also helped (see below) as it announced after the close that to ease strains in the Treasury market resulting from the coronavirus and increase banking organizations’ ability to provide credit to households and businesses, the Fed announced a temporary change to its supplementary leverage ratio rule, which would exclude U.S. Treasury securities and deposits at Federal Reserve Banks from the calculation of the rule for holding companies, and will be in effect until March 31, 2021. This frees bank to increase loans to small businesses but the thing with loans is they are only as effective as the demand for them. The USD is rather mixed with risk off attracting demand but with all the Fed are doing, it is clearly bearish. In the middle of all that, I am prepared to remain of the view that EURGBP pushes lower still as nothing has changed there and price action is very weak. No bounce and no rush to cover and the fundamentals remain. If we do see equities rise a tad, we may see the USD fall and Cable could test the resistance at 1.2480-1.2500. If we break then 1.2800 here we come.. But I am still rather bearish on stocks but suggest a reassessment if S&P hits 2620ish..

Keep the Faith..

Data.. All Times BST

09:30.. UK Construction PMI March Cons: None Prev: 52.6

10:00.. Eur PPI y/y Cons: -0.8% Prev: -0.5%

Eur PPI mom Cons: -0.2% Prev: 0.4%

13:30.. US Initial Jobless Claims Cons: 3.5mln Prev: 3.283mln

13:30.. US Trade Balance Cons: -40.0bln Prev: -45.3bln

15:00.. US Factory Orders Cons: 0.2% Prev: -0.5%

Speakers:..

None

Details 02/04/20

The US blame China for dodgy numbers: But they have been slow to react:

–

In what some could suggest is a plan to deflect blame for the late response to the virus in the US, the intelligence agency has suggested that the numbers that were originally reported in China, of those infected and who died, have been massively underestimated. That may or may not be the case but there is no getting away from the fact that the US and in particular, Trump, have been slow to accept the scientist’s forecasts of events and act. That is a mistake that will cost thousands of American lives. The US is way behind the rest of the deeply infected nations and a shock is coming to US shores and any thoughts of a V-shaped recovery are misplaced and optimistic in my view. As I expected, stocks have finally started to price this but I am not sure at all that the damage to earnings is fully priced yet. Many companies will not open again and while the Fed is going to add funds to massive chunks of the business community, some are not eligible. The non-bank lending businesses stick out here and to my mind, even with all the Fed support, the credit space is still high risk. Companies in the US are highly leveraged and piled full of debt. (Financial Post Sources (?): top US banks are threatening not to take part in the US Admin’s small business rescue program because of concerns about taking on too much financial/legal risk). Nice.

The Fed has gone another step in its fight to help with liquidity. A few experts had called for more action and last night the Fed took another step. The calls were for the Fed to ease the tension in the Treasury market and to potentially unlock hundreds of billions in new lending capacity among US commercial banks, this was to exclude Treasuries and deposits from the Fed’s much maligned Supplementary Leverage Ratio Rule, which forces banks to hold ultra-safe Treasuries and/or deposits on their books (which are traditionally viewed by the Fed as less risky than loans) or else suffer a G-SIB capital surcharge. Well the Fed has now relaxed that and USTs rallied last night. The Fed announced after the close that to ease strains in the Treasury market resulting from the coronavirus and increase banking organizations’ ability to provide credit to households and businesses, the Fed announced a temporary change to its supplementary leverage ratio rule, which would exclude U.S. Treasury securities and deposits at Federal Reserve Banks from the calculation of the rule for holding companies, and will be in effect until March 31, 2021.

Explaining the move, the Fed argued that as a result of the dramatic increase in deposits observed in recent weeks as investors dumped risky assets, banks may be limited in their abilities as “financial intermediaries and to provide credit to households and businesses.” The change to the supplementary leverage ratio should therefore “mitigate the effects of those restrictions and better enable firms to support the economy.” Usually if you give banks more money they shove it in the stock markets but to make sure that the expanded balance sheet capacity is not used by banks simply to accelerate stock buybacks, it explicitly stated that “the Board is providing the temporary exclusion in the interim final rule to allow banking organizations to expand their balance sheets as appropriate to continue to serve as financial intermediaries, rather than to allow banking organizations to increase capital distributions, and will administer the interim final rule accordingly.” Well said Jerome and I note a slight weakening of the USD this morning. Translation: what the Fed has effectively done is granted banks some 2% in balance sheet capacity to use as they see fit, as long as it is not for buybacks, eligible capital which they can – and likely will – use to buy more Treasury’s knowing they can then just flip those Treasury’s back to the Fed with a profit. Nice. Free money. With all the Fed has now done, do we feel they see a V-shaped recovery? The only thing I will say about creating more loans is that loans only help if there is demand for them.

The direction for the USD is rather opaque here as there are conflicting issues pulling in different directions but with all the Fed is doing it is hard to justify a USD long position. But risk off, if we really do tank, may see the USD rise. So it seems sensible to trade by taking the USD out of it and for that reason, I am still comfortable being short EURGBP for a while. Nothing has changed in my view and we are trading on recent lows here this morning and a test of .8747 mild support looks likely to me. Cable has some resistance between .12480-1.2500 but a break there brings 1.2800 into view. France has called for a Coronavirus bond but it is all very well suggesting help for the weaker nations but you have to convince Germany and the Netherlands about that. Again, this is a cancer inside the EU and it is not going to be forgotten. The ECB cannot fix this issue. (EURGBP below).

My target is still .8500.

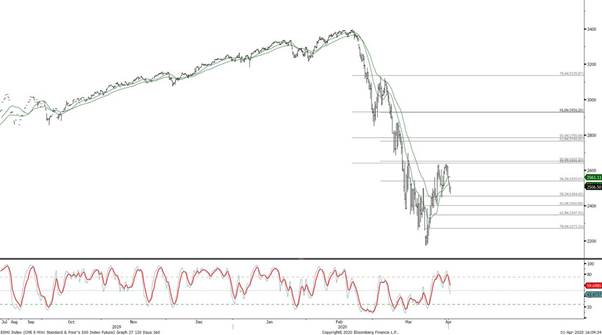

Meanwhile, Germany has extended its lock down until after Easter and the US is only just shutting playgrounds. Cases in Italy, Spain and the UK continue to rise and we are, in some cases, weeks behind peak virus and the US is even further behind but they need to prepare themselves for some shocking stats. The US has been slow to order people to say apart let alone stay indoors. Social distancing and testing have been methods that have probably saved many lives and the US is only just thinking of such measures. They may well pay for this. The number of deaths multiplied from 1,000 to 2,000 between Thursday and Saturday last week. This means that businesses will remain shuttered and for longer than many expect and the economy will stall. We have heard the horror stories for US growth and unemployment and today’s weekly Jobless claims could be historic by some margin. (GS are projecting 5.25m initial jobless claims number). Helicopter money is on its way but when; and will it be enough to see many through a crisis which may not end in 2 weeks or 2 months? The US is not ready for what is about to hit them and for that reason, I remain bearish the S&P and look for at least a test of recent lows. (Thanks for the chart Robin). I would reassess above 2620ish.

Then we heard that China is yet again locking down certain areas. Reuters reported that a county in central China’s Henan province announced on Wednesday it had “virtually banned all outbound movement of people, following several cases of coronavirus infection in the area.” How soon are people going to be comfortable going back to work, let alone travelling or taking a holiday and the hit to the consumer in all this is massive. Manufacturing PMIs were mixed but for me it is services that matter now and they are going to be dreadful when the data finally picks up the shutdowns. This is real; not some April fool joke! How fast can an economy repair itself after such a shock and this is both a supply shock and a demand shock; the world stopped. Force people to stay at home and the economy disintegrates; send them back to work and the virus hits hard and infects thousands more. We not only need to get past peak virus (which will be wonderful news) but we also need an all-clear.

Firms have already cut costs and for many the only option now is to lay off staff. Some of that will be seen in today’s jobless claims but it is likely to continue. But many corporate costs are fixed an earnings and margins will dive. Defaults seem inevitable with portfolio liquidations and forced selling. This applies to all sorts of companies. This could be a recession of some size and my fear is that the recession in the US lasts quite some time as they become the epicentre of this crisis. As far as stocks or investments are concerned, I am not sure at all this is the time to be brave or try catching falling knives. Oil is killing many over-leveraged and high debt companies and defaults there look very likely. Costs and jobs will be slashed and the oil and gas industry directly provide more than 5% of American jobs (and more indirectly), and it contributed greatly to the decline of unemployment since the GFC. That industry, like the auto industry is on its knees now. Analysts look for a move back to normal soon but what is the new normal going to look like?

So, what’s coming down the line, deflation or inflation? That is a very good question and one that probably depends on the time horizon as in the s/t it is deflation we face. In the longer teem it could be inflation. Many argue that no one is earning any money, therefore can’t spend anything, that’s deflationary – but we just created billions of billions of cash. The real issue is where all that printed cash actually goes and if the supply shock lasts then demand may outstrip supply; ergo prices rise. But that’s for another time. Right now we have to figure whether many asset markets and especially stocks, have priced all this in. I think not yet. If there is to be a V-shaped recovery, then why is the US administration talking of a further stimulus. The point is, we know these are bad times and sometimes the bad news gangs up on us. That surely can’t come as a surprise, nor should we pretend it does. If that is the case, to my mind, the US aren’t doing enough to overcome the challenges they now face. That is going to be mighty expensive in all terms; human and financially. What we need right no are the anti-body tests so we can start getting those who are immune or had the virus back to work or some form of normality. It is this testing that could make a difference but to test a whole population will take a long time.

HSBC (who cut dividend) and Goldman Sachs have now both come out with estimates about the extent of the collapse of share buybacks. So far into this crash, over 50 companies have suspended share buybacks, accounting for $190 billion in cash that is not flowing into the stock market, representing over a quarter of total share buybacks in 2019. HSBC estimates that over the next two quarters, share buybacks in the US could be cut by $300 billion, meaning $300 billion in “lost inflows” into the stock market. I would imagine, in this environment, more cuts are coming as it looks an irresponsible action now. I think they should be banned and I have said that for a while. This huge inflow – this relentless bid by companies to buy their own shares at the highest possible price to drive up share prices further so that executives get a bigger bonus – and the ceaseless hype surrounding it, helped inflate share prices into one of the greatest stock market bubbles ever, including a ludicrous 30% gain of the S&P 500 in 2019 when the economy was already struggling and when actual earnings growth had stalled. It should be stopped; now.

New Zealand’s central bank ordered the nation’s banks (most of which are owned by Australian lenders) to stop paying dividends and redeeming capital notes on Thursday in a move to bolster their balance sheets during the coronavirus crisis. The restrictions enter into force on Thursday and follow similar moves by European monetary authorities, which asked banks last week to refrain from paying dividends or share buy backs to enable banks better support the economy during what is expected to be a deep recession. The concern is justified and I guess many governments are no longer expecting that V-shaped recovery. I would imagine that the pressure is now on Aussie government to do the same. Last night we saw Aussie Business confidence fall; coming in at -11 after -1 prior.

According to the FT, fears of retirees making panicked runs on investments, a new generation of workers facing higher premiums and a $1.4tn state fund defying tradition to move away from domestic bonds are all part of the turmoil that the coronavirus pandemic has wrought on Asia-Pacific’s pensions industry. Investment funds and policymakers across the region, the first to be hit by the viral outbreak, have been forced to reassess their until now ironclad promises of money in retirement for ageing populations. Retail customers are losing millions in their pensions, ISAs and other investments and it will take time for confidence to return; this is not the time for non-essential spending. Investors and consumers will keep their social distancing from markets and non-food shops for a while.

—————————————————————————————————————-

Strategy:

Macro:.

Long Cable at 1.1675.. Took profits @ 1.2380

Short EURGBP @ 8901.. Stop above 9020.

Short S&P 2558

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.