Good Morning.. Blimey! Volatility in FX is back!! Cable hit 1.1411 last night and so far has had a high today of 1.1866 and AUD has bounced from .5000 yesterday to a high of .5986; incredible moves for FX markets that have been suffering so long from vol suppression. As I said yesterday, I think EURGB has a high in place now but I missed it. Risk on overnight is spilling into the start of Europe and we may have a better day but one word of warning, as this is quadruple witching day for options. But this may see a final blow in vols potentially calming things down next week and it seems there is some demand to get back into equities. The Fed swap lines helped ease some of the USD pressure but I have moved my stop down in EUR to the entry point so it’s a free look just in case US funding issues continue, as not all ills are cured in the credit and funding space in my view and we have not reached the peak for the virus and so shock headlines are still very likely, especially from the US. But governments are throwing trillions at this and there lies a problem; more debt to get rid of. If the corporate bond market is as broken as some suggest; why don’t the Fed request permission to buy; like the ECB can do? That would change a lot! But we are starting on a very positive note this morning (relative to recent days) but with all the option noise and potential left field headlines, don’t get married to a view here; plus it’s a Friday, so “Be careful out there”..

Keep the Faith

Data.. All Times GMT

09:30.. UK PSNB ex Interventions Cons: 0.8bn Prev: -9.8bn

10:30.. Russia Rate Cons: 6.00% Prev: 6.00%

12:30.. Canada Retail Sales m/m Cons: 0.3% Prev: 0.0%

Canada Core Retail sales mom Cons: 0.2% Prev 0.5%

14:00.. US Existing Home Sales Cons: 5.51mln Prev: 5.5mln

Speakers:..

09:00.. ECB Speaker: Rehn (Very Dovish) at Briefing on Coronavirus’ Economic Impact

Details 20/03/20

The Fed extended swap lines and some currencies bounce but stress still there in the funding markets. Should the Fed request permission to buy corporate bonds?

–

We saw some serious reversals yesterday after the Fed extended the swap lines and I am sure by now that you know where they were extended to. AUD rallied strongly after hitting a low of .5502 the previous night and made a high yesterday in NY of .5967; that is some move for the AUD.

The day’s range was massive. Norway and a few Skandies did OK as well but interestingly the EUR never found a real bid all day and broke that 1.0700 level I was talking about and struggled ever since.

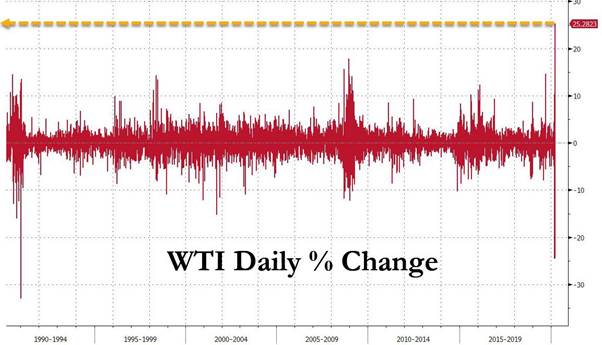

This could be a significant break and this after all the ECB has pledged to deliver but a risk on theme overnight has seen EUR bounce back somewhat. Oil has rebounded violently, and after rising as much as 26%, WTI settled up $4.85 at $25.22, or 23.81% higher, the biggest 1 day gain ever and is up a further 3.5% at the time of writing. Wow!

GBP had a real roller-coaster and yet again, after a steep and strong rally to 1.1795, fell against the rising USD and took another leg down when Boris again refused to want to lock London down bringing scorn from Italian scientists suggesting they were not reacting quick enough. However, I do think a high may now be in place for EURGBP and to my mind all the problems, both political and financial, lie in the EU. I would not be surprised at all to see the EUR lower still from here and recommend staying short for now unless we hear something on the USD from Mnuchin as that would suggest all USD bets are off, or the stop, which I am bring down to the entry level of 1.0932 is hit. The USD is due a breather and it seem today may be a day of consolidation.

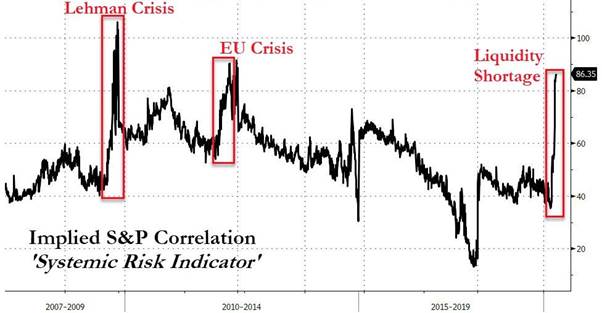

Overnight we have seen some calm restored to Asian markets with HK gaining 3%, Australia’s S&P/ASX 200 added 3.6% (as the stock index rebounded from a more than six-and-a-half year low) and South Korea’s Kospi benchmark was 4% higher. That index closed 8.4 per cent lower the previous day, triggering market circuit breakers and trading halts. Japan was closed for a holiday. Markets possibly reacting to further interventions from central banks with the BoE cutting and adding to QE and the ECB commitment to do more if necessary but we still probably have some shocks to come as the UK and US and a few others are not at peak virus yet. Overnight, the yields on 10-year Australian treasuries fell 19bps after the RBA said it would buy up to A$5bn ($2.9bn) in treasuries. But one of the biggest issues out there is liquidity still and not only for funding but market liquidity too. Reports are that any volume is tough to shift as markets fly around. As the FT reports this morning; Record amounts of money have been pulled from the world’s investment funds in the current market turmoil, putting global asset managers in the eye of the storm and challenging an industry struggling to navigate the end of a record-breaking bull run.

Italian deaths have now surpassed those of China and things there still seem extremely bleak and they need help. Not the Italian markets but the Italian people and businesses. Italy must not be cast adrift by the bureaucrats of the EU or they will never be forgiven. Italy’s prime minister has demanded the EU use “the full firepower” of its €500bn rescue fund to confront the continent’s economic crisis, as he warned against relying on monetary policy to counter a “global shock that has no precedents”. He is dead right; get on with it. With Europe now the epicentre of the outbreak, Italy has 41,035 total cases of the virus, civil protection officials said on Thursday. This includes 4,440 who have recovered from the illness and this with a lockdown since the beginning of the month! Meanwhile the BoE cut rates to 0.1% (as expected) and added to the QE programme (£200bln). Commenting on the emergency move, Andrew Bailey, the bank’s new governor, said the UK was in “an absolutely unprecedented situation” with financial markets “bordering on disorderly”. All markets look disorderly to me.

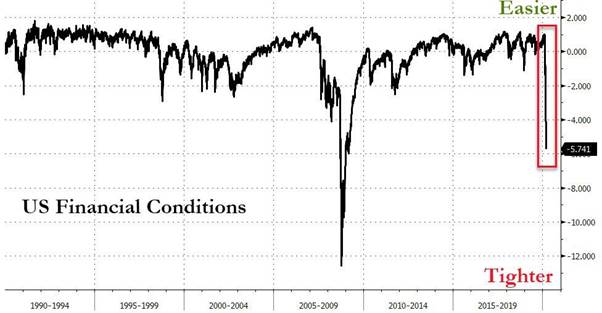

The 2007-08 global financial crisis was a supply shock to the liquidity mechanism, which caused a subsequent demand shock in the real economy. But this crisis, is a supply shock to the real economy that has triggered a massive precautionary demand shock for more liquidity and creates a demand shock as the consumer is frightened witless and can’t get to the shops anyway even if they did want to spend. The speed of this is a huge concern as the world has basically stopped turning. Natural processes like the smooth transaction of USDs, the hub of the global payments system, are being interrupted as well as the supply chains and industry is shuttering and staff being laid off. US jobless claims were higher but nowhere near where they will be next week. The Fed and US government know what’s coming and seem prepared to spend. There lies the problem. The issue is still that there is too much debt already and we are about to see global debt explode higher. Policymakers’ knee-jerk reaction to cut rates ever lower only makes the situation worse by encouraging the demand for debt, while simultaneously destroying the supply of liquidity by stripping banks’ margins and reducing the incentive to lend, thanks to growing counterparty risks. The prescribed cure may end up killing the patient. I am a little surprised that some central bank have not followed the RBA and BoJ and opted for YCC. A steeper yield curve would help many of the ailing banks.

The markets have seen wild swings and there is more on the way as today is shaping up as potentially one of the most volatile trading days in years, as scheduled changes in futures, options and other derivatives markets threaten to add to a frenzied trading month that has already had some of the biggest daily stock-index swings ever. It is a quadruple witching day, as options contracts outstanding tied to the S&P 500 Index hit a record this week. More than $1.5 trillion worth of S&P 500 options are slated to expire today, about a third of the contracts outstanding, according to Trade Alert data. It’s not going to be a session for a quick punt; that’s for sure. Next week may actually be a little calmer but we need to get there first! We are clearly living through some history here with the speed of some of these moves and related to other crises.

The issue, as ever in the past, is how long this lasts and where the base is. Realising a base is only usually seen when we have moved a long way from it. But within all this the USD still remains strong. The DXY traded as high as 103.00 last night (as Cable dumped to 1.1411) and may even have further to run as the more we see a stall in trade and global growth, the tighter businesses will hold and demand dollars. It is now quite clear there is a USD shortage and maybe the Fed will have to increase those swap lines further. I note they excluded China.

The coronavirus crisis is not merely putting a squeeze on economic activity and the credit cycle; it also appears to be giving added momentum to the isolationist/protectionist tendencies that have taken root in many countries. Trump talks of the “Chinese Virus” and will globalization ever be the same again after this and the trade war? Countries are shutting borders and monitoring who can enter. The world is possibly resetting to a more insular and protective nature. That’s is not good for a rebound in global growth and will/can central banks ever lift rates without toppling financial markets again? This is huge for the massive multi-national companies that roam the planet freely now.

Global stock and bond markets have seen $25 trillion of ‘paper’ wealth erased in the last month, wiping out all the gains from the Dec 2018 crash lows. I guess there are pockets of value down here but it feels like catching a falling knife and for many outside of the US, buying US stocks with local currencies hammered so hard, the US is now an expensive option for stock pickers.

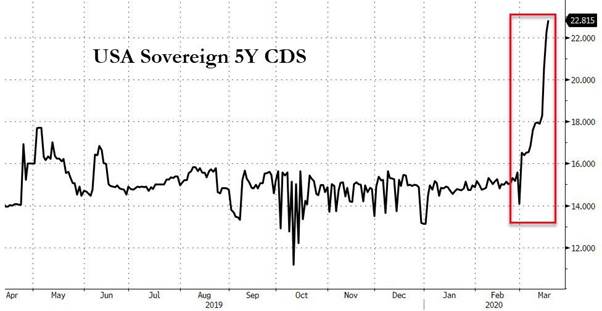

While it is good that the US and other governments sign up to spending billions on shutting down and supporting economies, the problem is debt; lots of it. The US already had a serious debt issue as Trump spent like crazy even in the good times; but this new addition is spooking a few, especially the CDS market.

Is it plausible that a sovereign nation could struggle to sell its debt? Maybe not the US but if US CDSs are spiking then I would think the risk elsewhere is considerably larger. The bigger question now is who is NOT spending; it is a lot shorter list. Weird stuff is going on and even as the Fed slashes rates and adds to QE and despite the endless liquidity from global central banks and politicians, financial conditions are tightening at their fastest rate ever.

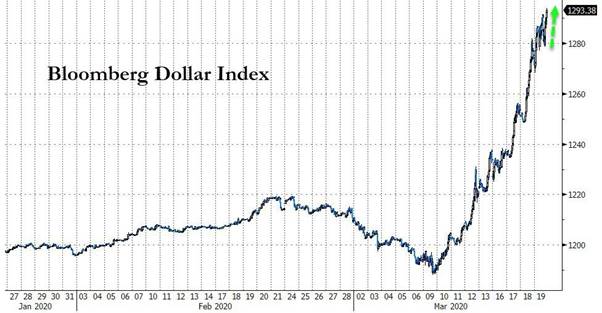

Despite the additional swap lines, the USD keeps advancing. The Bloomberg version of the USD Index has a broader look about it while the DXY is heavily weighted by the EUR.

That is some move in 8 days! No wonder we are taking a breather today.

As the FT reports this morning; Record amounts of money have been pulled from the world’s investment funds in the current market turmoil, putting global asset managers in the eye of the storm and challenging an industry struggling to navigate the end of a record-breaking bull run. The issue is, how quickly will investors be prepared to risk all again. The retail investor has seen some real damage done to pensions, ISA and personal investments that are deeply damaging. The trouble is that savings accounts return nothing now at best with rates slashed globally. Confidence plays a huge role after a shock like this and many may take time to regain confidence in what many are calling a broken market. Plus, the data headlines are going to be shocking at best going forwards and news headlines will be negative signals for some months. I think it could take a while for the Retail investor to get feelings of FOMO again.

Mutual funds and ETFs that invest in bonds suffered $109bn in outflows for the week ending Wednesday, a new record that also included the highest-ever weekly outflows for specialist junk bond and investment-grade corporate bond funds. Equity funds shed $20bn, the second-highest sum this year, on top of the record outflow of $23bn in the first week of March, according to the data from EPFR Global. But markets and professional investors have to look forward and we are all sitting here looking for opportunity and a base. That is a tough call but once we get into next week, I think we could see things start to calm a little. I think a lot of the Vol unwind has been done (after today) but of course we are still some way off peak virus but the signs from China and other parts of Asia are a little more encouraging with far less reports of contagion. The Fed is doing just about all it can to offer USDs to the market and governments are stepping up with trillions of spending allocated. Oil has bounced as the US suggested they will top up their strategic oil reserves. Have we seen a low in stocks? I am not sure but there may be some pockets of value for a macro investor. But we need to monitor credit markets and bond markets closely still as a shock there is still very possible.

It does seem that there are signs that the corporate bond markets are breaking down and this is one of my main concerns. I am wondering if the Fed will push to be allowed to do as the ECB are allowed to do and buy corporate bonds. I think that would be a major game shifter. Why shouldn’t they as they just set up a facility to buy commercial paper? Is this a step towards corporate bond buying; setting a precedent? Corporate credit has become a big concern for investors and, as we have seen in Europe, central banks can sharply improve pricing given illiquidity. Obviously, it will take some time for the Fed to set it up and get approval but the announcement itself would be very powerful. One would think that enough has already been done as the total announced stimulus in the US, EU and UK this week was $4.2 trillion, and counting. But the damage to the corporate world is ongoing. Investors are struggling as much as professional strategists with their inability to decipher the true economic impact of the virus and the unprecedented dollar shortage just below the surface.

—————————————————————————————————————-

Strategy:

Macro:.

Short EUR @ 1.0932 with a stop at entry

Short Cable @ 1.2225.. Stop above 1.2310 Took profits at 1.1565

Long US 10yr yields @ 0.835% (short USTs)

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.