Good Morning.. We are living through history with this virus and we may look back on it as a defining time in our lives. Financial markets are also having some historic moves and yesterday in oil markets we saw extreme moves never witnessed before. This is stress as global demand dives by a third and we have to ask whether the cuts will be enough. Storage is clearly an issue and the US is now on its own producing 2m b/d more than its slowing refineries need, and lacks available storage to handle the excess; will the June contract be under similar pressure? I think a few have learned their lesson but many bought not knowing this could go negative. Retail investors wiped out, HF losses and I would think some serious lenders to the energy sector are having some scrambled risk meetings today. We are seeing stress elsewhere as Libor is rising again and in the CLO space a AAA rated CLO failed its OC test (see below) and that never happened in 2008. The DXY is back above 100.15 and look at EU banks (sx7e sub 50). These stresses are a signal, if indeed you want to look but it seems to me that equity investors are standing on the beach wondering where the sea went!! Of course we all have to consider the huge dichotomy between what will possibly be one of the worst synchronised global economic slumps in history against what is undoubtedly the largest ever intervention. I guess that depends on how long the global growth hit lasts. I see less evidence of a V-shaped recovery coming. I have squared up my last bit of EURGBP as this has lost momentum. Brexit talks resume.

Keep the Faith..

Data.. All Times BST

10:00.. Germany ZEW Survey Expectations Cons:-42.3 Prev:-49.5

Germany ZEW Current Conditions Con:-77.5 Prev-43.1

13:30.. Canada Retail Sales m/m Cons:0.2% Prev:0.4%

15:00.. US Existing Home Sales Cons:5.3 Prev:5.8

Speakers:..

14:00.. ECB Speaker: Stournaras (Dovish) at an e-event by Delphi Economic Forum

Details 21/04/20

Front month oil trades at an historical low but that is just part of the problems. Squaring up EURGBP as Brexit talks start again.

–

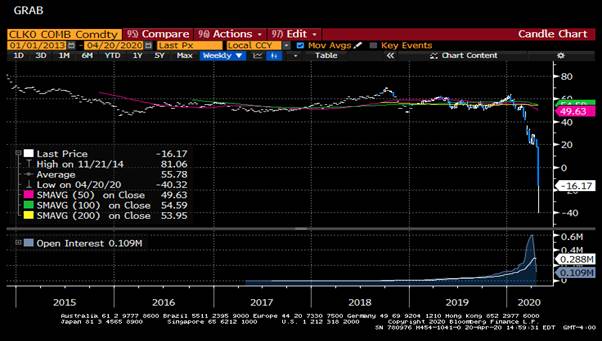

Yes, it’s front month and expiring but even so, the fall in oil was simply staggering yesterday with front month trading at negative. How can that be and I bet many inexperienced traders bought thinking that negative was impossible? In all my years it is one of the maddest things I have witnessed in these markets.

May WTI just traded below zero for the first time ever (trading below NEGATIVE $40 per barrel). There was a small bid right into the settlement at 1430ET leaving the May contract to settle at negative $37.63. WOW! I am not even sure what that means but there are some accidents in there and I am sure many bought thinking it could not go lower. There have been rumours of a huge loss at a fund but who knows but the irrational forced selling in the front month – sending the prompt spread to a stunning $60 – suggests at least one major player was buying the dip on the spread and was obliterated today. The June contract did not escape the fall either to a lesser degree. There is simply too much oil and nowhere to store it. If you cannot store oil that is due to be delivered from the May contract, then you have to sell your futures. Demand globally has dropped by about a third and that will not pass quickly.

Someone made a killing though, as traders with long-term leases were probably able to make huge profits out of the May/June spread. WTI contracts for delivery in June are still trading above $20 a barrel, even though they have fallen from near $60 at the start of the year. Get paid $30-$40 a barrel to take the oil, then sell it forward in the futures market for $20 a barrel. Nice. Will retail investors want to step back into trading oil? I would think they have been badly scarred by this event, along the lines of the SNB issue with the CHF peg. This was a flash-crash. Quite simply, as the coronavirus lockdowns spread and unemployment rises, the US is now on its own producing 2m b/d more than its slowing refineries need, and lacks available storage to handle the excess, say analysts. Consumption has to leap higher, oilfields need to be shut sooner or new unknown storage capacity needs to be found faster. The impact on the sectors credit is an ongoing concern and downgrades are coming and costs will be cut with some energy companies not pulling through. Keep an eye on the credit space and I think stocks are too high and the USD may start to rise as I see a period of risk aversion coming.

This, in part, is why I am now jumping out of the last small EURGBP position today. The rising USD may see GBP fall faster than the EUR for a while as positions in GBP may get unwound as talks restart. This leaves me square everything. Keeping some powder dry but I feel stocks are expensive here. Looking for opportunities but having said that, the EU still faces some severe tests going forwards (like survival). So I may look again at EURGBP at some point but higher from here.

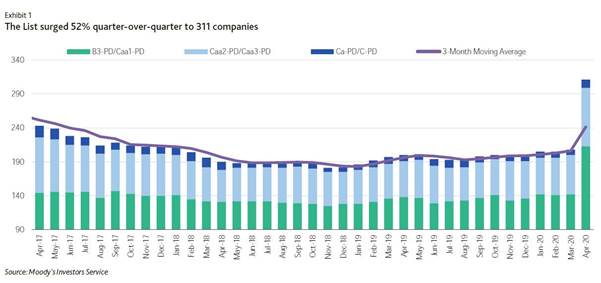

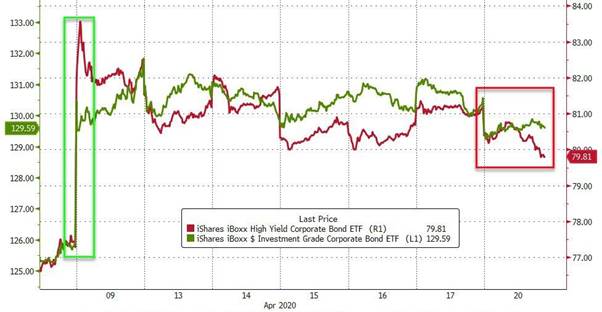

Oil is clearly a problem and may take time to recover and I am amazed stocks are not lower but this is not the only problem out there. The Fed still faces some significant challenges holding all the pieces together in this crazy jigsaw. The Fed has thrown almost everything at this but remember, the expanded Term Asset-Backed Securities Loan Facility (TALF) announced by the Fed last Thursday only buys AAA-rated bonds of CLOs, which after the coming tsunami of CLO downgrades is complete, will not only collapse in nominal size but will mean that any further attempts to stabilize the CLO space will require yet another Fed backstop of even riskier (rated AA and lower ) structured products. Downgrades are upon us which means the great wave of defaults is about to become apparent. Equity investors stand on the beach wondering where the sea has gone while they should be heading for the hills in my view. Moody’s warned it may cut the ratings on $22 billion of U.S. collateralized loan obligations – a fifth of all such bonds it grades – as a result of the collapse in cash flows due to the Covid-19 pandemic.

Bloomberg picked this up and suggested that “the firms that manage the CLOs will be forced to dump under-performing debt at fire-sale prices or suspend the cash payments they hand over to their investors.” Houston; we have a problem. Why do I think this demands so much drama and attention, well, in yet another case of something that was previously deemed impossible becoming reality thanks to the Coronavirus depression – like oil trading at a negative $14 per barrel – Bank of America writes that with some deals already reporting late March/early April data, we find that some deals are failing, not just the junior overcollateralization (OC) test but in one case, even the AAA/AA OC test! According to BoA, this will be the likely be the first “CLO 2.0” deal failing the senior most OC test; as a reminder, not even during the financial crisis were the super-safe AAA tranches impaired. This time it took just a few weeks for the cash flow collapse to impair the very top of the stack! Again; wow.

This has important ramifications for both bondholders and investors as many deal documents initiate a restricted trading condition if any IG-rated bond is downgraded. This will further limit manager’s ability to trade in/out of loans. Also, how exposed are lenders to failing energy sector firms as oil collapses? The Japanese pension funds love a AAA rated US investment and may have to think twice now. With the safest tranches facing impairments, the riskiest – or equity – tranches are set for a historic wipe-out. According to Bloomberg, analysts expect as many as one in three CLOs may soon have to limit pay-outs to holders of the equity portion.

Many an economist has looked back to compare this crisis with 2008 but that is dangerous as it may make them complacent, which sounds absurd but the speed of these moves are far scarier than what we experienced back then. In fact the CLO market recovered pretty well unscathed, especially the quality end. Not this time. What worries me is the billions shoved into these yielding markets in an age of zero yields and what happens now? The fact is that a key pillar of the credit market will be possibly removed for years: CLOs have been the biggest buyers in the $1.2 trillion leveraged loan market, helping fuel a surge in debt-fuelled buyouts and other transactions.

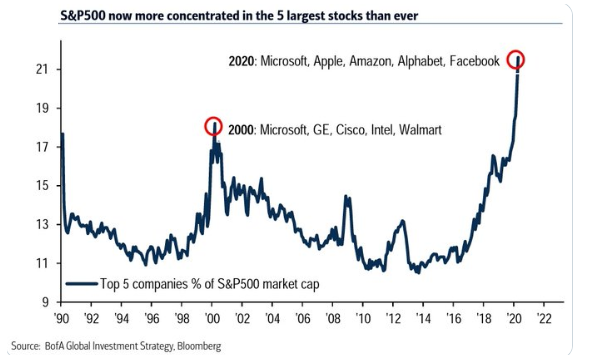

On top of all this and the 22mln Americans that just signed up to Jobless claims, as of April 16, more than 2.9 million homeowners – or 5.5% of all mortgages – have entered into COVID-19 mortgage forbearance plans. You cannot tell me that the lenders will not feel that. Now about that V-shaped recovery; are you kidding me? This could be worse than 2008. Plus we seem to be getting some battle lines being drawn between China and the US again as Trump and many others blame China for allowing the spread of this virus globally. This could get ugly and the trade war is by no means over. But just 5 major companies dominate the S&P500.

If the central banks were all-powerful, the Nikkei stock index would be at 200,000 instead of around 50 percent below its Dec 1989 high of around 40,000. Over the past 20 years the Bank of Japan has bought up just about everything and bailed out everyone and yet Japan still has a big problem that just will not go away. No growth and no inflation. Is this the template we are now all following?

Investors (an me) face and intriguing but huge dichotomy between what will possibly be one of the worst synchronised global economic slumps in history against what is undoubtedly the largest ever intervention. On the second point data shows that global central bank balance sheet expansion has already spiked by $2.7 trillion since early March which now comfortably eclipses the full peak 12-month increase seen during the GFC (under $2.5tn). This is the same amount as the annual total GDP of either the UK or French economies. Two thirds of this increase have come from the Fed so far and does not include the government injections either. To say this is huge is an understatement but so too is this crisis. Central banks are still very fearful but equity investors have rejected their fears. Many markets show signs of distress but not stocks. The USD is back up with DXY yet again stubbornly climbing back above the pivot at 100.15. This will only add to the pressure in the global economy and weigh heavily on the EM space again. Gold maybe about to make another run higher in all this, even if the USD does rise as we have a global debasement of money going on here.

—————————————————————————————————————-

Strategy:

Macro:. Flat

Short EURGBP @ 8901.. Squared remaining short @ .8734

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.