Good Morning.. So, in true EU fashion we end up with a deal but a compromise on the original deal but I still think this is something of a milestone for the EU. The downside is that it is a one-off (maybe not as the seal is now broken) and will not be delivered until next year. But its green credentials may attract global investors and I think the EUR looks better placed that the US or the UK right now and I have added EURGBP longs to my recommendations at .9020 this morning. This constitutes the biggest green stimulus package in history. To my mind, real money accounts will like this and we should test and break key resistance in EUR at 1.1497 soon. I remain long. I have also covered what some see as growing threat of inflation building. Clearly we are in a deep recession now but money supply in the system is sky rocketing. It’s a tad macro but I do think it is worth a discussion as the market is far too short term in its thinking right now. Apart from Canada retail sales, we have little data of note today.

Keep the Faith…

Details 21/07/20

EU finally reaches a deal on the bail-out: Is inflation a real threat and if so when?

–

Last night, after 4 days of wrangling over the balance of a rescue package, the EU leaders finally came together and agreed on a €750bln package. The market reacted in a very muted fashion to this initially and it seems a lot of this was priced and there was some disappointment in the split between grants and loans but in my opinion, this is still a big deal for the EU. The emergency fund will give out 390 billion euros of grants and 360 billion euros of low-interest loans and it has to be said that this is a triumph for Merkel and Macron but the EU is going to miss Merkel when she is gone. But while markets had a muted reaction and seem to have seen this as a buy the rumour, sell the fact trade, I think this is still a substantial deal and does solidify the EU bloc as a force to reckon with. But, it is a one off package that certainly does not cure all ills in the EU and the funds are unlikely to be delivered until well into next year and I think it is that, which markets are fearful of.

But when the dust settles, I think global investors will look at this and react positively to some of the details. Almost a third of the funds are earmarked for fighting climate change and, together with the bloc’s next 1 trillion-euro, seven-year budget, will constitute the biggest green stimulus package in history. Investors are keen to reward investment in green policies and rightly so and so I still think the downside for the EUR right now is limited. The EU is also seemingly dealing with the virus issue better than many and while cases in the US seem to be dropping, they may be weekend distortions that we always get. Hopes and encouraging tests for a vaccine have taken the S&P to the upper range band at 3250 but the US is still struggling with the impact of this virus more than most. I still think for a longer-term investment the EU credentials have improved. The EUR could benefit over time and against the USD and GBP, I still see it higher and I am adding EURGBP longs to my recommendations here at .9020 (07:30 BST). I am placing quite a tight stop as the technical picture is rolling over slightly (see chart below) and I would be more comfortable if both fundamentals and techs aligned. I remain bullish the EUR against the USD and see key resistance at 1.1497 challenged and broken soon.

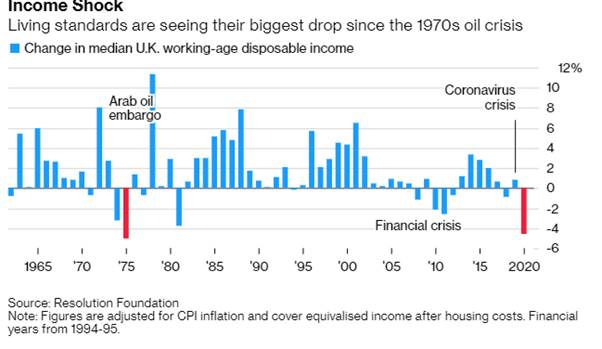

I think the UK is facing an especially tough time ahead as the economy slows and high unemployment unnerves the vitally important consumer. The businesses that feed off London are in crisis as the place is still a ghost town and confidence is low and many are staying at home. Barclay’s announced most of its staff can work from home until next year! The UK runs a current account deficit and we are still very reliant on foreign buyers of our debt and even if we do get a deal with the EU on trade, I am fairly sure it will be a weak one and the UK will have to go around with a begging bowl for deals elsewhere and we are not in a strong position for that. I could see EURGBP higher into more trade talks. The UK is facing a serious drop in living standards according to the Resolution Foundation head and piles pressure on Chancellor Rishi Sunak, with forecasters warning of mass job cuts this year unless help is made available beyond October when subsidies supporting the incomes of over 12 million workers are due to end. The debt mountain is growing and growing.

The Office for Budget Responsibility reckons unemployment could hit 12% by year end if just one in seven furloughed workers becomes unemployed, and over 13% in early 2021 under a more pessimistic scenario.

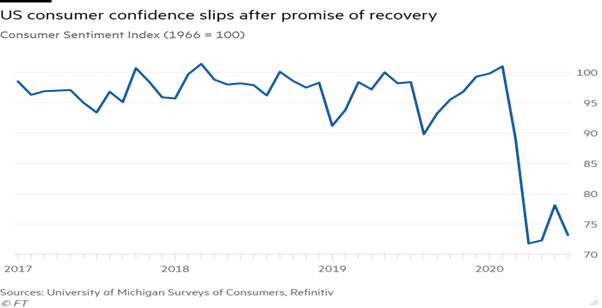

I also think the markets are over-estimating the US recovery as the impact of a prolonged bout of high unemployment will strangle consumer confidence and EUR could do well still against the USD. The initial confidence after the unlocking of the economy (too early) is already waning.

Line chart of Consumer Sentiment Index (1966 = 100) showing US consumer confidence slips after promise of recovery

The Michigan survey also showed a rise in inflation expectations and this is a topic of more conversation now, as central banks and governments flood the economy with money. In the US we are seeing demand starting to falter in some states. It means there is less mobility, it means there is less production and it also means that there will be more financial strains.

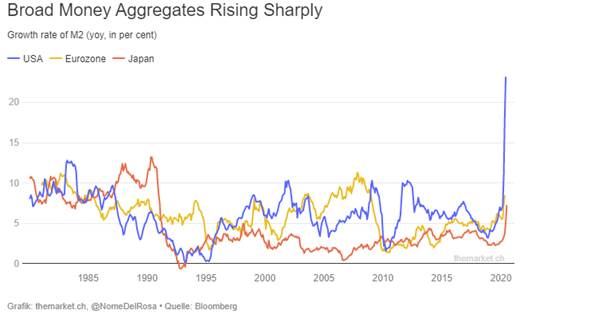

I have had a couple of emails from clients recently, asking me about my views on inflation and my first reaction is always to ask, over what period of time are you asking? Many people rightly believe that the massive injection of new and substantial money supply (money printing to you and me) could start to kindle the flames of inflation but there are some issues that need clearing up here. Firstly, the money that is printed is going to the banks but as consumers are unwilling to borrow more, the banks end up investing it in equities, the credit space and anything the Fed is actively involved in. Basically the money never hits the broad economy and yes, we do have inflation already; but it is all in financial markets and not the real economy. The irony is, with all the debt that we see at sovereign, bank and household levels, is that it is the inflation central banks seem to crave that could bring the debt issue into focus. But you can also have inflation with no growth and that ushers in stagflation; an equally damaging scenario.

But the issue right now is that monetary policy is not driving growth higher and it is now plain for all who wish to examine the evidence, that QE failed dismally to promote any growth at all. In fact, I would go as far to say that QE was deflationary. The reason for this is that the money printed did not go to where is was most needed; directly to the consumer. It went to the banks who invested it and thanks very much. But if this money ever finds its way into the broad economy then look out. But realising that monetary policy with rates already at zero or below is a waste of time, Central banks called upon governments to intervene and spend more directly into the broad economy via tax cuts, benefits and infrastructure spending. This is what could make the difference as consumers receive the money directly and it is not a loan. Just how much money have central banks wasted by lining the coffers of the banks when they could have saved the economy 10 years ago if they had directed stimulus to where it was needed directly? There are two ways of paying off debt; inflate yourself out of it or grow out of it and the latter is seemingly not an option as policies are actually hindering growth, CapEx, employment growth and R&D. Firms are only considering cost cutting.

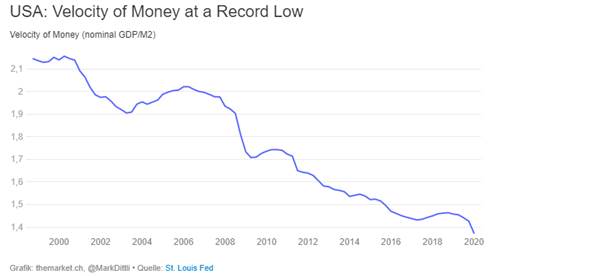

It is all very well having a ballooning money supply, whether it be M1, M2 or M3 but if the money has no velocity, then inflation and growth will never happen.

I am amazed central bankers didn’t realise this earlier! In the past we have seen manufacturing outsourced to economies with cheaper labour but globalisation is in retreat and costs could start rising. In the US, M2, the broadest aggregate available, is growing at more than 23% and you’d have to go back to at least the Civil War to find levels like that. In the Eurozone, M3 is currently growing at 8,9% and it will only be a matter of months before the previous peak of 11.5% which was reached in 2007 will be reached but velocity is at record lows. So we have two issues here, where is the money being sent and will it hit the broad economy at any point?

Right now it is difficult to get one’s head around anything to do with inflation as we are in a deep recession in most economies. But that does not mean we are not building up the pressure for the future. I also note a slight pick up in the inflation expectations in the US, as mentioned above. Governments are guaranteeing or underwriting corporate loans now, so why not lend? They will as it is risk free now. Will this fix the low growth and high debt problem that is facing us now? It has more of a chance than QE ever did and that is actually a concern as debt will matter if rates ever have to rise; even marginally. What we see now is short-termism and it seems the gloves are off on experimentation and the numbers stagger belief. There is a very real danger that central banks and especially populist governments, are slow to wind these stimuli back in if we do get a recovery. History is littered with examples of this since the War.

If and when we do get some growth, central banks and governments will not want to risk the growth pattern and will thus leave policies in place far too long. All this seems quite some way off but there is a growing issue that may bring about the next crisis. One of those problems out there is that the stress in lenders is now in the non-bank area whereas in 2018, it was the banks. This current crisis started in the non-bank arena and has far greater consequences. Non-bank crises have a habit of becoming bank crises and we have seen the big US banks set aside billions for bad loan provisions; they know what is coming. Commercial bankers are now waking up to this possibility. Already, businesses are in arrears as never before, with many shopping malls, office blocks, and factories unused and rents unpaid. It is this problem, shared by banks around the world, which due to the severity of current business conditions is likely to tip the banking system over the edge and into an immediate crisis. I am not sure that this is that far away and I think the banks know it.

Also productivity is going to fall steeply again as bankruptcies rise steeply with many finding no jobs to go back to, CapEx reduced to zero and cost cutting everywhere. As productivity falls while money supply starts gaining some velocity, we simply have a scenario where too much money will be chasing not enough goods. Basic economics. There is no way that markets are pricing what still looks like a nightmare scenario to me with unemployment, bankruptcies and defaults still to impact. There is only one outcome, other things being equal; the purchasing power of the dollar in terms of consumer goods will be driven significantly lower (hence the rise in gold). But central bank analysis rules this out, associating too much money chasing too few goods with only an expanding, overstimulated economy. I am sorry, I think they may be wrong and stagflation may be the result. The US government wants another $1-15trln to feed into the welfare system as they know the unemployment level is going to remain high now. Distribution of state money will increasingly be in the form of welfare to the unemployed, skewing spending toward life’s essentials.

In an economy with subdued Productivity/activity not responding quickly enough to produce the volumes of products desired, prices, mainly of essential items, will increase sharply. That is how it works. Keep an eye on headline CPI as you cannot tell me that essential costs like food and energy costs do not matter; they certainly do and rises here will be the canary in the coalmine for the spark of inflation. When prices for essentials are soaring, they will continue to increase the quantity of money in circulation, distracted by that 2 percent increase in the CPI target. By the time it creeps up above that rate it will be too late; and can they ever hike rates with debt as large as it is?

—————————————————————————————————————-

Strategy:

Macro:.

Long EUR @ 1.1210.. Stop at 1.1150

Long EURAUD @ 1.6250 stop at 1.6080

Long EURGBP @ .9020 Stop at .8920

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.

Risk Warning

This information is powered by Strategic Alpha. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice.

Home

Home