Good morning.. GBP has continued to weaken since the piece I sent out yesterday and charts are supporting some of these moves now with a convincing break higher in EURGBP last night. Techs suggests this should extend. But Cable and other crosses also look weak and I think this continues (see below). I also remain bearish the AUD and think we are seeing a lot of pressure being put on Oz from China regarding an investigation into the spread of the virus. This could be very damaging to Australia. One of my big macro issues is that Trump is breaking down the globalised economy that has delivered the growth and cheap goods we have seen since the GFC. This erosion is not priced. We are heading into this next phase extremely weak and a lot of policies have already reached close to their limits for many. I fear we may be in the eye of the storm here and at some point, data and debt will matter. EU PMI data this morning and US Jobless claims and other important data later from the US. Stocks, as ever, look rather high to me but how many times have I said that!

Keep the Faith..

Details 21/05/20

UK sells debt at negative yield and Bailey suggests NIRP still in the toolbox. The very underpinnings of the feeble growth we have seen are being eroded.

–

Following on from my update note on GBP yesterday, I realise that GBP did not move a great deal after the UK sold bonds at negative yield for the first time ever (July 2023 at -0.003%). But on top of this and the fact that Sstg started to move higher, Bailey suggested that NIRP is still in the toolbox at the BoE. This auction was also oversubscribed and to me that sends a pretty clear message that many see more QE and possibly negative rates. The oversubscribed sale reflects rising expectations that the BoE will increase its £200bn bond purchase programme next month to prop up the economy and try to lift wilting inflation back up towards its 2 per cent target. Fat chance, as is the case with the BoJ, the EU and others on this dismal trail. I fail to see the confidence of buyers but of course buyers will not hold this stuff to maturity and look to sell it on to another idiot in the future.

Some suggest that the robust demand underscores the appeal of gilts, long considered to be a haven due to the UK’s strong creditworthiness. I doubt that now as that appeal is waning fast. It is also suggested that fears that the large increase in borrowing the UK has undertaken due to the pandemic could deter investors are misplaced. Hmm; over time I doubt that too. While many see some positives in all this, I fail to see one. I also think the MPC is very close now to adopting a NIRP and that is not good for banks and not good for GBP and I happily remain bearish GBP against the USD and they JPY as per yesterday’s update. “Given what we’ve done in past few weeks, it should come as no surprise to learn that of course, we’re keeping the tools under active review in the current situation,” Bailey told lawmakers on Wednesday when asked about negative rates. “We do not rule things out as a matter of principle. That would be a foolish thing to do. That doesn’t mean we rule things in either.” Come on Bailey commit; but I think the Bank will be pleased that they may be able to continue to sell Gilts if rates do go into negative.

He is such a wet fish; but I think many on the MPC think with all the issuance coming, being able to sell debt at a negative rate is a mouth-watering proposition. They have just seen that it is possible even though it is not going to help Main St at all as loans won’t cheapen or mortgages I would think. I think we shall see NIRP in the UK at some point in the not too distant future but to who’s benefit is unclear apart from possibly the FTSE100 at the expense of GBP. GBP is about to get properly debased but I am not sure at all that negative rates are the way out of this downturn that is coming in the UK and I still fail to see the benefits. If they do endorse this mad policy in conjunction with an increased QE programme, then I fear that GBP will lose all friends. On top of this we still have the Brexit issue looming large and negotiations there are not going well. The other night, Barnier, in typical EU rhetoric, full of arrogance, said: “I remain convinced that with mutual respect and constructive engagement by the UK across the board, on all issues of the negotiating table, we can move forward in the limited available time”. Read as “if you do as we ask, we may let you have a deal”. Sorry M. Barnier, no can do. You are simply going to have to give some ground. But I fear we may have to walk. I think we could even be looking seriously at a hard Brexit as the UK announces the range of tariffs that it will be slashing, a clear signal it won’t be sticking to the EU external tariff barrier, and hence the negotiations will be short.

EURGBP broke higher yesterday and many GBP crosses look weak again. This is a EUR daily chart and shows the Bollinger bands starting to expand suggesting momentum to this move and I fail to see much on the charts above.

GBPJPY is also starting to suggest a break lower. The daily below staying below the mid-range of the bands and a look at the lower band looks likely. A break of 131.40 may confirm this and 129.80 look like an initial target.

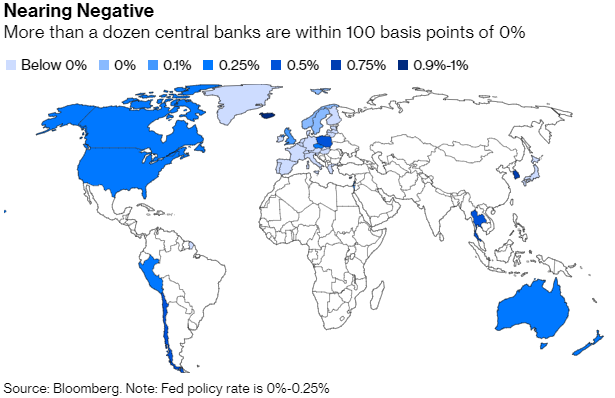

The fashion towards NIRP is gathering pace at central banks but not so far at the Fed and that suggests yield differentials will remain in favour of the USD.

In the UK, Interest-rate swaps, which are used to gauge where the benchmark may be, are just below 0% for December, and get progressively lower in 2021. UK bond markets are pricing NIRP and the BoE is NOT walking that back. Of course the BoE could and probably will go for more QE but we all know that is not going to help generate growth. Mind you, nor will negative interest rates; they are there to bring in cheap cash over the next few years as per yesterday’s auction; they got away with it. I think GBP could be in real trouble and if not against the USD than against a few others. Is that what they really want?

Meanwhile stocks surge ever higher and ignore all the negatives coming from those in the know; central banks. From Bailey, Kuroda and Lagarde to Powell there are many that see economic weakness ahead and no V-shaped recovery. But to be honest, what else is there to invest in that has a modicum of yield attached? Gold doesn’t although zero is better than negative but there simply are few alternatives to stocks. But that does NOT mean they cannot fall and to my mind it will be a “straw that breaks the Camel’s back”. There is no structure to this rally and it is solely based on liquidity injections from the Fed and a concentration in the top 5 US tech firms. This, in my view, is unsustainable but when will the hit come I hear you scream? To be honest, I simply do not know and I am not even sure we were cured from the 2008 crisis as the deep scars remain in place and the problem was just kicked down the calendar but we are left still with lower growth, lower wages, lower inflation, and lower productivity in its wake. We are heading into this next phase extremely weak and a lot of policies have already reached close to their limits for many.

The world is going though a dramatic change driven by Trumps ambition to break globalisation and this is yet to be priced in my view. A world where we see an end to the WHO and possibly the WTO and one in which nations turn inward and protectionist, risking the relationships within G20 and NATO; again something that is yet to be understood, let alone priced. What does all this mean for global growth and who will be able to lead the global economy away from the abyss? We are living in a world where central banks can heap trillions on badly run corporations and yet bailing out individuals who have lost jobs through no fault of their own get little. There could be a snap-back socially on this some day soon. The world is NOT going to emerge from this as it was; I just can’t see that. There is still a lot of euphoria out there seemingly because stock markets are rising but markets are NOT the economy. Can you imagine how much worse all this is going to get if Sunak and Powell are right (and I fear they may be) and global economies, including China, suffer permanent scarring? How do we all deal with it with policies already where they are?

Economies are not recovering as seen in the dreadful data from Japan last night where exports plummeted. The April number plunged by 21.9%, double the previous month’s -11.7% drop and the biggest plunge since the financial crisis.

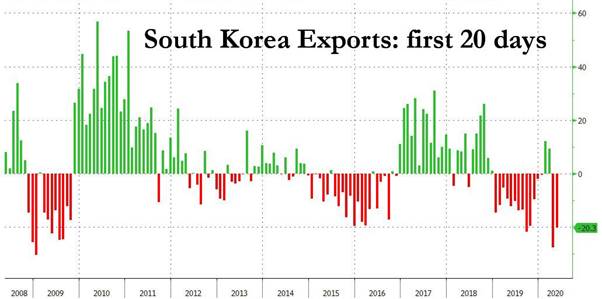

S. Korea followed suit with data the first 20 days of May, which some had expected to see a solid rebound in light of the so-called reopening observed this month. Well, it did not happen, and while the May number wasn’t quite as bad as the near-record plunge in April when exports plunged by 26.9% in the first 20 days, the -20.3% Y/Y drop in May – off an already depressed 2019 number – showed that any hopes for a solid global recovery taking hold have been painfully premature.

Data does matter and the more of this we see the more nervous I would think equity investors will become. But how can demand pick up if we are passing peak globalisation?

I am afraid to say that I think we are in the eye of the storm or on the beach as the sea drains from the shoreline as the Tsunami builds out of sight. We are about to experience a fracturing of the system that has delivered the little debt-based growth we have seen in the last decade or two where the foundations were clearly embedded in the globalised system. I fear those days maybe numbered and there is NO way this is priced. Can throwing more and more liquidity at this fix the problem? No; absolutely not as it is a political issue and as many central banks know all too well, politics is an area they have no control over. I noted with some concern that the Fed minutes suggested things were either very bad or outright disastrous unless congress goes all-in on spending/support. Any notion of a V-shaped recovery is surely now dead: Just need to inform equity investors now. None of this is being priced by equity markets; just bonds and the strong USD so far and possibly gold. One last thing about all the unemployed that are expected to race back to work in the US. Can anyone explain how we are going to motivate unemployed workers to go back to work when most of them can actually make more money camped on their sofas watching Netflix? Just a thought!

Meanwhile US/China relations are souring badly but also Australia/China relations too. China is pressing on Iron Ore imports from Oz. When necessary, Chinese customs officers will conduct test for harmful and toxic elements in imported iron ore, according to the new rules. There is a danger that Australia’s iron ore export to China could fall victim to the rising bilateral tensions and China is also suggesting looking hard at wine imports too. This is another implicit warning to Australia; Back off the investigations into the virus spread. China-Australian iron ore trade was worth $63 billion in 2019. But the RBA suggest they are not looking at negative rates anytime soon. Lowe said; Still prepared to increase bond buying again if required (why, as it doesn’t work); capital & liquidity buffer that exists can be drawn upon if needed to support the economy (it doesn’t help); there’s a limit to what can be achieved with monetary policy (yes correct). He went on; We aren’t contemplating negative rates and it would be extraordinarily unlikely; to the RBA, the cost of negative rates exceed the benefits (they do). He should go tell Lagarde and possibly Bailey that! But this spat with China is keeping me bearish the AUD and I also think the USD may bounce again on any equity weakness. And on that note the concentration in the top5 US stocks is getting scary. The combined market cap of the 30 Blue Chip comps in the benchmark index Dax is less than the mkt cap of Amazon.

While the market cap of the Dax is $1.1tn, Amazon’s is $1.25tn; Blimey! What could possibly go wrong?

—————————————————————————————————————-

Strategy:

Macro:.

Short AUD @ .6550. Stop @ .6685.

Short GBP yesterday @ 1.2260.. Stop at 1.2350

Short GBPJPY yesterday @ 131.95 Stop at 133.20

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.

Risk Warning

This information is powered by Strategic Alpha. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice.