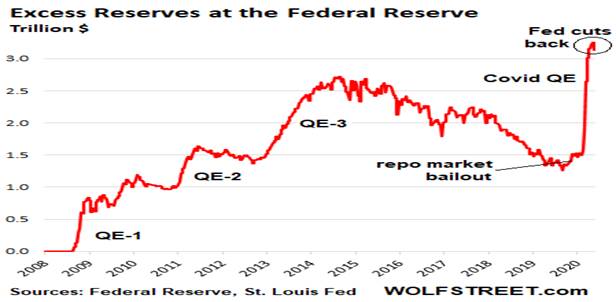

Good Morning.. Markets got spooked by comments from Navarro last night which hit S&P hard with a 1.6% move lower before recovering all losses as Trump stepped in to make clear the US/China trade deal is still on. But it shows how sensitive markets can still be to these issues and this trade war is not over by any means. .. It is flash PMI data today and we already saw decent beats in Oz but rather more mixed for Japan with manufacturing disappointing. But I see marked improvements coming for France, Germany and the EU today; not so sure about the UK. Again, with all the releases, it is services that matter most now. I do think data is going to start to matter again and in particular, unemployment data. Away from this I think we need to keep an eye on a developing story involving Canada. The Trump administration is considering re-imposing tariffs on aluminium imports from Canada and an announcement could come by the end of the week, according to people familiar with the matter. I am also watching the US yield curve and the Fed balance sheet, which seems to be starting to shrink ever so slightly. BoE’s Bailey’s comments that rates would not rise before balance sheets had been reduced, may be what central banks are discussing now. There is a real dilemma ahead as once a central bank resorts to QE and/or negative rates and markets rally on the back of it, a return to “standard monetary policy” becomes impossible. You become stuck forever in this Hotel California where central banks are held to ransom by the markets and “you can check out, but you can never leave”. An epiphany or “Minsky Moment” is what lies ahead; but when; that is the question?

Keep the Faith.

Details 23/06/20

When will data matter? Navarro spooks markets:

–

We have seen some shocking data recently, which to be honest, has been skipped over as we have had a forced closure of economies, the like of which has never been seen before; there is no precedent for what we are living through. But the longer we go on, the more likely data will matter (Flash PMI data today) as the unemployed fail to secure their jobs which were lost in this crisis. I think unemployment data is going to matter more as we move forward and housing data may also be a concern. Despite record low mortgage rates, soaring mortgage applications, and a modest rebound in US new home sales, existing home sales were not good. April’s collapse was the largest since July 2010’s expiration of the first-time homebuyer’s credit, and May saw the plunge continue, falling 9.7% mom (against expectations of a 5.6% mom decline).

What seems also to be happening (and something that may continue) is a move away from city centres as life there is less bearable with social unrest and the virus issues. At the same time, US house prices actually rose. Conflicting data for sure as May’s national price increase marks 99 straight months of year-over-year gains but sales of $1mm-plus home crashed.

There is a notable shift going on here and I think one which may be replicated around the developed world. A report attached to the data suggested that; “Relatively better performance of single-family homes in relation to multifamily condominium properties clearly suggest migration from the city centres to the suburbs.” “After witnessing several consecutive years of urban revival, the new trend looks to be in the suburbs as more companies allow greater flexibility to work from home.” This is not going to go away any time soon in my view and owning commercial property investments may not be such a good idea as companies embrace working from home and seek smaller office space. Are we looking at a serious transformation in how and where we work? I think we are looking at some fundamental shifts in how our economies will work and possibly what drives them. The virus has seen us leap forwards and embrace the technology that was already there and waiting for us to embrace it; we just did.

In 1999 and 2007, we saw markets believe that nothing could stand in their way and a new paradigm had been formed, only to find that this time was NOT different; it just took longer for the realisation to dawn. I think we are in the same place now as many feel the Fed and others are fully committed to keeping us all from a stock market rout. They may be right in the short-term and who knows, through the summer we may test the 3250 upper-range in S&P but reality has a habit of trumping euphoria but of course it is a matter of timing. But again, the markets are NOT the economy and while the tail (markets) may be wagging the dog, (the economy/central banks/Fed), the underlying economic health still matters. Central bankers have devised a cunning way of pushing the problem down the calendar but some things are beyond even their remit. They cannot impact politics or geopolitical events or earnings, volatility or the human psyche. Animal spirits can be a powerful force, particularly when investors are all in and leveraged one way but they can end. Markets remain susceptible to many risks; they have not gone away.

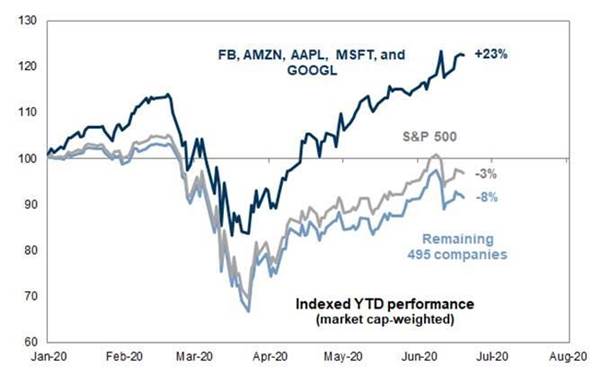

Today reminds me something of the Dot.com bubble where investors chase stuff that just confounds the senses. Retail investors are chasing bankrupt companies like Hertz and Chesapeake Energy and many companies with poor fundamentals to say the least. Free trading app Robinhood has added more than three million retail accounts in 2020, and now has over 13 million. The median age of its retail customer is 31. The Covid-19 lockdowns and the plunge in markets in March persuaded millions of new investors to open accounts. Some of the action appears to be from people who would otherwise be gambling or betting on sports—both of which were shut down. This is NOT investing as was the case in the Dot.com bubble. But it has momentum and has dragged many along with it and there is evidence that HF managers are now joining the party, as mentioned yesterday.

It is well documented that the Fed is driving this with policies likely to stay in place while unemployment adjusts back (If it ever does). But some of the risks have not gone away. US/China relations look set to sour and Pompeo remarks are an ominous threat. I think markets have moved this issue away from the frontal lobe and is a big mistake. Gold (weekly chart below) is breaking higher and sending signals that all is not well.

Just last night we saw clear evidence of how sensitive the markets are still to US/China trade issues when Navarro’s gaffe saw stocks turn down rapidly, only to recover when Trump suggested the deal was still in place. The S&P fell as much as 1.6% in quick time before recovering all of the losses. (S&P 30 min chart below)

These “newbie” retail investors are not trading based on fundamentals, earnings, estimates, products or market values, but rather talking up stocks driven by pure momentum. Robinhood makes the “research” even easier by posting the top holdings of its users. I am sorry but while this may last a while longer, it is built on sand. So, what kind of market are we in now? “Corrections” generally occur over very short time frames, do not break the prevailing trend in prices, and are quickly resolved by markets reversing to new highs. “Bear Markets” tend to be long-term affairs where prices grind sideways or lower over several months as valuations are reverted but can have strong reversals within them. Regardless of whether you believe fundamentals will ever matter again is largely irrelevant. What is important is that periods of excess speculation always end the same way. I think it may be time for looking at year-end S&P puts but for now the technical picture still seems to have legs.

A break below 2910 (weekly S&P chart above) may see that technical picture shift back down but it will probably take a headline or something that sparks concerted selling like the quarter end rebalancing, which may start this week. For now, stay at home stocks and techs continue to dominate.

I also think some issues have been swept under the carpet and whilst the worst of the virus is thought to be behind us, the stats in many places is still rather concerning. The US trade war with China has NOT gone away and will be making headlines again soon. The Fed, who have been the main support for equities are net/relatively reducing their stimulus is certain areas. They have steepened the curve which is helping the banks but keep an eye on this as if we see it flatten to any degree, it may suggest the Fed juicing is done. But the Fed seem to be prepared to go where few central banks have gone and clearly see the credit space as ground zero for risk. But geopolitical tensions are rising and there is nothing the Fed can do about China with HK or Taiwan and the US will get itself involved; I am sure. We have Israeli planes flying over Lebanon, Russian fighters playing games with the US air force over US airspace, China/India border clashes, trouble brewing in the South China sea and N. Korea playing dangerous games with the South and we still have no vaccine.

Stimulus is still what matters to markets and for now they seem to be expectant of more. Even after the stronger-than-anticipated jobs report in May, many still expect Congress to enact another $1.0 to 1.5tn (7% of GDP) in fiscal measures, most likely in late July or early August. While Congress’ initial policy response to the corona crisis was swift and powerful, it now faces a number of fiscal deadlines, including the likely exhaustion of some businesses’ funds secured though the Pay-check Protection Program (PPP) by late June, the start of the new fiscal year for nearly all states on July 1—with many states confronting significant revenue shortfalls—and the expiration of the extra $600/week jobless benefit on July 31. The US will need more and soon. Without this, then I think we see a very nasty reaction. For now the Fed owns the credit space and this is helping a lot.

We are in the middle of a very concerning time for financial markets with very strong opposing forces at work. Moody’s which to my mind should probably be closed down due to negligence in the past with ratings, suggests that rating implications will depend on governments’ ability to reverse debt trajectories ahead of potential future shocks. Failure to bring debt/GDP on a downward path would leave sovereigns with weaker credit profiles more vulnerable to future economic or financial shocks they say. But how on earth do governments or central banks reverse these policies when the markets threaten to crash if they do? I know, this is not for now but surely, any forward-looking market would be considering this. The irony is that the recovery brings all the problems to the fore! There is a real dilemma ahead as once a central bank resorts to QE and/or negative rates and markets rally on the back of it, a return to “standard monetary policy” becomes impossible. You become stuck forever in this Hotel California where central banks are held to ransom by the markets and “you can check out, but you can never leave”. An epiphany or “Minsky Moment” is what lies ahead; but when; that is the question?

Are we seeing a gradual shift at the central banks? The Fed has been cutting back for weeks on its asset purchases, and on its last weekly balance sheet, its total assets actually fell by $74 billion. Now Bank of England Governor Andrew Bailey published a piece in which he wrote that these massive central-bank balance sheets – he was talking in global terms – “mustn’t become a permanent feature.” “As economies recover, it’s likely that some of the exceptional monetary stimulus will need to be withdrawn,” he said. And this shedding of part of the bonds that had been purchased would happen before the central bank raises interest rates, he said. The Fed and the BoJ are tapering bond purchases with the BoJ replacing them with YCC; is that the template for the rest of the central banks now? I think there is a realisation that QE is pretty pointless as a monetary tool now. Last time, the Fed started raising rates before reducing the balance sheet. This time, the Fed front-loaded $2.8 trillion in QE and has already started shedding some of it even as FOMC members don’t see interest rate hikes through 2022. This is a big shift, of reducing the balance sheet first and then raising rates. Bailey made no reference to YCC or negative rates so both possibly not under consideration but suggests that the balance sheet was the primary tool for adding stimulus and so should be the first to be reduced.

Is the idea of QE infinity no longer valid? The problem here is markets are addicted to it. But the Fed is rolling back some of the help with repos and swap lines being withdrawn.

—————————————————————————————————————-

Strategy:

Macro:.

Long EURGBP @.8978 added @ .8940. Raising stop to .8940

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.

Risk Warning

This information is powered by Strategic Alpha. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice.