Good Morning.. It’s going to be a long week! Stocks lower as the US is unable to agree a package but something huge is coming and the amounts that are going to be given to the Fed make me think they may be allowed to end up buying Corporate debt! Who knows what’s coming as all bets are off as the Fed has to do more it seems. USTs rallied strongly last night and the USD followed yields lower but there still seems to be stress in the USD funding markets, so this dip may not hold. I am keeping my short EUR recommendation and looking for new lows below 1.0600. USTs are interesting and I am not prepared to risk too much on this view as the Fed is definitely going to do more. Oil still looks heavy but I am surprised gold is not higher.. The trouble with being long gold in paper is that it is leveraged and been hit by margin calls. Own the physical, as I think it is going up. I think the reality is now hitting most people that this is akin to a war footing, which impacts us all. Markets are hugely stressed and accidents will happen. Not all businesses will make it through and job losses are going to rise exponentially; all parts of the tragedy unfolding before us at lightening speed. Be prepared for the unexpected from governments, central banks and markets.

Keep the Faith.

Details 23/03/20

Reality dawns as the world stops!

–

It’s like the world suddenly stopped turning; the pace of the damage being done is extreme and difficult to comprehend and it’s coming to all of us. Adjusting life so quickly is difficult and businesses are simply collapsing. Friday saw a dreadful close on Wall St after all the volatility expiry’s and things were just ugly in Asia last night. The Aussie stocks fell 8% at one point after announcements of a lockdown (before rallying slightly) and US Treasuries rallied strongly taking the 10yr back to 0.8%. S&P futures were locked limit down before a bounce and we are in for a very volatile week as data picking up some of this stress starts to filter in. HK stocks fell 4% and China was down 3% and confidence is very low but at least we are past that Quad witching day on Friday. Nikkei closed up almost 2% after its holiday catch up. But we still face two main issues here; the virus headlines, which I am sure are to get worse in places like the UK and US as both are behind Italy (although I did here some comments that the speed in Italy may be dropping now with some newspapers are saying it might be the first realistic sign of a trend inversion); and second, the stress in the credit and funding space. Stocks also reacted badly to the news that US negotiations over a $2tn package to support the US economy during the coronavirus outbreak faltered, kicking off what could be another volatile week for global markets. This is going to be a long week.

It seems that the UK government is moving closer to keeping the nation indoors after millions hit the outdoor spaces after the sun finally came out. With sports people and parents with kids with nothing to do, it seemed the obvious thing to do but the crowds meant social distancing was not adhered to and the government is under pressure to lock everything down as we sit exactly on the path that Italy took. New Zealand said it would issue an order calling for nationwide self-isolation, while NYC announced the closure of all non-essential businesses. I also think some really bad stats are due from the US soon. This is going to keep markets extremely nervous and rallies will likely be rather short-lived unless we get some really encouraging news from the likes of Italy. China is sending out better news but its validity is always in question. Companies are going to be slashing dividends and earnings forecasts and some won’t make it; paying the price for wasting valuable cash on equity buybacks. Will they ever be justified after this? The USD came off its highs quite quickly last night as bonds flew higher as risk-off dominated. But I will be watching the funding space closely today as this USD dip may not last but the Fed has thrown a lot of liquidity at this and I note that the FRA-OIS is wider first thing this morning, so this USD dip may not last.

Germany is now reacting strongly to the damage to the economy and suggesting a massive package. Headlines suggest they are set to unveil a €500B bailout fund to deal with the economic fallout from the coronavirus pandemic. As a reference, a U.S. plan on the same scale in relation to the economy would be north of $3T. That’s a lot and I think Bunds may react lower to this at some point. Germany is to spend an additional €122.5bn this year to counter the slump caused by the coronavirus as it rips up the fiscal rulebook. It will also set up a €500bn bailout fund that will take stakes in stricken companies, in what amounts to a radical intervention by the state in the workings of the market economy. Governments are finally reacting to the size of the problem but business casualties will be seen and credit markets will stress. The Fed has resorted to just about all the emergency tools it used back in 2008 but is it now apparent that merely redoing what the Fed did in 2008 won’t be enough? This is a huge question. As stocks headed lower on Friday morning the Fed also announced a municipal bond bailout by including munis to the MMLF, yet even that was not sufficient to prevent stocks from sliding on quad-witching Friday. They must be wondering what to do next. Will they have to backstop everything, buy Corporate bonds and adopt YCC and other Japanese experiments? Rate moves are done.

Stock market falls are now becoming a much broader problem and could now have dire social implications. The Fed quite simply is going to have to go further and experiment and the US government has GOT to agree this spending package now. We now face a heath crisis and a financial crisis and the central banks have few bullets left but they are about to go -all in with the governments and goodness knows what we will end up with. The debt issue is for another time but it is not going away. Despite the impressive list of Fed actions last week, ongoing rate and spread volatility are amplifying the already high systemic risks and credit is a massive concern now. We are on a war footing here now and it is time we all realised this. I think US Treasuries are higher this morning as there is a danger that the Fed backstops Treasuries to stop yields rising. Drastic measures are needed to get financial markets through this; anything is possible and do not be surprised if the Fed make a significant statement this week. Do we need markets right now?

Post-crisis regulations to improve bank capital and liquidity were meant to ensure a repeat of 2008 would not happen. However, what is exposed now is that leverage and liquidity risk had simply shifted away from banks to other sectors of the economy and investor universe. The corporate sector became more leveraged, with holdings at money managers that have quickly become sellers, as credit risk spiked and redemptions surged. REITs, another leveraged sector, have been sucked into this vortex. With banks already full on liquid assets this unfortunately leaves the Fed as the only game in town. Could the Fed buy equities? Nothing can be ruled out. The unilateral response from governments to the coronavirus is to helicopter money to people and their businesses in unlimited quantities. We have historically had a lot of faith in our central banks, especially the Fed but even the Fed is going to be tested to its limits now as the task ahead is gigantic.

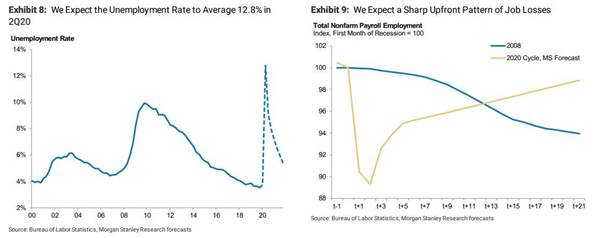

While the Fed is doing everything it can to achieve a number of objectives simultaneously, it needs to ensure the funding is in place for the US Government, which is dramatically increasing its spending. It must ensure the banks have sufficient reserves so as not to foreclose on its customers, thereby preventing a deflationary contraction of bank credit. It needs to inject liquidity into wholesale money markets to ensure no financial entity becomes insolvent. It is trying to anticipate future negative effects of the coronavirus, which are likely to be far greater than anyone dares admit in public. The Fed’s public mission is to rescue the American economy single-handedly by providing the money required and last but not least, it must retain control over financial market pricing to deliver these objectives. They are going to have to be bold and assertive and be quick. Forecasts for growth are being slashed dramatically on a daily basis and many look like wild guesses but people are losing their jobs at a rapid pace and companies are shutting down. The reality of that is about to become apparent in some data over the next few weeks and they may be shockingly bad. Morgan Stanley have some view on jobs.

A lot of guesswork but the trend is clear. The fact is that we are already in a global recession and the realty of that is starting to dawn.

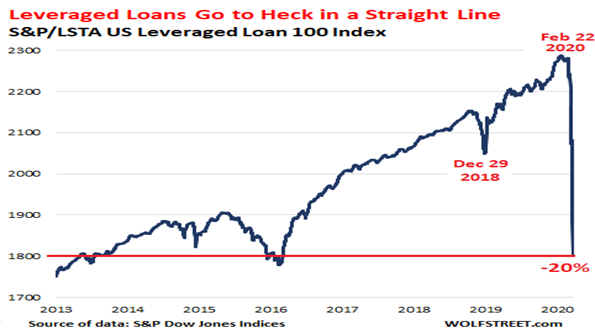

Leveraged loans (they’re issued by junk-rated overleveraged companies with insufficient cash flows) are part of the gigantic pile of risky corporate debt that is now being brutally repriced as concerns over credit risk (the risk of default) are finally bubbling to the surface. Since February 22, the S&P/LSTA US Leveraged Loan 100 Index, which tracks the prices of the largest leveraged loans, has plunged 20%!

These loans are traded in slices like securities or are packaged into highly rated Collateralized Loan Obligations (CLOs). But for years, investors have scrambled to own them, driven by their relentless chase for yield, in a world of interest rate repression. The Fed, the Bank of England, the ECB, the Bank of Japan, have all warned about leveraged loans. But they don’t regulate them because central banks are not securities regulators. And securities regulators, such as the SEC, consider them loans and not securities, and they don’t regulate them either. No one knows into whose balance sheets leveraged loans can blow holes. But now they’re blowing holes into balance sheets. Credit is where the real implosion could still come from and the Fed is well aware of that. When corporate debt blows up, it has an immediate impact on the real economy: At that point, these companies have to restructure their debts either in bankruptcy court or outside of it, which nearly always leads to layoffs, cost cuts, and slashed capital expenditures, which then ripple through the rest of the economy, thereby acerbating the downturn. I fear that some nasty corporate headlines are on the way.

—————————————————————————————————————-

Strategy:

Macro:.

Short EUR @ 1.0932 with a stop at entry

Long US 10yr yields @ 0.835% (short USTs)

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.

Home

Home