Good Morning.. Stocks break higher again after a weak attempt at some rotation from tech stocks yesterday, briefly saw NASDAQ underperform. It doesn’t take much to spark a rally and in my view phase1 of the trade deal is not a buy in stocks whereas the very real threat is phase2 which is ongoing, which is more of a sell, dangerous and bad for global markets but equity “investors” have no inclination to consider that. Despite all the hope, we still have no vaccine. I have said on a few occasions here that the central banks are destroying capitalism and Trump is destroying globalisation. Can you really tell me that those two issues will allow us to return to the normal we knew? Not a chance. We are at the dawn of a new normal and right now we have no idea what that will look like and that scares me personally; and as an investor. The Fed has no idea either but the title of the JH gathering is “Navigating the Decade Ahead: Implications for Monetary Policy.” My first thought on that is that they have no clue what is coming by December this year, let alone 10 years hence. I will, however, try and stay awake through some of it. German IFO, US housing data and US Consumer confidence to look out for today but data, whether good or bad, seems to drive stocks higher.. What a world!

Keep the Faith..

Details 25/08/20

Just a whiff of hope sends US stocks to new all-time highs:

–

At one point yesterday, on the back of a weak speech from Trump suggesting an unproven breakthrough on Covid (using plasma), US stocks made a new all-time high. There was slightly better news according to one guy at Fox News. According to Fox News reporter Edward Lawrence; “a Pfizer Spokesperson just told me Pfizer & BioNTech will be ready as early as October 2020 with enough coronavirus vaccine data for approval. If regulatory authorisation or approval comes 100 million doses would be ready by end of 2020 and 1.3 billion doses by end of 2021”. Stocks seemed to like this good news but it is still hearsay. I want a vaccine found as much as the next person but so far, I have no concrete evidence we are getting one this year. This rally is based on hope and low volumes and that worries me. We saw leisure and hospitality stocks outperform as tech slipped a bit but no wonder after recent rises; Apple was up 10% since Friday’s open at one point yesterday.

Bonds were less impressed as ever, with most close to unchanged for most of the day. But then stocks started to tire after the European close and as schools get set to receive pupils again, we are already seeing infections rise across Europe which seemed to weigh on EUR yesterday.

Last night saw a new wave of buying on the back of encouraging talks on phase1 of the trade deal but to my mind, that is just about China needing soybeans and something of a necessity for both sides. This is nothing like what phase2 is about and that is ongoing and will be so for a considerable time with a very damaging impact on the global economy. But again, hope springs eternal and equity “investors” need very little excuse to buy; and buy they did with Nikkei up 1.75%, Kospi up 1.3% while China and HK slipped (S&P futures up another 15 points as I type).

I am sorry to burst your bubble (I just had to use that pun; apologies) but collapsing market breadth is becoming a major concern for the market and while an entire market is defined by just one stock – Apple, I can see a problem building. If, at some point, this does not derail the new bull market then I would be very surprised indeed. I am not sure how much further this rally in US stocks can go.

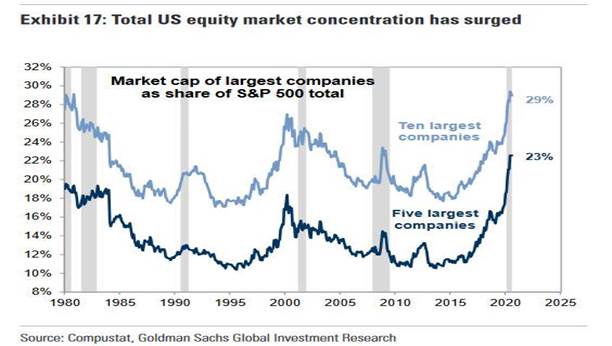

Let’s take a step back and ask when did we last have a correction of 3 or 4%? This is straight line stuff and markets do not trade like that for too long. Is anyone taking profits? I know I have got this wrong before but with a big week ahead, some profit taking, or an imminent reversal seems overdue to me. Interestingly, the FX market seems to agree as the USD started to bounce again yesterday afternoon. I was shown the extreme lack of depth in the price action on Friday, where price action was perhaps the most extreme example yet. Just one stock, Apple, contributed 105% of the total return of the Nasdaq100 and S&P500 and 88% of the total return of the Dow Jones Industrial Average. That is NOT normal and I wonder if this could be a blow-out top for stocks. The facts remain that we do NOT have a vaccine, we still have a very damaging trade war going on, a US election looming and rising geopolitical tensions and social unrest spreading across the planet. The impact on global trade may yet to be fully realised.

Of course, you all want to know when and what will cause this reversal but maybe running into the JH gathering could start to see at least some take something off the table. Congress remains gridlocked over the next round of fiscal stimulus and markets may start to stress over the impact of a much smaller package; if we get one at all. No package and these stocks are headed down. I guess Congress is aware of this and with an election looming may not want to be held accountable so a deal of some sort will probably be agreed upon. We have seen better US data but are they behind the EU in the recovery cycle; and the data is about to sour; or are they in front? I am not sure but data later this week and especially Claims data will be watched closely and I still believe that unemployment is a longer-term issue than many believe. How many bankruptcies do we need before the markets get spooked or how poor global data needs to be before a reassessment of the recovery is made, which will impact earnings.

Most US sectors are struggling. Energy is down by one-third since late February, reflecting the hit to oil prices, Financials are down by a fifth in response to the drop in benchmark interest rates, Utilities and real estate have made little upward progress since the fire-sale in risky assets that took place in March. I guess bonds offer little for global investors now though. This lack of breadth in the market may continue for a while as Fidelity International calculates that on average, the “big five” tech companies, which between them account for nearly a quarter of the value of the entire S&P 500 index, are expected to generate 41 per cent higher earnings in 2021 than last year. For the rest of the index, analysts expect earnings to be pretty much flat.

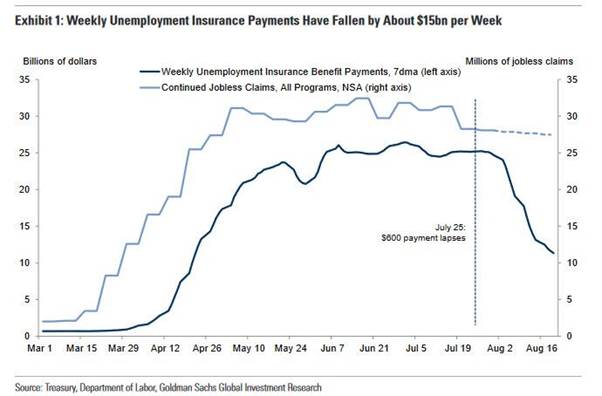

In the US, millions are no longer receiving their $600 a week from the government with most now seeing half of that after the Trump executive order and that is not enough to keep many afloat. Companies will continue to cut costs and that means less staff in many places if indeed the company survives. Spending is likely to be concentrated into essentials in coming weeks/months. Just this past week we heard commentary from several retailers like Walmart suggesting they have begun to see a slowdown in spending. Some of this is likely attributable to the suspension of these benefits along with the fact that demand for certain spending categories was pulled forward in 2Q when much of the economy was locked down. The chart below from Goldman shows just how steep the drop in UI payments has been.

This surely impacts not only many already struggling but the psyche of most consumers in the 90% that didn’t benefit from the Fed stoking the stock markets for the wealthy. Meanwhile the rich get richer and the poor get poorer and they wonder why there is social unrest in the major US cities. Powell would only have to be slightly less dovish (and why not after the data) and this market will stress. It appears clear that negative rates or YCC are not on the cards for a while.

I guess many investors feel that what has worked so far should continue with a Fed prepared to backstop everyone and so the prudent case is to assume that the can-kicking fiscal and monetary policies we have recently pursued will linger ; much as finance ministers try to argue it is already time to try to put fiscal genies back in bottles. Just how on earth do they do that without crashing the markets? Maybe now is the time for the Fed to remind us all that markets are NOT a one-way bet. We are in danger of building a society that wants a lot for nothing and guarantees that investments are safe. Populist politics always worry me and they often end badly when there simply is nothing left to give and an uprising is born. But maybe the crash will come from Main St and not Wall St as the wealth divide finally breaks loose a backlash against the wealthy and the establishment. You can see the start of that in many States in the US but also across the globe. Change is afoot.

I have said on a few occasions here that the central banks are destroying capitalism and Trump is destroying globalisation. Can you really tell me that those two issues will allow us to return to the normal we knew? Not a chance. We are at the dawn of a new normal and right now we have no idea what that will look like and that scares me personally; and as an investor. When will central banks realise that they need to accept that the way forward for the real economy has little to do with forward guidance or yield-curve control? They have actually done too much and seem hell-bent on following Japan. Maybe, just maybe, central banks can see that things are getting out of whack and a dose of reality is needed but alas, I doubt it. There is so much unhealthy about this rally, the global economy and the geopolitical tensions around the world but for some reason we have given up looking, let alone seeing because we don’t want to, as we may miss out. This JH gathering is titled “Navigating the Decade Ahead: Implications for Monetary Policy.” My first thought on that is that they have no clue what is coming by December this year, let alone 10 years hence. I will, however, try and stay awake through some of it.

The scenario of recurring bubbles continues. So is there a way out for central banks, should they wish to normalise things? Well, with debt set to keep rising, the only option to reduce debt to either pre-Covid levels, or even more to pre-global financial crisis levels would require massive fiscal austerity and private sector deleveraging, something which no self-respecting politician will ever campaign on ever again. Why take the plunge: as long as inflation remains low and central banks keep policy rates at zero, there is no reason for such pain; so goes the theory of MMT. The Fed and other central banks have taken us all into a nasty downward feedback loop. The real economy is weak, but asset prices are strong because of loose macro policy support (more decoupling between Wall Street and main street). This will continue until unexpected shocks take place, asset price bubbles burst, which then needs even looser macro policies to avoid an even weaker real economy, leading to new asset price bubbles. The result is a vicious cycle spiralling to even higher debt levels, lower interest rates and larger central bank balance sheets, without inflation but with an even weaker real economy and even worse asset price bubbles. Yet we have so much faith in every action they take and every word they utter. Just where does this end?

—————————————————————————————————————-

Strategy:

Macro:.

Long Gold @ $1875 Stop at $1875

Long EURAUD @ 1.64675 (average) and Stop below 1.6235.

Shorth AUDCAD @ .9445 with a stop at .9565.

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.

Risk Warning

This information is powered by Strategic Alpha. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice.