Good Morning… Wall St rallied again into the close (minus the Dow) and nothing seems to be able to stop this and so I have exited my AUD crosses I had. Asian markets were unchanged or negative as we now head into the JH symposium tomorrow. I am not sure if it is book squaring or something else but US yields are on a tear and up another 4bps overnight in the long end. I do not think this is the time to be short vol, especially in bonds. Has something from Powell been leaked or is this positioning? I have covered some of the possibilities below. I was also amazed that there was so little reaction to a steep drop in US consumer confidence as I think it warrants attention (see below). High unemployment for longer is now more of a threat to the US economy than the rise in virus cases (as the mortality rate is falling). I also think that it will become very clear soon that the Fed will continue to debase the USD and on a macro view I see this EUR a lot higher even though it is underperforming into Thursday as positions are largely long. I think anyone with the ability to trade on a more macro basis, may look at buying again here at 1.1805ish and on the charts, it looks like 1.1705-1.1695 needs to hold and so it’s a tight stop. I would add on a further dip to 1.1760. I guess with all the data and the Powell opening remarks tomorrow, we may be quiet today but we do get the volatile US durable goods data later.

Keep the Faith

Details 26/08/20

US consumer confidence drops but bond yields rise: Universal Basic Income:

–

There was not a great deal of reaction to what I saw as a significant day yesterday as stocks in the US did their normal thing and closed higher in most cases. But the data yesterday, whilst mixed with better New Home sales, contained some data I have been expecting to see and that was a steep drop in consumer confidence. I have suggested for a while that job losses, job insecurity and the ending of recent benefit packages for millions of unemployed, will start to impact the psyche of the consumer. US Conference Board Consumer Confidence came in at 84.8 vs. 93 expected in August and makes for a new cycle low yoy, down 49.4pts. This now is a record disconnect with current equity valuations (market cap/GDP ratio).

The danger here is that starts to spill into spending and could start to trend lower as higher unemployment for longer seems to be developing in the US. Claims data remains very important going forward. To my mind it is unemployment and how long it takes to recover that is now the main focus and not Covid cases. The issue now with Covid is that infections are rising again in certain areas but mortality rates are very low now and the amount of work being done on vaccines, suggests we may not be far away. But the unemployed face a long, hard year or so and that will negatively impact the US and global recovery.

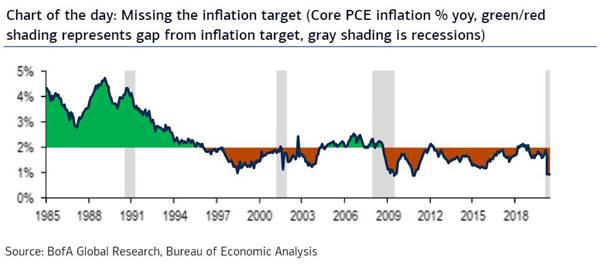

At the same time we are seeing quite a concerning move higher in US yields and I have been digging around to find a reason and all I can come up with is this weeks JH symposium: Are the bond markets getting spooked by what he may announce? This is interesting as the policy review that has been going on for the last year or so is almost complete but I do not think any policy shifts that come from it have been voted on. If this move in bonds is based on a “leak”, then what could it be? There is a general perception that the Fed is leaning to a shift on how it looks and deals with inflation and it is believed that they will move to a policy of average inflation targeting. That means higher inflation will be tolerated for longer. That may be the root of it but there may be more attached to inflation and monetary policy: What if they also attach a return to their version of “full employment” as well?

Powell has spoken a great deal about the importance of getting unemployment down and for good reason., as I mentioned above; it will be a drag on the economy for years possibly. But if they do attach unemployment to average inflation targeting, then the chances of any move up in rates would probably pushed even further down the calendar into at least 2023 or worse. BoA is not convinced that they will formally adopt Average Inflation Targeting because according to the bank, that would entail picking a specific time period over which PCE inflation is required to average 2% before beginning a policy normalisation (hiking) process. This is a problem, because in simulations conducted by the BofA rates team, it found this could in require the Fed to remain on hold for 42 years! Blimey; where will stocks be on that basis?

You can see what is driving stocks higher and higher.

So, why are bond yields rising if we are going to be lower for longer? I think they maybe concerned that low interest rates for as far as the eye can see and a potentially ever-increasing balance sheet, the Fed may actually end up fighting inflation. If there is one market out there that looks prime for a major volatility shock it is US bonds. The long end yields are on the rise whereas the Fed still controls the short end; the curve is steepening. This looks set to continue and if the Fed ever adopt YCC then this will see the short end out to possibly the 5year space remain nailed to the floor and the long run wild. I think it is now clear that markets believe the Fed has given up thinking of reducing the balance sheet after what happened last time they tried. The Fed has not met its PCE inflation target for years.

This could be a massive game changer and looking at the lack of buyers in US bonds and the massive issuance still to come, bond vols look set to rise.

I think it is time for Powell to give some clear views on policy and inflation but any idea of reducing the balance sheet are over. In fact I think they will, at some point, expand it further. This move in yields, off such a low base is actually quite large and 10yr & 30yr yields we up another 3bps last night with 10yr at .71% and 30s at 1.415%. This is no time to be short vol in my view.

The curve is steepening and a break of 58 in 2s-10s could be significant. Maybe Powell will say little new but either way, the Powell speech may spark volatility one way of the other. Plus the 2yr auction yesterday as very impressive suggesting few think we get a hawkish surprise from Powell tomorrow. One thing Powell can’t fix is the disturbing rise in US social unrest and it is getting scary out there in many cities. I fear that the wealth divide is beginning to take its toll on society and this could become very damaging. On top of this, we also need to consider the rise in geopolitical tensions building across the globe. US/China, Turkey/Greece, India/China

On top of all this from central bank policies, it seems governments are prepared to extend spending to those that need it. In Germany, they are extending virus relief for the economy including help for SMEs until end of this year & extending wage support program until end of next year (was due to expire Mar ’21). Japan will extend its worker subsidy program until end of this year and many others will be doing the same. The spending is on the rise. Just how far will governments have to go to bridge the gap for those that have lost their jobs or companies that risk annihilation? If this problem does not go away soon then some major shifts in how we deal with mass unemployed maybe on the cards. Something that is gaining some traction is the idea of a “Universal Basic Income”. In fact, Germany is trialling this over 3 years already.

Starting this week, 120 Germans will receive a form of universal basic income every month for three years. The volunteers will get monthly payments of €1,200, or about $1,400, as part of a study testing a universal basic income. The study will compare the experiences of the 120 volunteers with 1,380 people who do not receive the payments. About 140,000 people have helped fund the study through donations. The concept of universal basic income has gained traction in recent years, and Finland tested a form of it in 2017. Supporters say it would reduce inequality and improve well-being, while opponents argue it would be too expensive and discourage work. Are we moving towards the new normal being less people working due to the advancement of technology? It seems the virus has brought forward the use of many available technologies out there and coupled with advancements in AI, the workplace may never be the same again but the cost of this on a global scale is frightening; where will all the money come from and what sort of debt mountain are we building.

Universal basic income is the idea that a government should pay a lump sum of money to each of its citizens, usually once a month, regardless of their income or employment status, effectively replacing means-tested benefits. This is a version of “Helicopter money” that sends funds directly to the consumer and not like the useless QE venture that sent Trillions to the banks to lend where there was no demand. But the cost would be huge. Opponents claim that with a basic income people would stop working in order to remain nailed to the couch with fast food and streaming services (buy Netflix). Proponents argue that people will continue to do fulfilling work, become more creative and charitable, and save democracy. Hmm, sounds like a massive socialist programme to me and again at some point, debt will matter. I am not sure it is a positive to encourage people not to work as if they have too much free time then who knows what may happen socially. I am not sure many will turn to charitable causes to be honest. The pubs will be full all day though.

The USD is mixed but as stocks refuse to do anything but go up, I am exiting the EURAUD position here at 1.6430 for a tiny loss. For the same reasons I will exit the AUDACD trade at 9484. This range trading looks set to continue. But the last day or so has seen EUR underperform and again we see many of its crosses lower this morning and I am not sure why; apart from position adjustments into Thursday’s Powell comments. On a macro basis, I think the lows around 1.0800 are in place and that the joint bond agreement will see the EUR continue to be a viable alternative to the USD which is about to be further debased by the Fed. I can see a case where we see more Fed actions in coming months and the balance sheet expand and that will continue to undermine the USD and so this dip, for those of a more macro bent, is worth starting to scale into in my view. I would look to start here (just in case) at 1.1805 and reappraise if we continue to fall after Powell. 1.1705-1.1695 needs to hold so it’s a tight stop for a macro fund. The Fed seems determined to use all tools to get inflation back up and will be very slow to react when seen, while they continue to debase the USD. I am not sure that any correlation between higher US yields and a higher USD will work. US real yields may even fall a tad further from the already -1% where they are now. Does this mean that stocks are still of value here? Who would own bonds with a real yield of -1%? The Fed is forcing investors out of bonds and into stocks and other high-risk investments. Maybe this equity rally still has legs if the Fed is going to do more; just like the BoJ did!

—————————————————————————————————————-

Strategy:

Macro:.

Long Gold @ $1875 Stop at $1875

Long EURAUD @ 1.64675 (average) Closed at 1.6430

Shorth AUDCAD @ .9445 Closed at .9484

Long EUR @ 1.1805 look to add with stop at 1.1690.

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.

Risk Warning

This information is powered by Strategic Alpha. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice.

Home

Home