Good Morning.. Another very quiet Asia session with China still closed but we saw a steep rally into the Wall St close as financials reacted stronger to some relaxation in some of the Volker Rules on US banks. But Banks took an after hours knock when the Fed stress test report was released as buybacks and dividends were stopped or capped. The markets have been given a few boosts this week along with the ECB actions in the repo space but can they keep this up every time the equity markets have a wobble? Basically, taking a step back, the S&P is in a 2910-3250 range so play it until it breaks. A lot of chatter about pension fund rebalancing which could be seen today but the jury is out on that. The USD is also in a range and JPY crosses are just stuck. It is time we saw data starting to impact again but yesterday’s Claims data had a muted response but maybe Personal income PCE or Michigan confidence data today can. But we may see a choppy finish if specs have shorted stocks on the hope of seeing the pension fund selling and it’s a Friday, so “Be careful out there”..

Keep the Faith.

Details 26/06/20

Good and bad news for US financials as stocks tread water:

–

It has been an interesting week to be honest with a bit of everything for everyone but taking a step back, stocks are still in a range, despite the noise. Stocks have had a helping hand or two this week amid signs of structural weakness as virus cases around the world rise as economies are unlocked. We have had additional boosts like the ECB announcement of more repo support and yesterday, early in the US session, we heard that some of the Volker Rules on banks were being rolled back and this sent financials soaring and Wall St rallied into the close in what ended up being a positive day in the end with the S&P up 1%. Bloomberg reported that the Office of the Comptroller of the Currency and the FDIC have approved changes to the Volcker Rule, further easing its provisions, and allowing banks to increase their dealings with certain funds by providing more clarity on what’s allowed. The OCC also scrapped a requirement that lenders hold margin when trading derivatives with their affiliates, according to Bloomberg. This may not be the last of this rolling back of strict rules as Trump is not a fan. Separately, a reversal of the inter-affiliate margin requirement for swaps trades could free up an estimated $40 billion for Wall Street banks, though regulators added a new speed bump that limits the scale of margin that can be forgiven.

But financials then reacted to the Fed stress test results and guidance, showing how the top 34 banks would fare in a hypothetical crash (including, for the first time, a pandemic scenario) and whether they will be allowed to execute their dividend plans. This news was not so good for the banks. The Fed said that big banks will be required to suspend share buybacks and cap dividend payments at their current level for the third quarter of this year. The regulator also said that it would only allow dividends to be paid based on a formula tied to a bank’s recent earnings. Not the news many wanted to hear.

Furthermore, the industry will be subject to ongoing scrutiny: For the first time in the decade-long history of the stress test, banks will have to resubmit their pay-out plans again later this year. Trump gives; and the Fed taketh away. After hours saw BoA and Wells hit quite hard and equities still face a potential hit from quarter end rebalancing from Pension funds.

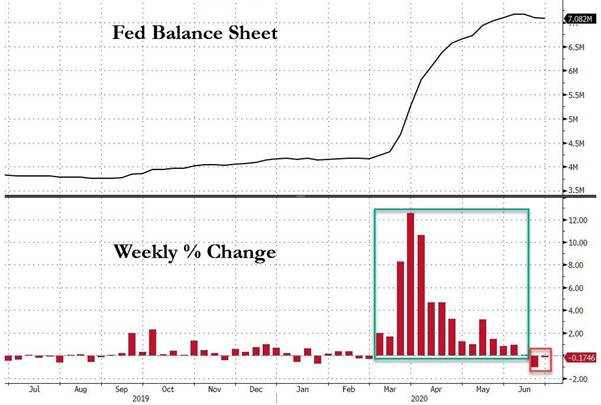

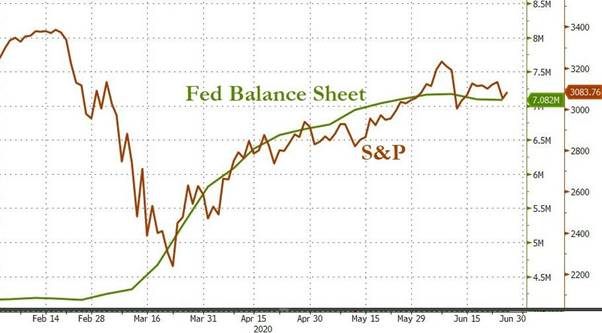

Sticking with the Fed, it is interesting to note that the balance sheet is shrinking still. It’s not huge but is significant in my view. The Fed’s balance sheet has posted its second consecutive weekly decline since the start of the corona crisis according to the latest H.4.1 statement.

We all know the sensitivity in markets to the Fed’s balance sheet and so a few will be looking closely at this as a trend maybe developing slowly. While not nearly as large as last week’s decline which was the largest since May 2009, the $12 billion weekly decline to $7.082 trillion was certainly notable for that very reason.

But markets may take this in their stride as this is not a Fed pulling down UST purchases but the relaxation of repo and Swap line support which seems to have seen a drop in demand. That may suggest something of a return to normality but some may suggest that this means the system is once again seeing a shrinkage in the circulation of the world’s reserve currency and an explicit tightening in financial conditions. Either way the S&P is still stuck in what looks like a 2910-3250 range; so play it. Drilling down into the data, it seems the Fed is still VERY busy supporting these markets, as it seems the Fed is now buying around $350mln in corporate bonds and/or ETFs every single day. Oh, how I long for free markets and price discovery!

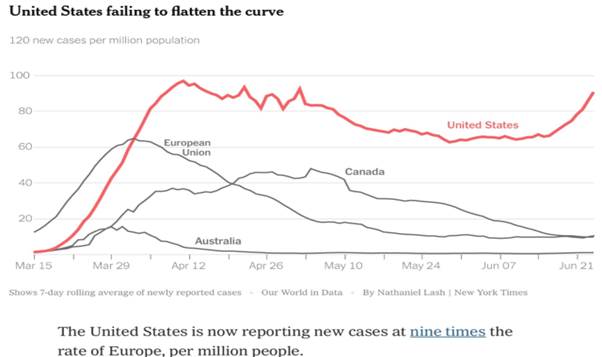

I still think the markets are rather ignoring the continuing rises in virus cases across not only the US but elsewhere as economies are unlocked. The issue here is that it could impact retail activity for longer than many originally thought and many will still be reluctant to get on a plane or on public transport. But others are clearly ignoring the dangers as beaches fill up in the hot weather and parties are having to be broken up. But consumer spending is in real danger still and I still do not think markets are pricing in the longer-term impacts of high unemployment. There is also data suggesting that restaurant table bookings are falling again and supermarket spending is on the rise; both suggesting some risk aversion among the consumer in the US. It is becoming clear that the young do not see this virus as their problem and to be honest it seems for most it may not be but that does not stop them spreading it. That is what concerns the elderly or infirm.

Interestingly, while we have seen some swings in equities, JPY crosses have hardly moved and FX in the last 3 or 4 days has been rather side-lined. It seems the JPY is now disconnected to risk moves and to a great extent UST moves. All very strange and I am not sure what drives the JPY these days. Blow is a 4hr chart of AUDJPY.

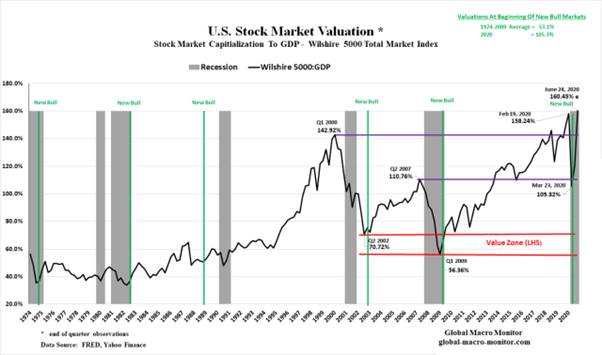

Maybe we are due a break out but the direction of that is unclear. The USD is still in a range and its outlook is far from clear with all the Fed is doing and its attachment to risk on or off on a daily basis. But gold has been holding gains through up and down days for equities recently and I think there is diversity demand going on. I think asset managers want some small portion in the portfolio, after all a zero yield is better than negative. It is tough fighting the Fed but tough to ignore the economic damage being done, which to my mind will not correct anytime soon. We still do NOT have a vaccine. It is increasingly obvious the Fed can’t allow markets to operate freely as the economic consequences of allowing prices to move to their equilibrium and fair value are not politically palatable or may not even be possible without blowing up the global economy.

Are we in a bear market rally or have we turned? This is the big question I guess and it remains to be proven one way or another. If we are still in a bear market, then vols will remain elevated and trading needs a different approach. One needs to be far more disciplined and selective in choosing which stocks are appropriate to hold in a bear market. Also consider your tolerance for risk, because markets will be more volatile in a bear market. Again we still do not have a vaccine and so second waves are very likely.

I think the chart above demands attention and we have to ask ourselves if the US will emerge first and strongest among the developed world economies and a failure to do so may hit the US dollar. It is also time to start asking how we price the US election as Biden starts to pull out quite a lead on Trump. What would a democratic Senate mean? The trouble is that the two parties are morphing into one when it comes to spending and there is now no one to check the balances. MMT has been fully embraced by both parties it seems.

I am growing increasingly bearish on America’s prospect to arrest the spread of COVID-19 due to growing restlessness over the shelter-in-place rules leading to quarantine fatigue, weak political leadership, and lack of uniform measures to mitigate the spread across, and within, all fifty states. If the US still has 10% unemployment levels heading into the elections, it could see a change in the WH but it will also leave scars on the economy. There is an unemployment crisis in the US and no one is pricing it and reports suggest that some states are still trying to catch up with the torrent of unemployment claims and that some states still haven’t figured out how to process unemployment claims under federal programs, including Florida. And so, after three weeks of improving, the data tracking the unemployment crisis got worse. The numbers are still shocking as seen in claims data. The total number of people who continued to receive unemployment compensation in the week ended June 20 under all state and federal unemployment insurance programs combined, including gig workers, rose to 30.55 million people (not seasonally adjusted), according to Labour Department data yesterday. Also, why would economists look at seasonally adjusted data in a crisis like this? I just don’t get that nonsense; think about it. Why would the weather make any difference to jobs when fighting a pandemic? Again they just cannot adapt to what is clearly something unprecedented. Get off your spreadsheets and smell the coffee.

This is up by 1.3 million people from the prior week (29.26 million), and the second highest ever, just below the record during the week ended May 23. The robustness of the economic recovery is growing increasingly uncertain and globalization, the main driver of the secular bull market is in retreat. Unemployment will and always does matter and I think data like claims and NFPs will start to have an impact on markets again soon. Data does matter.

Stocks are simply not pricing any risks; anywhere. To be honest the central banks do seem to step in on any day that stocks have a wobble but can they keep adding new policies every time? One day soon we will get two down days (a rarity indeed) and it will seem like the bottom has fallen out of the world. There is a battle between Bulls (the Fed will save us) and the Bears (the economy is in tatters and valuations are ridiculous) and it seems MM funds are being tapped for better yielding investments (cautiously bullish). But there does seem to be a lot of money out there doing very little and this also cannot go on for much longer. Is there a queue waiting for the next dip?

According to GS and JPM, we may get that dip as pension funds are suggested to have massive selling into quarter end. But there is some doubt on that note. With the current quarter about to end, longer-term investors may indeed do some automatic selling of equities as they adjust their portfolio weightings. However, a look at the US equity exposure of major US mutual funds reveals that these mutual funds do not have excessive equity holdings, nor are they even overweight. If anything, unlike JPMorgan which expects up to $170BN in selling, Nomura thinks they may have executed what little selling they needed to when adjusting their portfolio weightings in April-May after swinging to buying stocks when rebalancing their portfolios at the end of March. Nothing is ever clear is it? To my mind, JPM may well be proven right, as major US mutual funds are just a small fraction of the overall pool of longer-term investors and it is difficult to come to any clear conclusions about that larger pool of investors. Oh well, at the end of the day, we are still in that 2910-3250 range in S&P so keep playing that I guess; simples.

—————————————————————————————————————-

Strategy:

Macro:.

Long EURGBP @.8978 added @ .8940. Raising stop to .8940

Long EURCAD @ 1.5340.. Stop at 1.5220

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.

Risk Warning

This information is powered by Strategic Alpha. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice.